United States Pulp and Paper Machinery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Paper Machines and Pulper Machines), By Equipment Type (Batch Equipment and Continuous Equipment), By End-use Industry (Printing & Writing Paper and Packaging Paper), and United States Pulp and Paper Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Pulp and Paper Machinery Market Insights Forecasts to 2035

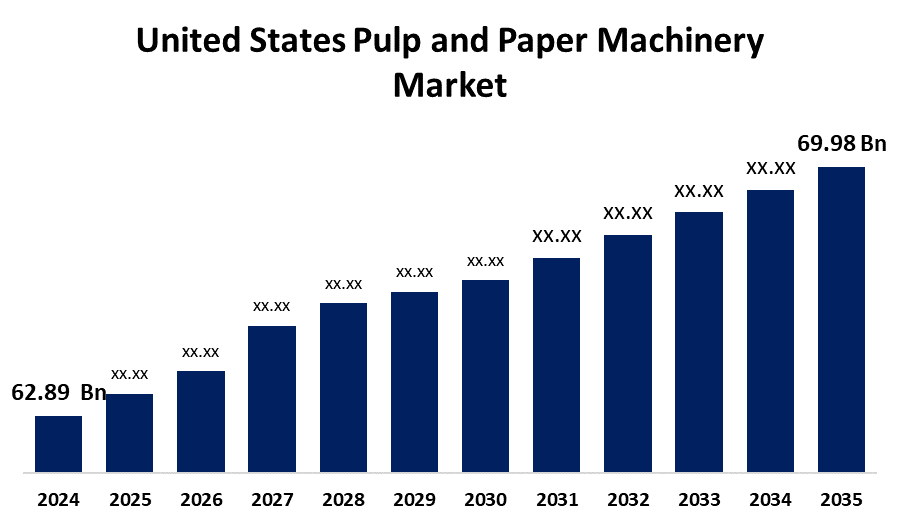

- The United States Pulp and Paper Machinery Market Size was Estimated at USD 62.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 0.98% from 2025 to 2035

- The United States Pulp and Paper Machinery Market Size is Expected to Reach USD 69.98 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States pulp and paper machinery market is anticipated to reach USD 69.98 billion by 2035, growing at a CAGR of 0.98% from 2025 to 2035. This is due to the increased demand for e-commerce for environmentally friendly packaging solutions, including corrugated boxes and paper-based products, which has led to investment in high-tech machinery to cater to the manufacturing needs. Technological innovation, such as automation, artificial intelligence, and machine learning, is increasing production efficiency, quality, and lowering the environmental footprint.

Market Overview

The US paper and pulp industry defines the general range of paper and paper products, as well as their production, from raw materials like wood pulp and recycled paper to end products like packaging, printing, writing papers, tissue, and specialty papers. Some of the drivers include the growing e-commerce industry, which has further increased demand for sustainable packaging solutions, and increased consumer demand for green products. This change has given rise to higher use of recycled content and biodegradable packaging. The US pulp and paper industry offers great opportunities fueled by drivers such as growth in e-commerce, growing demand for sustainable packaging, and higher consumption of hygiene products. Policies in the US pulp and paper industry are mainly aimed at encouraging sustainability, such as recycled content requirements, and providing support to the industry through rules and incentives. These efforts seek to minimize pollution, promote recycling, and promote a more sustainable and competitive pulp and paper industry.

Report Coverage

This research report categorizes the market for the United States pulp and paper machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pulp and paper machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pulp and paper machinery market.

United States Pulp and Paper Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 62.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 0.98% |

| 2035 Value Projection: | USD 69.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Equipment Type, By End-use Industry and COVID-19 Impact Analysis |

| Companies covered:: | WestRock, Georgia-Pacific Corporation, WestRock, Domtar Inc., Verso Corporation, Valmet Inc., Kimberly-Clark Corporation, Graphic Packaging International, Resolute Forest Products, Sappi Ltd., and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The US pulp and paper industry is fueled by the increasing need for sustainable packaging, driven by the swift growth of e-commerce and heightened environmental consciousness. Businesses and consumers are turning away from plastic and opting for biodegradable and recyclable paper packaging. Furthermore, government support for green alternatives drives market expansion. Large players in the industry are making investments in cutting-edge packaging technology and raising production capacities to cope with increasing demand. As packaging paper experiences considerable growth, the writing and printing paper segment declines because digitalization lowers the demand for conventional paper products.

Restraining Factors

Volatile raw material prices, especially chemicals and wood, have a major impact on production costs and profit margins. Moreover, stringent pollution controls mandate huge investments in compliance steps, including waste management systems and emission control. Supply chain disruptions like trade tensions and labor shortages add to the complexity and restrain the market for U.S. pulp and paper machinery market.

Market Segmentation

The United States pulp and paper machinery market share is classified into product type, equipment type, and end-use industry.

- The paper machines segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pulp and paper machinery market is segmented by product type into paper machines and pulper machines. Among these, the paper machines segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is mainly due to the growing need for different paper products, particularly in packaging and other end-use areas. Furthermore, the emphasis on green packaging options, with paper as a recyclable and reusable substitute for plastics, also boosts demand for paper machine technology.

- The continuous equipment segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pulp and paper machinery market is segmented by equipment type into batch equipment and continuous equipment. Among these, the continuous equipment segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that such systems are intended for operation on a continuous basis, handling mass quantities of material flow-through. Continuous processes, as applied in the manufacturing of pulp and paper making, tend to be cheaper and more effective than batch processes.

- The packaging paper segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pulp and paper machinery market is segmented by end-use industry into printing & writing paper and packaging paper. Among these, the packaging paper segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to strong demand for paper-based packaging and its sustainability advantage, along with increasing e-commerce and food delivery growth. Paper packaging is more easily biodegradable and recyclable, which makes it a sustainable option compared to plastic.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pulp and paper machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- WestRock

- Georgia-Pacific Corporation

- WestRock

- Domtar Inc.

- Verso Corporation

- Valmet Inc.

- Kimberly-Clark Corporation

- Graphic Packaging International

- Resolute Forest Products

- Sappi Ltd.

- Others

Recent Developments:

- In January 2025, Svante was selected for US DOE funding to advance carbon capture in the pulp & paper industry. Svante Technologies Inc. (Svante), a leader in next-generation carbon capture and removal technology, announced that it is developing a first-of-a-kind carbon capture and storage project at the Ashdown pulp mill facility in Arkansas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States pulp and paper machinery market based on the below-mentioned segments:

U.S. Pulp and Paper Machinery Market, By Product Type

- Paper Machines

- Pulper Machines

U.S. Pulp and Paper Machinery Market, By Equipment Type

- Batch Equipment

- Continuous Equipment

U.S. Pulp and Paper Machinery Market, By End-use Industry

- Printing and Writing Paper

- Packaging Paper

Need help to buy this report?