Global Clopidogrel Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Clopidogrel and Clopidogrel Bisulfate), By Application (Acute Coronary Syndrome (ACS), Myocardial Infarction (MI), Stroke, and Peripheral Artery Disease (PAD)), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Clopidogrel Market Size Insights Forecasts to 2035

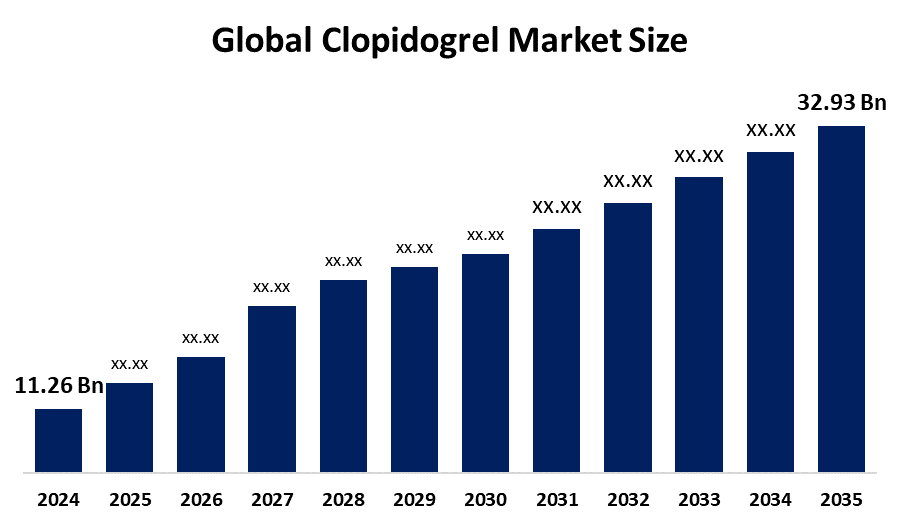

- The Global Clopidogrel Market Size Was Valued at USD 11.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.25% from 2025 to 2035

- The Worldwide Clopidogrel Market Size is Expected to Reach USD 32.93 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Clopidogrel Market Size was worth around USD 11.26 Billion in 2024 and is predicted to Grow to around USD 32.93 Billion by 2035 with a compound annual growth rate (CAGR) of 10.25% from 2025 to 2035. The global clopidogrel market is experiencing growth because cardiovascular disease cases are increasing, the population is becoming older, and stroke risks are rising. The market continues to expand because affordable generic drugs reach developing countries while their usage increases.

Market Overview

The global clopidogrel market includes all activities related to manufacturing and distributing clopidogrel, which serves as an oral antiplatelet medication to stop blood clots in cardiovascular patients. Clopidogrel functions as a primary treatment for acute coronary syndrome, myocardial infarction, ischemic stroke, and peripheral arterial disease, and it serves as a vital element of dual antiplatelet therapy, which doctors use after patients undergo angioplasty and stent placement. The worldwide growth of cardiovascular diseases, together with population ageing, diabetes and hypertension, has created a market expansion. The widespread availability of cost-effective generic formulations has expanded access, particularly in emerging economies.

The EMA’s CHMP recommended a marketing authorisation update for Clopidogrel Zentiva in July 2025. The approval extends its use to secondary prevention of atherothrombotic events in adults with ST-segment elevation myocardial infarction undergoing PCI. Clopidogrel functions as a treatment for both recent myocardial infarction and ischemic stroke, and established peripheral arterial disease. The expansion of healthcare infrastructure, the growth of preventive cardiac care awareness, and rising procedural volume present organisations with new opportunities. The market is highly competitive because Sanofi, Viatris, Teva Pharmaceuticals, Sun Pharmaceutical Industries, Dr Reddy's Laboratories, Aurobindo Pharma, and Lupin are major players specialising in producing and delivering generic medicines in large volumes to international markets.

Report Coverage

This research report categorizes the clopidogrel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the clopidogrel market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the clopidogrel market.

Global Clopidogrel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.25% |

| 2035 Value Projection: | USD 32.93 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 259 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Sanofi SA, Cipla Inc., Aurobindo Pharma Ltd, Dr. Reddy’s Laboratories Ltd, Apotex Inc., Torrent Pharmaceuticals Ltd, Novartis AG, Sun Pharmaceutical Industries Ltd, Merck & Co. Inc., F. Hoffmann-La Roche AG, Intas Pharmaceuticals Ltd, Lupin Limited, Daiichi Sankyo Company Ltd., Teva Pharmaceutical Industries Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global clopidogrel market exists because cardiovascular diseases (CVDs), which include heart attacks and strokes, have become the most common fatal medical conditions. The growing demographic of elderly people will drive market growth because this age group has a higher risk of developing thrombotic disorders. The generic drug market experienced substantial growth after patent expiration because affordable generic drugs became widely available in developing nations. The market demand increases because of the rising use of clopidogrel in clinical guidelines for secondary prevention and the development of healthcare systems throughout the Asia-Pacific. The market grows because of increasing public knowledge about preventive healthcare.

Restraining Factors

The global clopidogrel market experiences limitations because increasing generic competition leads to price declines, which result in reduced profit margins. The market growth faces multiple challenges, which include the development of superior antiplatelet medications, the high resistance rates to existing drugs and the potential for gastrointestinal bleeding.

Market Segmentation

The clopidogrel market share is classified into product type, application, and distribution channel.

- The clopidogrel bisulfate segment dominated the market in 2024, approximately 85% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the clopidogrel market is divided into standard clopidogrel and clopidogrel bisulfate. Among these, the clopidogrel bisulfate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The clopidogrel bisulfate section led market expansion due to it delivered better stability, solubility and bioavailability results than standard clopidogrel. The product achieved extensive market presence through its adoption by both branded and generic products, which, combined with rising cardiovascular disease rates and antiplatelet therapy guidelines, drove demand across hospitals and retail pharmacies and into developing international markets.

- The acute coronary syndrome (ACS) segment accounted for the largest share in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the clopidogrel market is divided into acute coronary syndrome (ACS), myocardial infarction (MI), stroke, and peripheral artery disease (PAD). Among these, the acute coronary syndrome (ACS) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The acute coronary syndrome (ACS) segment growth in the clopidogrel market is driven by the high global prevalence of ACS, the increasing incidence of heart attacks and the widespread adoption of dual antiplatelet therapy. Hospitals and clinics extensively prescribe clopidogrel to prevent thrombotic events post-angioplasty and stenting, which causes strong market growth through high product demand.

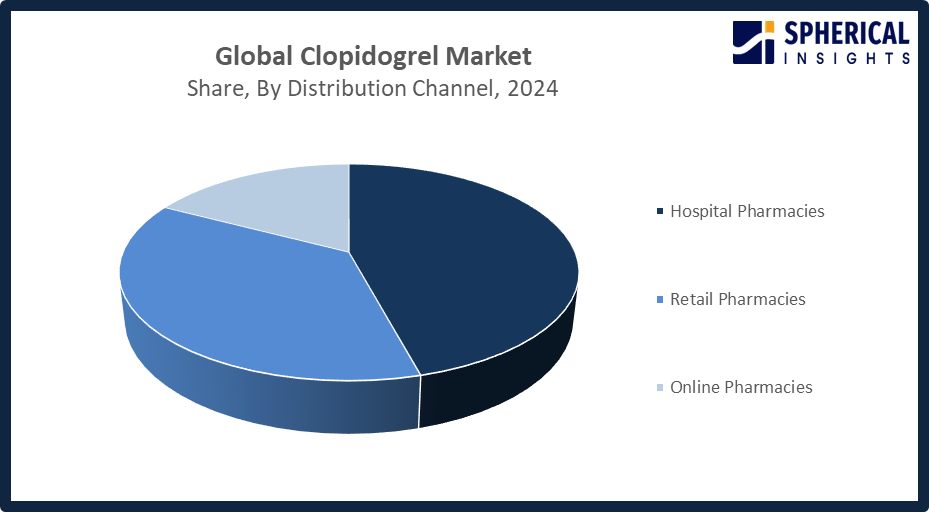

- The hospital pharmacies segment accounted for the highest market revenue in 2024, approximately 46% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the clopidogrel market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital pharmacies segment grows because hospitals use clopidogrel to treat acute coronary syndrome and myocardial infarction, and post-angioplasty patients. Hospitals serve as the primary point for dispensing critical cardiovascular medications, which receive backing from physician prescriptions and guideline-driven therapy, thus creating strong demand in this distribution channel.

Get more details on this report -

Regional Segment Analysis of the Clopidogrel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the clopidogrel market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the clopidogrel market over the predicted timeframe. North America will become the 40% market share for clopidogrel due to its high rate of cardiovascular disease and its widespread use of antiplatelet treatment. The United States serves as the main source of clopidogrel usage because its health system, insurance programs and clinical guidelines support doctors who use clopidogrel to stop heart attacks and strokes. The North American market grows through three factors, which include a better understanding of heart health, access to both branded and generic drugs and continuous research of antiplatelet medications.

Asia Pacific is expected to grow at a rapid CAGR in the clopidogrel market during the forecast period. The clopidogrel market in the Asia Pacific will experience a 20% market share growth through increasing heart disease cases, growing urban areas, and changes in people's health. The healthcare system in China and India is developing as people gain access to lower-priced generic clopidogrel and learn more about cardiovascular problems. The market across the region experiences strong growth because government programs improve healthcare access to patients who need antiplatelet treatments.

The clopidogrel market in Europe shows moderate growth due to two people living longer and more people developing cardiovascular diseases. The market gains support from Germany, the UK, and France because these countries have established healthcare systems, and most people have insurance, and doctors practice antiplatelet treatment. The market continues to grow throughout the area because regulatory systems remain consistent and generic clopidogrel products become more accessible.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the clopidogrel market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi SA

- Cipla Inc.

- Aurobindo Pharma Ltd

- Dr. Reddy’s Laboratories Ltd

- Apotex Inc.

- Torrent Pharmaceuticals Ltd

- Novartis AG

- Sun Pharmaceutical Industries Ltd

- Merck & Co. Inc.

- F. Hoffmann-La Roche AG

- Intas Pharmaceuticals Ltd

- Lupin Limited

- Daiichi Sankyo Company Ltd.

- Teva Pharmaceutical Industries Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Aspire Biopharma announced the filing of a provisional USPTO patent for the first sublingual powder formulation of clopidogrel. The novel delivery system aims to enhance bioavailability and reduce gastric irritation, with commercialization planned via the FDA 505(b)(2) pathway.

- In December 2024, in a split 3:2 ruling, the High Court of Australia dismissed the Commonwealth’s appeal, upholding earlier Federal Court decisions that denied compensation claims against Sanofi. The case stemmed from an undertaking as to damages linked to an interlocutory injunction that blocked Apotex Australia from launching generic clopidogrel products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the clopidogrel market based on the below-mentioned segments:

Global Clopidogrel Market, By Product Type

- Standard Clopidogrel

- Clopidogrel Bisulfate

Global Clopidogrel Market, By Application

- Acute Coronary Syndrome (ACS)

- Myocardial Infarction (MI)

- Stroke

- Peripheral Artery Disease (PAD)

Global Clopidogrel Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global Clopidogrel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the clopidogrel market over the forecast period?The global clopidogrel market is projected to expand at a CAGR of 10.25% during the forecast period.

-

2. What is the market size of the clopidogrel market?The global clopidogrel market size is expected to grow from USD 11.26 billion in 2024 to USD 32.93 billion by 2035, at a CAGR of 10.25% during the forecast period 2025-2035.

-

3. What is the clopidogrel market?The clopidogrel market refers to the global industry for producing, distributing, and selling clopidogrel, an antiplatelet drug.

-

4. Which region holds the largest share of the clopidogrel market?North America is anticipated to hold the largest share of the clopidogrel market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global clopidogrel market?Sanofi SA, Cipla Inc., Aurobindo Pharma Ltd, Dr Reddy’s Laboratories Ltd, Apotex Inc., Torrent Pharmaceuticals Ltd, Novartis AG, Sun Pharmaceutical Industries Ltd, Merck & Co. Inc., F. Hoffmann-La Roche AG, and Others.

-

6. What factors are driving the growth of the clopidogrel market?Key factors driving the clopidogrel market include the rising prevalence of cardiovascular diseases, an ageing global population, increased demand for generic formulations, and widespread use in post-stent procedures.

-

7. What are the market trends in the clopidogrel market?Market trends in the clopidogrel market include rising cardiovascular disease, increasing generic use, growing dual therapy adoption, and expanding Asia-Pacific demand.

-

8. What are the main challenges restricting wider adoption of the clopidogrel market?Key challenges limiting wider clopidogrel adoption include significant bleeding risks, genetic variability (CYP2C19 poor metabolizers), drug-drug interactions with proton pump inhibitors, and competition from newer, more effective P2Y12 inhibitors like ticagrelor.

Need help to buy this report?