Australia Hydrogen Market Size, Share, By Technology (Steam Methane Reforming And Membrane Cell Technology), By Application (Petroleum Refinery, Ammonia Cracking, Chemical & Petrochemical, And Others), And Australia Hydrogen Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAustralia Hydrogen Market Size Insights Forecasts to 2035

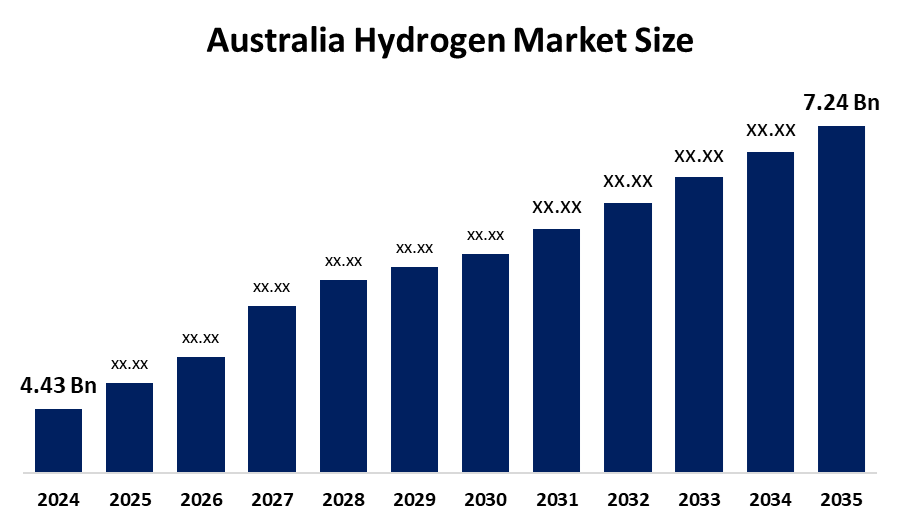

- Australia Hydrogen Market Size 2024: USD 4.43 Bn

- Australia Hydrogen Market Size 2035: USD 7.24 Bn

- Australia Hydrogen Market Size CAGR 2024: 4.57%

- Australia Hydrogen Market Size Segments: Technology and Application

Get more details on this report -

The Australia Hydrogen Market Size comprises all aspects of creating, storing and using hydrogen energy, its associated products, and services within Australia and as an exporter. Hydrogen represents a flexible way to transport energy as either a clean fuel to store energy generated from renewable sources, or as a raw material for producing chemicals like ammonia and methanol. Hydrogen can be derived from the electrolysis of water utilizing renewable electric energy, or through natural gas reforming and storing CO2 produced during the process.

The hydrogen in Australia are backed by government support, including the National Hydrogen Strategy published by the Department of Climate Change, Energy, the Environment and Water, designed to hasten the establishment of an innovative and competitive hydrogen sector in Australia, aimed to produce at least 0.5Mt of clean hydrogen annually by 2030 and then increase that annual production to 15Mt by 2050. This will support both domestic needs and export opportunities. These targets communicate the Government's commitment to increasing hydrogen production as part of Australia's national energy transition into a sustainable future and industrial development.

As technology advances, Australia’s hydrogen providers are now using electrolysers, developing hydrogen energy storage solutions and fuel cell systems. The increased focus on hydrogen for energy generation, storage and transportation has led to increased collaborative R&D efforts supported by government funding and partnerships from industry to develop new ways of producing hydrogen at lower costs make these hydrogen production systems commercially viable, therefore competitive with conventional means of producing power in Australia.

Australia Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 4.43 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.57% |

| 2035 Value Projection: | 7.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Fortescue Metals Group, Woodside Energy, Origin Energy, AGL Energy, Pure Hydrogen Corp, Hazer Group, Frontier Energy, Hysata, Hydrexia, Energys Australia, H2X Global, HydGene Renewables, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Australia Hydrogen Market Size:

The Australia Hydrogen Market Size is driven by the its vast renewable energy potential, strategic export opportunities to Asian markets, strong policy support that encourages private investment and infrastructure development, versatility of hydrogen with low-carbon fuel for transport and industry, technological advancement with strong government supports, and efficient chemical feedstock and energy storage medium.

The Australia Hydrogen Market Size is restrained by the high production costs, infrastructure limitations, technological challenges in storage and long-distance transportation market uncertainty driven by evolving policies, and competitive pressure from other renewable energy technologies.

The future of Australia Hydrogen Market Size is bright and promising, with versatile opportunities emerging from the rise of exporting products made from renewable resources to other countries, regional centres for hydrogen production, and connections with new clean industrial value chains will provide new opportunities for growth in Australia. By using its existing competitive advantages, Australia will be able to capitalise on the growing demand around the world for low-carbon energy carriers such as hydrogen and hydrogen-derived products, and will have the potential to play a major role in the global market for energy transition technologies.

Market Segmentation

The Australia Hydrogen Market Size share is classified into technology and application.

By Technology:

The Australia Hydrogen Market Size is divided by technology into steam methane reforming and membrane cell technology. Among these, the steam methane reforming segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Australia’s abundant natural gas supply, low-cost, well established infrastructure, and immediate economic feasibility of producing hydrogen all contribute to the steam methane reforming segment's largest share and higher spending on hydrogen when compared to other technology.

By Application:

The Australia Hydrogen Market Size is divided by application into petroleum refinery, ammonia cracking, chemical & petrochemical, and others. Among these, the chemical & petrochemical segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The chemical & petrochemical segment dominates because of existing industrial demand that uses hydrogen for ammonia, ready-made green transition of hydrogen, holds largest upcoming projects, and increasingly recognized as a key method for exporting green hydrogen.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia Hydrogen Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Hydrogen Market Size:

- Fortescue Metals Group

- Woodside Energy

- Origin Energy

- AGL Energy

- Pure Hydrogen Corp

- Hazer Group

- Frontier Energy

- Hysata

- Hydrexia

- Energys Australia

- H2X Global

- HydGene Renewables

- Others

Recent Developments in Australia Hydrogen Market Size:

In July 2025, ARENA announced $432 million in funding for Hunter Valley Hydrogen Hub project (Phase 1:50 MW), which was a key winner in the first round of the Hydrogen Headstart Program.

In September 2024, Australia and Germany finalized a deal to provide EUR 400 million to support Australian renewable hydrogen producers through the H2Global auction mechanism, bridging the price gap for exports to Europe.

In August 2024, Fortescue launched a $50 million Green Metal Project at the Christmas Creek Green Energy Hub in the Pilbara. It produces green hydrogen to power mining equipment and a fleet of ten coaches.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia Hydrogen Market Size based on the below-mentioned segments:

Australia Hydrogen Market Size, By Technology

- Steam Methane Reforming

- Membrane Cell Technology

Australia Hydrogen Market Size, By Application

- Petroleum Refinery

- Ammonia Cracking

- Chemical & Petrochemical

- Others

Frequently Asked Questions (FAQ)

-

What is the Australia Hydrogen Market Size?Australia Hydrogen Market Size is expected to grow from USD 4.43 billion in 2024 to USD 7.24 billion by 2035, growing at a CAGR of 4.57% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the Australia’s vast renewable energy potential, strategic export opportunities to Asian markets, strong policy support that encourages private investment and infrastructure development, versatility of hydrogen with low-carbon fuel for transport and industry, technological advancement with strong government supports, and efficient chemical feedstock and energy storage medium.

-

What factors restrain the Australia Hydrogen Market Size?Constraints include the high production costs, infrastructure limitations, technological challenges in storage and long-distance transportation market uncertainty driven by evolving policies, and competitive pressure from other renewable energy technologies.

-

How is the market segmented by technology?The market is segmented into steam methane reforming and membrane cell technology.

-

Who are the key players in the Australia Hydrogen Market Size?Key companies include Fortescue Metals Group, Woodside Energy, Origin Energy, AGL Energy, Pure Hydrogen Corp, Hazer Group, Frontier Energy, Hysata, Hydrexia, Energys Australia, H2X Global, HydGene Renewables, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?