Europe Sustainable Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Bioplastics, Paper and Paperboard, Metal, Glass and Flexible Packaging), By End User (Food and Beverages, Pharmaceuticals, Personal Care, Household Goods, and Retail), and Europe Sustainable Packaging Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsEurope Sustainable Packaging Market Insights Forecasts to 2035

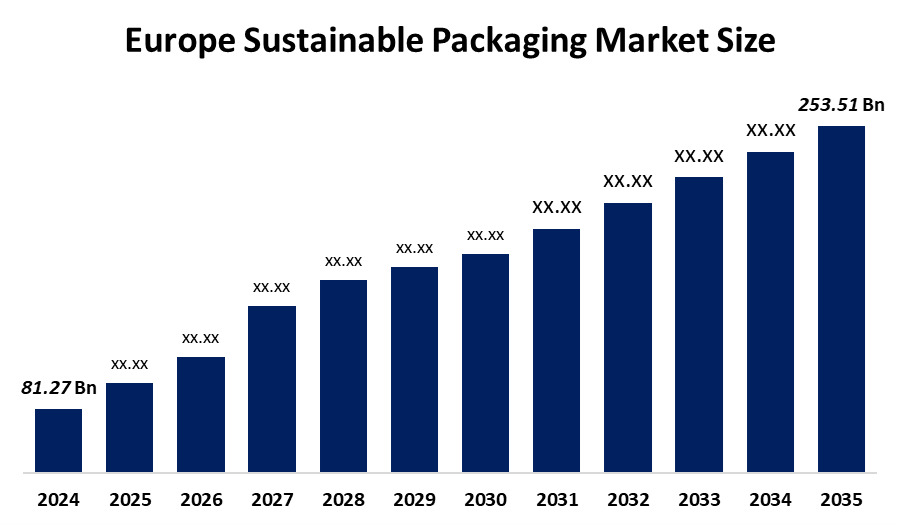

- The Europe Sustainable Packaging Market Size Was Estimated at USD 81.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.9% from 2025 to 2035

- The Europe Sustainable Packaging Market Size is Expected to Reach USD 253.51 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Sustainable Packaging Market size is Anticipated to Reach USD 253.51 Billion by 2035, Growing at a CAGR of 10.9% from 2025 to 2035. The market is driven by the growing concern regarding plastic waste and the enhancement of recycling processes. The upward movement in online shopping has led to an increase in the need for eco-friendly packaging

Market Overview

Sustainable packaging is described by its extensive reduction of ecological impact with the help of several methods such as making it more recyclable, using recycled materials, and producing less waste. The European Union has adopted measures that are legally binding for each country to bring down the amount of packaging waste generated. Various governments' actions are taking place to cut down waste and to promote circular economy practices, and these are having an effect on the market dynamics. Eco-friendly materials and designs are used in sustainable packaging to minimize environmental impact; thus, it serves the food, e-commerce and electronics industries for protection, information, and promotion applications while at the same time reducing waste and carbon footprint.

nnovia Films will introduce a novel series of eco-friendly packaging films in Germany in March 2025. Citing 2024 as a year of partnership, Saica Group and Mondelez will collaborate on a new paper-based packaging product for multipack applications in the candy, cookie, and chocolate markets, which will be recyclable within the paper waste stream.

In Europe, the use of plant-based packaging sources like paper, bagasse, and seaweed saw a growth of 15% in the year 2023. The novel ideas not only cut down on plastic use and at the same time increasing the share of renewable resources, since the consumption of paper packaging is already 45% of Europe's whole packaging market. Developments in bio-based and compostable materials, along with the investments in the green supply chain technology, also drove the growth of Europe plant-based packaging sector.

Report Coverage

This research report categorizes the market for the Europe sustainable packaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe sustainable packaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe sustainable packaging market.

Europe Sustainable Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 81.27 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 10.9% |

| 2035 Value Projection: | USD 253.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material |

| Companies covered:: | Amcor Plc, Mondi Group, DS Smith Plc, Smurfit Kappa Group, Sealed Air Co., Stora Enso, Tetra Pak, Berry Global, Tipa-Corp Ltd, Notpla, and Other key palyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sustainable packaging market in Europe is driven by the awareness of environmentally friendly practices among consumers. There is a continuous investment in the materials and methods that can make traditional plastics obsolete. The application of artificial intelligence in waste management, recycling, and bio-plastics is not only a great opportunity but also a source of innovations in the years to come. The increase in online shopping, convenient foods, and personalized packaging is contributing to the diversification of the market. Companies are increasingly adopting high-tech solutions such as smart and active packaging in order to enhance product security and monitoring.

Restraining Factors

The sustainable packaging market in Europe is restrained by according to the European Environment Agency, only 64% of the total packaging waste was recycled in the entire EU in 2021, and there were major differences in these figures among different countries and materials. Packaging reduction must be done while controlling the hygiene and safety requirements. The production of bioplastics is about 20%-30% costlier than that of traditional plastics due to the technology involved.

Market Segmentation

The Europe sustainable packaging market share is categorised into material type and end user.

- The paper and paperboard segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe sustainable packaging market is segmented by material type into bioplastics, paper and paperboard, metal, glass and flexible packaging. Among these, the paper and paperboard segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the biodegradability and renewability properties. It is a highly accepted segment mainly for its versatility and cost-effectiveness in the e-commerce and food & beverage industry. The rising knowledge of consumers about the ecological effect has increased the demand in this segment.

- The food and beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe sustainable packaging market is segmented into food and beverages, pharmaceuticals, personal care, household goods, and retail. Among these, the food and beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the packaging industry's constant innovative practices. The introduction of such sustainable packaging is an absolute necessity, along with the guarantee of safety and durability and the assurance of necessary extension of shelf life. Furthermore, the online grocery sales surge is also a contributing factor to the development of sustainable packaging focusing on transport and delivery in terms of protection and durability with the use of recyclable and lightweight materials. It also allows food brands to build their image by moving towards such packaging solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe sustainable packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor Plc

- Mondi Group

- DS Smith Plc

- Smurfit Kappa Group

- Sealed Air Co.

- Stora Enso

- Tetra Pak

- Berry Global

- Tipa-Corp Ltd

- Notpla

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Sonoco launched paper can have made from 100% recycled fibre. Sonoco’s new Paper Can featuring a paper bottom is an award-winning paper container made to meet the diverse packaging needs of modern brands.

In October 2025, Polish co-packer FILLSY announced plans to open a new manufacturing facility in Zyrardow, Poland, in partnership with Swedish packaging technology company Meadow.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Sustainable Packaging Market based on the below-mentioned segments:

Europe Sustainable Packaging Market, By Material Type

- Bioplastics

- Paper and Paperboard

- Metal

- Glass

- Flexible Packaging

Europe Sustainable Packaging Market, By End User

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Household Goods

- Retail

Frequently Asked Questions (FAQ)

-

What is the Europe sustainable packaging market size?Europe sustainable packaging market size is expected to grow from USD 81.27 billion in 2024 to USD 253.51 billion by 2035, growing at a CAGR of 10.9% during the forecast period 2025-2035.

-

What is sustainable packaging, and its primary use?Sustainable packaging is characterized by a reduction of its ecological impact through various measures, like increased recyclability, the use of recycled materials, and less waste. There are targets for each member state to cut down the amount of packaging waste produced.

-

What are the key growth drivers of the market?Market growth is driven by the awareness of environmentally friendly practices among consumers. There is a continuous investment in the materials and methods that can make traditional plastics obsolete.

-

What factors restrain the Europe sustainable packaging market?The market is restrained by packaging reduction must be done while controlling the hygiene and safety requirements. The production of bioplastics is about 20%-30% costlier than that of traditional plastics due to the technology involved

-

How is the market segmented by material type?The market is segmented into bioplastics, paper and paperboard, metal, glass and flexible packaging

-

Who are the key players in the Europe sustainable packaging market?Key companies include Amcor Plc, Mondi Group, DS Smith Plc, Smurfit Kappa Group, Sealed Air Co., Stora Enso, Tetra Pak, Berry Global, Tipa-Corp Ltd, and Notpla.

Need help to buy this report?