Brazil Ethylene Vinyl Acetate Market Size, Share, By Technology (Extrusion, Injection Molding, Hot Melt Adhesives, And Foam Molding), By Application (Solar Cell Encapsulation, Foams, Packaging Films, Adhesives & Sealants, Wires & Cables, And Others), And Brazil Ethylene Vinyl Acetate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Ethylene Vinyl Acetate Market Size Insights Forecasts to 2035

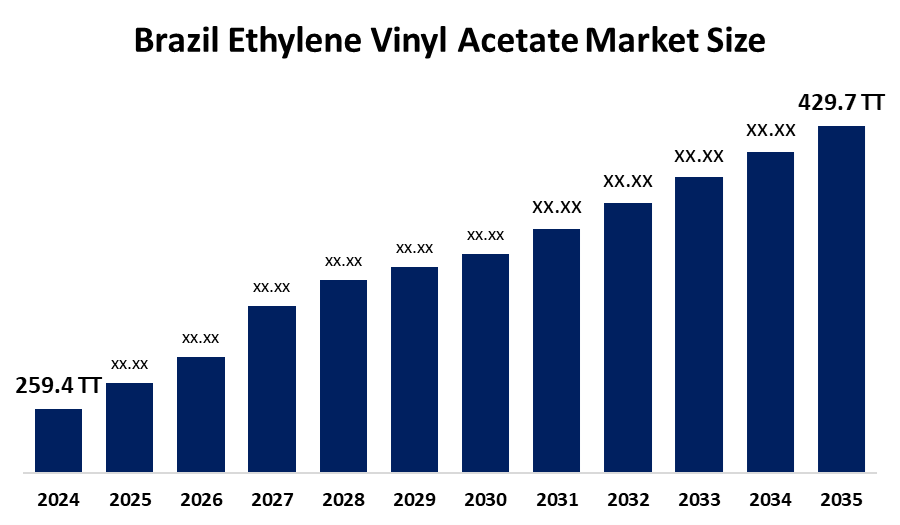

- Brazil Ethylene Vinyl Acetate Market Size 2024: 259.4 Thousand Tonnes

- Brazil Ethylene Vinyl Acetate Market Size 2035: 429.7 Thousand Tonnes

- Brazil Ethylene Vinyl Acetate Market Size CAGR 2024: 4.7%

- Brazil Ethylene Vinyl Acetate Market Size Segments: Technology and Application

Get more details on this report -

The Brazil Ethylene Vinyl Acetate Market Size encompasses the production of EVA copolymers to consumption in Brazil's industry. EVA is a highly usable thermoplastic copolymer created by the reaction between ethylene and vinyl acetate and is known for being extremely flexible while also having excellent strength, durability, UV resistant, and lightweight, which makes it ideal for various applications including shoes, flexible packaging film, adhesives, flexible foam, and developing uses in photovoltaic encapsulation and automotive parts. Additionally, EVA has strong support from Brazil's shoe production industries and packaging film production, construction, and renewable energy industries through the continued use of EVA products.

The ethylene vinyl acetate in Brazil are backed by government support, including the Brazilian Development Bank (BNDES), which in recent years allocated substantial funding to renewable energy projects including solar power installations. This support stimulates the deployment of photovoltaic systems that extensively use EVA encapsulant films, thereby indirectly increasing material demand.

As technology advances, Brazilian ethylene vinyl acetate providers are now using new polymer blends and processing systems to add value to products while also making them environmentally friendly. Many companies are looking at innovative ways to combine different polymers and improve their coupling techniques through the use of new technologies, such as advanced cross-linking, to create EVA materials with better elasticity and resistance. In addition, companies are creating bio-based EVA and more eco-efficient production processes to develop the best performance-based products to comply with Brazilian environmental regulations and help support global trends toward lower-impact materials.

Brazil Ethylene Vinyl Acetate (EVA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 259.4 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.7% |

| 2035 Value Projection: | 429.7 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Celanese Corporation, Dow Inc., ExxonMobil Corporation, LyondellBasell Industries, Arkema S.A., Braskem S.A., Formosa Plastics Corporation, Hanwha Solutions, TP Polymer Private Limited, SABIC, LG Chem Ltd., Clariant AG, Repsol, S.A., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Ethylene Vinyl Acetate Market Size:

The Brazil Ethylene Vinyl Acetate Market Size is driven by the continued expansion of the footwear sector, strong activity in packaging and flexible film applications, growing consumer goods industries, rising deployment of solar photovoltaic systems, rise in high-performance EVA encapsulants, robust agricultural, construction, and automotive sectors, and strong government funding policies for EVA.

The Brazil Ethylene Vinyl Acetate Market Size is restrained by the volatility in raw material prices, petrochemical feedstocks challenges, fluctuations with global oil markets, environmental concerns, increasing regulatory scrutiny over plastics and polymer waste management, and competition from alternative materials.

The future of Brazil Ethylene Vinyl Acetate Market Size is bright and promising, with versatile opportunities emerging from the use of bio-based and recyclable EVA materials at the intersection of global sustainability trends and circular economy projects. There are huge opportunities for growth in the areas of healthcare and medical uses due to the biocompatibility of EVA, as well as in advanced construction materials that require flexible and durable polymeric materials. Growth in the renewable energy sector has created new opportunities for unique EVA applications, with a focus on distributed solar applications and energy storage solutions. These applications will lead to a high level of innovation and market differentiation that is consistent with environmental objectives.

Market Segmentation

The Brazil Ethylene Vinyl Acetate Market Size share is classified into technology and application.

By Technology:

The Brazil Ethylene Vinyl Acetate Market Size is divided by technology into extrusion, injection molding, hot melt adhesives, and foam molding. Among these, the extrusion segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High dominance in solar energy, extensively used for food packaging, cost effective, provide consistent quality, and well established industries in Brazil all contribute to the extrusion segment’s largest share and higher spending on ethylene vinyl acetate segment when compared to other technology.

By Application:

The Brazil Ethylene Vinyl Acetate Market Size is divided by application into solar cell encapsulation, foams, packaging films, adhesives & sealants, wires & cables, and others. Among these, the foams segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The foams segment dominates because of high demand in the footwear industry, lightweight, cushioning, and flexible properties, and essential for producing shoes, sports equipment, and automotive components in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Ethylene Vinyl Acetate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Ethylene Vinyl Acetate Market Size:

- Celanese Corporation

- Dow Inc.

- ExxonMobil Corporation

- LyondellBasell Industries

- Arkema S.A.

- Braskem S.A.

- Formosa Plastics Corporation

- Hanwha Solutions

- TP Polymer Private Limited

- SABIC

- LG Chem Ltd.

- Clariant AG

- Repsol, S.A.

- Others

Recent Developments in Brazil Ethylene Vinyl Acetate Market Size:

In October 2025, Braskem introduced two new EVA grades produced from recycled industrial scrap, specifically targeting the footwear and sporting goods markets in Brazil. These, part of the Wenow portfolio, were designed for tatami mats, sneakers insoles, and shoe soles.

In October 2025, Braskem unveiled a new I’m greenTM bio-based EVA with 21% vinyl acetate, designed for high performance, soft footwear, and soles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Ethylene Vinyl Acetate Market Size based on the below-mentioned segments:

Brazil Ethylene Vinyl Acetate Market Size, By Technology

- Extrusion

- Injection Molding

- Hot Melt Adhesives

- Foam Molding

Brazil Ethylene Vinyl Acetate Market Size, By Application

- Solar Cell Encapsulation

- Foams

- Packaging Films

- Adhesives & Sealants

- Wires & Cables

- Others

Frequently Asked Questions (FAQ)

-

What is the Brazil Ethylene Vinyl Acetate Market Size?Brazil Ethylene Vinyl Acetate Market Size is expected to grow from 259.4 thousand tonnes in 2024 to 429.7 thousand tonnes by 2035, growing at a CAGR of 4.7% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the continued expansion of the footwear sector, strong activity in packaging and flexible film applications, growing consumer goods industries, rising deployment of solar photovoltaic systems, rise in high-performance EVA encapsulants, robust agricultural, construction, and automotive sectors, and strong government funding policies for EVA.

-

What factors restrain the Brazil Ethylene Vinyl Acetate Market Size?Constraints include the volatility in raw material prices, petrochemical feedstocks challenges, fluctuations with global oil markets, environmental concerns, increasing regulatory scrutiny over plastics and polymer waste management, and competition from alternative materials.

-

How is the market segmented by technology?The market is segmented into extrusion, injection molding, hot melt adhesives, and foam molding.

-

Who are the key players in the Brazil Ethylene Vinyl Acetate Market Size?Key companies include Celanese Corporation, Dow Inc., ExxonMobil Corporation, LyondellBasell Industries, Arkema S.A., Braskem S.A., Formosa Plastics Corporation, Hanwha Solutions, TP Polymer Private Limited, SABIC, LG Chem Ltd., Clariant AG, Repsol, S.A., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?