United Kingdom Vegan Fast Food Market Size, Share, and COVID-19 Impact Analysis, By Product (Meat & Seafood, Creamer, Ice Cream and Frozen Novelties, Yogurt, Cheese, Butter, Meals, Protein Bars, and Others), By Distribution Channel (Online and Offline), and United Kingdom Vegan Fast Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Vegan Fast Food Market Insights Forecasts to 2035

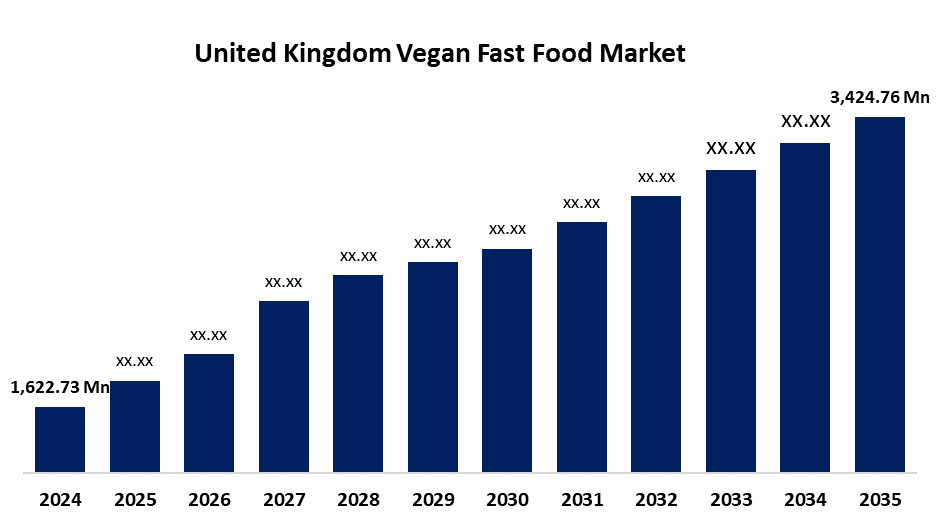

- The United Kingdom Vegan Fast Food Market Size Was Estimated at USD 1,622.73 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.03% from 2025 to 2035

- The United Kingdom Vegan Fast Food Market Size is Expected to Reach USD 3,424.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Vegan Fast Food Market is anticipated to reach USD 3,424.76 million by 2035, growing at a CAGR of 7.03% from 2025 to 2035. The increasing consumer demand for sustainable, ethical food options, environmental concerns, growing health consciousness, a growing number of vegans, and creative plant-based product releases, each of which is bolstered by fast food chains that are expanding their vegan cuisines.

Market Overview

The United Kingdom vegan fast food market refers to the industry that provides plant-based, animal-free meals in a quick service approach. It includes burgers, wraps, pizzas, and snacks made with meat. This market meets the rising demand from consumers for food that is produced ethically, sustainably, and healthily. In the UK, it includes restaurants, food chains, and delivery services that focus on or provide vegan fast-food options. Growing consumer consciousness on health, animal welfare, and sustainability. There is potential for flavor, texture, and variety innovation as the market for substitutes made from plants expands. There is a promise regarding emerging food production technologies, including lab-grown components and meat alternatives. Additionally, firms can increase their market share and foster customer loyalty by targeting flexitarian consumers and branching out into unexplored places of business. The development of realistic-looking substitutes for meat from plants, the application of sustainable packaging, AI-powered menu personalization, and improvements in food technology to improve flavor and texture. In an effort to appeal to a wide range of consumer tastes, brands are starting to experiment with international vegan cuisines.

Report Coverage

This research report categorizes the market for the United Kingdom vegan fast food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom vegan fast food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom vegan fast food market.

United Kingdom Vegan Fast Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,622.73 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.03% |

| 2035 Value Projection: | USD 3,424.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Greggs, Danone SA, Beyond Meat, Amy’s Kitchen, VBites, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Consumers growing health consciousness is encouraging many to switch to plant-based diets in an attempt to lower their likelihood of developing chronic illnesses. Individuals prefer more sustainably produced foods due to environmental concerns, such as whether the production of animal products contributes to climate change. Animal welfare ethics are also very important. Consumer behavior is also being impacted by the proliferation of creative vegan products, celebrity endorsements, and more social media awareness. Technological developments in food processing and fast-food companies’ expansion of their vegan menus are driving market expansion and drawing in a wider clientele.

Restraining Factors

The high production and ingredient costs for plant-based products result in premium pricing. Concerns about flavor and texture, a lack of consumer awareness in particular regions, and opposition from traditional meat eaters all impede broad adoption and market penetration.

Market Segmentation

The United Kingdom vegan fast food market share is classified into product and distribution channel.

- The meat & seafood segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom vegan fast food market is segmented by product into meat & seafood, creamer, ice cream and frozen novelties, yogurt, cheese, butter, meals, protein bars, and others. Among these, the meat & seafood segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by demands for sustainability, ethical considerations, health consciousness, and technological advancements in plant-based proteins, drawing in both flexitarians and devoted vegans in search of palatable, recognizable, and environmentally responsible solutions.

- The online segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom vegan fast food market is segmented by distribution channel into online and offline. Among these, the online segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing urban lives, growing online platforms, growing customer need for convenience, and greater use of meal delivery apps have contributed to fast food alternatives that are vegan are more accessible and served fast.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom vegan fast food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Greggs

- Danone SA

- Beyond Meat

- Amy’s Kitchen

- VBites

- Others.

Recent Developments:

- In December 2024, Plant-based brand THIS™ launched two new products: THIS Isn’t Chicken Kyiv and this Isn’t Chicken Wings. The Kyiv is made from soya and fava protein with a wild garlic plant-based butter center, while the wings feature a seaweed-based crispy skin designed to mimic traditional chicken wings.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom vegan fast food market based on the below-mentioned segments:

United Kingdom Vegan Fast Food Market, By Product

- Meat & Seafood

- Creamer

- Ice Cream and Frozen Novelties

- Yogurt

- Cheese

- Butter

- Meals

- Protein Bars

- Others

United Kingdom Vegan Fast Food Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?