Global Calcium Hydroxide Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder, Granules, Slurry, and Paste), By Purity (90-95%, 95-98%, 98-99%, and 99% & above), By Application (Paper and Pulp Industry, Water Treatment, Food and Beverages, Chemical and Pharmaceutical Industry, and Other Industrial Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Calcium Hydroxide Market Insights Forecasts to 2035

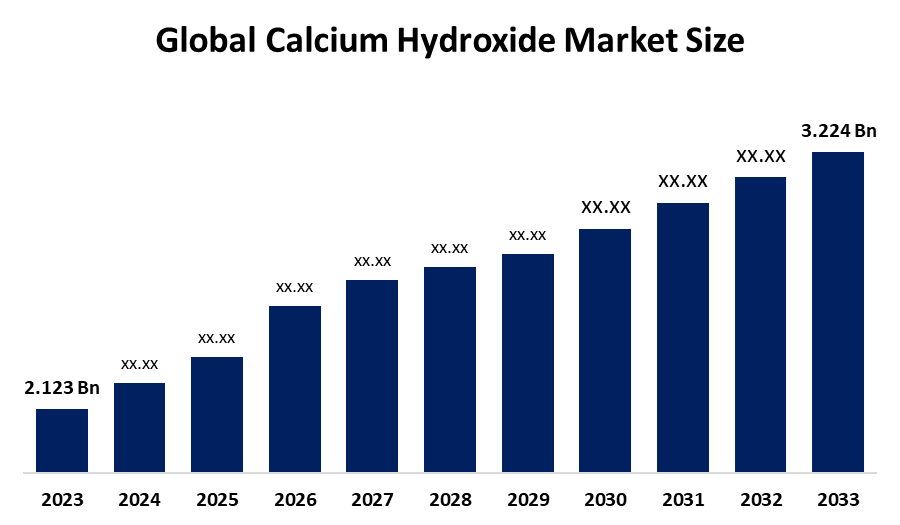

- The Global Calcium Hydroxide Market Size Was Estimated at USD 2.123 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.87% from 2025 to 2035

- The Worldwide Calcium Hydroxide Market Size is Expected to Reach USD 3.224 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global calcium hydroxide market size was worth around USD 2.123 Billion in 2024 and is predicted to Grow to around USD 3.224 Billion by 2035 with a compound annual growth rate (CAGR) of 3.87% from 2025 to 2035. The calcium hydroxide market is growing globally with increasing applications in construction, due to environmental regulations regarding water and flue gas purification, and also in the pulp and paper, food, and metal industries.

Market Overview

The calcium hydroxide world market is defined as the production and demand of calcium hydroxide, commonly known as slaked lime, which is a chemical compound with alkaline properties. It is mainly used in water treatment, wastewater treatment, and construction purposes such as mortar, plastering, or soil stabilization alongside applications in the sugar industry, production of paper products, or manufacturing chemical products. Rising demand for clean water, growing investment in the area of infrastructure, or the need to satisfy an environmental policy to treat flue gas or an acidic effluent are pushing the global calcium hydroxide market.

In August 2024, the USDA also included calcium hydroxide on the list of substances authorized on the National List of Allowed Substances for organic production in 2025. The organic utilization of calcium hydroxide approved for usage in 2025 will be subject to the organic sunset review process on the National List of Allowed Substances for organic production in 2025. This aligns with global organic standards such as IFOAM. Opportunities lie in countries in which the economy is still developing via urbanization and the installation of environmental management systems. Furthermore, advancements in the efficiency of technology in production and recycling of waste also contribute to the growth of the market. The prominent participants in the calcium hydroxide market are Carmeuse, Lhoist Group, Mississippi Lime Company, Graymont Limited, and Sigma Minerals.

Report Coverage

This research report categorizes the calcium hydroxide market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the calcium hydroxide market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the calcium hydroxide market.

Global Calcium Hydroxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.123 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.87% |

| 2035 Value Projection: | USD 3.224 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Form |

| Companies covered:: | Mississippi Lime Company, Carmeuse, Lhoist Group, Graymont Limited, Sigma Minerals, Omya AG, Minerals Technologies Inc., Hydrite Chemical Co., Jost Chemical Co., GFS Chemicals, Inc., Schaefer Kalk, Nordkalk Corporation, Cao Industries Sdn Bhd, United States Lime & Minerals, Inc., and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the global calcium hydroxide market is facilitated by the increased use of calcium hydroxide as a pH conditioner in the water and wastewater treatment industry. Rising construction endeavors facilitate the growth of the global calcium hydroxide market as a construction agent for the production of mortar, plaster, and soil stabilizing agent. Increased use as an intermediate in the production of chemicals, pulping of paper, and sugar refining processes contributes to the growth of the global calcium hydroxide market. Environmental regulations accelerate the growth of the global calcium hydroxide market as a flue gas cleaning agent or an acid neutralization agent

Restraining Factors

The factors that are hindering the development of the global calcium hydroxide market are related to dangers caused by the processing and inhalation of this compound, and safety regulations that are very stringent. Additionally, the emission of dust constitutes an environmental issue that is a restraint to market development.

Market Segmentation

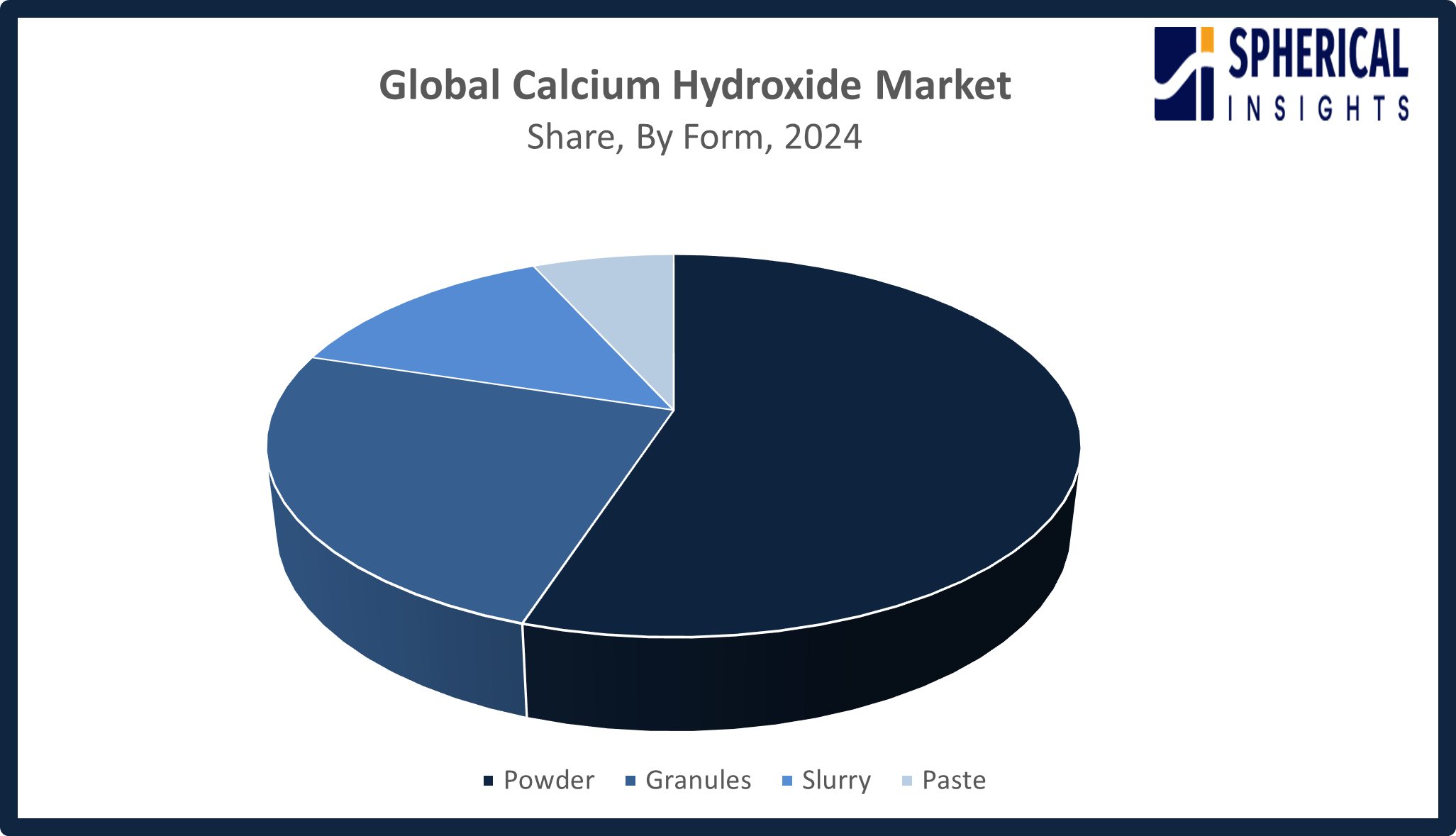

The calcium hydroxide market share is classified into form, purity and application.

- The powder segment dominated the market in 2024, approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the calcium hydroxide market is divided into powder, granules, slurry, and paste. Among these, the powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market for calcium hydroxide powder grew the most in comparison to the calcium hydroxide segment. Powdered calcium hydroxide has numerous applications in the field of construction, treatment of water, and chemical production for the purpose of dry mixing, precise dosing, and transporting. Powdered calcium hydroxide is the most economical and feasible alternative to slurry, granules, or paste.

Get more details on this report -

- The 99% & above segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the purity, the calcium hydroxide market is divided into 90-95%, 95-98%, 98-99%, and 99% & above. Among these, the 99% & above segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The category of 99% & above purity dominated the calcium hydroxide market due to its requirements in high applications, including pharmaceuticals, specialty chemicals, and water treatment processes. The ultra-high purity of calcium hydroxide will allow for the maintenance of performance consistency, adherence to regulatory standards, and reduced presence of contaminants, making ultra-high purity preferred in applications utilizing high standards.

- The water treatment segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the calcium hydroxide market is divided into paper and pulp industry, water treatment, food and beverages, chemical and pharmaceutical industry, and other industrial applications. Among these, the water treatment segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The water treatment segment had growth in the calcium hydroxide market, with extensive applications regarding the adjustment of pH, neutralization of contaminants, and water softening in municipal and industrial systems. Increasing investments from governments in clean water infrastructure, along with firmer environmental regulations and growing demand for safe drinking and wastewater treatment, are driving strong adoption of calcium hydroxide.

Regional Segment Analysis of the Calcium Hydroxide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the calcium hydroxide market over the predicted timeframe.

North America is anticipated to hold the largest share of the calcium hydroxide market over the predicted timeframe. North America is projected to account for the 40% share in the calcium hydroxide market due to the established industry base and stringent environmental regulations. The leading growth in the United States is fueled by the application of calcium hydroxide in wastewater treatment plants, flue gas desulfurization, and the manufacturing of building materials. Canada follows with their applications in the pulp and paper industry, chemical industry, and municipal water treatment. Additionally, the EPA’s NESHAP regulations for lime production and the Infrastructure Investment and Jobs Act make a significant contribution to the demand for high-calcium lime.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the calcium hydroxide market during the forecast period. Asia Pacific is anticipated to have a 25% market share of the calcium hydroxide industry due to the growth of the industry, urbanization, and rising construction activities. China and India lead the demand based on infrastructure developments, wastewater treatment, and industrial usage. Increasing green projects and environmentally friendly infrastructure drive the demand. China’s NDRC announced the 2023–2025 Action Plan in September 2023, aiming to improve environmental infrastructure, handle sewage, waste, and dangerous materials, improve environmental monitoring, and increase facilities from urban to rural areas to achieve the vision of Beautiful China based on the concept of sustainability.

The European market for calcium hydroxide is currently expanding due to progressive environmental policies, effective water treatment projects, and a significant demand for this chemical. The markets of Germany, France, as well as UK are leading in this region. Calcium hydroxide is primarily used as a water treatment chemical as well as in engineering projects. This chemical is playing a crucial role in determining Europe's infrastructure requirements as well as dealing with its environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the calcium hydroxide market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mississippi Lime Company

- Carmeuse

- Lhoist Group

- Graymont Limited

- Sigma Minerals

- Omya AG

- Minerals Technologies Inc.

- Hydrite Chemical Co.

- Jost Chemical Co.

- GFS Chemicals, Inc.

- Schaefer Kalk

- Nordkalk Corporation

- Cao Industries Sdn Bhd

- United States Lime & Minerals, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Graymont completed its acquisition of Compact Energy’s Banting, Malaysia lime facility, adding 390,000 tonnes of quicklime and 70,000 tonnes of hydrated lime capacity. The plant strengthens Graymont’s Malaysian and Asia Pacific operations, supporting local employment and supplying high-quality calcium-based solutions to essential industries.

- In September 2022, Mississippi Lime Company (MLC), an HBM Holdings firm, acquired Singleton Birch, the UK’s leading independent lime supplier. The move supports MLC’s strategy for growth, innovation, and sustainability through geographic expansion and new technologies. Financial details of the acquisition were not disclosed.

- In January 2022, Omya launched Top Flow Calcium, a liquid limestone solution for soil conditioning and crop nutrition. Its ultrafine particles rapidly release calcium, correcting soil acidity and enhancing nutrient uptake, plant vigor, and crop productivity, supporting healthier, more fertile soil for improved agricultural performance worldwide.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the calcium hydroxide market based on the below-mentioned segments:

Global Calcium Hydroxide Market, By Form

- Powder

- Granules

- Slurry

- Paste

Global Calcium Hydroxide Market, By Purity

- 90-95%

- 95-98%

- 98-99%

- 99% & above

Global Calcium Hydroxide Market, By Application

- Paper and Pulp Industry

- Water Treatment

- Food and Beverages

- Chemical and Pharmaceutical Industry

- Other Industrial Applications

Global Calcium Hydroxide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the calcium hydroxide market over the forecast period?The global calcium hydroxide market is projected to expand at a CAGR of 3.87% during the forecast period.

-

2. What is the calcium hydroxide market?The calcium hydroxide market involves the production and sale of calcium hydroxide used in various applications, including water treatment, construction, chemicals, food, and industry globally

-

3. What is the market size of the calcium hydroxide market?The global calcium hydroxide market size is expected to grow from USD 2.123 billion in 2024 to USD 3.224 billion by 2035, at a CAGR of 3.87% during the forecast period of 2025-2035

-

4. Which region holds the largest share of the calcium hydroxide market?North America is anticipated to hold the largest share of the calcium hydroxide market over the predicted timeframe

-

5. Who are the top 10 companies operating in the global calcium hydroxide market?Mississippi Lime Company, Carmeuse, Lhoist Group, Graymont Limited, Sigma Minerals, Omya AG, Minerals Technologies Inc., Hydrite Chemical Co., Jost Chemical Co., GFS Chemicals, Inc., and Others

-

6. What factors are driving the growth of the calcium hydroxide market?The growth of the calcium hydroxide market is primarily driven by its extensive and critical use across major industries such as construction, water and wastewater treatment, and environmental management, alongside increasing demand in emerging economies and stringent environmental regulations.

-

7. What are the market trends in the calcium hydroxide market?Rising water treatment demand, industrial applications growth, high-purity powder preference, environmental regulations, and expanding construction usage drive calcium hydroxide market trends

-

8. What are the main challenges restricting wider adoption of the calcium hydroxide market?The main challenges restricting the wider adoption of the calcium hydroxide market are competition from alternative products, supply chain and logistical complexities, health and safety risks, and environmental concerns related to its production

Need help to buy this report?