China Phenol Market Size, Share, By Derivative Type (Bisphenol A, Phenolic Resins, Caprolactum, Alkyl Phenols, And Others), By End Use (Chemicals, Constructions, Automotive, Electronic Communication, Pharmaceuticals, And Others), And China Phenol Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Phenol Market Size Insights Forecasts to 2035

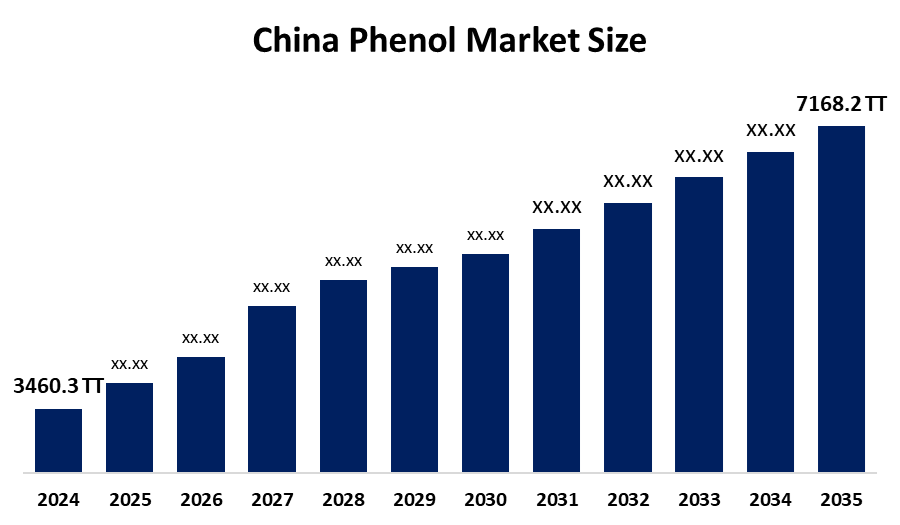

- China Phenol Market Size 2024: 3460.3 Thousand Tonnes

- China Phenol Market Size 2035: 7168.2 Thousand Tonnes

- China Phenol Market Size CAGR 2024: 6.85%

- China Phenol Market Size Segments: Derivative Type and End Use

Get more details on this report -

The China Phenol Market Size encompasses the various aspects of its production and consumption of phenol and its derivatives. Phenol is an important organic intermediate that serves as the basis for many products that include phenolic resin, bisphenol A, polycarbonate, epoxy resin, pharmaceuticals, agrochemicals and specialty chemicals. The primary source of phenol is through the oxidation of cumene and is used as a key building block for plastics, coatings, adhesives, etc., to produce many of the materials used in industrial production, which add up to an important piece of the overall petrochemical industry in China.

The phenol in China are backed by government support, including the China’s extension of anti-dumping duties on phenol imports from the United States, the European Union, South Korea, Japan and Thailand for another five years, as announced by the Ministry of Commerce, aimed at protecting domestic producers from unfairly priced foreign phenol. This move reflects country intervention to stabilize local industry conditions and strengthen domestic supply chains

As technology advances, Chinese phenol providers are now using large, integrated phenol-acetone plants that combine upstream feedstock production with downstream refining, transportation costs are decreased while yield efficiencies are improved resulting in a more competitive operation compared to stand-alone plants. In addition to these integrated facilities, trends in digital process control, automation, and safety optimization are also being applied more broadly in chemical production hubs to increase environmental compliance and operational reliability. The general trend for chemical companies in China is to use industry 4.0 style technologies to increase competitiveness and sustainability throughout the industry.

China Phenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 3460.3 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.85% |

| 2035 Value Projection: | 7168.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Derivative Type, By End Use |

| Companies covered:: | Sinopec, Formosa Chemicals & Fibre Corp, LG Chem Ltd., Mitsui Chemicals, Inc., Shell Chemicals, Mitsubishi Chemical Group Corporation, Solvay S.A., Chang Chun Group, CEPSA Quimica, AdvanSix Inc., Fujian Yongrong Jinjiang Co. Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Phenol Market Size:

The China Phenol Market Size is driven by the expanding demand for phenol derivatives, growing end user sectors, rise in phenol consumption, domestic industrial capacity building, globalization of Chinese chemical producers further support market growth, state-led policies to secure supply chains, encourage large-scale refining complexes underpin expansion, and China’s expanding export orientation in chemical intermediates has contributed to sustained phenol industry activity and investment.

The China Phenol Market Size is restrained by the oversupply and weak downstream demand, price depressions and cyclical downturns challenges, weakening effective demand, creating supply-chain feedback that depressed phenol prices, environmental regulation, and raw material price volatility also add cost pressures.

The future of China Phenol Market Size is bright and promising, with versatile opportunities emerging from the continuous change toward producing higher value derivative and specialized commercial chemicals product use of phenol has an opportunity for value-added growth, particularly in producing advanced resin systems, engineering plastic and high-performance materials. Phenolic resin market expansion as a result of increased global demand for resins used in the renewable energy, electronics and automotive vehicle weight reduction industries create new potential end-use markets. Opportunities also exist for sustainable and bio-based phenol production, which would support China’s broader goals around carbon reduction and green industrial development.

Market Segmentation

The China Phenol Market Size share is classified into derivative type and end use.

By Derivative Type:

The China Phenol Market Size is divided by derivative type into bisphenol A, phenolic resins, caprolactum, alkyl phenols, and others. Among these, the bisphenol A segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Rapid expansion of downstream industries, global manufacturing hub, demand for high-performance engineering plastics, urbanization, and growing requirement for bisphenol A all contribute to the bisphenol A segment's largest share and higher spending on phenol when compared to other derivative type.

By End Use:

The China Phenol Market Size is divided by end use into chemicals, construction, automotive, electronic communication, pharmaceuticals, and others. Among these, the chemical segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The chemical segment dominates because it is an indispensable raw material for producing high-demand, downstream chemical derivatives, essential for China’s massive manufacturing sectors, large scale domestic production and integration, and rapid growth in end use industries in China.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Phenol Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Phenol Market Size:

- Sinopec

- Formosa Chemicals & Fibre Corp

- LG Chem Ltd.

- Mitsui Chemicals, Inc.

- Shell Chemicals

- Mitsubishi Chemical Group Corporation

- Solvay S.A.

- Chang Chun Group

- CEPSA Quimica

- AdvanSix Inc.

- Fujian Yongrong Jinjiang Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Phenol Market Size based on the below-mentioned segments:

China Phenol Market Size, By Derivative Type

- Bisphenol A

- Phenolic Resins

- Caprolactum

- Alkyl Phenols

- Others

China Phenol Market Size, By End Use

- Chemicals

- Construction

- Automotive

- Electronic Communication

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

What is the China Phenol Market Size?China Phenol Market Size is expected to grow from 3460.3 thousand tonnes in 2024 to 7168.2 thousand tonnes by 2035, growing at a CAGR of 6.85% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the expanding demand for phenol derivatives, growing end user sectors, rise in phenol consumption, domestic industrial capacity building, globalization of Chinese chemical producers further support market growth, state-led policies to secure supply chains, encourage large-scale refining complexes underpin expansion, and China’s expanding export orientation in chemical intermediates has contributed to sustained phenol industry activity and investment.

-

What factors restrain the China Phenol Market Size?Constraints include the oversupply and weak downstream demand, price depressions and cyclical downturns challenges, weakening effective demand, creating supply-chain feedback that depressed phenol prices, environmental regulation, and raw material price volatility also add cost pressures.

-

How is the market segmented by derivative type?The market is segmented into bisphenol A, phenolic resins, caprolactum, alkyl phenols, and others.

-

Who are the key players in the China Phenol Market Size?Key companies include Sinopec, Formosa Chemicals & Fibre Corp, LG Chem Ltd., Mitsui Chemicals, Inc., Shell Chemicals, Mitsubishi Chemical Group Corporation, Solvay S.A., Chang Chun Group, CEPSA Quimica, AdvanSix Inc., Fujian Yongrong Jinjiang Co. Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?