United States Ethylene Vinyl Acetate EVA Market Size, Share, and COVID-19 Impact Analysis, By Type (Very Low-Density, Low-Density, Medium-Density, and High-Density EVA), By End User (Photovoltaic Panels, Footwear & Foams, Packaging, Pharmaceuticals, and Agriculture), and United States Ethylene Vinyl Acetate EVA Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Ethylene Vinyl Acetate EVA Market Insights Forecasts to 2035

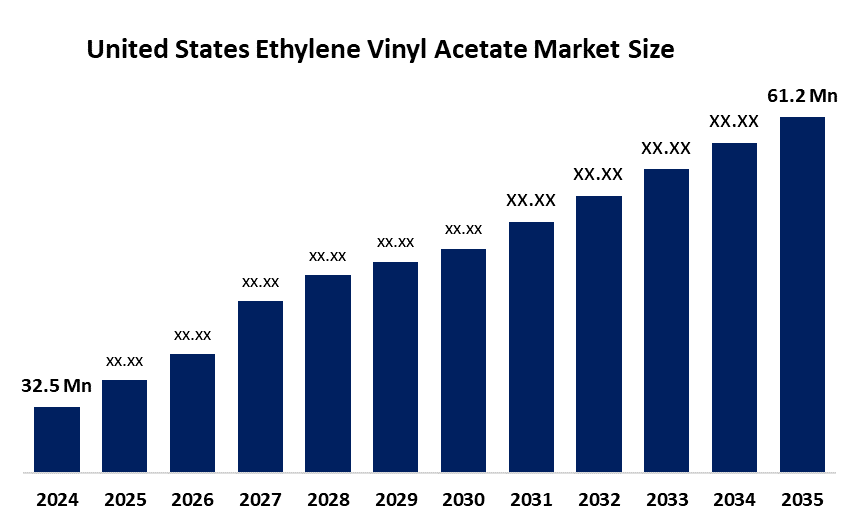

- The United States Ethylene Vinyl Acetate EVA Market Size Was Estimated at USD 32.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.92% from 2025 to 2035

- The United States Ethylene Vinyl Acetate EVA Market Size is Expected to Reach USD 61.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States ethylene vinyl acetate EVA market size is anticipated to reach USD 61.2 million by 2035, growing at a CAGR of 5.92% from 2025 to 2035. The ethylene vinyl acetate EVA market in United States is driven by growing solar energy installations, robust demand from the packaging and footwear sectors, the expansion of hot-melt adhesives, the use of lightweight materials, and favorable renewable energy legislation.

Market Overview

The United States Ethylene Vinyl Acetate (EVA) market refers to the production and use of a copolymer made from ethylene and vinyl acetate, which people value because it offers a flexible and tough material that can withstand impacts. EVA is widely applied in footwear soles, packaging films, and hot-melt adhesives, solar panel encapsulation, and wire and cable insulation, medical devices, and foam products because these applications create demand in automotive, renewable energy, construction, and consumer goods industries.

The U.S. government provides support for renewable energy and clean technology projects through the Inflation Reduction Act, which provides more than USD 10 billion for solar power incentives. The federal government supports plastics recycling through funding dedicated to advanced polymer research, which supports sustainable EVA material development. The Superfund excise tax functions as a regulatory measure that affects petrochemical feedstock costs while encouraging the use of recycled materials.

The United States has achieved progress through EVA production technologies, which include Univation's high-pressure process that started in June 2024 and High-VA EVA resin products, which enhance performance and sustainability for electric vehicles and solar applications. The rising need for solar encapsulants, together with the demand for bio-based EVA formulations, drives the creation of new products. The future provides opportunities for development through renewable energy sources and recyclable materials, which can be used in footwear cushioning and advanced packaging solutions.

Report Coverage

This research report categorizes the market for the United States ethylene vinyl acetate EVA market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ethylene vinyl acetate EVA market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ethylene vinyl acetate EVA market.

United States Ethylene Vinyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 32.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.92% |

| 2035 Value Projection: | USD 61.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ExxonMobil Corporation, Dow Inc., Celanese Corporation, DuPont, Westlake Chemical Corporation, Huntsman Corporation, Innospec, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethylene vinyl acetate EVA market in United States is driven by the solar panel encapsulation needs, renewable energy investments, and the Inflation Reduction Act to maintain its high demand. The market expansion receives support from the footwear, packaging, and automotive industries, the rising adoption of hot-melt adhesives and lightweight flexible materials, and the growing demand for impact-resistant, durable polymers.

Restraining Factors

The ethylene vinyl acetate EVA market in United States is mostly constrained by the unpredictable crude oil and ethylene price changes, environmental issues linked to plastic waste and recycling difficulties, and the growing demand for sustainable bio-based polymer solutions.

Market Segmentation

The United States ethylene vinyl acetate EVA market share is classified into type and end user.

- The low-density segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States ethylene vinyl acetate EVA market is segmented by type into very low-density, low-density, medium-density, and high-density EVA. Among these, the low-density segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is widely used in footwear soles, foam products, packaging films, and hot-melt adhesives. It provides the best possible blend of flexibility, cushioning, durability, and affordability, which promotes large volume consumption and consistent demand growth.

- The photovoltaic panels segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States ethylene vinyl acetate EVA market is segmented by end user into photovoltaic panels, footwear & foams, packaging, pharmaceuticals, and agriculture. Among these, the photovoltaic panels segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large-scale solar capacity expansions, robust federal incentives under the Inflation Reduction Act, and EVA's vital role as an encapsulant that improves panel longevity, durability, and efficiency, supporting high-volume demand, are the main drivers of this.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ethylene vinyl acetate EVA market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Corporation

- Dow Inc.

- Celanese Corporation

- DuPont

- Westlake Chemical Corporation

- Huntsman Corporation

- Innospec

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2024, to promote encapsulation technologies, such as EVA films, for the US solar market, HIUV and H.B. Fuller inked a cooperation.

- In June 2024, to increase manufacturing capabilities and efficiency, Univation Technologies LLC introduced a high-pressure production process for EVA and LDPE resins.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States ethylene vinyl acetate EVA market based on the below-mentioned segments:

United States Ethylene Vinyl Acetate EVA Market, By Type

- Very Low-Density

- Low-Density

- Medium-Density

- High-Density EVA

United States Ethylene Vinyl Acetate EVA Market, By End User

- Photovoltaic Panels

- Footwear & Foams

- Packaging

- Pharmaceuticals

- Agriculture

Frequently Asked Questions (FAQ)

-

Q: What is the United States ethylene vinyl acetate EVA market size?A: United States ethylene vinyl acetate EVA market size is expected to grow from USD 32.5 million in 2024 to USD 61.2 million by 2035, growing at a CAGR of 5.92% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by solar panel encapsulation needs, renewable energy investments, and the Inflation Reduction Act to maintain its high demand.

-

Q: What factors restrain the United States ethylene vinyl acetate EVA market?A: Constraints include the unpredictable crude oil and ethylene price changes, environmental issues linked to plastic waste, and recycling difficulties.

-

Q: How is the market segmented by type?A: The market is segmented into very low-density, low-density, medium-density, and high-density EVA.

-

Q: Who are the key players in the United States ethylene vinyl acetate EVA market?A: Key companies include ExxonMobil Corporation, Dow Inc., Celanese Corporation, DuPont, Westlake Chemical Corporation, Huntsman Corporation, Innospec, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?