Asia Pacific Polyvinyl Chloride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, Chlorinated PVC), By Application (Pipes and Fittings, Films and Sheets, Wires and Cables, Bottles, Profiles, Hoses, and Tubings, and Others), and Asia Pacific Polyvinyl Chloride Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Polyvinyl Chloride Market Size Insights Forecasts to 2035

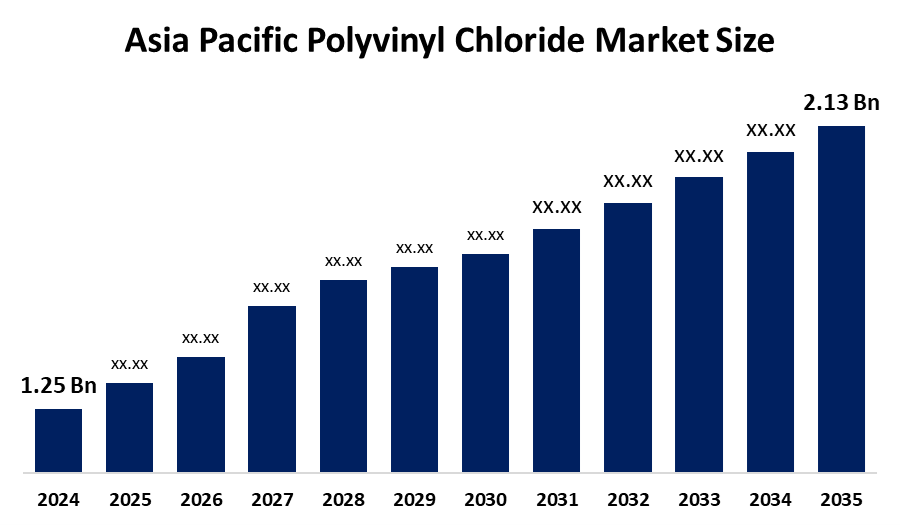

- The Asia Pacific Polyvinyl Chloride Market Size Was Estimated at USD 1.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.96% from 2025 to 2035

- The Asia Pacific Polyvinyl Chloride Market Size is Expected to Reach USD 2.13 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Polyvinyl Chloride Market Size is anticipated to reach USD 2.13 Billion by 2035, growing at a CAGR of 4.96% from 2025 to 2035. The market is driven by the demand for PVC is growing in view of its versatile nature, cost-effectiveness, and favorable characteristics like long-term durability and corrosion resistance.

Market Overview

The Polyvinyl Chloride (PVC) Market Size serves as an essential component that supports industrial growth and urbanization efforts in different regions. This thermoplastic material originates from vinyl chloride monomer production, serves vital functions in construction, electronics and packaging industries due to its strength, chemical resistance and affordable price. The use of rigid PVC window profiles for energy efficiency is a key value proposition. The automotive sector requires flexible PVC materials to produce interior components that mattress manufacturers need. The market will expand because PVC recycling processes will increase in production. The rising need for PVC pipes and fittings comes from developing nations, including India, China and Indonesia, among others.

A manufacturer focusing on supply chain consolidation might vertically integrate into VCM production to mitigate price shocks, which reduces raw material cost fluctuations by more than 15% while providing stable raw materials needed to manufacture specialized rigid PVC products and flexible PVC products, which improves operational resilience and market competitiveness of the company.

India's Ministry of Chemicals and Fertilizers has directed the Bureau of Indian Standards (BIS) to establish quality control measures for PVC imports, which will safeguard product safety and prevent the entry of substandard products that contain excessive Residual Vinyl Chloride Monomer (RVCM) from China into the domestic market.

Report Coverage

This research report categorizes the market for the Asia Pacific Polyvinyl Chloride Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Polyvinyl Chloride Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia pacific Polyvinyl Chloride Market Size.

Asia Pacific Polyvinyl Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.96% |

| 2035 Value Projection: | USD 2.13 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Shin-Etsu Chemical, LG Chem, Formosa Plastics Corporation, Xinjiang Zhongtai Chemical Co. Ltd., Reliance Industries Limited, Chemplast Sanmar Limited, Tianjin Dagu Chemical Co., Ltd., Finolex Industries Ltd., Hanwha Solutions Corporation, SCG Chemicals Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Polyvinyl Chloride Market Size in Asia Pacific is driven by the building and construction sector, which represents the highest PVC usage in the region due to its utilisation of pipes and fittings, together with window profiles and flooring materials for its new housing and urban development projects. The development of advanced compounding technologies enables the creation of high-performance PVC materials that demonstrate improved durability, flame-retardant properties, and chemical stability for use in various industrial applications.

Restraining Factors

The Polyvinyl Chloride Market Size in Asia Pacific is restrained by the hazardous substances that can escape during the complete manufacturing process of PVC create concerns about its production, distribution and final disposal methods. The Asia Pacific governments currently enforce more rigorous environmental regulations that control both PVC manufacturing processes and PVC waste disposal methods.

Market Segmentation

The Asia Pacific Polyvinyl Chloride Market Size share is categorised into product type and application.

- The rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Polyvinyl Chloride Market Size is segmented by product type into rigid PVC, flexible PVC, low-smoke PVC, chlorinated PVC. Among these, the rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the material serving as the primary construction material because it possesses strong mechanical properties, high impact protection and easy manufacturing capabilities which make it suitable for multiple construction needs.

- The pipes and fittings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific Polyvinyl Chloride Market Size is segmented into pipes and fittings, films and sheets, wires and cables, bottles, profiles, hoses, and tubings, and others. Among these, the pipes and fittings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by an increased demand for water distribution systems, irrigation systems and drainage systems. The combination of durability, lightweight properties and corrosion resistance makes PVC the preferred material for plumbing and construction work.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Polyvinyl Chloride Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shin-Etsu Chemical

- LG Chem

- Formosa Plastics Corporation

- Xinjiang Zhongtai Chemical Co. Ltd.

- Reliance Industries Limited

- Chemplast Sanmar Limited

- Tianjin Dagu Chemical Co., Ltd.

- Finolex Industries Ltd.

- Hanwha Solutions Corporation

- SCG Chemicals Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Polyvinyl Chloride Market Size based on the below-mentioned segments:

Asia Pacific Polyvinyl Chloride Market Size, By Product Type

- Rigid PVC

- Flexible PVC

- Low-Smoke PVC

- Chlorinated PVC

Asia Pacific Polyvinyl Chloride Market Size, By Application

- Pipes and Fittings

- Films and Sheets

- Wires and Cables

- Bottles

- Profiles

- Hoses

- Tubings

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific Polyvinyl Chloride Market Size?The Asia Pacific Polyvinyl Chloride Market Size is expected to grow from USD 1.25 billion in 2024 to USD 2.13 billion by 2035, growing at a CAGR of 4.96% during the forecast period 2025-2035.

-

What is polyvinyl chloride, and its primary use?The Polyvinyl Chloride (PVC) Market serves as an essential component that supports industrial growth and urbanization efforts in different regions. This thermoplastic material originates from vinyl chloride monomer production.

-

What are the key growth drivers of the market?Market growth is driven by the building and construction sector, which represents the highest PVC usage in the region due to its utilisation of pipes and fittings, together with window profiles and flooring materials for its new housing and urban development projects.

-

What factors restrain the Asia Pacific Polyvinyl Chloride Market Size?The market is restrained by the hazardous substances that can escape during the complete manufacturing process of PVC create concerns about its production, distribution and final disposal methods.

-

How is the market segmented by product type?The market is segmented into the rigid PVC, flexible PVC, low-smoke PVC, and chlorinated PVC

-

Who are the key players in the Asia Pacific Polyvinyl Chloride Market Size?Key companies include Shin-Etsu Chemical, LG Chem, Formosa Plastics Corporation, Xinjiang Zhongtai Chemical Co., Ltd., Reliance Industries Limited, Chemplast Sanmar Limited, Tianjin Dagu Chemical Co., Ltd., Finolex Industries Ltd., Hanwha Solutions Corporation, and SCG Chemicals Co., Ltd.

Need help to buy this report?