India Naphtha Market Size, Share, By Type (Light Naphtha and Heavy Naphtha), By Sales Channel (Direct Sale and Indirect Sale), India Naphtha Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Naphtha Market Insights Forecasts to 2035

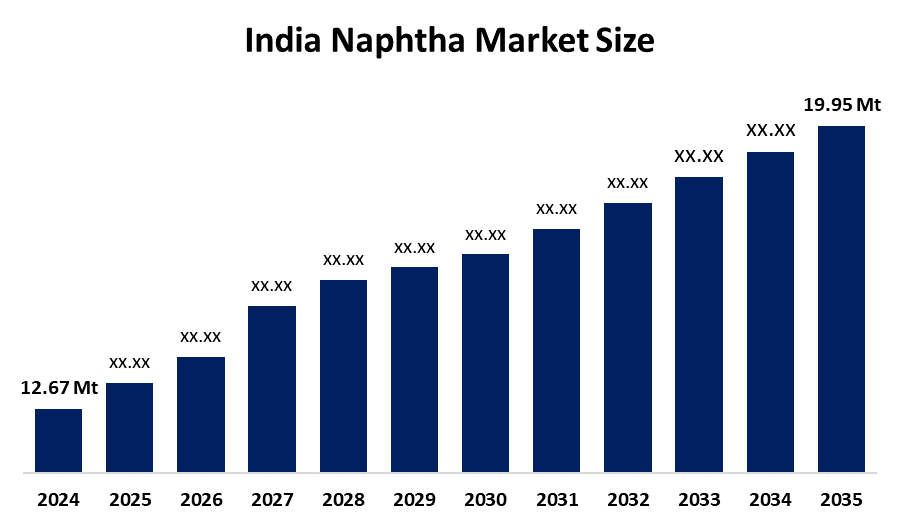

- India Naphtha Market Size 2024: 12.67 Million Tonnes

- India Naphtha Market Size 2035: 19.95 Million Tonnes

- India Naphtha Market CAGR 2024: 4.21%

- India Naphtha Market Segments: Type and Sales Channel

Get more details on this report -

The India Naphtha Market Size consists of all activities related to the production, distribution and consumption of naphtha, which serves as a petroleum-based hydrocarbon that functions mainly as a petrochemical feedstock, fuel blending component and industrial solvent.

On January 03 2025 Indian Oil Corporation IOCL disclosed its investment plans for a naphtha cracker project located in Paradip Odisha which will cost INR 61000 Crore 711 Billion USD The formalization will happen at the 'Utkarsh Odisha Make in Odis

The Petroleum and Natural Gas Regulatory Board PNGRB intends to establish a petroleum products exchange, which will enable naphtha trading together with other fuel transactions. The initiative aims to enhance market transparency and pricing efficiency for domestic market products, which include naphtha.

The India Naphtha Market Size presents excellent future development prospects, which result from increasing petrochemical production capacity and growing polymer requirements and refinery modernization projects, and rising naphtha consumption as both feedstock and fuel.

India Naphtha Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 12.67 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.21% |

| 2035 Value Projection: | 19.95 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type , By Sales |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Haldia Petrochemicals Limited (HPL), Nayara Energy, Oil and Natural Gas Corporation (ONGC), Mangalore Refinery and Petrochemicals Limited (MRPL), GAIL (India) Limited, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Naphtha Market:

The India Naphtha Market Size is driven by the expansion of petrochemical and polymer markets, together with refinery capacity growth and increased naphtha use as feedstock for producing olefins and aromatics and the industrialization process and government initiatives which support domestic petrochemical production and infrastructure development.

The India Naphtha Market Size is restrained by the unpredictable nature of crude oil prices, together with the increasing market demand for natural gas-based feedstock, the implementation of strict environmental regulations, the supply chain disruptions and the industry's heavy reliance on imports, which create challenges that impede pricing stability and profitability for end-users.

The future of India's naphtha market is bright and promising, with the combination of rising petrochemical investments, together with increased polymer demand, refinery modernization and government policies that enhance domestic feedstock access and create markets for extended periods of time.

Market Segmentation

The India Naphtha Market share is classified into type and sales channel.

By Type:

The India Naphtha Market Size is divided by type into light naphtha and heavy naphtha. Among these, the light naphtha segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to higher demand as a petrochemical feedstock, better cracking efficiency, and widespread use in olefins and aromatics production, driving large-volume industrial consumption.

By Sales Channel:

The India Naphtha Market Size is divided by sales channel into direct sale and indirect sale. Among these, the direct sale segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large refineries and petrochemical players procure naphtha in bulk through long-term contracts, ensuring stable supply, consistent quality, cost efficiency, and reliable producer support.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Naphtha Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Naphtha Market:

- Reliance Industries Limited

- Indian Oil Corporation Limited (IOCL)

- Bharat Petroleum Corporation Limited (BPCL)

- Hindustan Petroleum Corporation Limited (HPCL)

- Haldia Petrochemicals Limited (HPL)

- Nayara Energy

- Oil and Natural Gas Corporation (ONGC)

- Mangalore Refinery and Petrochemicals Limited (MRPL)

- GAIL (India) Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Naphtha Market Size based on the below-mentioned segments:

India Naphtha Market, By Type

- Light Naphtha

- Heavy Naphtha

India Naphtha Market, By Sales Channel

- Direct Sale

- Indirect Sale

Frequently Asked Questions (FAQ)

-

Q: What is the India naphtha market size?A: India naphtha market is expected to grow from USD 12.67 million tonnes in 2024 to USD 19.95 million tonnes by 2035, growing at a CAGR of 4.21% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the unpredictable nature of crude oil prices, together with the increasing market demand for natural gas-based feedstock, the implementation of strict environmental regulations, the supply chain disruptions and the industry's heavy reliance on imports, which create challenges that impede pricing stability and profitability for end-users.

-

Q: What factors restrain the India naphtha market?A: Constraints include the unpredictable nature of crude oil prices, together with the increasing market demand for natural gas-based feedstock, the implementation of strict environmental regulations, the supply chain disruptions and the industry's heavy reliance on imports, which create challenges that impede pricing stability and profitability for end-users.

-

Q: How is the market segmented by type?A: The market is segmented into light naphtha and heavy naphtha.

-

Q: Who are the key players in the India naphtha market?A: Key companies include Reliance Industries Limited, Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Haldia Petrochemicals Limited (HPL), Nayara Energy, Oil and Natural Gas Corporation (ONGC), Mangalore Refinery and Petrochemicals Limited (MRPL), GAIL (India) Limited and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?