Japan High Capacity Power Bank Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lithium-Ion and Lithium-Polymer), By Capacity (10,000-20,000 mAh, 20,001-30,000 mAh, and Above 30,000 mAh), By Application (Smartphones, Tablets, Laptops, and Others), and Japan High Capacity Power Bank Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerJapan High Capacity Power Bank Market Insights Forecasts to 2035

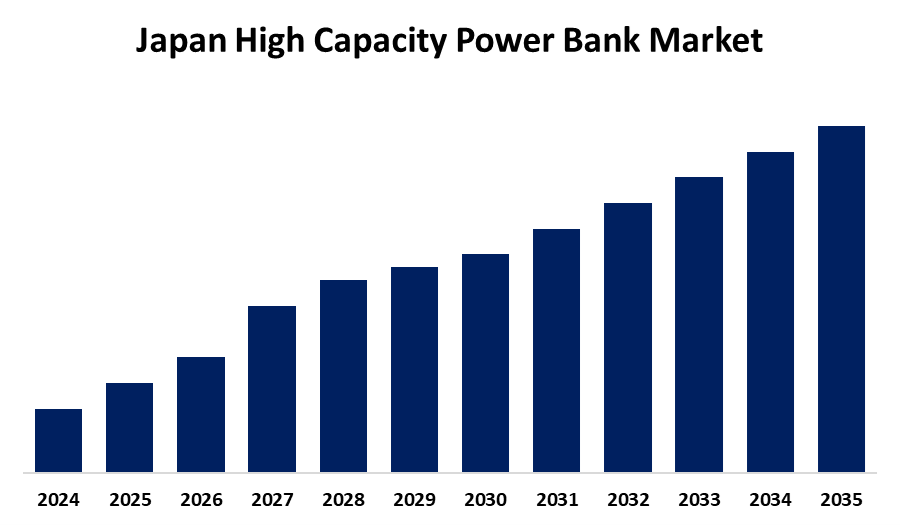

- The Japan High Capacity Power Bank Market Size is Expected to Grow at a CAGR of 7.2% from 2025 to 2035

- The Japan High Capacity Power Bank Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan High Capacity Power Bank Market Size is expected to hold a significant share by 2035, at a CAGR of 7.2% during the forecast period 2025-2035. The Japan high-capacity power bank market is undergoing strong growth based on various factors, spearheaded by the growing use of mobile devices and the necessity for solid on-the-move charging solutions.

Market Overview

The Japan high-capacity power bank market refers to portable charge tools, commonly lithum-ion or Li-polymer, that hold high levels of energy (typically over 8,000 mAh) and charge smartphones, tablets, laptops, and werables while in motion. Such devices are essential for urban working professionals, tourists, and studetns depend on conotinous mobile power. The Strengths of the market are in Japans electronics inoovation center, supported by top R&D and manufacuring, and consumer appeal for high-end, energy-efficient, small devices that combine wireless charging and long life. Prospects are many, Graphene and solid-state battery technology offer increased capacities, quicker charge rates, and evironmentally friendly properties, wireless/Phoenix charging of smartphones, and a remote work, trends. Market drivers are Japans 92% urbanization, more than 70% penetration of smartphones, and a remote work, travel, and outdoors activities boom, giving strong demand for tough, multi-port, quick-charge, hight-capacity banks. Government policies are supportive, including strict safety, efficiency, and import-export regulations, research and development grants and incentives, tax credits, extended producer responsibility, and circular-economy initiatives that promote sustainable battery technology development.

Report Coverage

This research report categorizes the market for the Japan high capacity power bank market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan high capacity power bank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan high capacity power bank market.

Japan High Capacity Power Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Companies covered:: | Sony Group Corporation, Sharp, Panasonic Corporation, Xiaomi Corporation, Elecom, Samsung Electronics, Furukawa Battery Co., Ltd., Maxell, Ltd., Lenovo Group Limited, Yoshino Technology, Inc., GS Yuasa, Belkin International, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The prime drivers for Japan's high-capacity power bank market are Japans high smartphone and mobile device usage, increasing demand for backup power with reliability while traveling, emergency situations, and working remotely, and rising use of energy-hungry gadgets. Japans population is technology-conscious and prefers fast charging, multi-device compatibility, and small form factors. Growing outdoor activities, tourism, and energy consciousness also drive demand. Moreover, the development of battery technology and encouragement from the government to adopt sustainable electronics also drive market growth.

Restraining Factors

The Japan high-capacity power bank market faces stringent safety rules, production costs, battery disposal issues, and market saturation. Moreover, growing competition and availability of substitute charging solutions cap growth in some consumer bases.

Market Segmentation

The Japan high capacity power bank market share is classified into battery type, capacity, and application.

- The lithium-ion segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan high capacity power bank market is segmented by battery type into lithium-ion and lithium-polymer. Among these, the lithium-ion segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are affordable and have high energy density. Lithium-ion batteries have a long cycle life, which makes them a good option for high capacity power banks that need effective power storage. Lithium-ion batteries are also widely used owing to they are cheap to produce, making it easy for manufacturers to provide power banks at affordable prices without compromising on profitability.

- The 10,000-20,000 mAh segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan high capacity power bank market is segmented by capacity into 10,000-20,000 mAh, 20,001-30,000 mAh, and above 30,000 mAh. Among these, the 10,000-20,000 mAh segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to it has the optimal combination of portability and adequate power capacity. The power banks in this category are suited for charging smartphones and smaller tablets several times, which is just enough for the average consumer.

- The smartphones segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan high capacity power bank market is segmented by application into smartphones, tablets, laptops, and others. Among these, the smartphones segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the omnipresent nature of smartphones in contemporary life. Users predominantly use their phones for communication, entertainment, and work, so there is an ever-present demand for portable power supplies. As such, power banks designed specifically for smartphone use tend to have slender designs with adequate capacity to charge phones several times from a single charge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan high capacity power bank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sony Group Corporation

- Sharp

- Panasonic Corporation

- Xiaomi Corporation

- Elecom

- Samsung Electronics

- Furukawa Battery Co., Ltd.

- Maxell, Ltd.

- Lenovo Group Limited

- Yoshino Technology, Inc.

- GS Yuasa

- Belkin International

- Others

Recent Developments:

- In March 2022, Panasonic Corporation announced that its Energy Company will establish a production line at the Wakayama Factory in western Japan to produce new 4680 lithium-ion batteries for electric vehicles. To promote worldwide EV adoption, Panasonic is expanding its battery portfolio and developing high-capacity 4680 batteries at several locations in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan high capacity power bank market based on the below-mentioned segments:

Japan High Capacity Power Bank Market, By Battery Type

- Lithium-Ion

- Lithium-Polymer

Japan High Capacity Power Bank Market, By Capacity

- 10,000-20,000 mAh

- 20,001-30,000 mAh

- above 30,000 mAh

Japan High Capacity Power Bank Market, By Application

- Smartphones

- Tablets

- Laptops

- Others

Need help to buy this report?