Global Corrugated Board Market Size By Flute Type (A-Flute, B-Flute, C-Flute, E-Flute, F-Flute), By Board Style (Single Face, Single Wall, Double Wall, Triple Wall), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Advanced MaterialsGlobal Corrugated Board Market Insights Forecasts to 2032

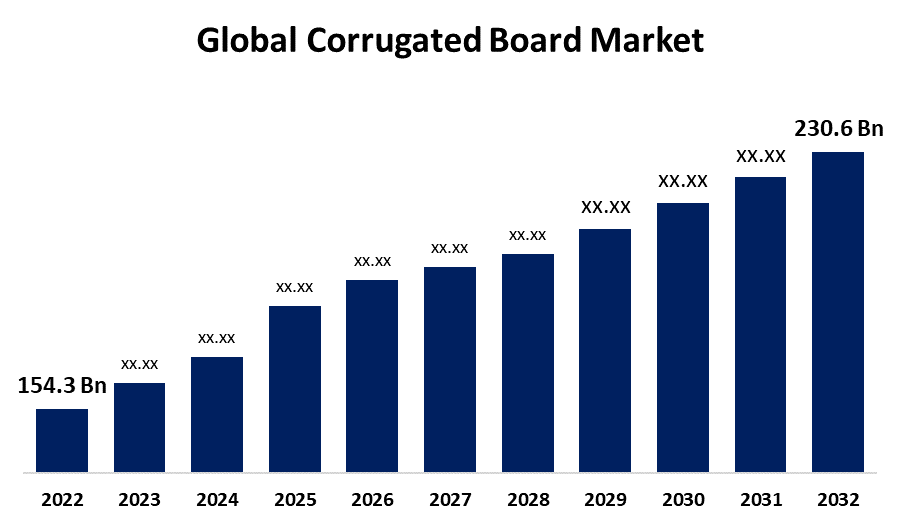

- The Global Corrugated Board Market Size was valued at USD 154.3 Billion in 2022

- The Market Size is growing at a CAGR of 7.4% from 2022 to 2032

- The Worldwide Corrugated Board Market Size is expected to reach USD 230.6 Billion by 2032

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Corrugated Board Market Size is expected to reach USD 230.6 Billion by 2032, at a CAGR of 7.4% during the forecast period of 2022–2032.

In order to offer cardboard boxes strength and longevity, corrugated boards are layered structures. Their affordability and adaptability make them a huge deal in the packaging sector. The need for environmentally friendly and sustainable packaging solutions is driving this market. Environmental consciousness is growing, and corrugated boards meet all the necessary criteria. They are lightweight, recyclable, and have a wide range of uses. The market for corrugated board has been expanding due to the growth of e-commerce. Consider this: in order for the packages being delivered all over the world to arrive at their destination, they require strong boxes. It's a small but important piece of the supply chain and logistics puzzle.

Corrugated Board Market Value Chain Analysis

The main source materials are virgin fibres and recycled paper. In order to make the liner and medium used in corrugated boards, recycled paper is frequently gathered from diverse sources and processed. The manufacturing process is what separates the raw paper components into the medium and liner layers. This process entails shaping, pulping, and refining the paper sheets. The wavy layer (medium) is then created by corrugating the paper sheets. Corrugated board is made up of two flat sheets (liners) and this corrugated substance, which is pasted between them to form the basic structure. After that, the sheets of corrugated board are cut, scored, and folded into the precise shapes required for packaging. You may acquire those recognisable cardboard boxes here. Certain boxes go through design and printing processes, particularly when used as retail packaging. The final corrugated boxes are subsequently supplied to a variety of industries, including electronics, e-commerce, food & beverage, and more. The boxes eventually make it to the final consumers or enterprises. They act as product packaging both on store shelves and during transit.

Corrugated Board Market Opportunity Analysis

Strong packaging is becoming more and more in demand as internet buying continues to grow. When delivering goods, corrugated boards are frequently used. The corrugated board industry has an excellent opportunity for expansion as e-commerce keeps growing on a global scale. The packaging sector is going green along with the rest of the globe. Corrugated boards are in high demand since they are recyclable and environmentally beneficial. Innovation has a great chance to develop even more environmentally friendly alternatives, like bio-based adhesives or further lightening the boards. Packaging becomes more and more necessary as economies expand. The corrugated board industry has unrealized potential in emerging markets. Businesses can take advantage of the chance to address the growing need for packaging by developing their presence in these locations. Environmentally friendly packaging is becoming more and more favoured by legislation as a result of consumer and government pressure for sustainable practises.

Global Corrugated Board Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 154.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.4% |

| 2032 Value Projection: | USD 230.6 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Flute Type, By Board Style, By Region, By Geographic Scope |

| Companies covered:: | Mondi, WestRock Company, International Paper, Stora Enso, Rengo Co., Ltd., Industrial Development Company sal, Nine Dragons Worldwide (China) Investment Group Co., Ltd., Klabin S.A., Cascades inc., Neway Packaging., EmenacPackaging, Klingele Papierwerke Gmbh & Co. Kg, Smurfit Kappa, DS Smith Georgia-Pacific., VPK Packaging Group, Packaging Corporation of America, Oji Holdings Corporation, Western Container Corporation, Wertheimer Box Corp., Arabian Packaging Co LLC and Other Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Corrugated Board Market Dynamics

Global expansion of e-commerce market

Growing numbers of consumers are purchasing online, which has increased need for dependable and durable packaging. Corrugated boards have replaced wood as the preferred material for shipping boxes due to their strength and adaptability. Particular packaging trends, such the emergence of subscription boxes, eco-friendly packaging, and personalised branding, have been brought about by the expansion of e-commerce. Corrugated boards, which provide a blank canvas for innovative and environmentally friendly packaging ideas, are essential for meeting these trends. The global nature of e-commerce and the supply chain is intrinsic. For the protection of goods during international shipping, corrugated boards are crucial. The surge in e-commerce has increased demand for creative packaging ideas. Traditional shipping boxes are not the only application for corrugated boards; innovative packaging designs also make use of them.

Restraints & Challenges

Paper is a major raw material used in the corrugated board industry. Price fluctuations for paper can have an effect on production costs and, consequently, producers' profit margins. The dominance of corrugated boards may be threatened by the introduction of substitute packaging materials, such as bioplastics or other creative alternatives. Even though corrugated boards are frequently used in online shopping, packaging efficiency must always be prioritised. It can be difficult to strike a balance between the requirement for protection and minimising the use of surplus materials, particularly in light of the growing emphasis on waste reduction. As a link in the global supply chain, the corrugated board market is vulnerable to interruptions. Consumer spending and, by extension, the demand for packaged goods can be affected by economic downturns or unpredictabilities in important markets.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Corrugated Board Market from 2023 to 2032. One of the main factors propelling the corrugated board market in North America is the growth of e-commerce. The popularity of internet shopping has led to a rise in the need for durable and dependable packing materials like corrugated boards. Customized and branded packaging solutions are becoming more and more in demand in the North American market. In order to meet the branding requirements of diverse businesses, corrugated boards provide a wealth of alternatives for creative design and printing. The logistics network as a whole, the supply of raw materials, and the transportation infrastructure are all closely related to the corrugated board market in North America.

Asia Pacific Market Statistics

Get more details on this report -

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The market in the area has grown significantly as a result of a number of reasons, including the growing e-commerce industry, urbanisation, industrialization, and population expansion. E-commerce is booming in the Asia-Pacific area, where nations like China, India, and Southeast Asia are seeing a sharp increase in online sales. The need for corrugated boards as the main packing material for shipment has increased as a direct result of this. Asia-Pacific serves as a manufacturing centre for a number of sectors, including textiles, consumer goods, and electronics. Packaging solutions are in high demand, particularly corrugated boards, to guarantee the secure transit of goods both inside and outside the region. The burgeoning middle class in nations like China and India is driving up demand for packaged products and increasing consumer spending.

Segmentation Analysis

Insights by Flute Type

C-flute segment accounted for the largest market share over the forecast period of 2022-2032. The need for packaging materials that can survive the rigours of shipping has increased with the growth of e-commerce. Because they work well for this use, C-flute corrugated boards are the material of choice for packaging in the e-commerce industry. The strength and affordability of C-flute are well-balanced. For many applications, it offers enough structural stability without being as costly as thicker flute profiles. Businesses trying to cut expenditures on packaging are drawn to this cost-effectiveness. Retail packaging and point-of-purchase (POP) displays frequently use C-flute corrugated boards. Their robustness makes it possible to design robust and eye-catching displays, which supports marketing initiatives in physical businesses. Corrugated boards with C-flute help make the supply chain more effective. They provide an excellent balance between structural integrity.

Insights by Board Style

The single-wall segment accounted for the largest market share over the forecast period 2023 to 2032. Corrugated boards with a single wall are less expensive than those with two or three walls. They are therefore a desirable option for companies trying to strike a balance between packaging effectiveness and cost. Single-wall corrugated boards have become a popular option for shipping boxes due to the explosive expansion of e-commerce. They shield goods from harm during transportation without adding needless bulk or expense. Food packaging frequently uses single-wall corrugated boards, which provide a dependable means of safeguarding perishable items while in transit. In this regard, their lightweight construction is very advantageous. Single-wall corrugated boards are a popular option for companies with a range of packaging needs due to their availability in the market. They come from a variety of manufacturers and are easily accessible.

Recent Market Developments

- In May 2022, Mondi declared that it would invest EUR 280 million to boost cardboard and corrugated board production.

- In April 2022, a corrugated cardboard box for medical equipment shipping via e-commerce has been created and introduced by DS Smith, a sustainable packaging provider situated in the United Kingdom.

Competitive Landscape

Major players in the market

- Mondi

- WestRock Company

- International Paper

- Stora Enso

- Rengo Co., Ltd.

- Industrial Development Company sal

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- Klabin S.A.

- Cascades inc.

- Neway Packaging.

- EmenacPackaging

- Klingele Papierwerke Gmbh & Co. Kg

- Smurfit Kappa

- DS Smith Georgia-Pacific.

- VPK Packaging Group

- Packaging Corporation of America

- Oji Holdings Corporation

- Western Container Corporation

- Wertheimer Box Corp.

- Arabian Packaging Co LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Corrugated Board Market, Flute Type Analysis

- A-Flute

- B-Flute

- C-Flute

- E-Flute

- F-Flute

Corrugated Board Market, Board Style Analysis

- Single Face

- Single Wall

- Double Wall

- Triple Wall

Corrugated Board Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Corrugated Board Market?The Global Corrugated Board Market Size is expected to grow from USD 154.3 Billion in 2023 to USD 230.6 Billion by 2032, at a CAGR of 7.4% during the forecast period 2023-2032.

-

2. Who are the key market players of the Corrugated Board Market?Some of the key market players of market are Mondi, WestRock Company, International Paper, Stora Enso, Rengo Co., Ltd., Industrial Development Company sal, Nine Dragons Worldwide (China) Investment Group Co., Ltd., Klabin S.A., Cascades inc., Neway Packaging., EmenacPackaging, Klingele Papierwerke Gmbh & Co. Kg, Smurfit Kappa, DS Smith, Georgia-Pacific., VPK Packaging Group, Packaging Corporation of America, Oji Holdings Corporation, Western Container Corporation, Wertheimer Box Corp. and Arabian Packaging Co LLC.

-

3. Which segment holds the largest market share?C-Flute type segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Corrugated Board Market?North America is dominating the Corrugated Board Market with the highest market share.

Need help to buy this report?