Global Polyvinyl Chloride (PVC) Packaging Film Market Size, Share, and COVID-19 Impact Analysis, By Type (Pouches, Bags and Sacks, Tubes, Liners, Sachets and Stick Packs, Tapes and Labels, and Wraps/Rolls), By Packaging Level (Primary Packaging, Secondary Packaging, and Tertiary Packaging), By End Use (Food, Beverages, Homecare, Personal Care, Healthcare, Electrical and Electronics, and Other Consumer Goods), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Polyvinyl Chloride (PVC) Packaging Film Market Insights Forecasts to 2035

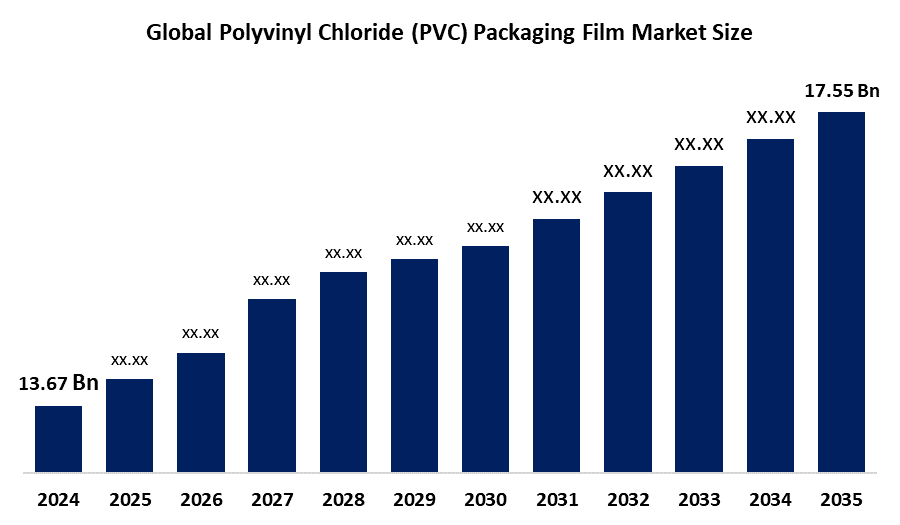

- The Global Polyvinyl Chloride (PVC) Packaging Film Market Size Was Estimated at USD 13.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.3% from 2025 to 2035

- The Worldwide Polyvinyl Chloride (PVC) Packaging Film Market Size is Expected to Reach USD 17.55 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global polyvinyl chloride (PVC) packaging film market size was worth around USD 13.67 billion in 2024 and is predicted to grow to around USD 17.55 billion by 2035 with a compound annual growth rate (CAGR) of 2.3% from 2025 to 2035. The polyvinyl chloride (PVC) packaging film industry is expanding due to increasing requirements for affordable and visually transparent packaging in food, pharmaceuticals and consumer products. The growth of e-commerce sectors, combined with advancements in film quality and manufacturing technology, also boosts market acceptance.

Market Overview

The Global Industry for Polyvinyl Chloride (PVC) Packaging Film consists of films made from the synthetic plastic polymer PVC, known for its clarity, durability, flexibility and resistance to chemicals and moisture. These films are extensively utilized in packaging applications, such as pharmaceutical blister packaging, shrink wraps, cling films for preserving food freshness (meat, fruits and vegetables, baked goods) and protective layers, for both consumer goods. The primary elements propelling the market include the increasing demand for sanitary and easy-to-use packaged foods, the rapid expansion of e-commerce requiring shipping protection, and the growth of the healthcare industry with its necessity for sterile medical packaging. The EU’s revised Packaging and Packaging Waste Regulation (PPWR), published on January 22 2025 and coming into force on February 11, replaces rules and imposes tougher lifecycle criteria for all packaging types, including PVC films. This regulation seeks to improve recyclability, cut down waste and promote circular economy objectives. Development opportunities lie in innovations such as producing films with gauges (light weighting) and new environmentally friendly, recyclable PVC formulations, as well as bio-based plasticizers that address problems and regulatory obstacles. Top firms in the sector, including Amcor, Berry Global, Sealed Air, Mondi and Jindal Poly Films, focus on partnerships and continuous innovation to enhance product quality and boost their market standing.

Report Coverage

This research report categorizes the polyvinyl chloride (PVC) packaging film market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the polyvinyl chloride (PVC) packaging film market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the polyvinyl chloride (PVC) packaging film market.

Driving Factors

The global demand for polyvinyl chloride (PVC) packaging film is driven by increasing requirements for cost- versatile packaging options within the food, pharmaceutical and consumer product industries. PVC films offer clarity, barrier performance and chemical resistance, making them suitable for protecting products. Growth in retail, e-commerce and the transportation of consumer goods further amplifies the need for packaging solutions. Moreover, innovations in film manufacturing enhanced recyclability, and the broader use of flexible packaging contributes to the market’s growth. Developing economies experiencing growing industrialization and urban growth continue to increase the demand for PVC films, enhancing market prospects.

Restraining Factors

The polyvinyl chloride (PVC) packaging film industry encounters limitations due to worries about stringent rules regarding chlorine-containing plastics and mounting demands to move towards sustainable options. Difficulties involve waste management problems, restricted recyclability and rivalry from materials such as PET and compostable films. Fluctuating costs of materials also obstruct market expansion.

Market Segmentation

The polyvinyl chloride (PVC) packaging film market share is classified into type, packaging level, and end use.

- The pouches segment dominated the market in 2024, approximately 24% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the polyvinyl chloride (PVC) packaging film market is divided into pouches, bags and sacks, tubes, liners, sachets and stick packs, tapes and labels, and wraps/rolls. Among these, the pouches segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market expansion is propelled by PVC pouch packaging due to its adaptability, light weight and ease of use, which boost consumer attraction and functionality. Providing superb barrier qualities, suitability for automated filling processes, customizable designs along with accommodation for serve and ready-to-eat items, PVC pouches enhance product shelf life, safety and operational productivity. Innovations in films and coatings additionally reinforce their leading market position.

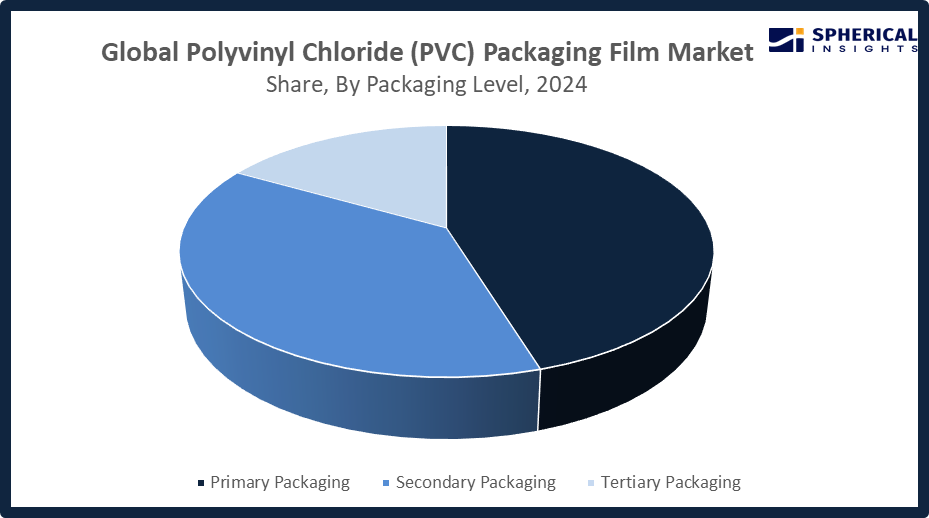

- The primary packaging segment accounted for the largest share in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the packaging level, the polyvinyl chloride (PVC) packaging film market is divided into primary packaging, secondary packaging, and tertiary packaging. Among these, the primary packaging segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Primary PVC packaging prevails owing to its safeguard’s products, maintaining freshness and providing barrier qualities, flexibility and clarity. Suitable for pouches, wraps and trays, it caters to needs, cost-effectiveness and automated production. The growing need for packaged foods, beverages and pharmaceuticals, along with quality requirements and shelf-life expectations, sustains its position in the market.

Get more details on this report -

- The food segment accounted for the highest market revenue in 2024, approximately 33% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the polyvinyl chloride (PVC) packaging film market is divided into food, beverages, homecare, personal care, healthcare, electrical and electronics, and other consumer goods. Among these, the food segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growth in the food segment is driven by rising demand for packaged and ready-to-eat products requiring protection from contaminants, moisture, and oxygen. PVC films provide barrier properties, clarity, and flexibility, enhancing safety, shelf life, and visibility. Expanding retail and e-commerce channels, regulatory compliance, and consumer preference for convenience and hygiene sustain its market leadership.

Regional Segment Analysis of the Polyvinyl Chloride (PVC) Packaging Film Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the polyvinyl chloride (PVC) packaging film market over the predicted timeframe.

North America is anticipated to hold the largest share of the polyvinyl chloride (PVC) packaging film market over the predicted timeframe. North America holds a 35% market share of the PVC packaging film market, driven by demand from the food and beverage, healthcare and consumer goods sectors. Expansion is supported by manufacturing technologies, automated packaging systems and strict food-contact regulations. The United States, being the contributor, gains from elevated packaged-food consumption, growing e-commerce and the need for sustainable high-quality packaging. In 2025, Maryland and Washington became part of states such as California and Colorado by adopting Extended Producer Responsibility (EPR), which mandates producers to disclose packaging information and finance recycling efforts, intensifying the push to decrease PVC use in packaging.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the polyvinyl chloride (PVC) packaging film market during the forecast period. The Asia Pacific region is anticipated to have 25% market share of the growth in the PVC packaging film market, fueled by increasing demand from the food and beverage, pharmaceutical and consumer goods industries, swift urban development, growing retail and e-commerce sectors and a rise in disposable income. China and India are at the forefront owing to their populations increasing consumption of packaged foods and efforts toward sustainable packaging. In September 2025, China’s rules on packaging speed up the phase-out of non-recyclable plastics, set restrictions on excessive packaging, broaden EPR pilot programs and require labelling and traceability, encouraging companies to use paper, moulded fibre, PFAS-free barriers and single-material designs.

Europe is expected to witness steady growth in the PVC packaging film market, driven by stringent recyclability regulations, demand for sustainable, high-performance packaging, and strong food and pharmaceutical sectors. Germany, France, and the UK lead, with manufacturers adopting recyclable PVC films, multilayer structures, and advanced barrier properties. In December 2024, the EU introduced new packaging rules setting strict recyclability targets, limiting unnecessary packaging, and restricting certain single-use plastics, promoting waste reduction and circular economy practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the polyvinyl chloride (PVC) packaging film market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor

- Shin-Etsu Chemical (Shintech)

- Berry Global

- LG Chem

- Sealed Air

- Jindal Poly Films

- Mondi

- Tekra, LLC

- 3M

- Solvay

- NanYa Plastics Corporation USA

- INEOS

- DuPont

- Achilles USA

- Plastic Film Corporation

- Avery Dennison Corporation

- Teknor Apex

- Klockner Pentaplast

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, LG Chem signed an MoU with Ansan City, South Korea, to recycle 15,000 tonnes of end-of-life PVC annually. Using chemical recycling, the PVC will convert into pyrolysis oil for its Dangjin facility, supporting LG Chem’s mission to become an eco-friendly, sustainable petrochemical business.

- In December 2023, UK-based Ineos Inovyn expanded its PVC portfolio with products featuring higher recycled content and lower carbon footprint. Its bio-attributed Biovyn, launched in 2019, is designed for carbon neutrality and is increasingly used across automotive, construction, medical, and fashion sectors, supporting sustainable, low-emission applications.

- In November 2023, Berry Global launched Omni Xtra+ polyethylene cling film, enhancing elasticity, stretch uniformity, and impact resistance for fresh food packaging. The high-performance alternative to PVC film also supports sustainability, aligning with upcoming EU Packaging Waste Regulations (PPWR) and Extended Producer Responsibility (EPR) requirements.

- In October 2023, Solvay launched Diofan Ultra736, a PVDC coating with ultra-high water vapor barrier for pharmaceutical blister films. The aqueous dispersion meets direct-contact regulatory standards, enables thinner, sustainable coatings, and reduces carbon footprint, advancing eco-friendly, high-performance packaging solutions for the pharmaceutical industry.

- In July 2023, PVC producer Orbia signed a preliminary joint venture with Solvay to build two southeastern U.S. plants producing battery-grade PVDF. The specialty polymer, used in pipes, sheets, and insulators, is increasingly sought for lithium-ion batteries, supporting the growing global shift toward electric vehicles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the polyvinyl chloride (PVC) packaging film market based on the below-mentioned segments:

Global Polyvinyl Chloride (PVC) Packaging Film Market, By Type

- Pouches

- Bags and Sacks

- Tubes

- Liners

- Sachets and Stick Packs

- Tapes and Labels

- Wraps/Rolls

Global Polyvinyl Chloride (PVC) Packaging Film Market, By Packaging Level

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Global Polyvinyl Chloride (PVC) Packaging Film Market, By End Use

- Food

- Beverages

- Homecare

- Personal Care

- Healthcare

- Electrical and Electronics

- Other Consumer Goods

Global Polyvinyl Chloride (PVC) Packaging Film Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the polyvinyl chloride (PVC) packaging film market over the forecast period?The global polyvinyl chloride (PVC) packaging film market is projected to expand at a CAGR of 2.3% during the forecast period.

-

2. What is the polyvinyl chloride (PVC) packaging film market?The PVC packaging film market involves producing and selling flexible polyvinyl chloride films used for food, pharmaceutical, and consumer goods packaging.

-

3. What is the market size of the polyvinyl chloride (PVC) packaging film market?The global polyvinyl chloride (PVC) packaging film market size is expected to grow from USD 13.67 billion in 2024 to USD 17.55 billion by 2035, at a CAGR of 2.3% during the forecast period 2025-2035.

-

4 Which region holds the largest share of the polyvinyl chloride (PVC) packaging film market?North America is anticipated to hold the largest share of the polyvinyl chloride (PVC) packaging film market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global polyvinyl chloride (PVC) packaging film market?Amcor, Shin-Etsu Chemical (Shintech), Berry Global, LG Chem, Sealed Air, Jindal Poly Films, Mondi, Tekra LLC, 3M, Solvay, and Others.

-

6. What factors are driving the growth of the polyvinyl chloride (PVC) packaging film market?The growth of the polyvinyl chloride (PVC) packaging film market is primarily driven by the increasing demand for packaged goods in major industries, the film's inherent versatility and cost-effectiveness, and expanding markets in developing economies.

-

7. What are the market trends in the polyvinyl chloride (PVC) packaging film market?Market trends in PVC packaging film include growth in demand for food preservation and convenience, driven by organized retail and rising disposable incomes, particularly in the Asia Pacific region.

-

8. What are the main challenges restricting wider adoption of the polyvinyl chloride (PVC) packaging film market?The main challenges restricting the wider adoption of polyvinyl chloride (PVC) packaging film are significant environmental and health concerns, complex recycling processes, stringent regulations, and competition from alternative materials

Need help to buy this report?