Global Diethylene Glycol (DEG) Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade, Food Grade, and Pharmaceutical Grade), By Application (Solvent, Plasticizer, Humectant, Intermediate, and Dehydrating Agent), By End Use (Automotive, Textiles, Construction, Pharmaceuticals, and Food & Beverage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Diethylene Glycol (DEG) Market Insights Forecasts to 2035

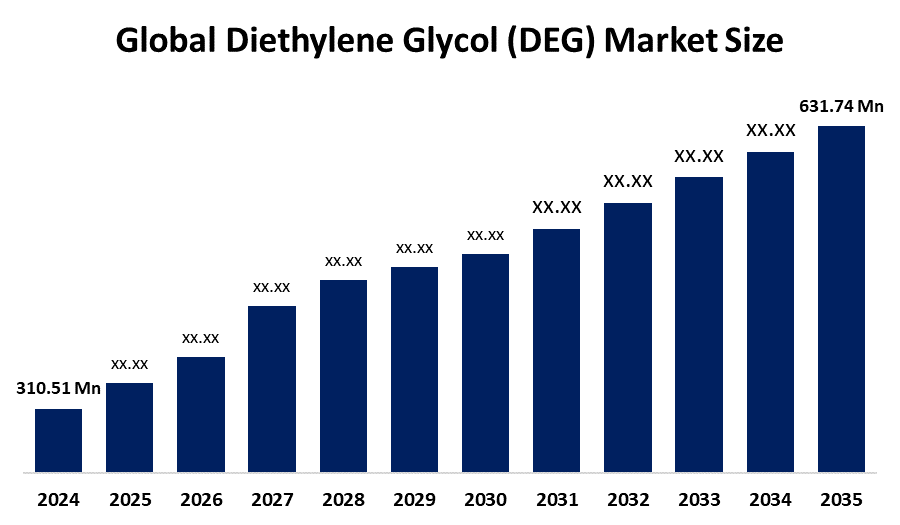

- The Global Diethylene Glycol (DEG) Market Size Was Estimated at USD 310.51 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.67% from 2025 to 2035

- The Worldwide Diethylene Glycol (DEG) Market Size is Expected to Reach USD 631.74 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Diethylene Glycol (DEG) Market Size was Worth around USD 310.51 Million in 2024 and is Predicted to Grow to around USD 631.74 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 6.67% from 2025 to 2035. The diethylene glycol (DEG) market is growing globally in emerging nations such as China and India, owing to increased industrialization in these regions. The result is an increased need for DEG, which is a raw material in these industries.

Market Overview

The diethylene glycol (DEG) market can be defined as the global trade and commercial sector associated with the production, distribution, and consumption of diethylene glycol, which is a clear liquid with a chemical formula of C4H10O3, known to be odorless and hygroscopic in nature and commonly used as a chemical intermediate, solvent, or humectant. DEG is generally used in the manufacture of unsaturated polyester resin materials, plasticizers, polyurethane, antifreeze solutions, solvents, adhesives, or as a humectant in various industrial applications. Demand for DEG in the global market is being driven by the growing application in the construction, automobile, packaging, and textile industries because of the increased application of polyester resin and fibers. Industry growth in the Asia Pacific countries further stimulates the DEG market because of the growing industrialization in these countries.

Market opportunities arise from the growing application in the pharmaceuticals, cosmetics, and speciality chemicals segments, capacity expansions in the Asia Pacific market also create opportunities in the DEG market circuit. The key market participants for the global DEG market include BASF SE, Dow Inc., SABIC, Shell Chemicals, Reliance Industries Limited, and LyondellBasell. In October 2025, the WHO issued a Medical Product Alert, based upon a notification by India's CDSCO of diethylene glycol (DEG) contamination of three oral liquids for cold and cough symptom relief. The notification was based on reports of serious illnesses and deaths of children who ingested those drugs.

Report Coverage

This research report categorizes the diethylene glycol (DEG) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diethylene glycol (DEG) market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diethylene glycol (DEG) market.

Global Diethylene Glycol (DEG) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 310.51 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.67% |

| 2035 Value Projection: | USD 631.74 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade, By Application, By End Use, By Regional Analysis |

| Companies covered:: | SABIC, BASF SE, Reliance Industries Limited, LyondellBasell Industries, Dow Inc., Shell Chemicals, Mitsubishi Chemical Corporation, Sinopec Corp, Merck KGaA, Huntsman Corporation, Nippon Shokubai Co. Ltd., India Glycols Limited, Eastman Chemical Company, Indorama Ventures Public Company Limited, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Factors driving the world diethylene glycol (DEG) market include the increasing demand in end-user industries such as polyester resins, plasticizers, antifreeze, and solvents. Increasing demand in construction, automotive, and DEG in unsaturated polyester resins, adhesives, and coolants is another factor driving the world market. The rising demand for textiles and packaging further aids the demand for the product. The rising pace of urbanization and industrialization in developing nations drives the use of DEG. The rising usage of the product in the production of drugs, cosmetic items, and personal care products, as well as its easy and cheaper availability, further supports the use of the product.

Restraining Factors

The diethylene glycol (DEG) market is constrained by its toxicity. Any environmental and health hazards associated with this compound often result in strict regulations. The price volatility of raw materials like ethylene oxide is another factor that increases cost unpredictability. The preference for cost-effective and biodegradable substitutes and unpredictable demands from downstream industries also limit this market.

Market Segmentation

The diethylene glycol (DEG) market share is classified into grade, application, and end use.

- The industrial grade segment dominated the market in 2024, approximately 60% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the diethylene glycol (DEG) market is divided into industrial grade, food grade, and pharmaceutical grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The industrial-grade segment led the diethylene glycol (DEG) market due to its large use as a plasticizer for polyester resins, antifreeze, paints, adhesives, and plastic, as well as its high use in the automobile, textiles, and chemical industries. In addition to this, it is relatively cheaper and compatible with large-scale production processes.

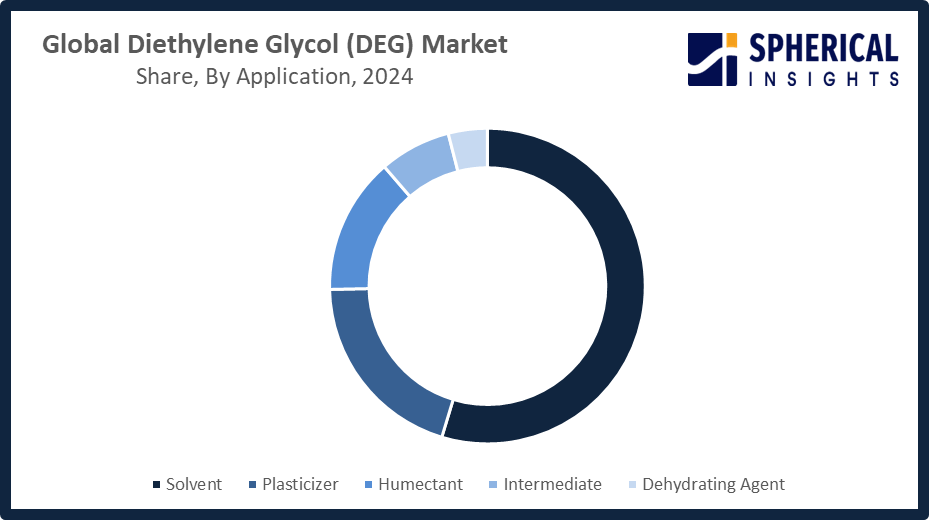

- The solvent segment accounted for the largest share in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the diethylene glycol (DEG) market is divided into solvent, plasticizer, humectant, intermediate, and dehydrating agent. Among these, the solvent segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The solvent market has registered the highest demand in DEG due to its industrial applications in paints, adhesives, and cleaning agents. The DEG acts as an additive to improve solubility and viscosity properties. The dominant DEG market growth in this range of applications has been attributed to its efficiency and competitiveness in comparison to other solvents in the market.

Get more details on this report -

- The automotive segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the diethylene glycol (DEG) market is divided into automotive, textiles, construction, pharmaceuticals, and food & beverage. Among these, the automotive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The automotive segment showed the greatest market growth for diethylene glycol (DEG) due to its high utilization as a component of antifreeze fluids and coolants, as well as a freezing point depressant in brake fluids. The increasing production of autos worldwide, particularly electric and hybrid autos, and strict regulatory demands for improved thermal fluids for autos have fueled the utilization of DEG significantly.

Regional Segment Analysis of the Diethylene Glycol (DEG) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the diethylene glycol (DEG) market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the diethylene glycol (DEG) market over the predicted timeframe. The Asia Pacific region is anticipated to represent the 42% market share in the diethylene glycol (DEG) industry due to its fast-growing pace of industrialization and development of automotive, textiles, and chemical industries, besides high polyester resin, antifreeze, and coating demands. China and India are major country-specific drivers because of their bulk chemical production, increasing automotive production, and growing urbanization. Other factors, such as government support for industrial progress and enhanced export promotions, further fuel this dominance. In October 2025, Madhya Pradesh, India, introduced compulsory testing of diethylene glycol in raw and final syrup products of cough syrup Coldrif because of child deaths from contaminated products.

North America is expected to grow at a rapid CAGR in the diethylene glycol (DEG) market during the forecast period. The North American market is projected to have a 21% market share of the diethylene glycol (DEG) industry owing to rising applications in industries such as automobiles, paint, and chemicals, wherein DEG is used for manufacturing antifreeze, coolants, adhesives, and resins, respectively. The United States is the largest contributor because of its higher automobile production and adoption of advanced technologies for thermal energy management and stringent quality requirements. Other driving forces behind the use of DEG include technological advancements and infrastructure development, as well as increasing interest in other types of specialties.

The diethylene glycol (DEG) market in Europe is registering steady growth because of increasing demand in coatings, adhesives, plastics, and automotive industries, where DEG acts as a performance-enhancing and strengthening agent. The German market leads this demand in Europe because of its advanced chemical production technology, high auto production, and concentration on industrial innovation. Furthermore, stricter environmental policies to ensure eco-compatible and low-VOC chemical products have motivated people to opt for specialty DEG, thus registering steady growth in the European market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the diethylene glycol (DEG) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SABIC

- BASF SE

- Reliance Industries Limited

- LyondellBasell Industries

- Dow Inc.

- Shell Chemicals

- Mitsubishi Chemical Corporation

- Sinopec Corp

- Merck KGaA

- Huntsman Corporation

- Nippon Shokubai Co. Ltd.

- India Glycols Limited

- Eastman Chemical Company

- Indorama Ventures Public Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Dow and MEGlobal finalized an agreement for Dow to supply an additional 100 KTA of ethylene from its Gulf Coast operations. The ethylene will support MEGlobal’s ethylene glycol production at the co-located Oyster Creek facility, enhancing feedstock reliability and production capacity.

- In June 2025, Thailand’s Ministry of Public Health set strict contamination limits for ethylene glycol (EG) and diethylene glycol (DEG) in 12 high-risk food additives, strengthening import controls. The regulation, published in the Official Gazette, will take effect in October 2025, urging businesses to ensure compliance.

- In January 2024, SABIC approved the final investment for the SABIC Fujian Petrochemical Complex in China, a USD 6.4 billion joint venture. The facility, set for 2026 completion, will produce 1.8 million tons of ethylene annually, along with EG, PE, PP, PC, and other downstream products.

- In December 2023, Ineos Oxide announced a $700 million acquisition of LyondellBasell’s Bayport, Texas, ethylene oxide and derivatives business. The deal, including EO, ethylene glycol, and glycol ethers plants, provides Ineos access to cost-advantaged US feedstocks, energy, and logistics, helping offset European margin pressures and global competition.

- In December 2023, SABIC, Scientific Design (SD), and Linde Engineering signed an MoU to explore collaboration in decarbonizing SD’s ethylene glycol process. The partnership aims to implement SABIC’s CO2 recovery technology, enabling sustainable, low-carbon ethylene oxide and glycol production, setting benchmarks for carbon-neutral industrial practices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the diethylene glycol (DEG) market based on the below-mentioned segments:

Global Diethylene Glycol (DEG) Market, By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Global Diethylene Glycol (DEG) Market, By Application

- Solvent

- Plasticizer

- Humectant

- Intermediate

- Dehydrating Agent

Global Diethylene Glycol (DEG) Market, By End Use

- Automotive

- Textiles

- Construction

- Pharmaceuticals

- Food & Beverage

Global Diethylene Glycol (DEG) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the diethylene glycol (DEG) market over the forecast period?The global diethylene glycol (DEG) market is projected to expand at a CAGR of 6.67% during the forecast period.

-

2. What is the market size of the diethylene glycol (DEG) market?The global diethylene glycol (DEG) market size is expected to grow from USD 310.51 million in 2024 to USD 631.74 million by 2035, at a CAGR of 6.67% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the diethylene glycol (DEG) market?Asia Pacific is anticipated to hold the largest share of the diethylene glycol (DEG) market over the predicted timeframe.

-

4. What is the diethylene glycol (DEG) market?The diethylene glycol (DEG) market involves production, distribution, and sales of DEG, used in plastics, solvents, antifreeze, and cosmetics.

-

5. Who are the top 10 companies operating in the global diethylene glycol (DEG) market?SABIC, BASF SE, Reliance Industries Limited, LyondellBasell Industries, Dow Inc., Shell Chemicals, Mitsubishi Chemical Corporation, Sinopec Corp, Merck KGaA, Huntsman Corporation, and Others.

-

6. What factors are driving the growth of the diethylene glycol (DEG) market?Factors driving DEG market growth include rising demand in antifreeze, plastics, solvents, cosmetics, increasing industrialization, expanding automotive and pharmaceutical sectors, growing chemical production, and rising infrastructure development globally.

-

7. What are the market trends in the diethylene glycol (DEG) market?Market trends in the diethylene glycol (DEG) market include rising use in polyester/PET, growth in automotive coolants and solvents, a sustainability shift toward bio‑based DEG, and product innovation for specialty applications.

-

8. What are the main challenges restricting wider adoption of the diethylene glycol (DEG) market?The main challenges restricting the wider adoption of the diethylene glycol (DEG) market are its high toxicity, stringent regulatory constraints and health concerns, and volatile raw material prices.

Need help to buy this report?