Europe Air Defense System Market Size, Share, and COVID-19 Impact Analysis, By Component (Weapon System, Fire Control System, Command and Control System and Others), By Type (Missile Defense System, Anti-Aircraft System, Counter Unmanned Aerial Systems, and Counter Rocket, Artillery and Mortar Systems), By Platform (Land, Naval, and Airborne), By Range (Long Range, Medium Range, Short Range), and Europe Air Defense System Market Size Insights, Industry Trends, Forecast to 2035

Industry: Aerospace & DefenseEurope Air Defense System Market Size Insights Forecasts to 2035

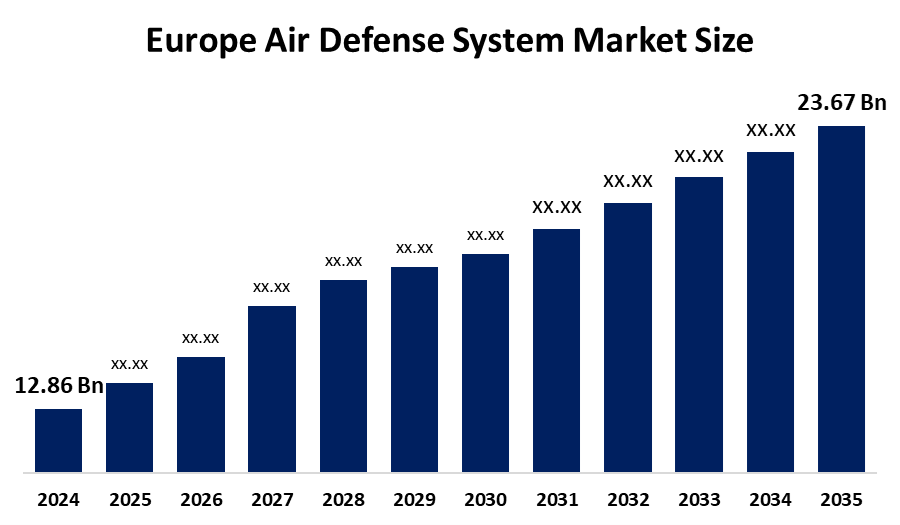

- The Europe Air Defense System Market Size Was Estimated at USD 12.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.7% from 2025 to 2035

- The Europe Air Defense System Market Size is Expected to Reach USD 23.67 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Air Defense System Market Size is Anticipated to reach USD 23.67 Billion by 2035, growing at a CAGR of 5.7% from 2025 to 2035. The market is driven by the threats that are becoming more and more complex, and thus, the countries have to rely on these systems to protect themselves from possible airstrikes and attacks from the sky.

Market Overview

Air Defense Systems consist of radar-controlled interceptors, command and control systems, and counter aerial threat devices, which are built to sense, trace, and eliminate air dangers such as piloted military planes, automated drones, and cruise missiles. Consequently, the escalating danger of UAVs (unmanned aerial vehicles) is anticipated to result in increased counter-UAV technologies being incorporated into air defense systems.

Europe is set to invest an enormous sum of money in the military sector. The British Prime Minister Keir Starmer promised to increase the country’s defense budget, while the EU announced that it would allocate up to 800 billion euros ($867 billion) for rapidly increasing the bloc’s security spending.

In March 2025, XTI Aerospace, Inc., the company known for its innovative VTOL and powered-lift aircraft solutions, declared the fruitful transition to a new fuel system design as a major 2025 first-quarter product and engineering milestone that was previously communicated in a press release.

The UK government’s integrated review of security, defence, development, and foreign policy focuses on defence technology, particularly missile and air protection, as one area where increased investment will be made. NATO, along with European countries, are gradually extending its collaboration, and this is going to lead to a higher number of shared defense resources such as air defense systems. The anticipated cooperation in terms of joint procurement and interoperability standards will rapid transfer of modern air defense technologies to the whole region.

Report Coverage

This research report categorizes the market for the Europe air defense system market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe air defense system market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe air defense system market.

Europe Air Defense System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 12.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.7% |

| 2035 Value Projection: | 23.67 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Type |

| Companies covered:: | Saab AB ADR, Thales Group, Rheinmetall AG, BAE Systems PLC, Leonardo SpA ADR, Rheinmetall AG, Lockheed Martin Corporation, THALES, RTX Corporation, Kongsberg Gruppen ASA, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Air Defense System Market in Europe is driven by the NATO air policing missions have significantly increased, European military spending reached €279 billion in 2023, which is according to the European Defence Agency (EDA), a 10% rise compared to 2022, Germany's special defense fund of €100 billion, announced in 2022, consists of approximately €33.4 billion which is intended for air defense systems and modernization. Anti-drone technologies are expected to be incorporated into existing air defense systems to counter this new threat. The EU's anti-drone market is projected to hit €1.86 billion by 2025, with a CAGR of 28.5%. The progress in radar, missile interception, and artificial intelligence is very likely to be the main factor in the expansion of the air defense market in Europe.

Restraining Factors

The air defense system market in Europe is restrained by the high price of air defense systems will hinder the market growth. It is expected that governments and defense contractors will have budget limitations that will restrict the use of advanced technology in defense. A lack of skilled workers in the field of air defense technology is going to be a barrier to the growth of the market. The strict rules and compliance requirements in the European countries. The slow process of development and procurement of advanced air defense technologies.

Market Segmentation

The Europe Air Defense System Market Size share is categorised into component, type, platform and range.

- The weapon system segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe air defense system market is segmented by component into weapon system, fire control system, command and control system and others. Among these, the weapon system segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by missiles and anti-aircraft guns, which are among the advanced weapon systems that are essential not only for airspace protection but also for the safeguarding of critical infrastructures. Air defense systems still consider weapon systems the most significant category because they are at the heart of both offensive and defensive capabilities, thereby making sure that the system is effective against aerial and missile attacks.

- The missile defense system segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on type, the Europe air defense system market is segmented into missile defense system, anti-aircraft system, counter unmanned aerial systems, and counter rocket, artillery and mortar systems. Among these, the missile defense system segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the systems are indispensable for capturing and deactivating fast missiles aimed at important installations. The growing focus on counteracting missile risks, especially from unfriendly nations and terrorist groups, places missile defense systems at the top of the list in the Europe air defense system market.

- The land segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe air defense system market is segmented by platform into land, naval, and airborne. Among these, the land segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by This is mainly because of their extensive application in the protection of territory borders, important infrastructures and military areas. The air defense systems that are land-based grant the flexibility, mobility and scalability that are essential for large-area aerial threats such as missiles and drones to be defended with different kinds of support.

- The long-range segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on range, the Europe air defense system market is segmented into long range, medium range, short range. Among these, the long-range segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by systems that are essential for protecting large areas or key sites against different types of aerial attacks. As the emphasis on safeguarding borders and important installations rises, the deployment of LRAD has become a necessity for ensuring total airspace security in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe air defense system market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saab AB ADR

- Thales Group

- Rheinmetall AG

- BAE Systems PLC

- Leonardo SpA ADR

- Rheinmetall AG

- Lockheed Martin Corporation

- THALES

- RTX Corporation

- Kongsberg Gruppen ASA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, Raytheon, a business, and Diehl Defence signed a memorandum of understanding to co-produce key elements of the Stinger missile in Europe. This agreement lays the groundwork for the extension of production for Stinger missiles at Diehl Defence as part of the company's growth plan.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe air defense system market based on the below-mentioned segments:

Europe Air Defense System Market Size, By Component

- Weapon System

- Fire Control System

- Command and Control System

- Others

Europe Air Defense System Market Size, By Type

- Missile Defense System

- Anti-Aircraft System

- Counter Unmanned Aerial Systems

- Counter Rocket

- Artillery and Mortar Systems

Europe Air Defense System Market Size, By Platform

- Land

- Naval

- Airborne

Europe Air Defense System Market Size, By Range

- Long Range

- Medium Range

- Short Range

Frequently Asked Questions (FAQ)

-

What is the Europe Air Defense System Market Size?Europe air defense system market size is expected to grow from USD 12.86 billion in 2024 to USD 23.67 billion by 2035, growing at a CAGR of 5.7% during the forecast period 2025-2035.

-

What is air defense system, and its primary use?Air defense systems consist of radar-controlled interceptors, command and control systems, and counter aerial threat devices, which are built to sense, trace, and eliminate air dangers such as piloted military planes, automated drones, and cruise missiles. Consequently, the escalating danger of UAVs (unmanned aerial vehicles) is anticipated to result in increased counter-UAV technologies being incorporated into air defense systems.

-

What are the key growth drivers of the market?Market growth is driven by the NATO air policing missions have significantly increased, European military spending reached €279 billion in 2023, which is according to the European Defence Agency (EDA), a 10% rise compared to 2022, Germany's special defense fund of €100 billion, announced in 2022, consists of approximately €33.4 billion which is intended for air defense systems and modernization.

-

What factors restrain the Europe Air Defense System Market Size?The market is restrained by the high price of air defense systems will hinder the market growth. It is expected that governments and defense contractors will have budget limitations that will restrict the use of advanced technology in defense. A lack of skilled workers in the field of air defense technology is going to be a barrier to the growth of the market.

-

How is the market segmented by component?The market is segmented into weapon system, fire control system, command and control system and others

-

Who are the key players in the Europe Air Defense System Market Size?Key companies include Saab AB ADR, Thales Group, Rheinmetall AG, BAE Systems PLC, Leonardo SpA ADR, Rheinmetall AG, Lockheed Martin Corporation, THALES, RTX Corporation, Kongsberg and Gruppen ASA.

Need help to buy this report?