United States Roofing Market Size, Share, and COVID-19 Impact Analysis, By Roof Type (Low Sloped Roofs, Flat Roofs, Pitched Roofs), By Material Type (Metal Roofing, Spray Polyurethane Foam (SPF), Poly Vinyl Chloride (PVC), Thermoplastic Polyolefin (TPO), Ethylene Propylene Diene Terpolymer (EPDM), Others), By Services (Roofing Inspection, Roof Repairs/Maintenance, Roof Restoration, Roof Replacement, Roof Installation), By End-Users (Residential, Healthcare, Educational Institutes, Hotels & Restaurants, Banks & Financial Institutions, Airports, Warehouses, Retail, Others), and Others and United States Roofing Market Insights Forecasts to 2033

Industry: Construction & ManufacturingUnited States Roofing Market Insights Forecasts to 2033

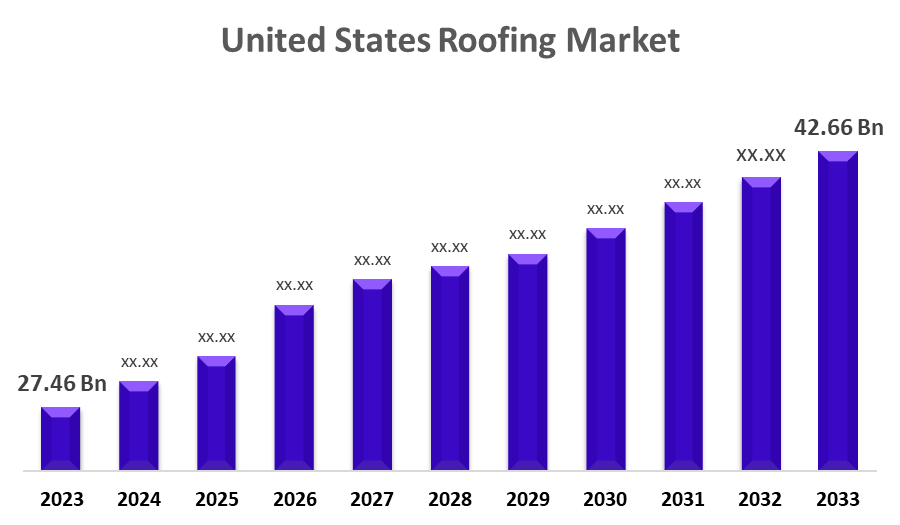

- The United States Roofing Market Size was valued at USD 27.46 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.5% from 2023 to 2033.

- The United States Roofing Market Size is Expected to Reach USD 42.66 Billion by 2033.

Get more details on this report -

The United States Roofing Market Size is expected to reach USD 42.66 Billion by 2033, at a CAGR of 4.5% during the forecast period 2023 to 2033.

Market Overview

Roofing is the process of building a roof on a building. Roofing materials include ceramic tiles, hypalon, teflon fabric, metals such as zinc and cast iron, and asphalt shingles. Metal roofing, shingles roofing, tile roofing, and membrane roofing such as pmma roofing are all types of roofing. Roofing is the most important aspect of commercial, residential, and industrial construction because it protects against external environmental factors, particularly climatic events. Factors such as rising residential construction activity, rising commercial construction expenditure, and government policies aimed at providing affordable housing for the poor have boosted roofing market growth. Certain roofing types, such as tile roofing, are more expensive and require specialty flashing designed specifically for tile roofs.

Report Coverage

This research report categorizes the market for United States roofing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States roofing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States roofing market.

United States Roofing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.46 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.5% |

| 2033 Value Projection: | USD 42.66 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Roof Type, By Material Type, By Services, ), By End-Users |

| Companies covered:: | 3M Company, Atlas Roofing Corporation, BASF SE, Berkshire Hathaway Inc., Carlisle Companies Inc., Certain Teed Corporation, DoW Chemical Company, Dupont de Nemours Company, Duro-Last Inc., GAF, IKO Industries Ltd and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing awareness about the negative effects of carbon emissions on the environment, as well as the need to reduce energy consumption and costs, are driving demand for energy-efficient and sustainable roofing systems. The growing popularity of green and sustainable buildings is also driving demand for energy-efficient and sustainable roofing systems. Adoption of innovative roofing technologies such as cool roofs, which can reduce energy consumption by up to 15%, is helping to grow the United States roofing market. Demand for roofing services is being driven by an increase in construction activity, both in the residential and non-residential sectors. The construction of new buildings and infrastructure projects necessitates roofing solutions, as does the need to replace aging roofs in existing buildings. Climate change is causing an increase in extreme weather events such as hurricanes and heavy rainfall, which is increasing demand for roofing repair and replacement services and creating new opportunities for roofing companies.

Restraining Factors

The roofing industry is highly dependent on raw materials like asphalt, metal, and tiles. These materials' prices can be volatile due to supply and demand imbalances, regulatory changes, and other factors such as natural disasters and geopolitical tensions. Raw material price volatility can have an impact on the profitability of roofing companies and raise the prices of roofing services for consumers, resulting in decreased demand. This could stifle the growth of the United States roofing market.

Market Segment

- In 2023, the flat roofs segment accounted for the largest revenue share over the forecast period.

Based on the roof type, the United States roofing market is segmented into low sloped roofs, flat roofs, and pitched roofs. Among these, the flat roofs segment has the largest revenue share over the forecast period. Flat roofs have several advantages, including their low cost, ease of installation, and ability to accommodate a variety of roofing materials. They also provide a large usable roof space that can be used for a variety of purposes such as rooftop gardens, solar panels, and HVAC systems. Sloped roofs, on the other hand, are more common in residential buildings and have a smaller market share in the roofing industry.

- In 2022, the spray polyurethane foam (SPF) segment accounted for the largest revenue share over the forecast period.

Based on the material type, the United States roofing market is segmented into metal roofing, spray polyurethane foam (SPF), poly vinyl chloride (PVC), thermoplastic polyolefin (TPO), ethylene propylene diene terpolymer (EPDM), and others. Among these, the spray polyurethane foam (SPF) segment has the largest revenue share over the forecast period, owing to its excellent insulation properties, durability, and versatility. It is commonly used in both commercial and residential roofing applications, and it provides several benefits, including improved indoor air quality and energy efficiency.

- In 2022, the roof installation segment accounted for the largest revenue share over the forecast period.

Based on the services, the United States roofing market is segmented into roofing inspection, roof repairs/maintenance, roof restoration, roof replacement, roof installation. Among these, the roof installation segment has the largest revenue share over the forecast period. The growth can be attributed by new construction and roof replacements, and it is typically provided by specialized roofing contractors who have experience with various roofing materials and designs.

- In 2022, the residential segment accounted for the largest revenue share over the forecast period.

Based on the end-users, the United States roofing market is segmented into residential, healthcare, educational institutes, hotels & restaurants, banks & financial institutions, airports, warehouses, retail, and others. Among these, the residential segment has the largest revenue share over the forecast period. The residential segment includes all types of homes, from single-family homes to multi-family structures like apartments and condos. The increasing number of new housing construction projects, the need to replace aging roofs in existing homes, and the rising demand for sustainable roofing options are all driving growth in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States roofing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Atlas Roofing Corporation

- BASF SE

- Berkshire Hathaway Inc.

- Carlisle Companies Inc.

- Certain Teed Corporation

- DoW Chemical Company

- Dupont de Nemours Company

- Duro-Last Inc.

- GAF

- IKO Industries Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, Holcim acquired Malarkey Roofing Products, which will broaden Holcim's range of roofing systems in the lucrative residential roofing market in the United States.

- In April 2021, LafargeHolcim acquired Firestone Building Products, a leader in commercial roofing and building envelope solutions based in the United States, making LafargeHolcim a global leader in innovative and sustainable building solutions.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States roofing market based on the below-mentioned segments:

United States Roofing Market, By Roof Type

- Low Sloped Roofs

- Flat Roofs

- Pitched Roofs

United States Roofing Market, By Material Type

- Metal Roofing

- Spray Polyurethane Foam (SPF)

- Poly Vinyl Chloride (PVC)

- Thermoplastic Polyolefin (TPO)

- Ethylene Propylene Diene Terpolymer (EPDM)

- Others

United States Roofing Market, By Services

- Roofing Inspection

- Roof Repairs/Maintenance

- Roof Restoration

- Roof Replacement

- Roof Installation

United States Roofing Market, By End Users

- Residential

- Healthcare

- Educational Institutes

- Hotels & Restaurants

- Banks & Financial Institutions

- Airports

- Warehouses

- Retail

- Others

Need help to buy this report?