United States Hyperconnectivity Market Size, Share, and COVID-19 Impact Analysis, By Product (Cloud Platforms, Middleware Software, Enterprise Wearable Devices, and Business Solutions), By Component (Software and Services), and United States Hyperconnectivity Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Hyperconnectivity Market Insights Forecasts to 2035

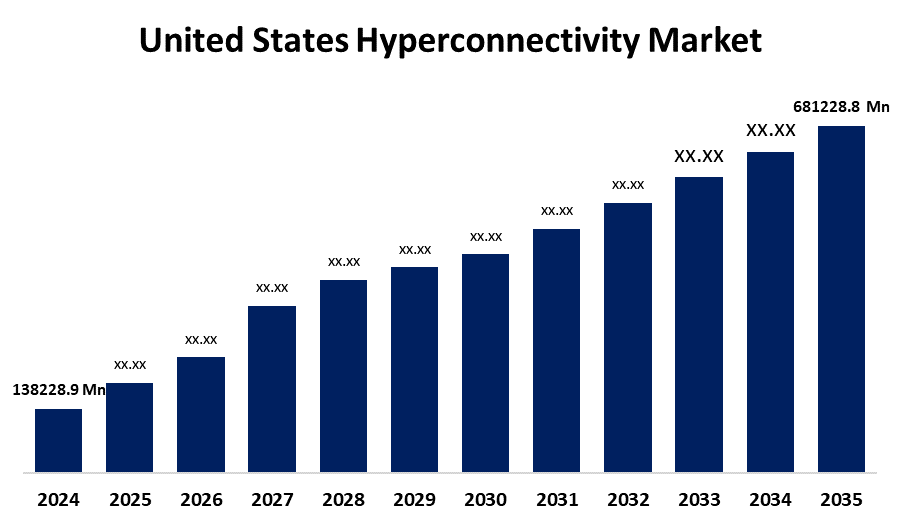

- The US Hyperconnectivity Market Size Was Estimated at USD 138228.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.6% from 2025 to 2035

- The US Hyperconnectivity Market Size is Expected to Reach USD 681228.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Hyperconnectivity Market is anticipated to reach USD 681228.8 million by 2035, growing at a CAGR of 15.6% from 2025 to 2035. The expansion of the United States' hyperconnectivity market is propelled by the creation of smart homes, workplaces, and cities.

Market Overview

The applications in homes, workplaces, communities, and industries, such as healthcare and transportation, are advancing in response to a more digital and connected. The modern consumer has an expectation to have a seamless, customized, and integrated experience; such an experience will only be realized when networks, data streams, and connected devices work in concert. For organizations, generating this level of hyperconnectivity is a daunting challenge since it requires a mindset of perpetual novelty, continual engagement, and commitment to invention. In order to address these augmenting pressures, small and medium enterprises (SMEs) as well as large organizations are recognizing the need for hyperconnectivity solutions. During the forecast period, hyperconnectivity will have a growing market presence as a result of the Internet of Homes. As AI home virtual assistants become pervasive, there will be a hotter demand for contactless fingerprints and voice control security solutions. Manufacturers of smart devices will have to deliver multi-functional products that can manage several appliances as well as allow the integration for convenience and management. There is an opportunity for strategic collaborations between transportation, telecoms, and internet retailers around proposition development.

Report Coverage

This research report categorizes the market for the United States hyperconnectivity market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hyperconnectivity market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hyperconnectivity market.

United States Hyperconnectivity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 138228.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.6% |

| 2035 Value Projection: | USD 681228.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Component and COVID-19 Impact Analysis |

| Companies covered:: | Extreme Networks Inc, Avaya, Broadcom Inc, Microsoft Corp, International Business Machines Corp, Oracle Corp, Cisco Systems, Inc., IBM Corporation, AT&T Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hyperconnectivity market is boosted because it is generating significant business models and workday opportunities as new mobile devices enter the market, and internet speeds are increasing. As the workforce becomes more virtual, they will need to connect to single or multiple corporate networks via many technologies. The workforce is also looking to collaborate and develop tools for teamwork and means to stimulate engagement and productivity. Businesses can make better decisions and produce more output with hyperconnection technologies. The Internet of Things is one of the key components of a highly interconnected market.

Restraining Factors

The United States hyperconnectivity market faces obstacles as both businesses and underprivileged rural areas are financially impacted by the expenses of infrastructure deployment and power usage, particularly for dense 5G, edge, and fibre networks. In addition to ongoing digital and socioeconomic divisions, interoperability issues across vendor-siloed systems hinder uptake and restrict market penetration.

Market Segmentation

The United States hyperconnectivity market share is classified into product and component.

- The cloud platforms segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hyperconnectivity market is segmented by product into cloud platforms, middleware software, enterprise wearable devices, and business solutions. Among these, the cloud platforms segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the speed at which cloud platforms can provide scalable, flexible, and cost-effective options accounts for the high percentage share of the market. Cloud platforms allow companies to connect multiple devices, coordinate massive amounts of data, and enable real-time communication across multiple sites. Also, because they are on-demand, companies can quickly and efficiently scale up their operations as connectivity grows or changes without significant investments in physical infrastructure.

- The software segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the component, the United States hyperconnectivity market is segmented into software and services. Among these, the software segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it offers the fundamental capacity for monitoring and integrating the complex networks of connected devices and systems. A hyperconnected environment requires seamless communication, data interchange, and platform synchronization, all of which are made possible through software solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hyperconnectivity market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Extreme Networks Inc

- Avaya

- Broadcom Inc

- Microsoft Corp

- International Business Machines Corp

- Oracle Corp

- Cisco Systems, Inc.

- IBM Corporation

- AT&T Inc.

- Others

Recent Development

- In July 2024, Oracle Corporation collaborated with Google LLC to introduce the Oracle Interconnect for Google Cloud Platform (GCP), providing a dedicated, low-latency private connection between Google Cloud and Oracle Cloud Infrastructure. This integrated service enables customers to run mission-critical workloads, access best-in-class services from both providers, and benefit from features such as high bandwidth, on-demand provisioning, and a collaborative support model, all without incurring cross-cloud data transfer charges.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hyperconnectivity market based on the following segments:

United States Hyperconnectivity Market, By Product

- Cloud Platforms

- Middleware Software

- Enterprise Wearable Devices

- Business Solutions

United States Hyperconnectivity Market, By Component

- Software

- Services

Need help to buy this report?