Global Liquid Cooling Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid Heat Exchanger Systems and Recirculating Chillers), By Cooling Capacity (Upto 500, 500-2500, 2500-3500, and Above 3500), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Electronics, ICT & MediaGlobal Liquid Cooling Systems Market Insights Forecasts to 2035

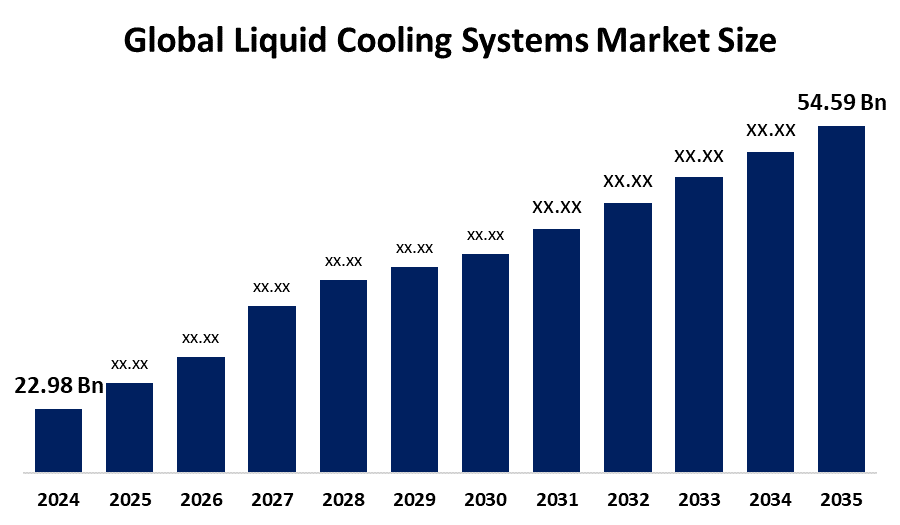

- The Global Liquid Cooling Systems Market Size Was Estimated at USD 22.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.81% from 2025 to 2035

- The Worldwide Liquid Cooling Systems Market Size is Expected to Reach USD 54.59 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Liquid Cooling Systems Market Size was worth around USD 22.98 Billion in 2024 and is predicted to grow to around USD 54.59 Billion by 2035 with a compound annual growth rate (CAGR) of 8.81% from 2025 and 2035. The market for liquid cooling systems has a number of opportunities to grow due to the growing need for high performance computing and energy efficient thermal management in data centers, the quick electrification of automobiles necessitating sophisticated battery and power electronics cooling, and the growing power density and miniaturization of electronic components.

Market Overview

A liquid cooling system is a thermal management system that transfers heat from vital components to a distant heat exchanger for dissipation by means of a circulating liquid. The growing need for high performance computing solutions is one of the main factors propelling the market for liquid cooling systems. Data centers are proliferating as a result of the increase in data collection and processing, which reuires for sophisticated cooling systems to control the heat produced by closely spaced servers. The International Energy Agency predicts that by 2025, the energy consumption of data centers worldwide will amount to 3,200 terawatt hours. The significance of liquid cooling systems, which are more effective than conventional cooling techniques at handling larger heat loads, is shown by this trend. The market is also expanding as a result of the increasing use of electric cars. For batteries to operate at their best and last a long time, liquid cooling systems are necessary. According to the U.S. Department of Energy, there may be more than 18 million electric cars on the road in the US alone by 2030, which would significantly increase the need for liquid cooling solutions in the automotive industry. These trends confluence to emphasize how essential liquid cooling technologies are to satisfying business demands.

Governments around the world are gradually supporting liquid cooling systems as one of the cutting edge cooling technologies through targeted initiatives. As an example, the U.S. Department of Energy provided US USD 40 million under the COOLERCHIPS program to support 15 projects that focus on energy efficient and high performance cooling for data centers, including liquid cooling technology.

Report Coverage

This research report categorizes the liquid cooling system market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid cooling system market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the liquid cooling system market.

Global Liquid Cooling Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.81% |

| 2035 Value Projection: | USD 54.59 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Cooling and By Region |

| Companies covered:: | Schneider Electric SE, Vertiv Holdings Co., Rittal GmbH & Co. KG, Asetek Inc., CoolIT Systems Inc., Green Revolution Cooling Inc., Alfa Laval AB, Emerson Electric Co., Fujitsu Ltd., LiquidCool Solutions Inc., Iceotope Technologies Ltd., HUBER and SUHNER AG, Mitsubishi Electric Corporation, STULZ GmbH, Boyd Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The liquid cooling system market is driven due to the growing requirement for thermal management and the growing demand for these systems from smartphone makers. The smartphone is developing into a very heat generating minicomputer. Compared to liquid cooling systems, air cooling systems require a lot more room. The market will expand as a result of the growing technical developments in the technology industry. The market for liquid cooling systems is continuously being driven by a number of applications, including semiconductors, data centers, and smartphones.

Restraining Factors

The liquid cooling system market is restricted by factors like the ongoing development of alternative cooling technologies, such as hybrid cooling systems and immersion cooling, which poses a threat to competitiveness. Special advantages like improved temperature management and simpler installation processes might be offered by these substitutes.

Market Segmentation

The liquid cooling system market share is classified into type and cooling capacity.

- The liquid heat exchanger Systems segment dominated the market in 2024, accounting for approximately 61.5% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the liquid cooling system market is divided into liquid heat exchanger systems and recirculating chillers. Among these,the liquid heat exchanger systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because of its adaptability, effectiveness, and wide range of applications. Liquid heat exchanger systems reign supreme in the global market for liquid cooling systems. Their versatility, which allows them to be incorporated into a variety of settings, including data centers and industrial machines, is a major factor in the domination of liquid heat exchanger systems throughout several industries.

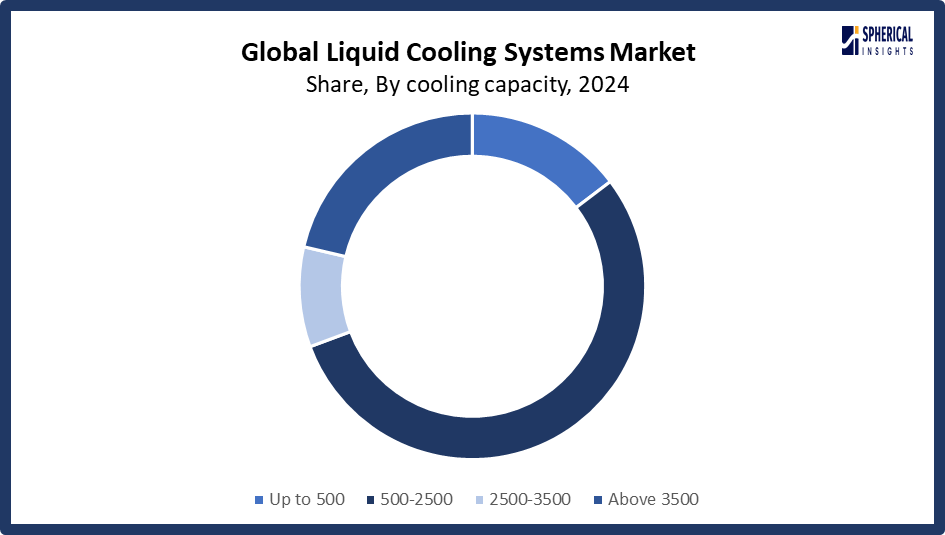

The 500 2500 segment accounted for the largest share in 2024, accounting for approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the cooling capacity, the liquid cooling system market is divided into up to 500, 500 2500, 2500 3500, and above 3500. Among these, the 500 2500 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the its strikes an excellent balance between performance and applicability. This range offers the most adaptable and extensively used cooling capacity and is extremely significant for a variety of high performance applications.

Get more details on this report -

Regional Segment Analysis of the Liquid Cooling Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 38% of the liquid cooling system market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 38% of the liquid cooling systems market over the predicted timeframe. In the North American market, the market is rising due to the elements, including the existence of significant data center operators and the expanding use of AI and high performance computing applications. With a significant manufacturing and automotive sector that fuels the need for liquid cooling systems.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 22.6% in the liquid cooling system market during the forecast period. The Asia Pacific area has a thriving market for liquid cooling systems due to the quick development of data centers and the growing use of liquid cooling technologies in developing nations like China and India, APAC is anticipated to grow at the quickest rate over the projected period. The growing need for industrial applications and data center infrastructure is predicted to fuel consistent expansion in South America and MEA.

Europes market share was fueled by significant investments in the continent's data center infrastructure. Regarding investment, Germany dominated the market in 2024, with Ireland, the United Kingdom, France, Norway, and Denmark following closely behind. In February 2025, for instance, France and the United Arab Emirates announced plans to invest USD 30 50 billion in a 1GW AI data center in Europe, according to statistics published by Data Center Dynamics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the liquid cooling system market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schneider Electric SE

- Vertiv Holdings Co.

- Rittal GmbH & Co. KG

- Asetek Inc.

- CoolIT Systems Inc.

- Green Revolution Cooling Inc.

- Alfa Laval AB

- Emerson Electric Co.

- Fujitsu Ltd.

- LiquidCool Solutions Inc.

- Iceotope Technologies Ltd.

- HUBER and SUHNER AG

- Mitsubishi Electric Corporation

- STULZ GmbH

- Boyd Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Boyd Extends its End-to-End AI Liquid Cooling Technologies Portfolio with a New Rack Emulator Developed in Collaboration with NVIDIA.

- In June 2025, GRC (Green Revolution Cooling) announced that it had secured additional investment to accelerate its growth. In this financing round, Samsung Ventures joined existing shareholders, including HTS, SK Enmove, and ENEOS, highlighting strong investor confidence in the companys technology. The investment follows several milestones GRC achieved in the past year, including new production level customer deployments, multiple product launches, and renewal of its ISO 9001:15 certifications. GRC also established an Engineering Alliance with Cisco and a strategic partnership with Park Place Technologies.

- In January 2025, Telehouse launched a liquid cooling lab at its London Docklands campus, collaborating with vendors like Accelsius, JetCool, Legrand, and EkkoSense to explore hybrid cooling solutions for AI and high-performance computing. This initiative enables customers to evaluate direct to chip and immersion cooling technologies while addressing operational challenges in mixed air and liquid environments.

- In November 2024, Vertiv and Compass Datacenters introduced the CoolPhase Flex, a hybrid cooling system that integrates both air and liquid cooling to support high density computing, particularly for AI applications. This system allows data centers to transition seamlessly from traditional air cooling to liquid cooling as demand for liquid cooling systems is increasing. By reducing deployment complexity, optimizing efficiency with predictive analytics, and minimizing infrastructure costs, this innovation is expected to accelerate the adoption of liquid cooling in AI-driven environments.

- In October 2024, Nautilus Data Technologies introduced the EcoCore COOL CDU, a high-capacity cooling distribution unit designed to support AI-driven, high-density data halls. The CDU offers 1,000kW of heat rejection and supports direct to chip, immersion, and rear door cooling methods. With a dual loop system utilizing diverse water sources, the innovation enhances energy efficiency and adaptability in liquid cooling infrastructure.

- In April 2024, Accelsius, an Innventure company, launched NeuCool, a two-phase direct to chip liquid cooling technology designed for AI and high performance computing workloads. The system offers an estimated 50% reduction in energy costs and an 80% cut in CO2 emissions while using zero water.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the liquid cooling system market based on the below mentioned segments:

Global Liquid Cooling Systems Market, By Type

- Liquid Heat Exchanger Systems

- Recirculating Chillers

Global Liquid Cooling Systems Market, By Cooling Capacity

- Up to 500

- 500-2500

- 2500-3500

- Above 3500

Global Liquid Cooling Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the liquid cooling system market over the forecast period?The global liquid cooling system market is projected to expand at a CAGR of 8.81% during the forecast period.

-

2. What is the market size of the liquid cooling system market?The global liquid cooling system market size is expected to grow from USD 22.98 Billion in 2024 to USD 54.59 Billion by 2035, at a CAGR of 8.81% during the forecast period 2025-2035

-

3. Which region holds the largest share of the liquid cooling system market?North America is anticipated to hold the largest share of the liquid cooling system market over the predicted timeframe

-

4. Who are the top 15 companies operating in the global liquid cooling system marketSchneider Electric SE, Vertiv Holdings Co., Rittal GmbH & Co. KG, Asetek Inc., CoolIT Systems Inc., Green Revolution Cooling Inc., Alfa Laval AB, Emerson Electric Co., Fujitsu Ltd., LiquidCool Solutions Inc., Iceotope Technologies Ltd., HUBER and SUHNER AG, Mitsubishi Electric Corporation, STULZ GmbH, Boyd Corporation, and Others

-

5. What factors are driving the growth of the liquid cooling system market?The liquid cooling system market growth is driven by the growing need for energy-efficient and high performance cooling solutions, especially in high-density computer settings and data centers where conventional air cooling is insufficient.

-

6. What are the market trends in the liquid cooling system market?The liquid cooling system market trends include the rise of immersion cooling and direct-liquid systems, growing sustainability and energy-efficiency focus, increasing use in automotive, EVs and , modular, scalable and smart cooled system designs, and high performance computing & AI driving adoption.

-

7. What are the main challenges restricting wider adoption of the liquid cooling system market?The liquid cooling system market trends include high installation and initial investment costs, particularly when retrofitting already existing air cooled systems

Need help to buy this report?