Global E-commerce Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Transportation and Warehousing), By Type (Forward Logistics and Reverse Logistics), By Model (3PL, 4PL, and Others), By Operation (Domestic and International), By Vertical (Apparels, Consumer Electronics, Automotive, Healthcare, Food & Beverage and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: Information & TechnologyGlobal E-commerce Logistics Market Insights Forecasts to 2030

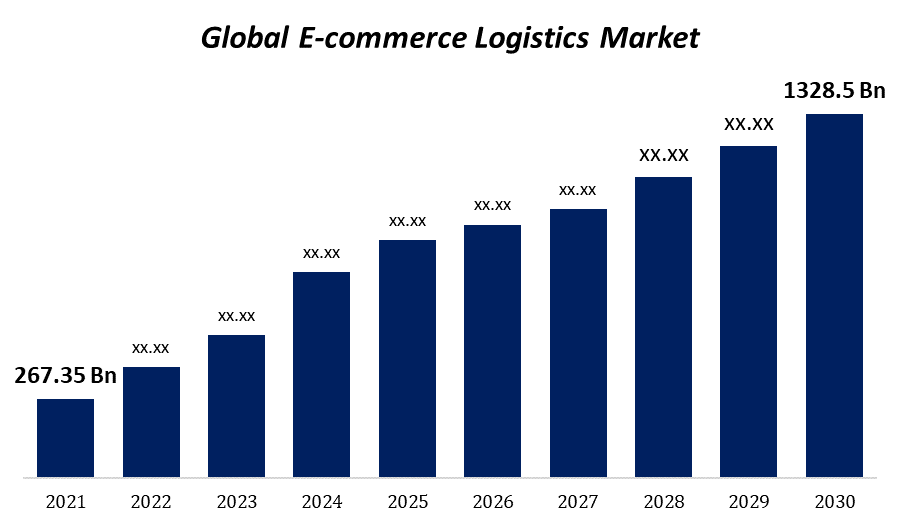

- The global E-commerce Logistics market was valued at USD 267.35 billion in 2021.

- The market is growing at a CAGR of 19.5% from 2021 to 2030

- The global E-commerce Logistics market is expected to reach USD 1328.5 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The global E-commerce Logistics market is expected to reach USD 1328.5 billion by 2030, at a CAGR of 25% during the forecast period 2021 to 2030. The need for online shopping and the rise of digital technology has led to an expansion in the E-commerce Logistics Market across various industries. The main forces behind online business growth are the expansion of the cross-border e-commerce Logistics Market and the rise in internet users, particularly in developing nations.

Market Overview

People now demand faster product delivery at the touch of a button, dramatically changing worldwide buying trends. End-user customers now have access to various items thanks to the proliferation of E-commerce Logistics C2C and B2C companies. Customers desire more affordable shipping rates, quicker fulfilment times, and straightforward return procedures. Traders and investors favour transparent and capable providers to guarantee transportation feasibility and ease. This is anticipated to result in customized logistics services for e-commerce. However, the businesses that offer these services favour cost-saving strategies. E-commerce logistics companies offer warehousing, transportation, and specialized services. The advent of the most recent outbreak, Covid-19, has positively affected the demand for liquid hand soap, which is anticipated to increase in the coming years. Demand for products has increased in several establishments, including restaurants, educational institutions, malls, and others, due to governments' strict standards for keeping cleanliness and adjusting hygienic practices among consumers. However, the global government's lockdown in 2020 to stop the spread of COVID-19 has presented various difficulties for the product producers, such as problems obtaining raw materials, damage to the supply chain, a lack of labour, and so on. The rate of e-commerce logistics adoption has increased with the development of digital technologies. Market expansion is being fueled by developments in cross-border e-commerce, import sales, and increased internet usage, particularly in emerging nations. People increasingly use e-commerce websites to purchase goods, including food, gadgets, personal care items, furniture, and clothing, instead of going to a real store. As a result of growing smartphone adoption, drone delivery, digitization, and digital payments, the market is expected to grow significantly throughout the projected period. The industry's expansion is further fueled by the growing use of hardware technologies, including the Internet of Things, barcodes, portable data terminals, GIS, and GPS.

Report Coverage

This research report categorizes the market for global e-commerce logistics based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global e-commerce logistics market. Recent market developments and competitive strategies such as expansion, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global e-commerce logistics market sub-segments.

Global E-commerce Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 267.35 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 19.5% |

| 2030 Value Projection: | USD 1328.5 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 191 |

| Tables, Charts & Figures: | 185 |

| Segments covered: | By Service Type, By Type, By Model, By Operation, By Vertical, By Region, COVID-19 Impact Analysis |

| Companies covered:: | FedEx Corporation, DHL International GmbH, Aramex International, Gati Limited, Kenco Group, Inc., Clipper Logistics Plc., Agility Public Warehousing Company, K.S.C.P., XPO Logistics Plc., United Parcel Service, Inc., and CEVA Logistics. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the transportation segment dominated the market with the largest market share of 58.7% and market revenue of 156.93 billion.

Based on the service type, the global e-commerce logistics market is categorized into transportation and warehousing. In 2021, the transportation segment dominated the market with the largest market share of 58.7% and market revenue of 156.93 billion. The transportation service segment dominates the market and is likely to expand at a high CAGR during the forecast period. The segment is growing owing to the rapid increase and rising popularity of same-day and next-day deliveries. Moreover, it provides several advantages such as quick delivery, flexibility, cost-friendly, tracking, and tracing services, and others that fuel the segment during the forecast period.

- In 2021, the Forward Logistics segment dominated the market with the largest market share of 68.7% and market revenue of 183.66 billion.

Based on Type, the market is categorized into forwarding Logistics and Reverse Logistics. In 2021, the Forward Logistics segment dominated the market with the largest market share of 68.7% and market revenue of 183.66 billion. Forward Logistics is expected to grow at the fastest CAGR during the forecast period as at the downstream end of the e-commerce supply chain; forward logistics manages the flow of goods, services, and products from suppliers to customers.

- In 2021, the 3PL segment dominated the market with the largest market share of 48.3% and market revenue of 129.10 billion.

Based on the model, the market is categorized into 3PL, 4PL, and others. The 3PL segment will likely hold a high CAGR during the forecast period. In 2021, the 3PL segment dominated the market with the largest market share of 48.3% and market revenue of 129.10 billion. The increase in demand for home delivery services and the growing prevalence of online shopping boost the 3PL segment. Moreover, by relieving the company of the stress of daily operations, a 3PL provider's services enable the company to concentrate on its main activities, such as R&D, manufacturing, and strategic planning. With no fixed overheads, outsourcing product fulfilment operations to a 3PL provider offer all the advantages of a full logistics setup, including warehousing, order processing technology, and computer and software systems that drive the segment.

- In 2021, the domestic segment dominated the market with the largest market share of 60.9% and market revenue of 162.81 billion.

Based on operation, the market is categorized into domestic and international. In 2021, the domestic segment dominated the market with the largest market share of 60.9% and market revenue of 162.81 billion. The market for domestic digital platforms is expanding swiftly as more and more customers prefer same-day delivery to regular or next-day deliveries. The increase in quick commerce for the delivery of food, groceries, and medications significantly impacts the demand for logistical services. The increase in 10-minute deliveries drives up demand for regional hubs and delivery facilities.

- In 2021, the Apparel segment dominated the market with the largest market share of 26.6% and market revenue of 71.1 billion.

Based on verticals, the market is categorized into apparel, consumer electronics, automotive, healthcare, food and beverage, and others. In 2021, the Apparel segment dominated the market with the largest market share of 26.6% and market revenue of 71.1 billion. The accessibility of selections, returnable practices, and attractive prices are gaining interest in the online fashion sector which increases the demand for apparel, thereby fueling the e-commerce logistics market.

Regional Segment Analysis of the global E-commerce Logistics Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

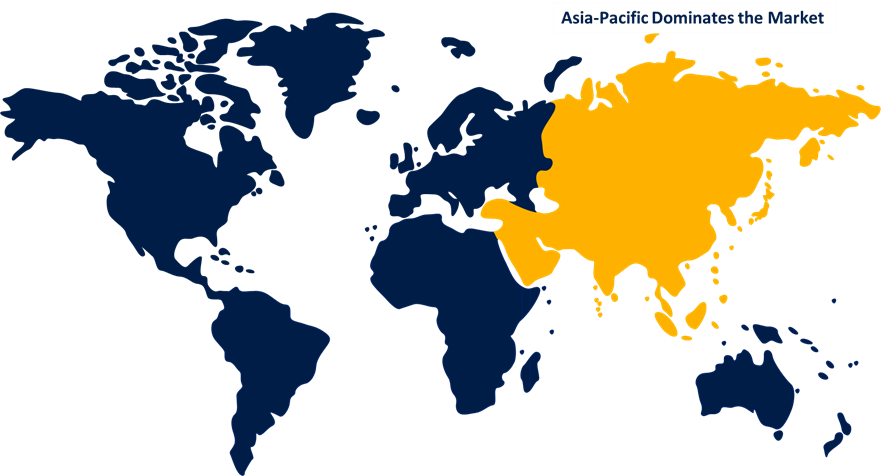

Asia- Pacific emerged as the largest market for the global E-commerce Logistics market, with a market share of around 34.7% and 92.77 billion of the market revenue in 2021.

- Asia- Pacific emerged as the largest market for the global E-commerce Logistics market, with a market share of around 34.7% and 92.77 billion of the market revenue in 2021. The Asia- Pacific region's high smartphone and internet adoption rate has increased demand for online shopping and E-commerce Logistics services. The emergence of new e-commerce firms in the area has expanded the e-commerce logistics sector.

- The North America market is expected to grow at the fastest CAGR between 2021 and 2030 Due to the presence of e-commerce behemoths like Amazon, Walmart, and eBay, the revenue share is significant. With a market worth more than USD 2.5 trillion, Amazon dominates the American e-commerce market, accounting for approximately 39% of all e-commerce suppliers. E-commerce logistics will be more in demand as e-commerce grows in popularity in the North America region.

COMPETITIVE LANDSCAPE

- FedEx Corporation

- DHL International GmbH

- Aramex International

- Gati Limited, Kenco Group, Inc.

- Clipper Logistics Plc.

- Agility Public Warehousing Company

- K.S.C.P.

- XPO Logistics Plc.

- United Parcel Service, Inc.

- CEVA Logistics

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In February 2021, By establishing a brand-new warehouse in Bien Hoa City, Vietnam, CEVA Logistics increased its foothold in Southeast Asia. The expansion seeks to meet customers' storage and distribution needs across several industries.

- In February 2021, The expansion of CEVA Logistics' operations in Thailand was announced. The company established a new headquarters in Bangkok to better serve consumers throughout Thailand.

- In November 2020, The opening of new pharmaceutical and cold chain warehouse facilities by Naqel Express in Jeddah.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global Travel Insurance market based on the below-mentioned segments:

Global E-commerce Logistics Market, By Service Type

- Transportation

- Warehousing

Global E-commerce Logistics Market, By Type

- Forward Logistics

- Reverse Logistics

Global E-commerce Logistics Market, By Model

- 3PL

- 4PL

- Others

Global E-commerce Logistics Market, By Operation

- Domestic

- International

Global E-commerce Logistics Market, By Vertical

- Apparels

- Consumer Electronics

- Automotive

- Healthcare

- Food and Beverage

- Others

Global E-commerce Logistics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the E-commerce Logistics market?As per Spherical Insights, the size of the E-commerce Logistics market was valued at USD 267.35 billion in 2021 to USD 1328.5 billion by 2030.

-

What is the market growth rate of the E-commerce Logistics market?The E-commerce Logistics market is growing at a CAGR of 19.5% from 2021 to 2030.

-

Which country dominates the E-commerce Logistics market?Asia Pacific emerged as the largest market for E-commerce Logistics.

-

Who are the key players in the E-commerce Logistics market?Key players in the E-commerce Logistics market are FedEx Corporation, DHL International GmbH, Aramex International, Gati Limited, Kenco Group, Inc., Clipper Logistics Plc., Agility Public Warehousing Company, K.S.C.P., XPO Logistics Plc., United Parcel Service, Inc., and CEVA Logistics.

-

Which factor drives the growth of the E-commerce Logistics market?Rising demand for delivery logistic is expected to drives the market's growth over the forecast period.

Need help to buy this report?