Canada Hydrogen Peroxide Market Size, Share, and COVID-19 Impact Analysis, By Grade (<30%, 30%-50%, 50%-80%, >80%, and Others), By Function (Disinfectant, Bleaching, Oxidant, and Others), Application (Pulp & Paper, Chemical Synthesis, Wastewater Treatment, Mining, Personal Care, Healthcare, and Others), and Canada Hydrogen Peroxide Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsCanada Hydrogen Peroxide Market Size Insights Forecasts to 2035

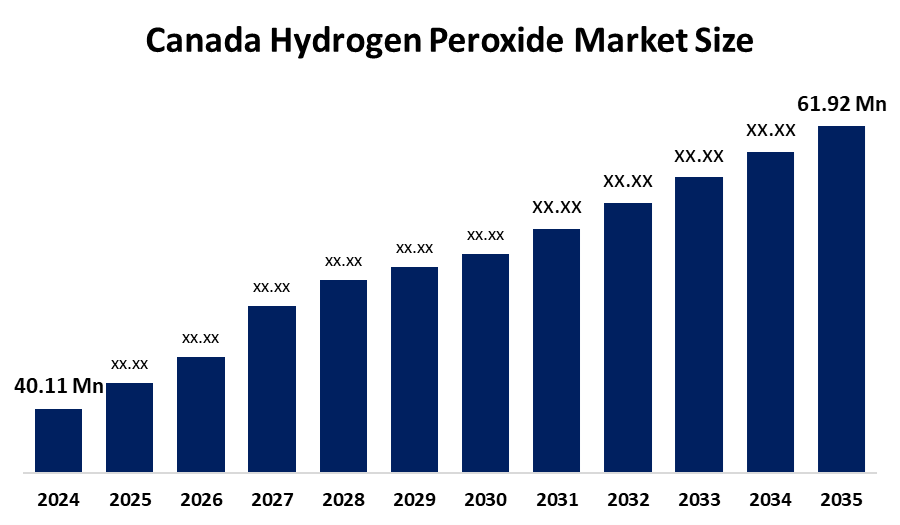

- The Canada Hydrogen Peroxide Market Size Was Estimated at USD 40.11 Million in 2024

- The Canada Hydrogen Peroxide Market Size is Expected to Grow at a CAGR of Around 4.03% from 2025 to 2035

- The Canada Hydrogen Peroxide Market Size is Expected to Reach USD 61.92 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Canada Hydrogen Peroxide Market Size is anticipated to reach USD 61.92 million by 2035, growing at a CAGR of 4.03% from 2025 to 2035. The Canada hydrogen peroxide market is driven by increasing demand from wastewater treatment, pulp & paper bleaching, and textile processing, where H2O2 is valued for its eco-friendly and efficient oxidizing properties. Growing use in healthcare, food processing, and industrial cleaning, along with stricter environmental regulations favoring sustainable chemicals, further supports market expansion.

Market Overview

The Canada Hydrogen Peroxide Market Size refers to the manufacturing, distribution, and sale of hydrogen peroxide (HO) throughout Canada, mainly for its use as an oxidizing, bleaching, and disinfecting agent. Among its main consumer industries are pulp & paper, wastewater treatment, healthcare, food processing, textiles, mining, and chemical manufacturing, with different concentrations and grades available for industrial, commercial, and institutional usage.

Canada’s adoption of the hydrogen peroxide market is partially influenced by its population of around 40 million and the country's significant industrial and environmental requirements. Canada stands as one of the major pulp & paper producers in the world, with a production level exceeding 17 million metric tons annually, where hydrogen peroxide is necessary for chlorine-free bleaching. Moreover, the increasing urban populations and industrial development result in the generation of billions of cubic meters of municipal and industrial wastewater annually, which in turn leads to the demand for hydrogen peroxide as a safe and effective oxidizing agent in water treatment. The increased utilization in sectors such as healthcare, food processing, mining, and industrial cleaning further accentuates the market's role in securing public health, achieving environmental compliance, and promoting industrial efficiency.

The Canada government actively supports this market through sustainability and innovation initiatives. For instance, the CAD 8 billion Net Zero Accelerator Initiative is aimed at encouraging cleaner industrial manufacturing, whereas the CAD 5 billion funding for water and wastewater infrastructure is thought to push the use of green chemicals in treatment. Alongside these, the regulatory focus on green solutions also works as an enabler and a very strong growth driver of the hydrogen peroxide market in Canada.

Report Coverage

This research report categorizes the market for the Canada hydrogen peroxide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada hydrogen peroxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada hydrogen peroxide market.

Canada Hydrogen Peroxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 40.11 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.03% |

| 2035 Value Projection: | USD 61.92 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Function |

| Companies covered:: | Evonik Industries AG, Arkema Canada Inc., Solvay S.A., Westlake Corporation, Orbia (Mexichem SAB de CV), SABIC, LG Chem, Aurora Plastics LLC, Formosa Plastics Corporation, Ineos Group Ltd., Kemira Oyj (via Evonik), Hanwha Chemical Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for Canada's hydrogen peroxide market is driven by the strong need from the pulp & paper industry, wastewater treatment facilities, and mining operations, where hydrogen peroxide is highly regarded for its environmentally friendly bleaching and oxidizing properties. There is also a rise in applications in healthcare, food processing, and industrial cleaning.

Restraining Factors

Canada hydrogen peroxide market is restrained by the fact that production, storage, and transportation of hydrogen peroxide are costly, as it is a highly reactive chemical and thus requires specialized handling. Moreover, stringent safety and environmental regulations, volatility in energy and raw material prices, as well as competition from alternative chemicals for treatment and bleaching purposes may pose limitations to the market growth.

Market Segmentation

The Canada Hydrogen Peroxide Market share is classified by grade, function, and application.

- The <30% segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The <30% segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada hydrogen peroxide market is segmented by grade into <30%, 30%–50%, 50%–80%, >80%, and others. Among these, the <30% segment leads the market due to its safer handling, cost-effectiveness, and wide suitability for applications such as wastewater treatment, pulp and paper bleaching, healthcare disinfection, and food processing. Its lower concentration aligns with regulatory requirements while ensuring operational safety, driving strong adoption across industrial and municipal sectors in Canada.

- The bleaching segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The bleaching segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Canada hydrogen peroxide market is segmented by function into disinfectant, bleaching, oxidant, and others. The dominance of the bleaching segment is attributed to hydrogen peroxide’s effectiveness as an eco-friendly bleaching agent, particularly in the pulp and paper, textile, and detergent industries. Growing demand for sustainably processed paper, fabrics, and cleaning products in Canada continues to support increased adoption of hydrogen peroxide for bleaching applications.

- The pulp & paper segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada hydrogen peroxide market is segmented by application into pulp & paper, chemical synthesis, wastewater treatment, mining, personal care, healthcare, and others. Among these, the pulp & paper segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The pulp & paper segment is growing because hydrogen peroxide is a key eco-friendly bleaching agent that allows for high-quality, chlorine-free paper production. Increasing demand for sustainable paper products, coupled with Canada’s strong paper manufacturing industry and stricter environmental regulations, drives the widespread adoption of H2O2 in this sector.

Recent Developments:

• In March 2025, Nouryon launched Eka HP Puroxide, a low-carbon hydrogen peroxide product that reduces carbon footprint by up to 90%. The product offers a more sustainable oxidizing solution for industries such as pulp and paper, mining, and water treatment, positively influencing sustainability trends in Canada’s hydrogen peroxide market.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada hydrogen peroxide market based on the below-mentioned segments:

Canada Hydrogen Peroxide Market Size, By Grade

- <30%

- 30%-50%

- 50%-80%

- >80%

- Others

Canada Hydrogen Peroxide Market Size, By Function

- Disinfectant

- Bleaching

- Oxidant

- Others

Canada Hydrogen Peroxide Market Size, By Application

- Pulp & Paper

- Chemical Synthesis

- Wastewater Treatment

- Mining, Personal Care

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Canada Hydrogen Peroxide Market Size in 2024?The Canada hydrogen peroxide market size was estimated at USD 40.11 million in 2024.

-

2. What is the projected market size of the Canada Hydrogen Peroxide Market Size by 2035?The Canada hydrogen peroxide market size is expected to reach USD 61.92 million by 2035.

-

3. What is the CAGR of the Canada Hydrogen Peroxide Market Size?The Canada hydrogen peroxide market size is expected to grow at a CAGR of around 4.03% from 2024 to 2035.

-

4. What are the key growth drivers of the Canada Hydrogen Peroxide Market Size?The Canada hydrogen peroxide market is driven by increasing demand from wastewater treatment, pulp & paper bleaching, and textile processing, where H₂O₂ is valued for its eco-friendly and efficient oxidizing properties.

-

5. Which function segment dominated the market in 2024?The bleaching segment dominated the market in 2024.

-

6. What segments are covered in the Canada Hydrogen Peroxide Market Size report?The Canada hydrogen peroxide market is segmented on the basis of grade, function, and application.

-

7. Who are the key players in the Canada Hydrogen Peroxide Market Size?Key companies include Evonik Industries AG, Arkema Canada Inc., Solvay S.A., Westlake Corporation, Orbia (Mexichem SAB de CV), SABIC, LG Chem, Aurora Plastics LLC, Formosa Plastics Corporation, Ineos Group Ltd., Kemira Oyj (via Evonik), Hanwha Chemical Co.Ltd, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?