Global Heavy Aromatic Solvent Naphtha Market Size, Share, and COVID-19 Impact Analysis, By Type (C9-C10 Solvent, C11-C12 Solvent, and Others), By Application (Paints & Coatings, Agro Chemicals, Rubber & Resin, Printing Inks, Industrial Cleaning, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Heavy Aromatic Solvent Naphtha Market Size Insights Forecasts to 2035

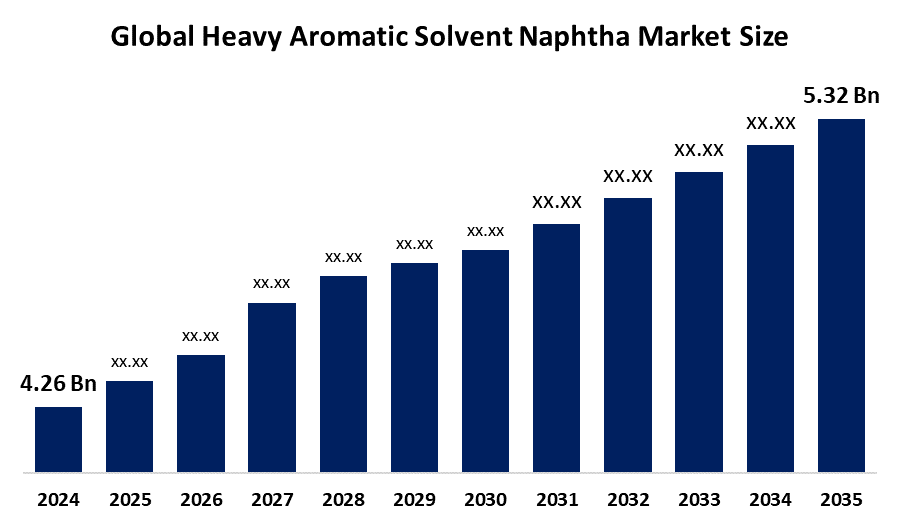

- The Global Heavy Aromatic Solvent Naphtha Market Size Was Estimated at USD 4.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.04 % from 2025 to 2035

- The Worldwide Heavy Aromatic Solvent Naphtha Market Size is Expected to Reach USD 5.32 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Heavy Aromatic Solvent Naphtha Market Size was worth around USD 4.26 Billion in 2024 and is predicted to Grow to around USD 5.32 Billion by 2035 with a compound annual growth rate (CAGR) of 2.04% from 2025 to 2035. Rising demand for paints & coatings, agrochemicals, industrial cleaning, and rubber processing, bolstered by growing automobile production, infrastructure development, and construction in emerging nations, creates opportunities for the heavy aromatic solvent naphtha market.

Market Overview

The Heavy aromatic solvent naphtha market refers to the global commercial ecosystem that includes production and refining and distribution, and end-use consumption of heavy aromatic solvent naphtha which is a petroleum-based hydrocarbon mixture that contains high aromatic content and strong solvent properties. According to regulatory classifications by bodies such as the European Chemicals Agency ECHA and US Environmental Protection Agency EPA the material contains mainly aromatic hydrocarbons which have carbon numbers between C9 and C16 and a boiling range of 165°C to 290°C 330°F to 554°F. The market consists of manufacturers and suppliers, traders, and end-use industries which use the product as an industrial solvent and chemical intermediate. The growing demand from the paint and coatings sector, which uses naphtha, a heavy aromatic solvent with exceptional solvency qualities, as a crucial ingredient, is one of the main development factors driving this heavy aromatic solvent naphtha market. The growing automobile sector is one of the major factors propelling the market for heavy aromatic solvent naphtha.

Report Coverage

This research report categorizes the heavy aromatic solvent naphtha market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the heavy aromatic solvent naphtha market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the heavy aromatic solvent naphtha market.

Global Heavy Aromatic Solvent Naphtha Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.04% |

| 2035 Value Projection: | USD 5.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, BP plc, Chevron Phillips Chemical Company, China National Petroleum Corporation (CNPC), Eastman Chemical Company, ExxonMobil Corporation, Formosa Plastics Corporation, Huntsman Corporation, Indian Oil Corporation Limited, LyondellBasell Industries N.V., Reliance Industries Limited, Royal Dutch Shell plc, Sinopec Limited, Total S.A., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is growing as a result of the increase in industrial activity, especially in developing nations, which raises demand for naphtha, a heavy aromatic solvent. The increasing requirement to boost agricultural productivity to meet the food needs of a growing global population necessitates the employment of effective agrochemicals. The worldwide automotive industry is expected to continue growing, particularly in emerging economies, which will raise demand for high-performance coatings and, consequently, heavy aromatic solvent naphtha. Furthermore, the creation of novel coatings that require premium solvents, which fuels the heavy aromatic solvent naphtha market expansion.

Restraining Factors

Strict environmental regulations on emissions of volatile organic compounds, rising health and safety concerns, volatile crude oil prices, the growing demand for bio-based and low-aromatic alternatives, and regulatory pressure preventing the use of solvents in coatings and agrochemical formulations are all factors restricting the heavy aromatic solvent naphtha market.

Market Segmentation

The heavy aromatic solvent naphtha market share is classified into type and application.

- The C9-C10 solvent segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the heavy aromatic solvent naphtha market is divided into C9-C10 solvent, C11-C12 solvent, and others. Among these, the C9-C10 solvent segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The C9–C10 solvent's balanced solvency power, ideal evaporation rate, and wide range of industrial applications are its main advantages. It is widely used in rubber processing, printing inks, paints & coatings, and adhesives because of its excellent compatibility with resins and polymers. The segment gains from steady demand in industrial maintenance, automotive refinishing, and construction.

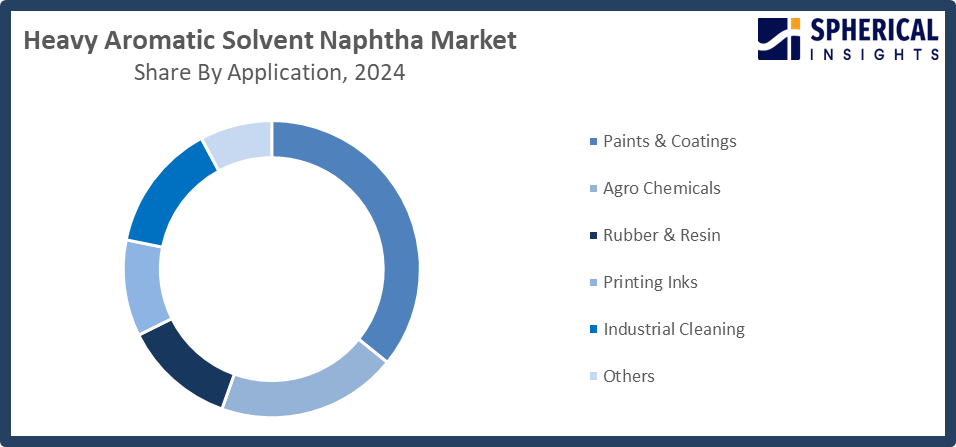

- The paints & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the heavy aromatic solvent naphtha market is divided into paints & coatings, agro chemicals, rubber & resin, printing inks, industrial cleaning, and others. Among these, the paints & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The solvent's cost-effectiveness, performance dependability, and compatibility with a wide range of resins and pigments all contribute to its dominant position in the paints and coatings market. Global demand for paints and coatings is greatly influenced by growing infrastructure development, construction activity, and automobile manufacturing.

Get more details on this report -

Regional Segment Analysis of the Heavy Aromatic Solvent Naphtha Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the heavy aromatic solvent naphtha market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the heavy aromatic solvent naphtha market over the predicted timeframe. Rapid industrialization, growing construction projects, and notable expansion in the automotive and manufacturing sectors in nations like China, India, Japan, and South Korea are the main drivers of the Asia Pacific region. More than 60% of regional demand comes from China alone, because of its enormous chemical production capabilities and sizable industrial sector. Strong industrialization, large petrochemical facilities, and rising demand from the paints and coatings, agrochemicals, and construction industries in nations like China and India have propelled the heavy aromatic solvent naphtha market, which holds a 40–47% market

North America is expected to grow at a rapid CAGR in the heavy aromatic solvent naphtha market during the forecast period. Environmental concerns and the use of alternative solvents are limiting expansion, yet the region has a predilection for high-performance formulations in industrial applications. Stable supply chains and proven refining capabilities are advantageous to the area. Demand is further boosted by an increase in remodeling projects, updating of infrastructure, and expansion of vehicle refinishing applications. Environmental restrictions, incentives for cleaner solvent innovation, and sustainable production are the main focuses of government initiatives and supportive policies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the heavy aromatic solvent naphtha market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- BP plc

- Chevron Phillips Chemical Company

- China National Petroleum Corporation (CNPC)

- Eastman Chemical Company

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Huntsman Corporation

- Indian Oil Corporation Limited

- LyondellBasell Industries N.V.

- Reliance Industries Limited

- Royal Dutch Shell plc

- Sinopec Limited

- Total S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the heavy aromatic solvent naphtha market based on the below-mentioned segments:

Global Heavy Aromatic Solvent Naphtha Market, By Type

- C9-C10 Solvent

- C11-C12 Solvent

- Others

Global Heavy Aromatic Solvent Naphtha Market, By Application

- Paints & Coatings

- Agro Chemicals

- Rubber & Resin

- Printing Inks

- Industrial Cleaning

- Others

Global Heavy Aromatic Solvent Naphtha Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the heavy aromatic solvent naphtha market over the forecast period?The global heavy aromatic solvent naphtha market is projected to expand at a CAGR of 2.04% during the forecast period.

-

2. What is the market size of the heavy aromatic solvent naphtha market?The global heavy aromatic solvent naphtha market size is expected to grow from USD 4.26 billion in 2024 to USD 5.32 billion by 2035, at a CAGR of 2.04 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the heavy aromatic solvent naphtha market?Asia Pacific is anticipated to hold the largest share of the heavy aromatic solvent naphtha market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global heavy aromatic solvent naphtha market?BASF SE, BP plc, Chevron Phillips Chemical Company, China National Petroleum Corporation (CNPC), Eastman Chemical Company, ExxonMobil Corporation, Formosa Plastics Corporation, Huntsman Corporation, Indian Oil Corporation Limited, LyondellBasell Industries N.V., Reliance Industries Limited, Royal Dutch Shell plc, Sinopec Limited, Total S.A., and Others.

-

5. What factors are driving the growth of the heavy aromatic solvent naphtha market?Growth is driven by expanding paints and coatings demand, rising construction activities, increasing agrochemical consumption, automotive production growth, rapid industrialization in emerging economies, and expanding petrochemical refining capacities globally.

-

6. What are the market trends in the heavy aromatic solvent naphtha market?Technological developments in solvent formulations, a growing emphasis on high-performance industrial solvents, strategic refinery expansions, rising demand from Asia Pacific, and a slow transition to environmentally friendly solvent solutions are some of the important concepts.

-

7. What are the main challenges restricting the wider adoption of the heavy aromatic solvent naphtha market?Strict environmental laws, unstable crude oil prices, health and safety issues, the growing desire for bio-based substitutes, the expense of regulatory compliance, and shifting supply-demand dynamics are some of the main barriers.

Need help to buy this report?