Global Copper Plate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electrolytic Copper Plate, Cast Copper Plate, and Rolled Copper Plate), By Application (Electrical & Electronics, Construction, Automotive, Industrial Machinery, and Others), By End-User (Residential, Commercial, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Copper Plate Market Size Insights Forecasts to 2035

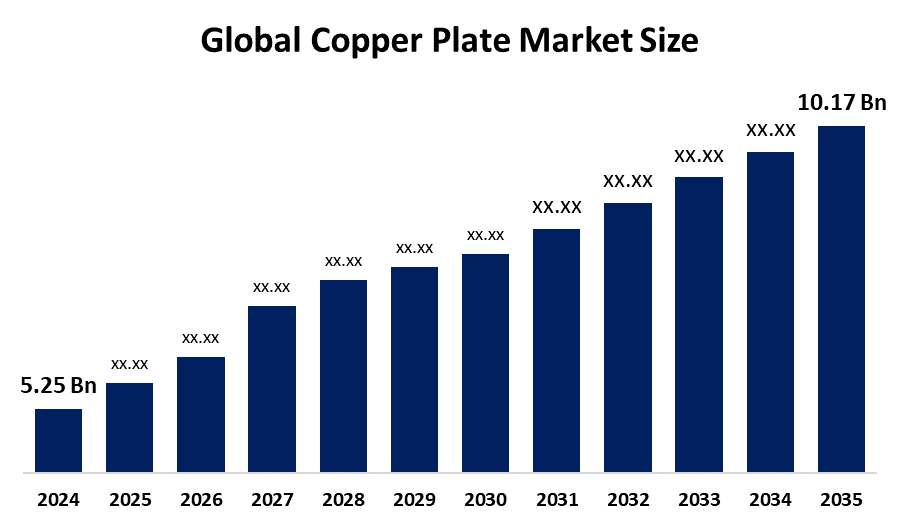

- The Global Copper Plate Market Size Was Estimated at USD 5.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.2% from 2025 to 2035

- The Worldwide Copper Plate Market Size is Expected to Reach USD 10.17 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Copper Plate Market Size was worth around USD 5.25 Billion in 2024 and is predicted to Grow to around USD 10.17 Billion by 2035 with a compound annual growth rate (CAGR) of 6.2% from 2025 to 2035. The global copper plate market is growing because the electrical and electronics and construction industries require more copper plates, and because renewable energy technologies and electric vehicle systems require copper plates and because production technology has improved technological production methods and because government programs back infrastructure development and energy-efficient building methods.

Market Overview

The global copper plate market refers to the production and sale of flat, thin sheets of copper, which manufacturers use for their excellent electrical and thermal conductivity and their corrosion resistance and durability. Copper plates are used in the electrical and electronics industries for circuit boards, conductors, transformers and connectors, while they are also used in construction and roofing, plumbing and industrial machinery. The market experiences primary growth because electronics, automotive and renewable energy sectors demand more products while developing regions face rapid urbanization and industrialization.

The market expansion receives additional support from the increasing public knowledge about sustainable materials and recyclable products. The main market competitors include Aurubis AG and Mitsubishi Materials Corporation, Jiangxi Copper Corporation, and Wieland Group who develop new products and increase their production capacity and form strategic alliances to build their international business operations and fulfil growing market needs. The Indian government eliminated basic customs duty on copper scrap and critical minerals through its 2025 budget, which Parliament approved in November 2025. The initiative seeks to enhance domestic manufacturing capabilities while providing cost-effective copper supplies to the electrical and infrastructure industries and increasing domestic production and the copper plate fabrication industry.

Report Coverage

This research report categorizes the copper plate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the copper plate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the copper plate market.

Global Copper Plate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.2% |

| 2035 Value Projection: | USD 10.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 157 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Aurubis AG, Wieland Group, Mitsubishi Materials Corporation, KME Group SpA, Hailiang Group, Poongsan Corporation, Furukawa Electric Co., Ltd, Hindalco Industries Ltd., Mueller Industries, Inc., Jiangxi Copper Corporation, Nippon Mining & Metals Co., Ltd., PMX Industries, Inc, Anhui Xinke New Materials Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global copper plate market depends on the rapid growth of electric vehicle production, which requires copper for thermal management and electrical connectivity purposes. The growth of renewable energy infrastructure investment, particularly in solar and wind technologies, creates a higher demand for durable power generation plates. The need for construction materials and electrical infrastructure components like transformers and switchgears has increased because emerging economies experience urbanization and industrial growth. The increasing number of data centers and 5G technology requires high-purity copper plates, which function for cooling and power distribution purposes. The rising use of recycling methods creates a stable supply of materials because raw copper prices experience unpredictable fluctuations.

Restraining Factors

The global copper plate market faces restraints from volatile raw material prices, which create difficulties for manufacturers to maintain their profit margins and predict their financial performance. The combination of strict environmental regulations for mining operations and labor strikes results in supply chain interruptions. The high copper prices make businesses choose less expensive material alternatives, such as aluminum which offer inferior performance in specific use cases.

Market Segmentation

The copper plate market share is classified into product type, application, and end-user.

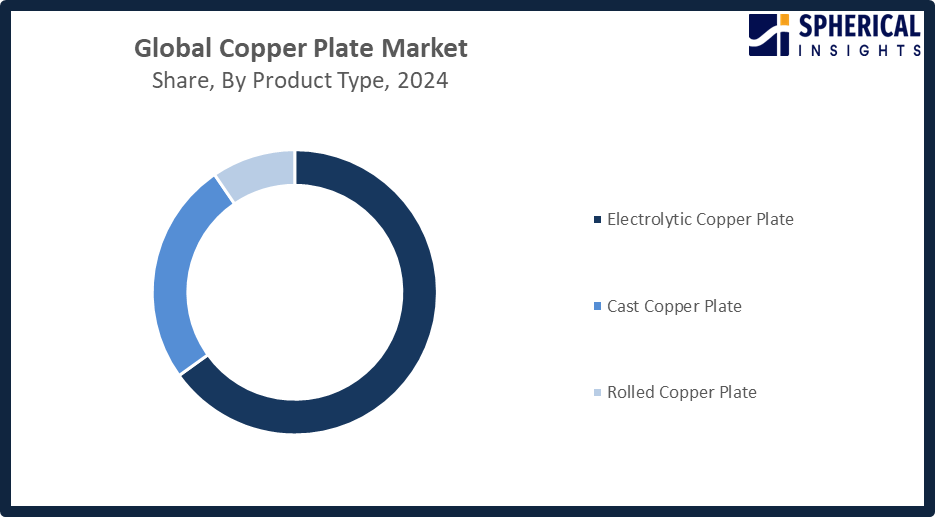

- The electrolytic copper plate segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the copper plate market is divided into electrolytic copper plate, cast copper plate, and rolled copper plate. Among these, the electrolytic copper plate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Electrolytic copper plates, which possess high purity and excellent electrical conductivity, serve as essential materials in the electrical and electronics industries. The market experiences rapid expansion because high-performance electronics, electric vehicles and renewable energy systems need materials with superior conductivity.

Get more details on this report -

- The electrical & electronics segment accounted for the largest share in 2024, approximately 43% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the copper plate market is divided into electrical & electronics, construction, automotive, industrial machinery, and others. Among these, the electrical & electronics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The electrical and electronics sector is the largest application for copper plates, driven by growing demand for high-performance devices and components. The electronic industry requires copper plates because of their ability to conduct electricity, which makes them necessary for printed circuit boards and connectors, and electronic devices. The global market experiences increased demand for these products because smart devices, IoT technologies and telecom advancements continue to develop.

- The industrial segment accounted for the highest market revenue in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the copper plate market is divided into residential, commercial, and industrial. Among these, the industrial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The industrial sector leads the copper plate market because the manufacturing, construction and automotive industries use copper plates extensively. The industrial sector requires copper plates because these materials provide reliability and durability, and conductivity for various industrial applications. Emerging economies will continue industrialization while developed regions will modernize their infrastructure, creating strong demand which will sustain the sector's market leadership.

Regional Segment Analysis of the Copper Plate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the copper plate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the copper plate market over the predicted timeframe. The copper plate market will experience its 45% share growth in the Asia-Pacific region because of rapid industrialisation, expanding electronics manufacturing and major infrastructure projects. China leads the region as the top producer and consumer of copper products because the electrical and electronics, construction and renewable energy sectors create high product demand. The market continues to grow because India, Japan and South Korea increase their investments in electric vehicles, power transmission systems and smart manufacturing technologies. The Asian Development Bank approved a $300 million loan for Pakistan's Reko Diq copper project in August 2025, which strengthens Asia's supply chain for essential minerals through increased worldwide demand.

North America is expected to grow at a rapid CAGR in the copper plate market during the forecast period. The copper plate market in North America will experience rapid growth, projected to have 20% share, due to increasing investments in renewable energy and electric vehicle development, and grid modernization efforts. The United States leads regional growth through strong government support for domestic copper production, critical minerals policies, and large-scale infrastructure upgrades. The United States government designated copper as an essential metal for energy, defence, and manufacturing purposes through Executive Order 14220, which aims to enhance domestic smelting capabilities, decrease foreign supply chain dependency and improve national mineral security.

The copper plate market in Europe shows continuous growth because renewable energy sources, electric vehicle production, and advanced manufacturing sectors create strong demand for copper plates. Germany dominates the market because its automotive and electronics industries drive growth, which supports the development of energy-efficient technologies. Government policies that support decarbonization efforts, grid development, and sustainable infrastructure projects create higher demand for copper plates throughout Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the copper plate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aurubis AG

- Wieland Group

- Mitsubishi Materials Corporation

- KME Group SpA

- Hailiang Group

- Poongsan Corporation

- Furukawa Electric Co., Ltd

- Hindalco Industries Ltd.

- Mueller Industries, Inc.

- Jiangxi Copper Corporation

- Nippon Mining & Metals Co., Ltd.

- PMX Industries, Inc

- Anhui Xinke New Materials Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Mitsubishi Materials Corporation (MMC) announced a global expansion of its resource circulation operations across Europe, the U.S., and Asia. The company is advancing secondary smelting using E-scrap and copper scrap, aligning with its policy of “creating the future through resource circulation” to promote sustainable metal production.

- In December 2025, copper’s critical role in electric vehicles, renewable energy, telecommunications, and infrastructure was highlighted amid rising clean energy demand. Analysts warn that U.S. and global copper supply may fall short within a decade, yet U.S. policy remains fragmented, lacking a long-term strategy to meet future demand.

- In September 2025, Aurubis AG secured a €200 million investment loan from the European Investment Bank (EIB). The five-year loan will fund two key projects: expanding copper refining at its Bulgarian site and scaling up metal recycling and environmental protection efforts at its Hamburg plant.

- In April 2025, Wieland launched a $500 million modernization at its East Alton, Illinois, rolling mill to enhance capabilities, efficiency, and quality. Acquired in 2019 via Global Brass and Copper Holdings, the site produces sheets, strips, foils, rods, tubes, and components under Olin Brass, Chase Brass, and A.J. Oster brands.

- In June 2023, Anglo American and Jiangxi Copper signed a memorandum of understanding to enhance the sustainability of copper mining, processing, and supply. The agreement, signed at Jiangxi Copper’s headquarters in Nanchang, China, aims to meet rising consumer demand for sustainably sourced raw materials.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the copper plate market based on the below-mentioned segments:

Global Copper Plate Market, By Product Type

- Electrolytic Copper Plate

- Cast Copper Plate

- Rolled Copper Plate

Global Copper Plate Market, By Application

- Electrical & Electronics

- Construction

- Automotive

- Industrial Machinery

- Others

Global Copper Plate Market, By End-User

- Residential

- Commercial

- Industrial

Global Copper Plate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the copper plate market over the forecast period?The global copper plate market is projected to expand at a CAGR of 6.2% during the forecast period.

-

2. What is the copper plate market?The global copper plate market involves manufacturing and supplying high-purity, rolled, or cast copper for construction, electronics, and EV industries.

-

3. What is the market size of the copper plate market?The global copper plate market size is expected to grow from USD 5.25 billion in 2024 to USD 10.17 billion by 2035, at a CAGR of 6.2% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the copper plate market?Asia Pacific is anticipated to hold the largest share of the copper plate market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global copper plate market?Aurubis AG, Wieland Group, Mitsubishi Materials Corporation, KME Group SpA, Hailiang Group, Poongsan Corporation, Furukawa Electric Co., Ltd, Hindalco Industries Ltd., Mueller Industries, Inc., Jiangxi Copper Corporation, and Others.

-

6. What factors are driving the growth of the copper plate market?Driven by surging EV production, renewable energy grid expansion, and AI data center infrastructure, the copper plate market is growing, supported by high electrical conductivity needs and increased industrial construction.

-

7. What are the market trends in the copper plate market?Key trends in the copper plate market include rising demand from electronics, renewable energy, EVs, infrastructure expansion, and increased domestic production initiatives.

-

8. What are the main challenges restricting wider adoption of the copper plate market?Key challenges restricting wider copper plate adoption include high, volatile raw material prices, intense competition from cheaper substitutes like aluminium, supply chain bottlenecks, and stringent environmental regulations impacting production costs.

Need help to buy this report?