Europe Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Type (Grey, Blue, and Green), By Application (Petroleum Refinery, Chemicals and Others), and Europe Hydrogen Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Hydrogen Market Insights Forecasts to 2035

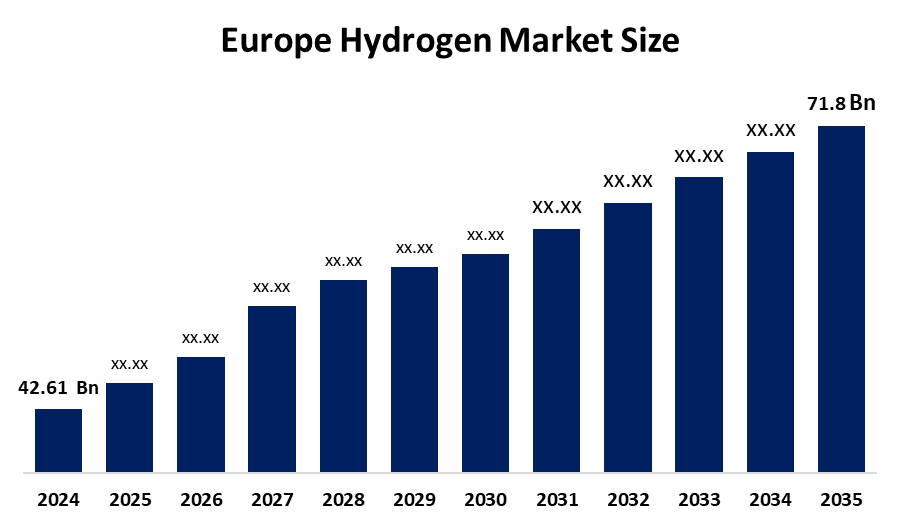

- The Europe Hydrogen Market Size Was Estimated at USD 42.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.86% from 2025 to 2035

- The Europe Hydrogen Market Size is Expected to Reach USD 71.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Hydrogen Market Size is anticipated to reach USD 71.8 Billion by 2035, Growing at a CAGR of 4.86% from 2025 to 2035. The market is driven by the growing industrial bases in developing economies, which are expected to boost business growth. Introduction of hydrogen programmes across the region, growing requirement to reduce carbon emissions and increasing adoption of hydrogen across fuel cells.

Market Overview

Hydrogen serves as a flexible clean energy carrier, which now functions as a crucial resource for achieving decarbonization across industrial operations, transportation systems and power generation facilities. The rising demand for hydrogen as an environmentally friendly energy source and production material has emerged as a growing research area that researchers worldwide are now studying. Europe is developing a strategic plan that will establish hydrogen as a primary element for its efforts to achieve decarbonization throughout the continent.

The Spanish Government chose 16 projects for its hydrogen valley program, which received €1.2 billion in funding and included major companies Repsol, Moeve, and bp as recipients in February 2025.

In October 2022, Nuvera Fuel Cells, LLC, which supplies hydrogen fuel cell engines for on-road and off-road applications, established a partnership through a memorandum of understanding with H2Boat, which operates from Italy as a system integrator that develops zero-emission energy solutions for marine usage.

European hydrogen trading in 2023 reached 29,767 tonnes, which represents a 13% decline from the previous year. European hydrogen fuel cell electric vehicle (FCEV) registrations reached 1,026 vehicles in 2023. Belgium exported 71% (21,159 tonnes) of the 29,767 tonnes of hydrogen that flowed to and between European countries, remaining Europe’s single largest exporter of hydrogen. The European Hydrogen Observatory (EHO) initiative, which serves as the main European hydrogen data source, investigates hydrogen's basic concepts and current developments and its function in energy transition.

Report Coverage

This research report categorises the European hydrogen market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe hydrogen market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe hydrogen market.

Europe Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42.61 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.86% |

| 2035 Value Projection: | USD 71.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Air Liquide, Linde Plc, Nel ASA, Thyssenkrupp Nucera, ITM Power, Plug Power, Siemens Energy, Enapter AG, Enagas, Snam, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen market in Europe is driven by the Clean Hydrogen Alliance and Horizon Europe funding programs, which will establish innovative technologies that will enhance the hydrogen industry throughout Europe. The EU established a delegated act in July 2025, which requires hydrogen to achieve 70% greenhouse gas emission reductions to be considered low-carbon. The European Commission launched its third European Hydrogen Bank (EHB) auction, which provided a budget of €1.3 billion and received an extra €1.7 billion from national budgets, creating total funding of €3 billion.

Restraining Factors

The hydrogen market in Europe is restrained by the cost of green hydrogen production is more expensive than all existing fossil-fuel alternatives. The absence of specialized facilities dedicated to large-scale storage, transportation and distribution operations hinders progress. The production process faces challenges because essential materials such as iridium and platinum remain scarce for PEM electrolyser production.

Market Segmentation

The Europe hydrogen market share is categorised into type and application.

- The grey segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe hydrogen market is segmented by type into grey, blue, and green. Among these, the grey segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The grey hydrogen segment dominated the market by holding a 70% share in 2024 because it provided cost-effective production, which required $1.5 per kilogram through steam methane reforming. The urgent need for cleaner alternatives exists because grey hydrogen fails to sustain long-term climate targets, while blue and green hydrogen serve as viable solutions for achieving decarbonization goals.

- The petroleum refinery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe hydrogen market is segmented into petroleum refinery, chemicals and others. Among these, the petroleum refinery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The petroleum refinery segment accounted for 60% market share in 2024. The company achieves its growth through its extensive implementation of hydrogen technology, serving both as a feedstock and an energy solution for essential industrial operations. The refineries employ hydrogen for their main purpose of extracting sulphur and other impurities from crude oil during its refining process.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide

- Linde Plc

- Nel ASA

- Thyssenkrupp Nucera

- ITM Power

- Plug Power

- Siemens Energy

- Enapter AG

- Enagas

- Snam

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe hydrogen market based on the below-mentioned segments:

Europe Hydrogen Market, By Type

- Grey

- Blue

- Green

Europe Hydrogen Market, By Application

- Petroleum Refinery

- Chemicals

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe hydrogen market size?Europe hydrogen market size is expected to grow from USD 42.61 billion in 2024 to USD 71.8 billion by 2035, growing at a CAGR of 4.86% during the forecast period 2025-2035.n

-

What is hydrogen, and its primary use?Hydrogen serves as a flexible clean energy carrier, which now functions as a crucial resource for achieving decarbonization across industrial operations, transportation systems and power generation facilities

-

What are the key growth drivers of the market?Market growth is driven by the Clean Hydrogen Alliance and Horizon Europe funding programs, which will establish innovative technologies that will enhance the hydrogen industry throughout Europe.

-

What factors restrain the Europe hydrogen market?The market is restrained by the cost of green hydrogen production, which is more expensive than all existing fossil-fuel alternatives.

-

How is the market segmented by type?The market is segmented into grey, blue, and green.h

-

Who are the key players in the Europe hydrogen market?Key companies include Air Liquide, Linde Plc, Nel ASA, Thyssenkrupp Nucera, ITM Power, Plug Power, Siemens Energy, Enapter AG, Enagas, and Snam.

Need help to buy this report?