Asia Pacific Medical Device Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Contract Manufacturing Services, Quality Assurance Services, Regulatory Affairs Services, and Product Maintenance Services), By Application (Cardiology, Diagnostic Imaging, Orthopedic, IVD, Ophthalmic, General & Plastic Surgery, and Others), By Class Type (Class I, Class II, and Class III), and Asia Pacific Medical Device Outsourcing Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareAsia Pacific Medical Device Outsourcing Market Size Insights Forecasts to 2035

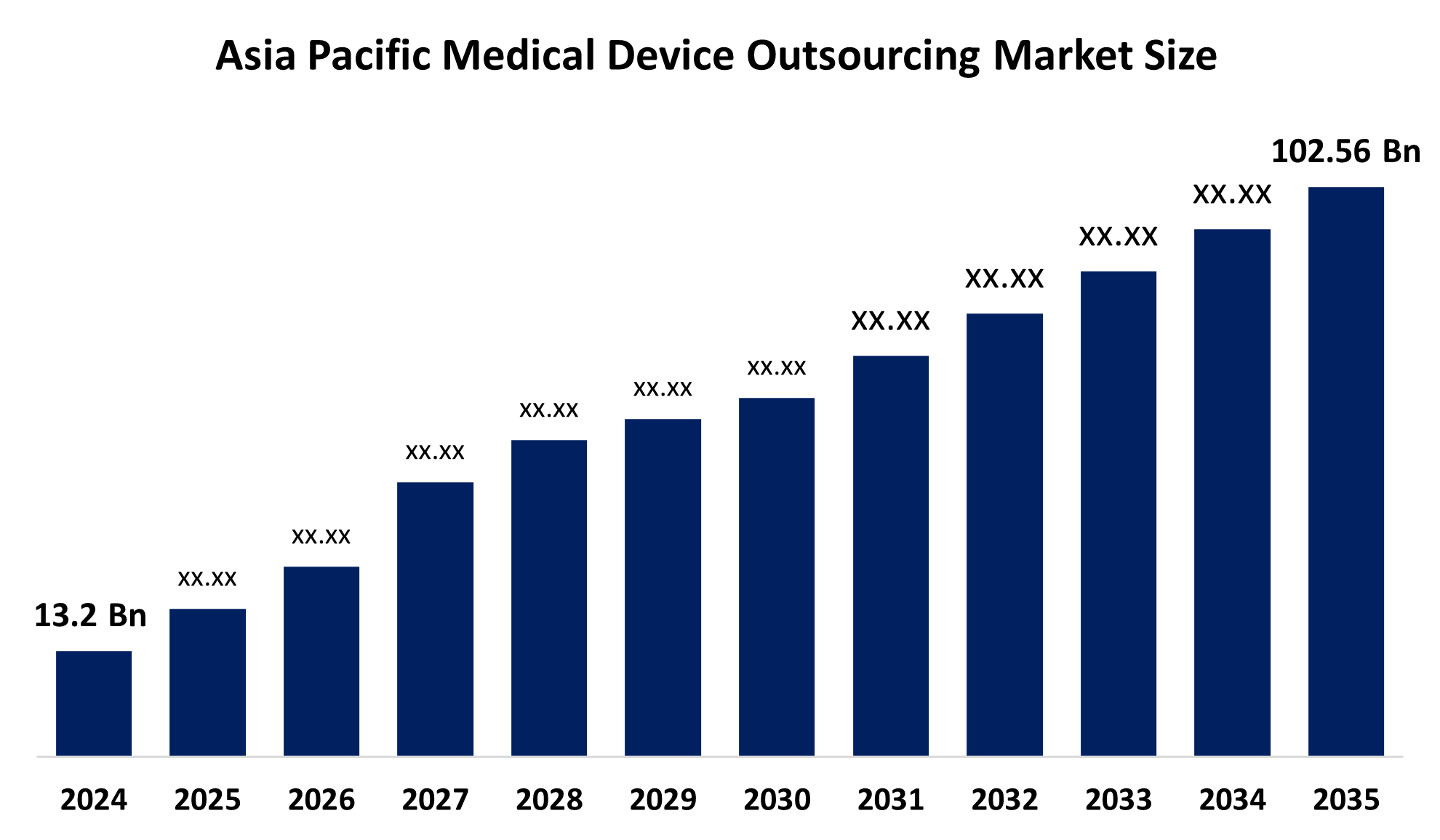

- The Asia Pacific Medical Device Outsourcing Market Size Was Estimated at USD 13.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 21.49% from 2025 to 2035

- The Asia Pacific Medical Device Outsourcing Market Size is Expected to Reach USD 102.56 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Medical Device Outsourcing Market Size is Anticipated to Reach USD 102.56 Billion by 2035, Growing at a CAGR of 21.49% from 2025 to 2035. The market is driven by the increasing need to minimize the cost of products and reduce organizational complexities increases acceptance of outsourcing. Growth in demand for low-cost-enabled devices.

Market Overview

Medical device outsourcing refers to the whole process of making, distributing, and using medical devices. Outsourcing within the medical device industry implies switching the production, assembly, testing, or even the regulatory part of the process to external companies, thus helping the firms to concentrate on their prime activities like developing, designing, and marketing. Medical outsourcing can be defined as a managerial process where medical technicians, nurses, doctors, or other clinical services are provided by external sources like nursing homes, hospitals, and medical practices that are operating in a managed service model.

Medical companies are looking for partners who can do fast prototyping, work with advanced materials, and be able to incorporate digital health technology such as artificial intelligence (AI) and the Internet of Medical Things (IoMT).

In October 2024, Terumo and NAMSA announced a partnership for outsourcing that was strategic in nature. According to the companies, NAMSA’s clinical research, testing, and counseling will be a very crucial factor for the rapid approval from regulatory bodies and the introduction of the whole range of products of Terumo to the market. This trend of partnering up for outsourcing has resulted in tech investments being made so that the firms' clients will have the most advanced solutions available to them.

Report Coverage

This research report categorizes the market for theAsia Pacific Medical Device Outsourcing Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific medical device outsourcing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific medical device outsourcing market.

Asia Pacific Medical Device Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.2 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.49% |

| 2035 Value Projection: | USD 102.56 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Service, By Application |

| Companies covered:: | Integer Holdings Corp, Integer Holdings Corp, Flex Ltd., TE Connectivity, Sanmina Co., Celestica Inc., Nortech Systems, Plexus Corp, Viant Medical, LSO Inc, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The medical device outsourcing market in Asia Pacific is driven by the growth of medical device outsourcing services, is the presence of a lot of medical device companies that are outsourcing their regulatory functions, like report writing and publishing, clinical trial application services, product design, and product maintenance, to regulatory service providers. The demand for innovations such as robotics, minimally invasive solutions, and smart medical technologies is growing. According to the US Food and Drug Administration (FDA)’s annual report of 2024, there has been a steady rise in the number of high-risk medical device approvals, especially for complex systems like the TriClip G4 System and Vercise DBS Systems, with more than 30 new devices entering the market in the first six months of the year.

Restraining Factors

The medical device outsourcing market in Asia Pacific is restrained by the factors of the high cost of R&D, supply chain risks, cost pressures, and margin constraints together challenge outsourcing firms to find a balance between low prices and quality and thereby drive the prices up. The FDA rules require strict adherence to the regulations that consist of Good Manufacturing Practices (GMP), thorough documentation, periodic audits, and extensive reporting. Loss of trust may have consequences, including severe financial losses, irreparable damage to the company's reputation, and litigation that stretches over a long time.

Market Segmentation

The Asia Pacific medical device outsourcing market share is categorised into service, application and class type.

- The contract manufacturing services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Medical Device Outsourcing Market Size is segmented by service into contract manufacturing services, quality assurance services, regulatory affairs services, and product maintenance services. Among these, the contract manufacturing services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by medical device market players who are aiming at cost reduction as profit margins are getting smaller. To cut down on fixed costs, firms are resorting to shift work. Besides, small and medium enterprises do not have the skilled workforce and technical resources needed to finish the project.

- The cardiology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific Medical Device Outsourcing Market Size is segmented into cardiology, diagnostic imaging, orthopedic, IVD, ophthalmic, general & plastic surgery, and others. Among these, the cardiology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the rise in the number of cardiovascular devices. Another factor contributing to this industry's growth is the rise in cases of illnesses such as angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, atrial fibrillation, and congenital heart disease.

- The class II segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Medical Device Outsourcing Market Size is segmented by class type into class I, class II, and class III. Among these, the class II segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the exorbitant prices of medical equipment, wherein nearly 43% of healthcare apparatuses can be classified as such. The medium risk category consists of such devices as tubes, needles, gloves for surgeries, sphygmomanometers, pregnancy test kits, vision aids, and blood transfusion sets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Medical Device Outsourcing Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Integer Holdings Corp

- Integer Holdings Corp

- Flex Ltd.

- TE Connectivity

- Sanmina Co.

- Celestica Inc.

- Nortech Systems

- Plexus Corp

- Viant Medical

- LSO Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Medical Device Outsourcing Market Size based on the below-mentioned segments:

Asia Pacific Medical Device Outsourcing Market, By Service

- Contract Manufacturing Services

- Quality Assurance Services

- Regulatory Affairs Services

- Product Maintenance Services

Asia Pacific Medical Device Outsourcing Market, By Application

- Cardiology

- Diagnostic Imaging

- Orthopedic

- IVD

- Ophthalmic

- General & Plastic Surgery

- Others

Asia Pacific Medical Device Outsourcing Market, By Class Type

- Class I

- Class II

- Class III

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific medical device outsourcing market size?A: The Asia Pacific Medical Device Outsourcing Market size is expected to grow from USD 13.2 billion in 2024 to USD 102.56 billion by 2035, growing at a CAGR of 21.49% during the forecast period 2025-2035.

-

Q: What is medical device outsourcing, and its primary use?A: Medical device outsourcing refers to the whole process of making, distributing, and using medical devices. Outsourcing within the medical device industry implies switching the production, assembly, testing, or even the regulatory part of the process to external companies, thus helping the firms to concentrate on their prime activities like developing, designing, and marketing.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growth of medical device outsourcing services is the presence of a lot of medical device companies that are outsourcing their regulatory functions, like report writing and publishing, clinical trial application services, product design, and product maintenance, to regulatory service providers. The demand for innovations such as robotics, minimally invasive solutions, and smart medical technologies is growing

-

Q: What factors restrain the Asia Pacific medical device outsourcing market?A: The market is restrained by the factors of the high cost of R&D, supply chain risks, cost pressures, and margin constraints together challenge outsourcing firms to find a balance between low prices and quality and thereby drive the prices up.

-

Q: How is the market segmented by service?A: The market is segmented into contract manufacturing services, quality assurance services, regulatory affairs services, and product maintenance services.

-

Q: Who are the key players in the Asia Pacific medical device outsourcing market?A: Key companies include Integer Holdings Corp, Integer Holdings Corp, Flex Ltd., TE Connectivity, Sanmina Co., Celestica Inc., Nortech Systems, Plexus Corp, Viant Medical, and LSO Inc.

Need help to buy this report?