North America Hydrogen Energy Storage Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Liquid, Solid, and Gas), By Technology (Compression, Liquefaction, Material Based), By Application (Stationary Power, Transportation), By End User (Industrial, Commercial), and North America Hydrogen Energy Storage Market Insights, Industry Trends, Forecast to 2035.

Industry: Energy & PowerNorth America Hydrogen Energy Storage Market Insights Forecasts to 2035

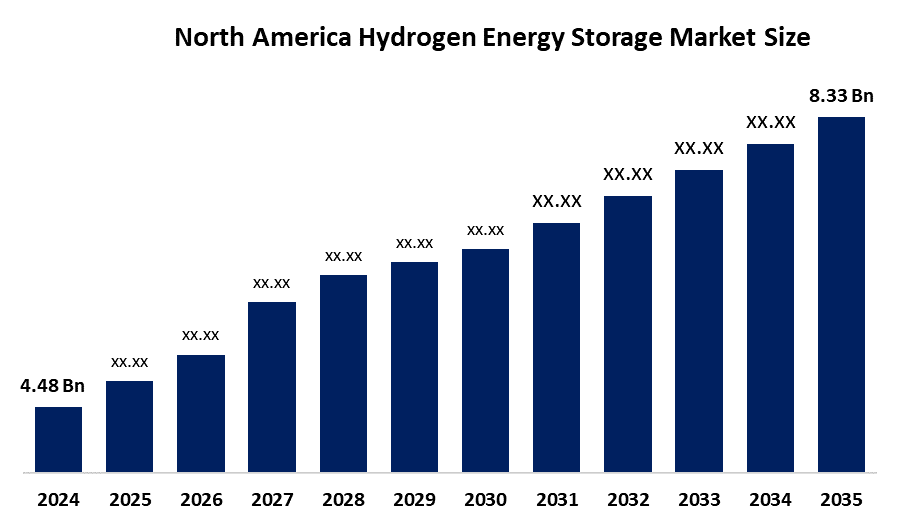

- The North America Hydrogen Energy Storage Market Size Was Estimated at USD 4.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.8% from 2025 to 2035

- The North America Hydrogen Energy Storage Market Size is Expected to Reach USD 8.33 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Hydrogen Energy Storage Market Size is anticipated to reach USD 8.33 Billion by 2035, Growing at a CAGR of 5.8% from 2025 to 2035. The market is driven by the transition toward renewable energy resources, including solar and wind, which are playing an important role in driving the market.

Market Overview

The market of hydrogen energy storage is currently experiencing strong growth due to the increasing demand for clean energy solutions. Technology is making constant improvements to hydrogen storage systems in a manner that will make them both very effective and low-cost. Companies and research institutions are collaborating to make better the methods of hydrogen production, including electrolysis, and also to optimize the methods of storage, such as metal hydrides and compressed gas systems.

The landmark for grid-scale hydrogen storage was the first green hydrogen production, storage, and combustion system in the U.S., which was officially activated in January 2026.

The US Department of Energy has set its research and development (R&D) priorities to meet the ambitious clean hydrogen cost targets laid down by the Biden administration. Renewable hydrogen production and storage, as well as technology for trucking applications, are some of the main focus areas of the DOE's Hydrogen and Fuel Cell Technologies Office, as stated in its Multiyear Program Plan. The US Department of Energy is planning to set up seven regional Clean Hydrogen Hubs that will be connected by production, storage, and use across the whole continent.

Report Coverage

This research report categorizes the market for the North America hydrogen energy storage market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America hydrogen energy storage market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America hydrogen energy storage market.

North America Hydrogen Energy Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.48 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.8% |

| 2035 Value Projection: | USD 8.33 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Air Products & Chemicals, Inc., Plug Power Inc, Cummins Inc., Linde Plc., Air Products, Engie, Chart Industries, Fuel Cell Energy, Bloom Energy, Steelhead Composites, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen energy storage market in North America is driven by the increase in solar and wind capacity, which has led to the requirement of hydrogen, which is considered a scalable solution as it can store excess energy during peak production and release it when the demand is high, thus making the grid stable. Industries like steel, cement, and chemical production are now relying on stored hydrogen more than ever to substitute fossil fuels in the high-temperature processes that are tough to electrify.

Restraining Factors

The hydrogen energy storage market in North America is hindered by hydrogen storage systems have a cost that is very much higher than traditional battery storage. Among the poor characteristics of hydrogen storage, one of them is that it is not as efficient as batteries for quick balancing. The absence of a strong pipeline and refueling network is the most important limiting factor.

Market Segmentation

The North America hydrogen energy storage market share is categorised into product type, technology, application and end user.

- The gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America hydrogen energy storage market is segmented by product type into liquid, solid, and gas. Among these, the gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the most common and established ways of storage, particularly where the use of fuel cell vehicles, industrial hydrogen supply, and energy storage are involved. The attractiveness of gas hydrogen storage for most sectors is mainly due to its cost-effectiveness and easy handling, as well as its low infrastructure requirements. The safety, efficiency, and durability of gas storage systems are continually improved by advancements in materials and tank designs.

- The compression segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the North America hydrogen energy storage market is segmented into compression, liquefaction, material based. Among these, the compression segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the widespread use in different areas, such as fuel cell vehicles and small-scale energy storage is the low cost of operation and existing technology. It takes time for new materials, such as composite materials, to be developed, but they are gradually improving the safety, efficiency, and cost-effectiveness of compressed hydrogen storage, along with the development of new materials.

- The transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America hydrogen energy storage market is segmented by application into stationary power, transportation. Among these, the transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the rapidly growing application segment, which has been primarily driven by the demand for zero-emission vehicles. Hydrogen fuel cell vehicles (FCVs), such as cars, buses, trucks, and trains, are becoming common because of their long-range and quick refueling capabilities that surpass those of battery-electric vehicles.

- The industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America hydrogen energy storage market is segmented into industrial, commercial. Among these, the industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by consumer of hydrogen energy storage in which hydrogen is engaged in various applications, including but not limited to manufacturing, chemical production, and refining. One of the major trends is the shift of the steel, cement, and chemical sectors towards hydrogen as they try to lessen carbon emissions through the use of cleaner energy. For instance, hydrogen is used in the processes of hydrogenation, refining, and as a reducing agent in metal manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America hydrogen energy storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Products & Chemicals, Inc.

- Plug Power Inc

- Cummins Inc.

- Linde Plc.

- Air Products

- Engie

- Chart Industries

- Fuel Cell Energy

- Bloom Energy

- Steelhead Composites

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Energy Vault Holdings, Inc., a global leader in grid-scale energy storage solutions, announced its acquisition and planned development of SOSA Energy Center, a 150 MW/300 MWh battery energy storage system (BESS) located in Madison County, Texas.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America hydrogen energy storage market based on the below-mentioned segments:

North America Hydrogen Energy Storage Market, By Component

- Hardware

- Software

- Services

North America Hydrogen Energy Storage Market, By Technology

- RFID

- M2M/IoT

- GPS

- Barcode

- Others

North America Hydrogen Energy Storage Market, By Deployment

- Cloud

- On-Premises

North America Hydrogen Energy Storage Market, By Enterprise Size

- Large Enterprise

- SMEs

Frequently Asked Questions (FAQ)

-

Q:What is the North America hydrogen energy storage market size?A:The North America hydrogen energy storage market size is expected to grow from USD 4.48 billion in 2024 to USD 8.33 billion by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.

-

A:The North America hydrogen energy storage market size is expected to grow from USD 4.48 billion in 2024 to USD 8.33 billion by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.A:The market of hydrogen energy storage is currently experiencing strong growth, mostly due to the increasing demand for clean energy solutions. Technology is making constant improvements to hydrogen storage systems in a manner that will make them both very effective and low-cost.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the increase in solar and wind capacity, which has led to the requirement of hydrogen, which is considered a scalable solution as it can store excess energy during peak production and release it when the demand is high, making the grid stable.

-

Q:What factors restrain the North America hydrogen energy storage market?A:The market is restrained by hydrogen storage systems have a cost that is very much higher than the traditional battery storage.

-

Q:How is the market segmented by product type?A:The market is segmented into liquid, solid and gas.

-

Q:Who are the key players in the North America hydrogen energy storage market?A:Key companies include Air Products & Chemicals, Inc., Plug Power Inc, Cummins Inc., Linde Plc., Air Products, Engie, Chart Industries, Fuel Cell Energy, Bloom Energy, and Steelhead Composites.

-

Q:What is the North America hydrogen energy storage market size?A:The North America hydrogen energy storage market size is expected to grow from USD 4.48 billion in 2024 to USD 8.33 billion by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.

-

A:The North America hydrogen energy storage market size is expected to grow from USD 4.48 billion in 2024 to USD 8.33 billion by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.A:The market of hydrogen energy storage is currently experiencing strong growth, mostly due to the increasing demand for clean energy solutions. Technology is making constant improvements to hydrogen storage systems in a manner that will make them both very effective and low-cost.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the increase in solar and wind capacity, which has led to the requirement of hydrogen, which is considered a scalable solution as it can store excess energy during peak production and release it when the demand is high, making the grid stable.

-

Q:What factors restrain the North America hydrogen energy storage market?A:The market is restrained by hydrogen storage systems have a cost that is very much higher than the traditional battery storage.

-

Q:How is the market segmented by product type?A:The market is segmented into liquid, solid and gas.

-

Q:Who are the key players in the North America hydrogen energy storage market?A:Key companies include Air Products & Chemicals, Inc., Plug Power Inc, Cummins Inc., Linde Plc., Air Products, Engie, Chart Industries, Fuel Cell Energy, Bloom Energy, and Steelhead Composites.

Need help to buy this report?