Global Protein-fortified Food Products Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic and Conventional), By Product (Bakery & Snacks Products, Protein Bars, RTD & RTM Beverages, Dairy & Dairy Alternatives, and Others), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, Online, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Protein-fortified Food Products Market Size Insights Forecasts to 2035

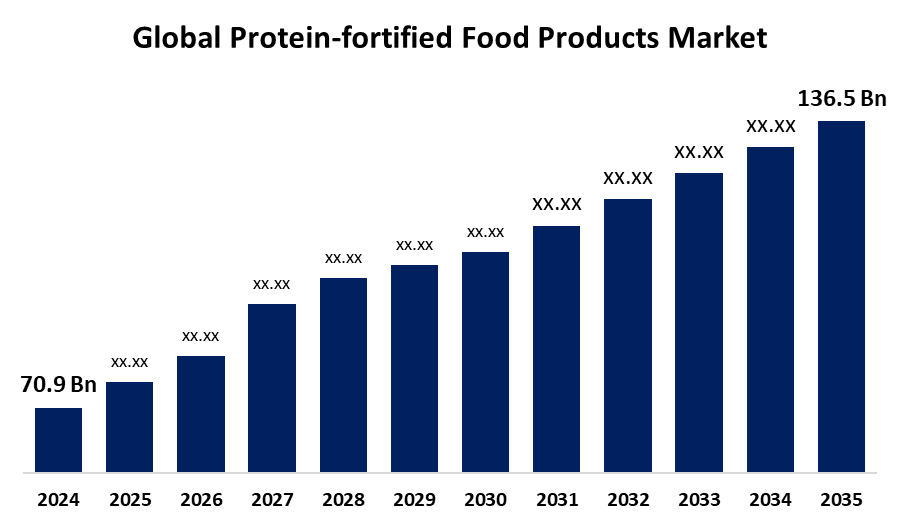

- The Global Protein-fortified Food Products Market Size Was Estimated at USD 70.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.14% from 2025 to 2035

- The Worldwide Protein-fortified Food Products Market Size is Expected to Reach USD 136.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Protein-Fortified Food Products Market Size was worth around USD 70.9 Billion in 2024 and is predicted to grow to around USD 136.5 Billion by 2035 with a compound annual growth rate (CAGR) of 6.14% from 2025 to 2035. The growing need for nutritious and healthy food, with growing consumer health consciousness, is driving the protein-fortified food products market globally.

Market Overview

The protein-fortified food products market refers to the food industry that emphasizes the addition of extra protein in everyday food items, such as snacks, bread, and beverages. Fortified food products are foods with added nutrients, aid in boosting their nutritional value and benefit health. Manufacturers are increasing focusing on the formulation of protein in classic products such as protein shakes and bars, with the protein technology innovations, is driving the protein fortification of food products. This is fueling the growth of protein-fortified snacks, beverages, and ready-to-eat meals. Furthermore, the trend towards health, wellness, and nutrition, among Gen-Z and millennials, is driving the need for healthier and more nutritious foods. Biofortification programs addressing widespread nutrient deficiencies, for improving public health, are bolstering the market opportunity for protein-fortified food products.

Report Coverage

This research report categorizes the protein-fortified food products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the protein-fortified food products market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the protein-fortified food products market.

Global Protein-fortified Food Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 70.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.14% |

| 2035 Value Projection: | USD 136.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 298 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Nature, By Product, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | General Mills, 1440 Foods, Bellring Brands, Inc., Caveman Foods LLC, Kellogg Company, Nestlé, Mondelez International, Glanbia, GNC Holdings, Mars Inc., Naturell India Pvt. Ltd, FULFIL, Bright Life Care Private Ltd., SFD S.A., MYPROTEIN - The Hut.com Ltd., Asahi Group Holdings, Ltd., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing popularity of food fortification, with an increasing demand for nutritious and healthy food as well as consumer health consciousness, is driving the protein fortified food products market. The inclination towards sports supplements among athletes for building mass or reducing body fat is also enhancing the market growth. Owing to the increasing nutrient deficiencies, there is the implementation of laws that drive the need for food suppliers to fortify certain grains, like flour, rice, and maize, which is propelling the market.

Restraining Factors

The increased cost of fortification and nutrient stability is restricting the protein-fortified food products market. Further, the failure to adhere to government-issued health guidelines is hindering the market growth.

Market Segmentation

The protein-fortified food products market share is classified into nature, product, and distribution channel.

- The conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the nature, the protein-fortified food products market is divided into organic and conventional. Among these, the conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The accessibility of conventional products in urban and rural areas, along with new product launches and innovation by key players, is driving the protein-fortified food products market.

- The protein bars segment accounted for a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the protein-fortified food products market is divided into bakery & snacks products, protein bars, RTD & RTM beverages, dairy & dairy alternatives, and others. Among these, the protein bars segment accounted for a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Protein bars are popularly used among athletes and fitness enthusiasts, having the capability to provide a quick protein boost, which is essential for muscle recovery, weight management, and overall health.

- The hypermarkets & supermarkets segment accounted for a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the protein-fortified food products market is divided into hypermarkets & supermarkets, convenience stores, specialty stores, online, and others. Among these, the hypermarkets & supermarkets segment accounted for a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Availability of various products in supermarkets and hypermarkets is responsible for market expansion, as customers may purchase the product as their preferences, dietary requirements, and budget.

Regional Segment Analysis of the Protein-fortified Food Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the protein-fortified food products market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the protein-fortified food products market over the predicted timeframe. With the growing emphasis on living healthier lifestyles, consumers' growing health consciousness is contributing to driving the protein-fortified food products market. The growing significance of nutrients in the daily diet is propelling the market growth. Further, an increasing disposable income is also enhancing the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the protein-fortified food products market during the forecast period. An increasing probiotic food and drinks market, which includes probiotics associated with yogurt and sour milk products, is propelling the market. Further, consumer' growing prioritization of protein nutrition as part of their fitness routine is escalating the protein-fortified food products market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the protein-fortified food products market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Mills

- 1440 Foods

- Bellring Brands, Inc.

- Caveman Foods LLC

- Kellogg Company

- Nestlé

- Mondelez International

- Glanbia

- GNC Holdings

- Mars Inc.

- Naturell India Pvt. Ltd

- FULFIL

- Bright Life Care Private Ltd.

- SFD S.A.

- MYPROTEIN - The Hut.com Ltd.

- Asahi Group Holdings, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, the UK’s leading online sports nutrition brand, Myprotein, launched a collaboration with Jimmy’s, the iced coffee brand.

- In January 2024, WK Kellogg Co. introduced its latest cereal brand, Eat Your Mouth Off, drawing from its century-old startup values. Eat Your Mouth Off is an innovative, vegan cereal containing an impressive 22 grams of plant-based protein, 0 grams of sugar, and 2 grams of net carbs or less per serving.

- In October 2023, Myoprotein, the world’s leading online sports nutrition brand, announced its first collaboration with global iconic confectionery brand Chupa Chups, paving the way for several Chupa Chups flavoured products to join the Myprotein range.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the protein-fortified food products market based on the below-mentioned segments:

Global Protein-fortified Food Products Market, By Nature

- Organic

- Conventional

Global Protein-fortified Food Products Market, By Product

- Bakery & Snacks Products

- Protein Bars

- RTD & RTM Beverages

- Dairy & Dairy Alternatives

- Others

Global Protein-fortified Food Products Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Global Protein-fortified Food Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the protein-fortified food products market over the forecast period?The global protein-fortified food products market is projected to expand at a CAGR of 6.14% during the forecast period.

-

2.What is the market size of the protein-fortified food products market?The global protein-fortified food products market size is expected to grow from USD 70.9 Billion in 2024 to USD 136.5 Billion by 2035, at a CAGR of 6.14% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the protein-fortified food products market?North America is anticipated to hold the largest share of the protein-fortified food products market over the predicted timeframe.

Need help to buy this report?