India Automotive Camera Market Size, Share, By Vehicle Type (Passenger Car, Light Commercial Vehicle, And Heavy & Medium Commercial Vehicle), By Technology (Digital Camera And Thermal Camera), And India Automotive Camera Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationIndia Automotive Camera Market Insights Forecasts to 2035

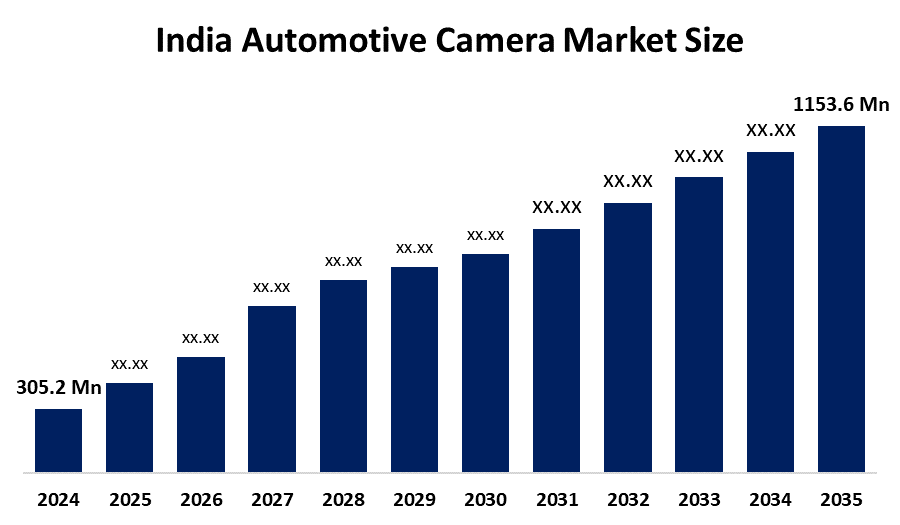

- India Automotive Camera Market Size 2024: USD 305.2 Mn

- India Automotive Camera Market Size 2035: USD 1153.6 Mn

- India Automotive Camera Market CAGR 2024: 12.85%

- India Automotive Camera Market Segments: Vehicle Type and Technology

Get more details on this report -

The India automotive camera market encompasses the entire process of making and utilizing camera systems for use in automobiles operating in that country, includes rear-view cameras, surround-view systems, forward-facing cameras, and ADAS cameras that provide features such as lane departure warnings, blind-spot detection, pedestrian recognition, and automatic emergency braking. The automotive camera market consists of OEM fitted and aftermarket options. The growth of this industry is impacted by factors including regulatory requirements, innovation in technology, and consumer demand.

The automotive camera in India are backed by government support, including the Bharat New Vehicle Safety Assessment Programme (BNVSAP), which includes requirements for rear-view cameras and other ADAS components in new vehicles to improve safety performance and reduce collisions. National policies such as the Automotive Mission Plan (AMP 2047) aim to strengthen the overall automotive ecosystem, encouraging advanced technologies and safety systems that inherently boost demand for camera-based solutions.

As technology advances, India’s automotive camera providers are now using enhanced vision systems, increased resolution images, as well as fusing different sensor modalities. Improved methods for detecting and responding to non-static roadway conditions, identifying traffic signs, and monitoring driver behaviour have all improved. Both camera software and hardware are being developed to incorporate artificial intelligence and machine learning which enables automatic hazard detection functions and improves automated decisions for the next generation of semi-automated functionality.

Market Dynamics of the India Automotive Camera Market:

The India automotive camera market is driven by the increasing emphasis on vehicle safety among consumers and regulators, broader adoption of ADAS features that rely on cameras for core functionality, rising vehicle production, growing consumer preference for smart and connected vehicle features, supportive government mandates and localization initiatives make it economically viable for manufacturers to embed sophisticated camera systems.

The India automotive camera market is restrained by the relatively high cost of advanced camera systems and ADAS technologies, India’s highly price-sensitive automotive segments, infrastructure limitations, slowing adoption in certain regions, and data privacy and the complexity of integrating multi-sensor systems.

The future of India automotive camera market is bright and promising, with versatile opportunities emerging from the rise of advanced driver assistance system (ADAS) capabilities into low-cost mass-market vehicles will be made possible as more consumers learn about their benefits. The ongoing shift towards plugged-in electric vehicles and connected cars makes the automotive marketplace very attractive to companies. Investment opportunities exist in manufacturing products locally, developing AI powered image processing software with current safety camera technology.

Market Segmentation

The India Automotive Camera Market share is classified into vehicle type and technology.

By Vehicle Type:

The India automotive camera market is divided by vehicle type into passenger car, light commercial vehicle, and heavy & medium commercial vehicle. Among these, the passenger car segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Increasing integration of advanced driver assistance systems, safety regulations, rapid growth of SUVs, and increased adoption of camera systems all contribute to the passenger car segment's largest share and higher spending on automotive camera when compared to other vehicle type.

By Technology:

The India automotive camera market is divided by technology into digital camera and thermal camera. Among these, the digital camera segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The digital camera segment dominates because of growing demand for ADAS, stricter regulations, increasing consumer awareness about safety, cost effective, and favours digital for enhancing vehicle safety and functionality.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India automotive camera market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Automotive Camera Market:

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- Magna International Inc.

- Autoliv Inc.

- Denso Corporation

- Uno Minda Limited

- Motherson Sumi Wiring India

- Pricol Limited

- Samsung Electro-Mechanics Co., Ltd.

- LG Innotex Co., Ltd.

- OmniVision Technologies, Inc.

- Hero Electronix Private Limited

- Hikvision Automotive Electronics Co., Ltd.

- Visteon Corporation

- Others

Recent Developments in India Automotive Camera Market:

In January 2026, NEXDIGITRON continues to expand its 70mai product range, offering 4K HDR dual-channel cameras (A810) and 3-channel (Prime Plus) systems with ADAS specifically for the Indian aftermarkets.

In September 2025, Kaynes Semicon & Consortium confirmed a major deal to supply 150,000 indigenous dash camera and automotive camera modules to a leading Mumbai-based automotive multinational by March 2026. This consortium includes 3rdiTech (sensors) and focally (optical design).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India automotive camera market based on the below-mentioned segments:

India Automotive Camera Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy and Medium Commercial Vehicle

India Automotive Camera Market, By Technology

- Digital Camera

- Thermal Camera

Frequently Asked Questions (FAQ)

-

Q: What is the India automotive camera market size?A: India automotive camera market is expected to grow from USD 305.2 million in 2024 to USD 1153.6 million by 2035, growing at a CAGR of 12.85% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing emphasis on vehicle safety among consumers and regulators, broader adoption of ADAS features that rely on cameras for core functionality, rising vehicle production, growing consumer preference for smart and connected vehicle features, supportive government mandates and localization initiatives make it economically viable for manufacturers to embed sophisticated camera systems.

-

Q: What factors restrain the India automotive camera market?A: Constraints include the relatively high cost of advanced camera systems and ADAS technologies, India’s highly price-sensitive automotive segments, infrastructure limitations, slowing adoption in certain regions, and data privacy and the complexity of integrating multi-sensor systems.

-

Q: How is the market segmented by vehicle type?A: The market is segmented into passenger car, light commercial vehicle, and heavy and medium commercial vehicle.

-

Q: Who are the key players in the India automotive camera market?A: Key companies include Robert Bosch GmbH, Continental AG, Valeo SA, Magna International Inc., Autoliv Inc., Denso Corporation, Uno Minda Limited, Motherson Sumi Wiring India, Pricol Limited, Samsung Electro-Mechanics Co., Ltd., LG Innotex Co., Ltd., OmniVision Technologies, Inc., Hero Electronix Private Limited, Hikvision Automotive Electronics Co., Ltd., Visteon Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?