India SUV Market Size, Share, By Vehicle Size (Compact, Mid-Size, Full-Size), By Fuel Type (Petrol, Diesel, Hybrid, Electric), By Drivetrain (2WD, 4WD, AWD), By End-User (Personal Use, Commercial Use), By Seating Capacity (5-Seater, 7-Seater and Above), India SUV Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationIndia SUV Market Insights Forecasts to 2035

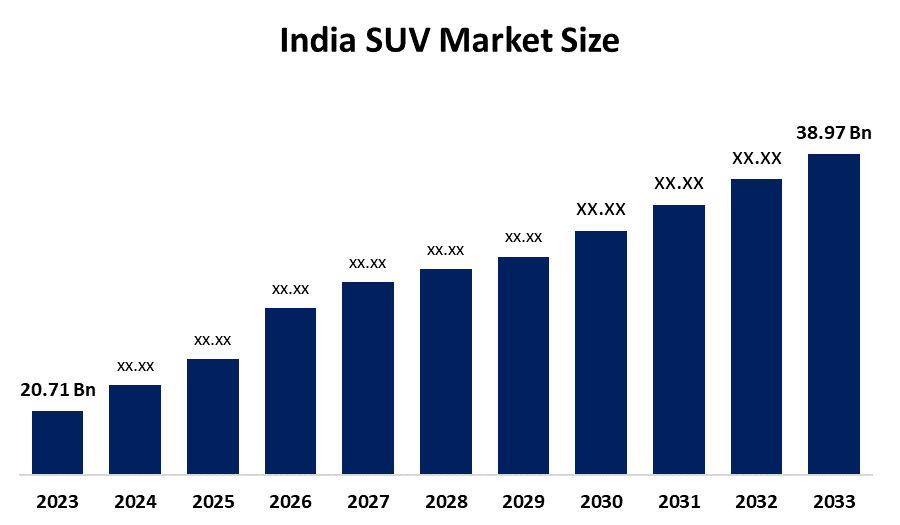

- India SUV Market Size 2024: USD 20.71 Bn

- India SUV Market Size 2035: USD 38.97 Bn

- India SUV Market CAGR 2025-2035: 5.92%

- India SUV Market Segments: Vehicle Size, Fuel Type, Drivetrain, End-User, Seating Capacity

Get more details on this report -

The Indian SUV market consists of compact, mid, size, and full, size sport utility vehicles that are suitable for urban commuting, long, distance travel, and light off, road adventures. These vehicles are increasingly preferred for personal mobility, family travel, and commercial fleet operations owing to features such as higher ground clearance, enhanced safety, versatile seating arrangements, and overall robust look. SUVs have become the dominant body type in India's passenger vehicle segment as the consumers are attracted more and more to vehicles that offer a combination of comfort, longevity, and advanced technology. To a large extent, the rising urbanization, the enhanced road infrastructure, and the facilitation of vehicle financing have been the factors which have kept the SUV sales upward not only in the metro areas but also in the small towns and rural areas.

The Indian passenger vehicle market has been mainly led by the utility vehicle segment (which comprises SUVs) in terms of sales with the segment accounting for around 65% of the total passenger vehicle sales in FY 2024, 25, according to the data reported by the Society of Indian Automobile Manufacturers (SIAM). This is a clear indication of the significant reshuffle of the Indian automobile market structure where the segment has shifted to SUVs. Moreover, the SUV export is going up gradually which is consistent with India's growing role as a global SUV production hub. Nevertheless, innovating technology remains the principal reason manufacturers are deciding to equip their models with connected car systems, advanced driver assistance systems, hybrid drivetrains, and electric SUV platforms.

Government funding is helping to open up and expedite the market transition as well by providing easy financing and enacting supportive policies such as the PM E, DRIVE scheme, which is facilitating electric mobility and the build, out of charging infrastructure with 10, 900 crores of approved expenditure. The concept of electric vehicles has numerous promising prospects to make the transition smooth and successful quite soon.

Market Dynamics of the Indian SUV market:

The India SUV market is primarily influenced by escalating consumer demands for vehicles that offer advanced safety, comfort, and are suitable for off, road use. A rise in the demand for compact SUVs in cities, improvement in the rural areas' connectivity, and additional availability of petrol, diesel, hybrid, and electric variants are some of the factors that are deepening the market penetration. Besides these, the efforts made by the automakers towards localization and platform sharing are also enhancing the cost efficiency and affordability level.

The market is facing a restraining factor in the form of high vehicle purchase costs for luxury segment SUVs. Other factors are the inconsistent fuel prices, supply chain disruptions, and the increasing costs of meeting regulatory requirements in terms of emissions and safety standards. Moreover, the congestion in urban areas and the rise in insurance and maintenance costs may restrict the adoption of the product in segments that are sensitive to prices.

The India SUV market has new opportunities to explore which include the electric or hybrid SUVs, the increasing demand for 7-seater vehicles for family and fleet use, the expansion of the charging infrastructure, and the growing penetration in Tier II and Tier III cities. The move towards connected and software, defined vehicles is estimated to be a significant factor in the enhancement of the market potential in the long run.

India SUV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.71 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.92% |

| 2035 Value Projection: | USD 38.97 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Vehicle Size, By Fuel Type |

| Companies covered:: | Maruti Suzuki India Ltd,Hyundai Motor India Ltd,Tata Motors Ltd,Mahindra and Mahindra Ltd,Kia India Pvt. Ltd,Toyota Kirloskar Motor Pvt. Ltd,MG Motor India Pvt. Ltd,Renault India Pvt. Ltd,Honda Cars India Ltd,Jeep India (Stellantis), And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India SUV Market share is classified into vehicle size, fuel type, drivetrain, end-user, and seating capacity.

By Vehicle Size:

The India SUV market is divided by vehicle size into compact, mid-size, and full-size. Among these, the compact SUV segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The India SUV market is classified into small, medium, and large SUVs. In 2024, the small SUV segment was leading due to its reasonable price, good fuel consumption, convenience of driving in crowded cities, low cost of ownership, and availability of a wide range of models for both prices, sensitive first, time and upgrade buyers.

By Fuel Type:

The India SUV market is segmented by fuel type into petrol, diesel, hybrid, and electric. Among these, the petrol segment dominated the market share in 2024, and is expected to grow at a notable CAGR during the forecast period. The market is divided into petrol, diesel, hybrid, and electric vehicle segments. In 2024, petrol SUVs were at the forefront because of the low initial cost of the vehicle, the availability of the fuel stations, the easy driving, lower noise levels, and good daily urban commuting and short, distance usage.

By Drivetrain:

The India SUV market is divided by drivetrain into 2WD, 4WD, and AWD. Among these, the 2WD segment held the largest share in 2024 and is expected to grow at a notable CAGR during the forecast period. The India SUV market has three different categories based on the drivetrains: 2WD, 4WD, and AWD systems. In 2024, 2WD had the biggest share of the market as the vehicle prices were lower, the maintenance expenses were reduced, fuel consumption was increased, and the typical urban roads and highways where off, road capability is not necessary were more suitable for 2WD.

By End-User:

The India SUV market is segmented by end-user into personal use and commercial use. Among these, the personal use segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The market segmentation based on the end, user includes personal and commercial use. In 2024, personal use was the major contributor to the market as the continuous demand was driven by rising disposable incomes, lifestyle upgrades, preference for spacious family vehicles, improved safety features, and increased ownership among urban and semi, urban households.

By Seating Capacity:

The India SUV market is divided by seating capacity into 5-seater and 7-seater and above. Among these, the 5-seater segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The India SUV market is divided into 5, seater and 7, seater and above. The 5, seater segment dominated in 2024 as it was preferred for its compact size, easier parking, better mileage, lower purchase cost, and a strong preference of nuclear families and urban professionals who are looking for daily usability.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India SUV, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India SUV Market:

- Maruti Suzuki India Ltd.

- Hyundai Motor India Ltd.

- Tata Motors Ltd.

- Mahindra and Mahindra Ltd.

- Kia India Pvt. Ltd.

- Toyota Kirloskar Motor Pvt. Ltd.

- MG Motor India Pvt. Ltd.

- Renault India Pvt. Ltd.

- Honda Cars India Ltd.

- Jeep India (Stellantis)

- Skoda Auto Volkswagen India Pvt. Ltd.

- Nissan Motor India Pvt. Ltd.

- BYD India Pvt. Ltd.

- Citroën India (Stellantis)

- Volvo Car India Pvt. Ltd.

- Mercedes-Benz India Pvt. Ltd.

- BMW India Pvt. Ltd.

- Audi India Pvt. Ltd.

- Jaguar Land Rover India Ltd.

- Isuzu Motors India Pvt. Ltd.

Recent Developments in India SUV Market:

In September 2025, Maruti Suzuki India Ltd. unveiled the All, New Victoris SUV. The mid, size SUV was available for purchase from 22 September 2025 with special introductory prices starting at 10.49 lakh (ex, showroom) and ARENA dealerships commenced bookings. The Victoris is equipped with multiple powertrains such as Smart Hybrid, strong hybrid, and S, CNG that is powering up Maruti Suzuki's SUV portfolio in India.

In March 2025, Nissan Motor India announced its latest lineup at the India product showcase, unveiling a 5, seater C, SUV and an all, new 7, seater B, MPV. The move signals the automaker's intent to extend its SUV and multi, utility vehicle portfolio, aiming to capitalize on the burgeoning demand in the two fast, growing segments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India SUV market based on the below-mentioned segments:

India SUV Market, By Vehicle Size

- Compact

- Mid-Size

- Full-Size

India SUV Market, By Fuel Type

- Petrol

- Diesel

- Hybrid

- Electric

India SUV Market, By Drivetrain

- 2WD

- 4WD

- AWD

India SUV Market, By End-User

- Personal Use

- Commercial Use

India SUV Market, By Seating Capacity

- 5-Seater

- 7-Seater and Above

Frequently Asked Questions (FAQ)

-

Q: What is the India SUV market size?A: The India SUV market is expected to grow from USD 20.71 billion in 2024 to USD 38.97 billion by 2035, at a CAGR of 5.92% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the India SUV market?A: Market growth is driven by rising urbanization, higher disposable incomes, increasing preference for SUVs with advanced safety and comfort features, expansion of financing options, and technological advancements such as hybrid and electric drivetrains.

-

Q: What factors restrain the India SUV market?A: Constraints include high purchase costs for luxury SUVs, fluctuating fuel prices, supply chain disruptions, rising costs of emissions and safety compliance, urban congestion, and increased insurance and maintenance expenses.

-

Q: How is the India SUV market segmented by vehicle size?A: The market is segmented into compact, mid-size, and full-size SUVs, with the compact segment dominating in 2024 due to affordability, fuel efficiency, urban suitability, and wide availability.

-

Q: How is the market segmented by fuel type?A: The market is segmented into petrol, diesel, hybrid, and electric, with petrol SUVs leading in 2024, while hybrid and electric SUVs are growing due to policy support and environmental awareness.

-

Q: Who are the key companies in the India SUV market?A: Key companies include Maruti Suzuki India Ltd., Hyundai Motor India Ltd., Tata Motors Ltd., Mahindra and Mahindra Ltd., Kia India Pvt. Ltd., Toyota Kirloskar Motor Pvt. Ltd., MG Motor India Pvt. Ltd., Renault India Pvt. Ltd., Honda Cars India Ltd., and Nissan Motor India Pvt. Ltd.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?