United States Wine Production Machinery Market Size, Share, and COVID-19 Impact Analysis, By Wine Type (Red, White, Sparkling, and Fortified), By Equipment Type (Crushing & Pressing Equipment, Fermentation Equipment, Filtration Equipment, Bottling Equipment, Temperature Control Equipment, Storage Tanks, and Others), By Automation Level (Manual, Semi-automatic, and Automatic), and United States Wine Production Machinery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Machinery & EquipmentUnited States Wine Production Machinery Market Insights Forecasts to 2035

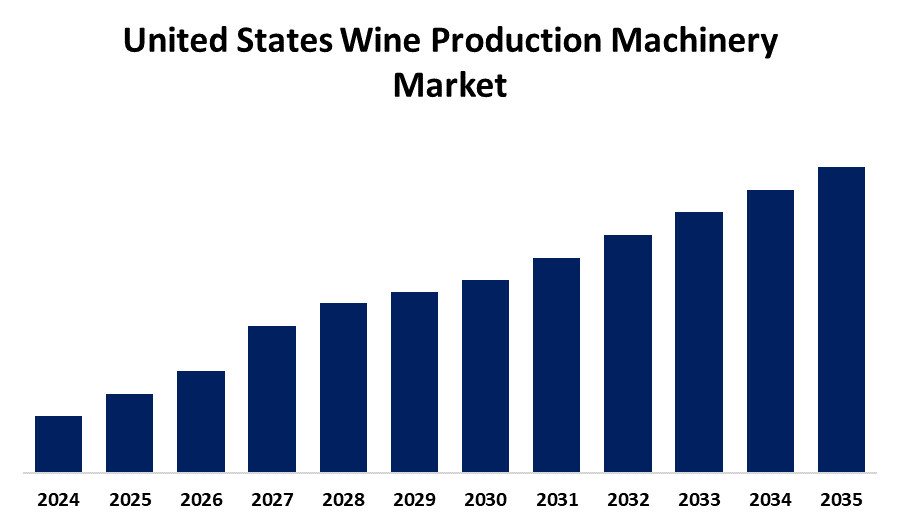

- The United States Wine Production Machinery Market Size is Expected to Grow at a CAGR of around 6.6% from 2025 to 2035.

- The U.S. Wine Production Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States wine production Machinery Market Size is Expected to hold a significant share By 2035, Growing at a CAGR of 6.6% from 2025 to 2035. The US wine manufacturing machinery market is fueled by factors such as urbanization, increasing disposable incomes, and changing consumer tastes. Wineries are also making investments in sophisticated machinery to enhance production efficiency, quality, and scalability.

Market Overview

The United States wine production machinery market encompasses all the machinery utilized in the process of winemaking, from grape harvesting to bottling, including crushers, fermenters, pumps, and bottling lines. The market is growing steadily, fueled by increasing global demand for wine, continuous technological innovation, and the growth of wine production in new and emerging markets. The position of the U.S. as a world-leading producer of wine, combined with growing demand from consumers for premium and high-quality wines, adds to the strength of the market. Further opportunities are emerging from sustainable wine production, wine tourism, and growing interest in artisanal and special wines. Complementing this momentum, government policies, including research and development funding, are taking center stage in supporting innovation, increasing production efficiency, and guaranteeing the long-term competitiveness of the industry.

Report Coverage

This research report categorizes the market for the United States wine production machinery market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States wine production machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States wine production machinery market.

United States Wine Production Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.6% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Wine Type, By Equipment Type, By Automation Level and COVID-19 Impact Analysis |

| Companies covered:: | Constellation Brands, E. & J. Gallo Winery, Criveller Group, The Wine Group, Pernod Ricard, Deutsch Family Wine & Spirits, Bronco Wine Company, Trinchero Family Estates, Agrovin, Della Toffola Pacific, Northern Brewer LLC, Grapeworks Pty Ltd, GW Kent Inc, Love Brewing Limited, Paul Mueller Company, Vitikit Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. wine production machinery market is driven by some major factors, such as increased demand from around the globe for wine, especially premium and high-quality types, which is triggering wineries to invest in highly advanced machinery. Technological breakthroughs are enhancing production efficiency as well as the quality of products, and the geographical expansion of vineyards to newer areas is spurring the requirement for newer-generation equipment. Finally, increased recognition of sustainable approaches to winemaking and handmade wines is transforming equipment requirements. Individually and collectively, they are propelling demand for efficient, innovative, and specialized equipment throughout the U.S. wine production sector.

Restraining Factors

The U.S. wine production machinery market is subject to various constraints that may affect its growth. Excessive initial investment in sophisticated machinery can be a major hindrance, particularly for small and medium-sized wineries. Climate change and environmental variations also cause fluctuations in grape production, creating challenges. Additionally, stringent rules and compliance levels may enhance operational sophistication and cost, which may cause a slowdown in new technology adoption.

Market Segmentation

The United States wine production machinery market share is classified into wine type, equipment type, and by automation level.

- The red segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States wine production machinery market is segmented by wine type into red, white, sparkling, and fortified. Among these, the red segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The U.S. wine industry prospers because of its extensive, heterogeneous industry, robust red wine heritage, and changing consumer preferences. The U.S. is home to an extensive wine production, with California playing a leading role, and presents an extensive range of red wine styles. The preference for lighter, crisper, and fruit-forward white wines comes at the right time, as consumers prefer fresh wines.

- The crushing & pressing equipment segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

The United States wine production machinery market is segmented by equipment type into crushing & pressing equipment, fermentation equipment, filtration equipment, bottling equipment, temperature control equipment, storage tanks, and others. Among these, the crushing & pressing equipment segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. This machinery plays an important role in the primary phase of winemaking by squeezing juice out of the grapes. The quest for superior wines may trigger the use of sophisticated crushing and pressing technology, especially by wineries that require precise control of extraction procedures.

- The semi-automatic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States wine production machinery market is segmented by automation level into manual, semi-automatic, and automatic. Among these, the semi-automatic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its provision of an affordable and adaptable solution for wineries looking to add automation to their process. They bring a combination of the convenience of manual control and the efficiency benefits of automation, which is ideal for most winemaking processes, particularly in small and medium-sized wineries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States wine production machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Constellation Brands

- E. & J. Gallo Winery

- Criveller Group

- The Wine Group

- Pernod Ricard

- Deutsch Family Wine & Spirits

- Bronco Wine Company

- Trinchero Family Estates

- Agrovin

- Della Toffola Pacific

- Northern Brewer LLC

- Grapeworks Pty Ltd

- GW Kent Inc

- Love Brewing Limited

- Paul Mueller Company

- Vitikit Limited

- Others

Recent Developments:

- In June 2023, E. & J. Gallo Winery (Gallo) announced that it had purchased the Hahn Family Wines portfolio, complementing Gallo's existing Central Coast offerings. The strategic investment includes the Smith & Hook, Hahn, and Hahn SLH brands.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States wine production machinery market based on the below-mentioned segments

U.S. Wine Production Machinery Market, By Wine Type

- Red

- White

- Sparkling

- Fortified

U.S. Wine Production Machinery Market, By Equipment Type

- Crushing & Pressing Equipment

- Fermentation Equipment

- Filtration Equipment

- Bottling Equipment

- Temperature Control Equipment

- Storage Tanks

- Others

U.S. Wine Production Machinery Market, By Automation Level

- Manual

- Semi-automatic

- Automatic

Need help to buy this report?