Asia Pacific Recycled Polypropylene Market Size, Share, and COVID-19 Impact Analysis, By Source (Bottles, Films, Bags, Foams, and Others), By Process (Mechanical and Chemical), By End User (Packaging, Building & Construction, Automotive, Textiles, Electrical & Electronics, and Others), and Asia Pacific Recycled Polypropylene Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Recycled Polypropylene Market Size Insights Forecasts to 2035

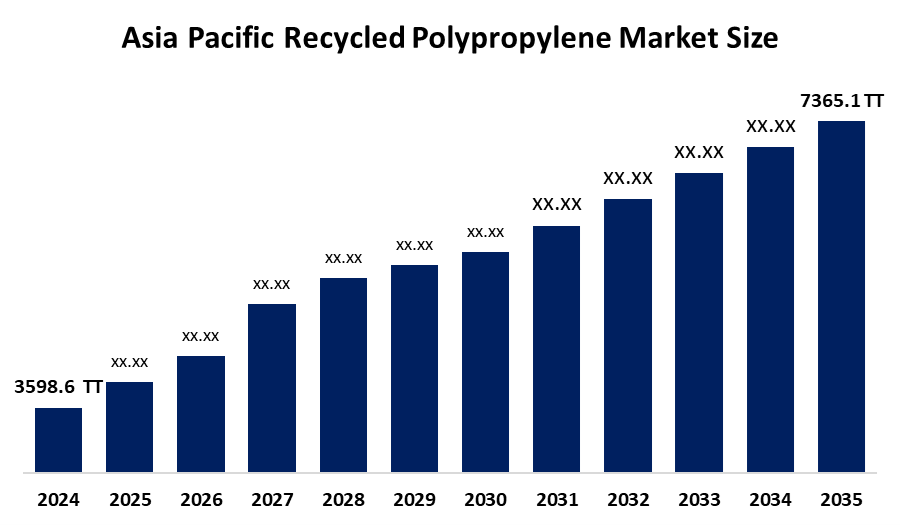

- The Asia Pacific Recycled Polypropylene Market Size Was Estimated at 3598.6 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.73% from 2025 to 2035

- The Asia Pacific Recycled Polypropylene Market Size is Expected to Reach 7365.1 Thousand Tonnes by 2035

Get more details on this report -

According to A Research Report Published by Spherical Insights & Consulting, The Asia Pacific Recycled Polypropylene Market Size is Anticipated to reach 7365.1 Thousand Tonnes by 2035, Growing at a CAGR of 6.73% from 2025 to 2035. The market is driven by rising middle-class populations and urban lifestyles have intensified demand for affordable, lightweight, and durable materials, particularly in packaging for e-commerce and food products, as well as in automotive interiors, where polypropylene helps reduce vehicle weight and improve fuel efficiency.

Market Overview

Recycled polypropylene is a post-consumer or post-industrial plastic material is reclaimed, processed, and reprocessed to produce new polypropylene products. The material is sourced from different origins include packaging materials, automotive components, consumer goods and industrial applications after their useful life has ended. The chemical recycling process has developed in APAC to produce rPP at higher purity levels, which enables its use in food-grade and medical applications as a substitute for virgin plastic.

The new laboratory line at Suzhou Technical Center combined with our higher research and development funding for the APAC region, enables us to keep our market-leading technical position.

The government programs that target plastic waste reduction and recycling promotion, with the increasing demand from consumers who prefer sustainable products, drive market expansion. The region's biggest market exists in China, which directs major funding towards recycling facilities and technological advancements. Vietnam will implement a ban on small non-biodegradable bags, which will extend to production activities and import practices in 2026. Vietnam is currently building a carbon credit trading system, which will start its pilot testing phase in 2027 and reach operational status between 2028 and 2029.

Report Coverage

This research report categorises the Asia Pacific Recycled Polypropylene Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Recycled Polypropylene Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific Recycled Polypropylene Market Size.

Asia Pacific Recycled Polypropylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 3598.6 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.73% |

| 2035 Value Projection: | 7365.1 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source, By Process |

| Companies covered:: | Veolia & SUEZ, LyondellBasell Industries Holdings B.V., Realince Industries Ltd, Sumitomo Chemicals Co., Ltd, Haldia Petrochemicals Ltd, Mitsubishi Chemical Co., & LG Chem, Polindo Utama, Local Indian Players, Indorama Ventures, The Shakti Plastic Industries, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Recycled Polypropylene Market Size in Asia Pacific is driven by the packaging and automotive industries, which face rising plastic demand because their main stakeholders increasingly consume recycled polypropylene. China and India show increased electric vehicle (EV) adoption, which drives rPP usage for interior trims, battery casings, and bumpers to achieve lower vehicle weight and better fuel efficiency. Recycled polypropylene usually costs less than virgin polypropylene because of its lower price during times of high crude oil price fluctuations.

Restraining Factors

The Recycled Polypropylene Market Size in the Asia Pacific is restrained by the enormous competition that virgin plastics present. Repeated recycling decreases mechanical strength, colour consistency, and heat resistance, which results in rPP becoming less suitable for premium applications.

Market Segmentation

The Asia Pacific Recycled Polypropylene Market Size share is categorised into source, process and end user.

- The bottles segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Recycled Polypropylene Market Size is segmented by source into bottles, films, bags, foams, and others. Among these, the bottles segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the beverage, personal care, and pharmaceutical sectors generate their highest waste quantities through their most frequently used products. Bottles have high collection rates because they are easily identifiable and better sorted than thin films or foams.

- The mechanical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on process, the Asia Pacific Recycled Polypropylene Market Size is segmented into mechanical and chemical. Among these, the mechanical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the complete adoption of recycled polypropylene material occurs across multiple mechanical applications that include automobile parts and appliances and furniture products. The mechanical sector will experience growth because industries now seek materials that combine lightweight characteristics with high durability.

- The packaging segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Recycled Polypropylene Market Size is segmented by end user into packaging, building & construction, automotive, textiles, electrical & electronics, and others. Among these, the packaging segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the increased demand for packaged food and beverages together with electrical and electronic goods and textiles created high share. The main products that drive recycled plastics demand include personal hygiene products such as electronic trimmers and shavers and automotive parts and clothes made from recycled plastics.]

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Recycled Polypropylene Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Veolia & SUEZ

- LyondellBasell Industries Holdings B.V.

- Realince Industries Ltd

- Sumitomo Chemicals Co., Ltd

- Haldia Petrochemicals Ltd

- Mitsubishi Chemical Co., & LG Chem

- Polindo Utama

- Local Indian Players

- Indorama Ventures

- The Shakti Plastic Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Recycled Polypropylene Market Size based on the below-mentioned segments:

Asia Pacific Recycled Polypropylene Market Size, By Source

- Bottles

- Films

- Bags

- Foams

- Others

Asia Pacific Recycled Polypropylene Market Size, By Process

- Mechanical

- Chemical

Asia Pacific Recycled Polypropylene Market Size, By End User

- Packaging

- Building & Construction

- Automotive

- Textiles

- Electrical & Electronics

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific Recycled Polypropylene Market Size?Asia Pacific Recycled Polypropylene Market Size is expected to grow from 3598.6 thousand tonnes in 2024 to 7365.1 thousand tonnes by 2035, growing at a CAGR of 6.73% during the forecast period 2025-2035

-

What is recycled polypropylene, and its primary use?Recycled polypropylene is a post-consumer or post-industrial plastic material that is reclaimed, processed, and reprocessed to produce new polypropylene products. The material is sourced from different origins include packaging materials, automotive components, consumer goods and industrial applications after their useful life has ended.

-

What are the key growth drivers of the market?Market growth is driven by the packaging and automotive industries, which face rising plastic demand because their main stakeholders increasingly consume recycled polypropylene.

-

What factors restrain the Asia Pacific Recycled Polypropylene Market Size?The market is restrained by repeated recycling decreasing mechanical strength, colour consistency, and heat resistance, which results in rPP becoming less suitable for premium applications.

-

Who are the key players in the Asia Pacific Recycled Polypropylene Market Size?Key companies include Veolia & SUEZ, LyondellBasell Industries Holdings B.V., Realince Industries Ltd, Sumitomo Chemicals Co., Ltd, Haldia Petrochemicals Ltd, Mitsubishi Chemical Co., & LG Chem, Polindo Utama, Local Indian Players, Indorama Ventures, and The Shakti Plastic Industries.

Need help to buy this report?