Global E-Mobility Raw Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Body Metals, Light Weight Plastic, Battery Chemicals, and Metals), By Application (Public Transport, Commercial Vehicle, and Personal Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal E-Mobility Raw Materials Market Insights Forecasts to 2035

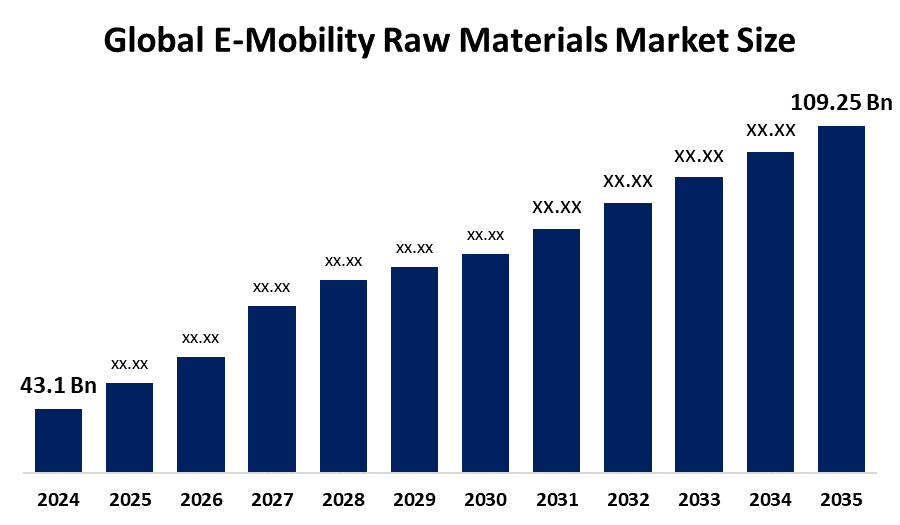

- The Global E-Mobility Raw Materials Market Size Was Estimated at USD 43.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.82 % from 2025 to 2035

- The Worldwide E-Mobility Raw Materials Market Size is Expected to Reach USD 109.25 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global E-mobility raw materials market size was valued at around USD 43.1 billion in 2024 and is predicted to grow to around USD 109.25 billion by 2035 with a compound annual growth rate (CAGR) of 8.82 % from 2025 to 2035. Expanding sustainable supply chains, developing battery technology, capitalizing on the rising demand for electric vehicles, promoting recycling programs, and facilitating strategic resource collaborations worldwide are some of the business opportunities in the e-mobility raw materials market.

Market Overview

The specialized international industry engaged in the procurement, extraction, processing, and supply of vital materials needed for electric mobility technologies is known as the "E-mobility raw materials market." The transition to sustainable transportation has significantly boosted demand for the critical raw materials lithium, cobalt, nickel, graphite, copper, and rare earth elements, and is expected to surpass 10 million tons annually by 2030. To address supply unpredictability, the industry employs a range of tactics, including extraction, processing, recycling, and geopolitics. In order to diversify sourcing, the European Union started 13 important raw material projects in Canada, Australia, Vietnam, and Africa in June 2025. In August 2025, the U.S. Department of Energy launched the Critical Minerals Accelerator to support domestic supply chains. The global switch from internal combustion engines to electric and hybrid mobility solutions is driving the E-mobility raw materials market, which operates at the intersection of the automotive, energy storage, and materials industries.

Report Coverage

This research report categorizes the E-mobility raw materials market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the E-mobility raw materials market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the E-mobility raw materials market.

Global E-Mobility Raw Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 43.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.82% |

| 2035 Value Projection: | USD 109.25 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 143 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Albemarle Corporation American Battery Technology Company BASF SE Contemporary Amperex Technology Co. Limited (CATL) Ganfeng Lithium Co., Ltd. Johnson Matthey LG Chem / LG Energy Solution Mitsubishi Chemical Holdings Corporation Norilsk Nickel (Nornickel) POSCO Chemical Samsung SDI Co., Ltd. Sumitomo Metal Mining Co., Ltd. Targray Technology International Inc. Umicore Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for e-mobility raw materials is expanding due to a number of interconnected variables that raise investment and demand in the industry. The market for raw materials used in e-mobility is growing as a result of several interrelated factors that raise investment and demand in the sector. Technological advancements in energy storage systems, electric drivetrains, and battery architecture further enhance the demand for premium raw materials. Positive government policies, incentives, and regulations aimed at reducing carbon emissions encourage the E-mobility raw materials market expansion. The most important of these is the worldwide movement toward eco-friendly transportation, which is typified by the expanding usage of hybrid and electric cars (EVs). Large quantities of vital raw materials, including lithium, cobalt, nickel, graphite, and rare earth elements, are needed for these technologies.

Restraining Factors

Limited resource availability, geopolitical supply risks, unstable raw material prices, strict environmental regulations, high extraction costs, and technological difficulties in sustainable recycling are all challenges to steady market growth and supply chain stability in the e-mobility raw materials market.

Market Segmentation

The E-mobility raw materials market share is classified into type and application.

- The battery chemicals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the E-mobility raw materials market is divided into body metals, light weight plastic, battery chemicals, and metals. Among these, the battery chemicals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing demand for energy storage systems and electric vehicles worldwide is the driving force behind battery chemistry. Government incentives encouraging electrification and rising investments in battery production have further solidified the battery chemicals segment's dominance in the industry.

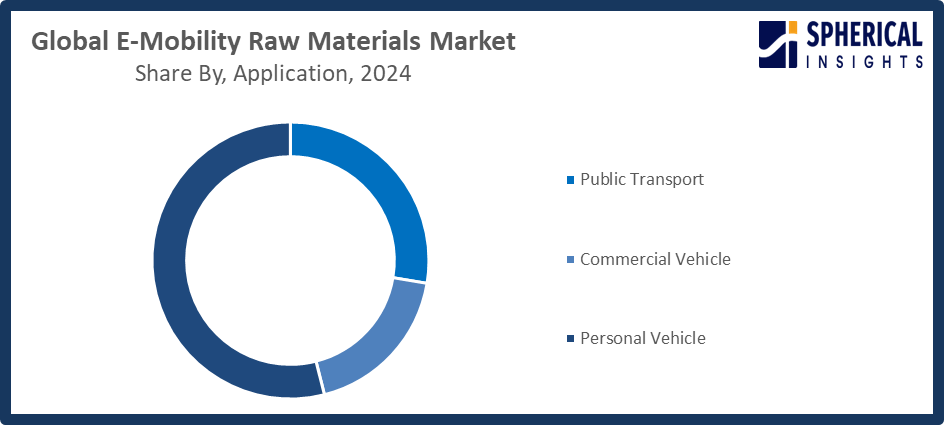

- The personal vehicle segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the E-mobility raw materials market is divided into public transport, commercial vehicle, and personal vehicle. Among these, the personal vehicle segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The quick uptake of electric and hybrid vehicles around the world is driving the personal vehicle market. Personal automobiles are now the main revenue-generating application in the E-Mobility Raw Materials Market due to increased disposable incomes and the development of charging infrastructure.

Get more details on this report -

Regional Segment Analysis of the E-Mobility Raw Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the E-mobility raw materials market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the E-mobility raw materials market over the predicted timeframe. The region has experienced gains from a strong automotive sector, cutting-edge manufacturing facilities, and large expenditures in battery and electric vehicle (EV) R&D. To improve national security and the resilience of EV production, President Trump issued an Executive Order in March 2025 requiring faster permitting for mining projects on federal lands, giving priority to leases for vital mineral extraction. In addition, local sourcing is strengthened in the face of global instability by the U.S. Department of Energy's October 2025 announcement of a 5% equity position in Lithium Americas' Thacker Pass project, which is expected to produce 88 million pounds of lithium carbonate yearly.

Asia Pacific is expected to grow at a rapid CAGR in the E-mobility raw materials market during the forecast period. The demand for vital raw materials like lithium, nickel, cobalt, and graphite is driven by the significant investments made by major economies like China, Japan, South Korea, and India in the production of electric vehicles, batteries, and related infrastructure. While China's 180GW ESS objective by 2027 and Vietnam's 16.3GW aspiration by 2030 increase the adoption of lithium-intensive LFP chemistry, South Korea's first 563MW ESS auction in 2025 and Australia's A$500 million battery manufacturing injection signal rapid deployment. Regional momentum is further demonstrated by Malaysia's 400MW ESS auction and India's 2025 integrated renewables awards, which forecast a 10.8% CAGR for electric two-wheelers alone.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the E-mobility raw materials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Albemarle Corporation

- American Battery Technology Company

- BASF SE

- Contemporary Amperex Technology Co. Limited (CATL)

- Ganfeng Lithium Co., Ltd.

- Johnson Matthey

- LG Chem / LG Energy Solution

- Mitsubishi Chemical Holdings Corporation

- Norilsk Nickel (Nornickel)

- POSCO Chemical

- Samsung SDI Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Targray Technology International Inc.

- Umicore

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Integrals Power Ltd. (IPL) launched advanced lithium batteries, leveraging innovative E-Mobility Raw Materials to enhance performance, reduce costs, and support widespread adoption in electric vehicles, electronics, and renewable energy systems.

- In September 2023, BYD launched a new range of electric buses incorporating advanced E-Mobility Raw Materials, enhancing battery performance, range, and sustainability, reinforcing its leadership in zero-emission public transportation and setting new industry benchmarks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the E-mobility raw materials market based on the below-mentioned segments:

Global E-Mobility Raw Materials Market, By Type

- Body Metals,

- Light Weight Plastic

- Battery chemicals

- Metals

Global E-Mobility Raw Materials Market, By Application

- Public Transport

- Commercial Vehicle

- Personal Vehicle

Global E-Mobility Raw Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?