Global Phenol Market Size, Share, and COVID-19 Impact Analysis, By End User (Chemical, Construction, Automotive, Electronic Communication, Metallurgy, and Others), By Application (Bisphenol A, Phenolic Resin, Caprolactum, Alkyl Phenyls, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Phenol Market Insights Forecasts to 2035

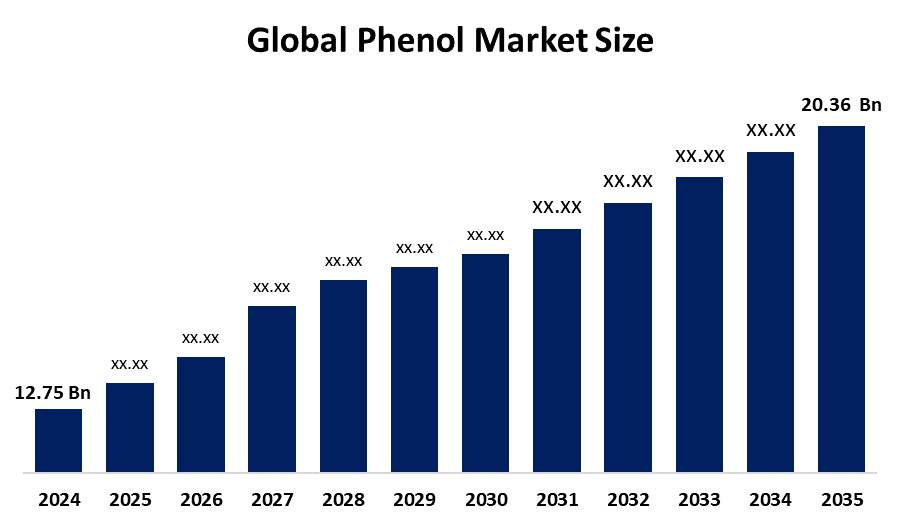

- The Global Phenol Market Size Was Estimated at USD 12.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.35% from 2025 to 2035

- The Worldwide Phenol Market Size is Expected to Reach USD 20.36 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global phenol market size was worth around USD 12.75 billion in 2024 and is predicted to grow to around USD 20.36 billion by 2035 with a compound annual growth rate (CAGR) of 4.35% from 2025 to 2035. Opportunities in the phenol market include growing applications in resins and plastics, increasing investment in sustainable, bio-based phenol manufacturing innovations worldwide, growing demand in electronics, construction, and pharmaceuticals, and technological advancements in production processes.

Market Overview

The Term "Phenol Market" refers to the global ecosystem that includes the extraction, synthesis, distribution, and use of phenol (C2H2OH). This versatile aromatic hydrocarbon is mostly produced by toluene or cumene oxidation. Phenol is an essential intermediate chemical that supports industries like automotive composites, construction adhesives, electrical laminates, and pharmaceutical antiseptics by facilitating the synthesis of phenolic resins, bisphenol A (BPA), ε-caprolactam, and alkylphenols. The phenol market is expanding steadily due to increased demand from sectors like electronics, construction, and automobiles. For Instance, in April 2024, KBR launched a technology licensing agreement with SABIC Fujian Petrochemicals for a 250,000-tonne-per-annum phenol plant in China. Construction starts in 2024, with completion by FY2026, marking one of Asia-Pacific’s largest phenol capacity expansions and highlighting continued investment in integrated petrochemical facilities. The synthesis of chemicals and their derivatives is the main factor driving the global phenol market. In several chemical industries, phenol is used to make essential chemicals like bisphenol A. One of the main factors is the increasing need for phenol in the manufacturing of caprolactam and adipic acid.

Report Coverage

This research report categorizes the phenol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the phenol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the phenol market.

Global Phenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.35% |

| 2035 Value Projection: | USD 20.36 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 80 |

| Segments covered: | By End User, By Application |

| Companies covered:: | SABIC, Versalis, LG Chem, Sasol Ltd., AdvanSix, Shell PLC, Solvay S.A., INEOS Group, Sinopec Corp., Mitsui Chemicals Inc., Kumho P&B Chemicals, Formosa Chemicals & Fibre Corp, Zhejiang Petroleum & Chemical Co., Ltd., PTT Global Chemical Public Company Ltd., And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for phenol-derived product, such as bisphenol A (BPA), phenolic resins, and caprolactam, which are extensively used in the manufacturing of polycarbonates, epoxy resins, and nylon, is the main factor driving the expansion of the phenol market. The market is expanding due to rising R&D expenditures as well as the rising need for strong, lightweight materials in electronics and consumer items. Increased demand for phenol-based materials for coatings, laminates, insulation, and composite applications has resulted from the building and automotive industries' rapid growth due to industrialization and urbanization. Additionally, consistent market expansion is supported by the growing use of phenol in household and pharmaceutical products.

Restraining Factors

The development of safer or bio-based alternatives that lessen reliance on traditional phenol-based chemical products, strict government restrictions, environmental and health concerns related to phenol toxicity, and fluctuating crude oil costs all pose obstacles to the phenol market.

Market Segmentation

The phenol market share is classified into end user and application.

- The chemical segment accounted for the largest share in 2024, and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the phenol market is divided into chemical, construction, automotive, electronic communication, metallurgy, and others. Among these, the chemical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The wide use of phenol as a crucial raw material in the synthesis of numerous chemical derivatives, such as bisphenol A, phenolic resins, caprolactam, and alkylphenols, which are crucial intermediates for a variety of industrial uses, is the main reason for the Chemical segment. Growing demand from downstream industries like plastics, adhesives, coatings, and pharmaceuticals contributes to the segment's substantial stake.

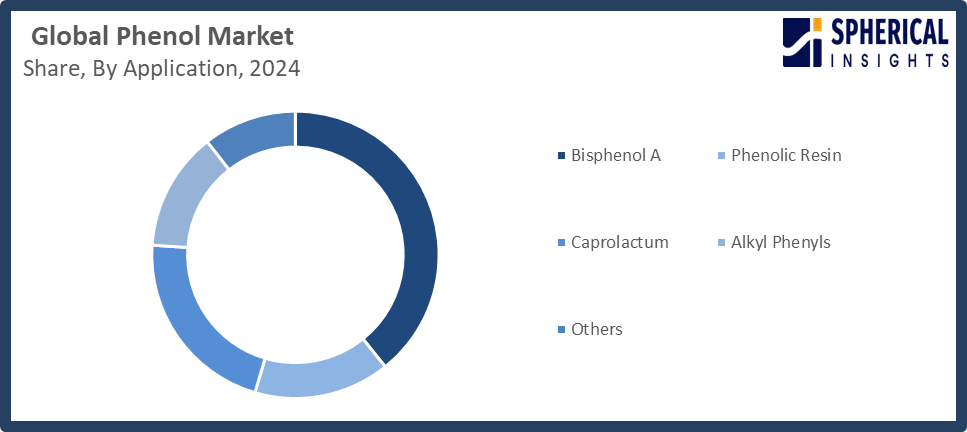

- The bisphenol A segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the phenol market is divided into bisphenol A, phenolic resin, caprolactam, alkyl phenyls, and others. Among these, the bisphenol A segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Bisphenol A (BPA), a derivative, is a key component of the global phenol market. BPA is a basic raw ingredient used to make epoxy resins and polycarbonate polymers. It is mostly made by condensing phenol and acetone.

Get more details on this report -

Regional Segment Analysis of the Phenol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the phenol market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the phenol market over the predicted timeframe. With the increasing number of infrastructure projects and a robust manufacturing base, East Asia is expected to continue to be the worldwide market's development engine until 2032. The continued growth of the petrochemical industries in China, Japan, South Korea, and India is expected to keep the region at the top. High-end downstream derivatives, particularly optical-grade polycarbonate and high-heat phenolic compounds for electronics, are supplied by South Korea and Japan, while ASEAN countries provide the expanding furniture and construction industries. Additionally, the growing production of bisphenol A (BPA) and phenolic resins to feed the plastics and adhesives sectors reinforces regional dominance. Asia-Pacific continues to be the key hub for supply and demand due to the phenol market.

North America is expected to grow at a rapid CAGR in the phenol market during the forecast period. North America advantages from an abundance of natural gas that allows competitive acetone co-product pricing despite feedstock-induced volatility. However, the supply of propylene has become more constrained due to refinery closures, which have reduced margins and sparked discussions about tolling agreements for split-feed cumene plants. The United States continues to be the top nation thanks to a robust infrastructure for chemical manufacturing. Although sustained competitiveness will depend on energy-efficiency improvements and possible bio-propylene collaborations, U.S. tariff policy and anti-dumping tariffs may provide short-term respite against rising Asian imports.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the phenol market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SABIC

- Versalis

- LG Chem

- Sasol Ltd.

- AdvanSix

- Shell PLC

- Solvay S.A.

- INEOS Group

- Sinopec Corp.

- Mitsui Chemicals Inc.

- Kumho P&B Chemicals

- Formosa Chemicals & Fibre Corp

- Zhejiang Petroleum & Chemical Co., Ltd.

- PTT Global Chemical Public Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Deepak Nitrite Ltd announced that its subsidiary, Deepak Chem Tech, has invested Rs 3,500 crore (USD 40.6 million) to establish a phenol and solvents manufacturing complex, producing 300 KTA of phenol, 185 KTA of acetone, and 100 KTA of isopropyl alcohol, nearly doubling existing production capacity.

- In January 2025, Mitsui Chemicals and Mitsubishi Chemical Corporation have launched a joint study to ensure a stable supply of phenol-related products, including phenol, acetone, α-methylstyrene, bisphenol A, and methyl isobutyl ketone, essential for polycarbonate, phenolic, and epoxy resins, paints, and other industries, supporting Japan’s economic security.

- In November 2024, Haldia Petrochemicals Ltd. (HPL) has launched a major expansion by signing a license amendment agreement with Lummus Technology to increase phenol production capacity at its upcoming Phenol and Acetone Plant in Haldia, West Bengal, marking a significant milestone in the company’s growth strategy.

- In April 2024, Mitsui Chemicals launched plans to close its Ichihara Works phenol plant, with a 190,000 tons/year capacity, by fiscal 2026, as part of its strategy to transform the Basic & Green Materials Business Sector into a sustainable, competitive green chemicals business focused on derivatives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the phenol market based on the below-mentioned segments:

Global Phenol Market, By End User

- Chemical

- Construction

- Automotive

- Electronic Communication

- Metallurgy

- Others

Global Phenol Market, By Application

- Bisphenol A

- Phenolic Resin

- Caprolactum

- Alkyl Phenyls

- Others

Global Phenol Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the phenol market over the forecast period?The global phenol market is projected to expand at a CAGR of 4.35% during the forecast period.

-

2. What is the market size of the phenol market?The global phenol market size is expected to grow from USD 12.75 billion in 2024 to USD 20.36 billion by 2035, at a CAGR of 4.35% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the phenol market?Asia Pacific is anticipated to hold the largest share of the phenol market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global phenol market?SABIC, Versalis, LG Chem, Sasol Ltd., AdvanSix, Shell PLC, Solvay S.A., INEOS Group, Sinopec Corp., Mitsui Chemicals Inc., Kumho P&B Chemicals, Formosa Chemicals & Fibre Corp., Zhejiang Petroleum & Chemical Co., Ltd., PTT Global Chemical Public Company Ltd., and others.

-

5. What factors are driving the growth of the phenol market?The growth of the phenol market is driven by increasing demand for phenol derivatives, industrial expansion, technological advancements, and rising applications in construction, automotive, and electronics industries.

-

6. What are the market trends in the phenol market?The development of bio-based phenol, capacity increases, strategic partnerships, sustainable manufacturing techniques, and the increasing use of cutting-edge technology to improve production efficiency are some of the major market trends.

-

7. What are the main challenges restricting wider adoption of the phenol market?The volatility of raw material prices, severe environmental restrictions, health and safety concerns, and competition from sustainable and eco-friendly phenol alternatives are the primary challenges preventing wider usage.

Need help to buy this report?