Europe Acrylonitrile Market Size, Share, and COVID-19 Impact Analysis, By Application (Acrylic Fiber, Adiponitrile, Styrene Acrylonitrile, Acrylamide, Carbon Fiber, Nitrile Rubber and Others), By End User (Automotive, Electrical and Electronics, Construction, Packaging, and Others), and Europe Acrylonitrile Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Acrylonitrile Market Size Insights Forecasts to 2035

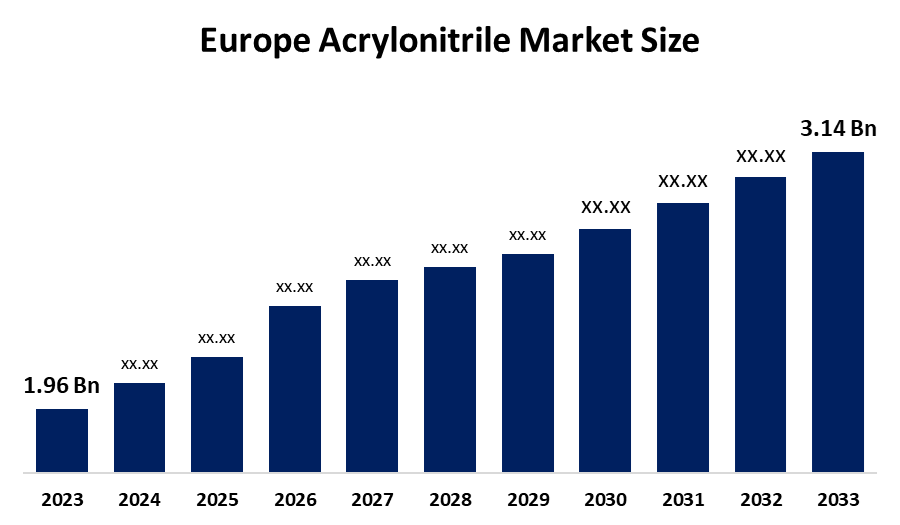

- The Europe Acrylonitrile Market Size Was Estimated at USD 1.96 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.38% from 2025 to 2035

- The Europe Acrylonitrile Market Size is Expected to Reach USD 3.14 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Acrylonitrile Market Size is Anticipated to reach USD 3.14 Billion by 2035, Growing at a CAGR of 4.38% from 2025 to 2035. The market is driven by the rising demand for acrylonitrile from industries such as automotive and construction. The demand for products in the consumer appliances industry is rising, driven by attributes such as heat and chemical resistance.

Market Overview

Acrylonitrile is an essential raw material that manufacturers use to create multiple products throughout different industries. The substance produces synthetic fibers with plastics, resins, and a variety of additional materials. The industry uses Acrylonitrile-Butadiene-Styrene (ABS) material to create lightweight components that can withstand impacts for use in automobiles, electronic devices, and home appliances. The substance creates oil-resistant fuel hoses together with O-ring seals and protective gloves, which industrial and medical facilities use. The materials serve as components in clothing, blankets, carpets and upholstery, which deliver products that offer consumers both comfort and durability.

The company to launch its bio-attributed products in June 2023 is INEOS Nitriles, with an Acrylonitrile product line launched under the brand InvireoTM.

The UK automotive industry produces more than one million vehicles each year and uses lightweight materials to achieve its emission reduction goals. The French Environment and Energy Management Agency reported that sustainable construction investments will increase by 10% each year. The UK has made financial commitments to advanced manufacturing technologies, which include carbon fiber composite manufacturing. The development of acrylonitrile-based products that demonstrate superior heat resistance, chemical resistance and flame retardancy capabilities will create new market opportunities for companies while increasing product demand.

Report Coverage

This research report categorises the European acrylonitrile market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Acrylonitrile Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe Acrylonitrile Market Size.

Europe Acrylonitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.96 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.38% |

| 2035 Value Projection: | USD 3.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 560 |

| Segments covered: | By Application, By End User |

| Companies covered:: | INEOS Group, AnQore B.V., Lucite International, Elix Polymers, Fibrant, Nouryon, Arpadis, Proquinorte, Aliancys, Clariant Chemicals, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The acrylonitrile market in Europe is driven by the increasing use of ACN-based plastics to create lightweight components that help fuel-efficient and electric vehicles to meet strict environmental regulations. The rising demand for household appliances and 5G hardware casings drives continuous consumption of ABS/SAN resins, which provide high impact and heat resistance properties. The aerospace and defence and wind energy industries require strong yet lightweight materials creates significant demand in these sectors.

Restraining Factors

The acrylonitrile market in Europe is restrained by the system, which displays high sensitivity because it depends on changes in propylene and ammonia prices. The textile and plastics industries demand sustainable bio-based products that prevent traditional fossil-fuel-based acrylonitrile from being used. The European market experiences slow capacity expansion because high entry barriers and extended payback periods combine with unpredictable pricing conditions to prevent new companies from entering the market.

Market Segmentation

The Europe Acrylonitrile Market Size share is categorised into application and end user.

- The acrylic fiber segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Acrylonitrile Market Size is segmented by application into acrylic fiber, adiponitrile, styrene acrylonitrile, acrylamide, carbon fiber, nitrile rubber and others. Among these, the acrylic fiber segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The acrylic fiber segment holds a share of 35.7% in 2024. The segment controls most of the market because acrylic fibers are widely used in textiles, which include winter clothing, carpets and home furnishings. Outdoor fabrics use acrylic fibers because they provide wool-like warmth and wool-like texture while being more durable and resisting sunlight. Rising consumer demand exists for low-cost fabrics that maintain high-quality standards.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe Acrylonitrile Market Size is segmented into automotive, electrical and electronics, construction, packaging, and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The automotive segment accounted for 40.6% of total consumption in 2024. The market operates through the widespread application of acrylonitrile derivatives, which include nitrile rubber and carbon fiber in vehicle production. Nitrile rubber serves as the primary material for automotive seals, gaskets and hoses because of its ability to withstand oil and fuel. Carbon fiber functions as the material used in making lightweight structural parts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Acrylonitrile Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Group

- AnQore B.V.

- Lucite International

- Elix Polymers

- Fibrant

- Nouryon

- Arpadis

- Proquinorte

- Aliancys

- Clariant Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Acrylonitrile Market Size based on the below-mentioned segments:

Europe Acrylonitrile Market Size, By Application

- Acrylic Fiber

- Adiponitrile

- Styrene Acrylonitrile

- Acrylamide

- Carbon Fiber

- Nitrile Rubber

- Others

Europe Acrylonitrile Market Size, By End User

- Automotive

- Electrical and Electronics

- Construction

- Packaging

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe Acrylonitrile Market Size?Europe Acrylonitrile Market Size is expected to grow from USD 1.96 billion in 2024 to USD 3.14 billion by 2035, growing at a CAGR of 4.38% during the forecast period 2025-2035.

-

What is acrylonitrile, and its primary use?Acrylonitrile serves as an essential raw material that manufacturers use to create multiple products throughout different industries. The substance produces synthetic fibers with plastics, resins, and a variety of additional materials.

-

What are the key growth drivers of the market?Market growth is driven by the increasing use of ACN-based plastics (ABS and SAN) to create lightweight components that help fuel-efficient and electric vehicles to meet strict environmental regulations.

-

What factors restrain the Europe Acrylonitrile Market Size?The market is restrained by the system, which displays high sensitivity because it depends on changes in propylene and ammonia prices.

-

How is the market segmented by application?The market is segmented into acrylic fiber, adiponitrile, styrene acrylonitrile, acrylamide, carbon fiber, nitrile rubber and others.

-

Who are the key players in the Europe Acrylonitrile Market Size?Key companies include INEOS Group, AnQore B.V., Lucite International, Elix Polymers, Fibrant, Nouryon, Arpadis, Proquinorte, Aliancys, and Clariant Chemicals.

Need help to buy this report?