Global Aircraft Interior Lighting Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Emergency and Signage Lights, Floor Strips Lights, Reading Lights, General Illumination Lights, and Low Profile Ambient Lights), By Application (Passenger Seating Area, Cockpit, Lavatory, and Cabin Crew Area), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Aircraft Interior Lighting Market Size Insights Forecasts to 2035

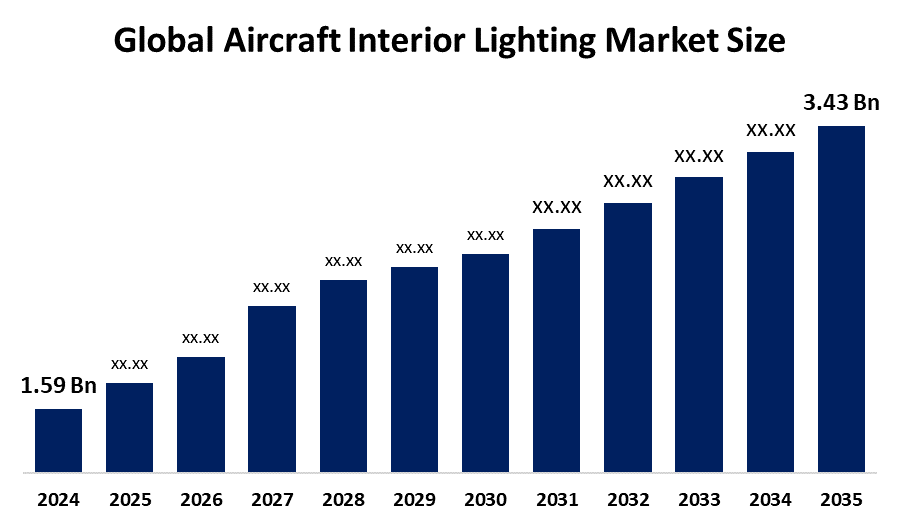

- The Global Aircraft Interior Lighting Market Size Was Estimated at USD 1.59 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.24 % from 2025 to 2035

- The Worldwide Aircraft Interior Lighting Market Size is Expected to Reach USD 3.43 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Aircraft Interior Lighting Market Size was valued at around USD 1.59 Billion in 2024 and is predicted to Grow to around USD 3.43 Billion by 2035 with a compound annual growth rate (CAGR) of 7.24 % from 2025 to 2035. The opportunities for energy-efficient LED adoption, smart cabin illumination, improving passenger comfort, customisation trends, and regulatory compliance are offered by the aircraft interior lighting market.

Market Overview

The aviation interior lighting industry includes the process of creating, producing, and bringing to life the most advanced lighting systems for the public, private, and military aircraft cabins. Those systems deliver passenger comfort, safety, and attractiveness through lighting techniques that are in harmony with the professional families' biological cycles, dynamic color choices, and eco-friendly LEDs. Strict aviation laws and sustainability criteria are the driving forces behind these systems, which feature overhead panels, reading lights, emergency egress illumination, and changeable ambient zones. Among the items in this industry that are meant to improve passenger comfort, safety, and the overall in-flight experience are LED lighting, ambient mood lighting, reading lights, and emergency illumination systems. The U.S. FAA launched the August 2025 Supplemental type Certificate for Aircraft Lighting International’s RGBW LED system on Gulfstream G550 jets, highlighting regulatory support for innovative, low-emission aviation technologies. The market is expanding more quickly due to the growing adoption of LED and RGBW lighting technologies, which offer advantages such as lower energy usage, fewer maintenance costs, and longer operating life.

Report Coverage

This research report categorizes the aircraft interior lighting market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aircraft interior lighting market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the aircraft interior lighting market.

Global Aircraft Interior Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.59 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.24% |

| 2035 Value Projection: | USD 3.43 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 134 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | AES, Astronics Corporation, Beadlight, Bruce Industries, Cobham Aerospace Communications, Collins Aerospace (Raytheon Technologies), Diehl Stiftung, Heads Up, Luminator Technology Group, Madelec Aero, Pilotlights, PWI Inc., SCHOTT, Safran, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The market is expanding more quickly due to the growing adoption of LED and RGBW lighting technologies, which offer advantages such as lower energy usage, fewer maintenance costs, and longer operating life. For the foreseeable future, there will be a major increase in demand for sophisticated aircraft interior lighting due to expanding preferences for luxurious and pleasant travel, as well as the growing need for attractive aircraft interior lighting systems. The aircraft interior lighting market is growing as a result of increased deliveries of new aircraft, fleet refurbishment, and modernization projects in the commercial, business, and regional aviation sectors.

Restraining Factors

The market for aircraft interior lighting is restricted by a number of factors, including high installation costs, difficult retrofitting of older aircraft, strict regulatory compliance, tight airline budgets, and sluggish adoption of cutting-edge lighting technologies.

Market Segmentation

The aircraft interior lighting market share is classified into product type and application.

- The emergency and signage lights segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the aircraft interior lighting market is divided into emergency and signage lights, floor strips lights, reading lights, general illumination lights, and low-profile ambient lights. Among these, the emergency and signage lights segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Airlines are making investments in cutting-edge emergency and signage lighting solutions that provide increased durability, energy efficiency, and adherence to global safety regulations. Passenger safety and regulatory compliance are becoming more and more important to airlines and aircraft manufacturers, which calls for sophisticated signs and emergency lighting solutions.

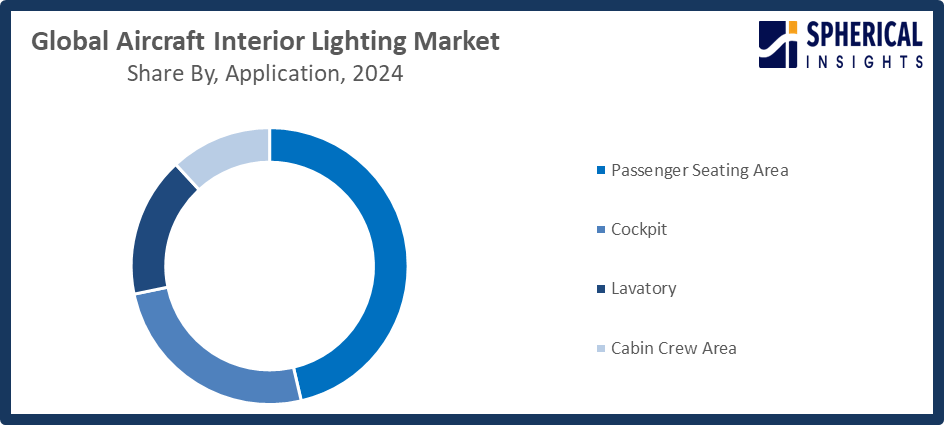

- The passenger seating area segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the aircraft interior lighting market is divided into passenger seating area, cockpit, lavatory, and cabin crew area. Among these, the passenger seating area segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing focus on improving passenger comfort and the in-flight experience through cutting-edge lighting solutions is responsible for the passenger seating area application category. To boost cabin aesthetics, mood, and overall passenger happiness, airlines are investing in ambient and configurable lighting systems, such as LED and RGBW technology.

Get more details on this report -

Regional Segment Analysis of the Aircraft Interior Lighting Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the aircraft interior lighting market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the aircraft interior lighting market over the predicted timeframe. The region has a strong aviation sector, a large capacity for producing airplanes, and early adoption of cutting-edge technologies. The integration of cutting-edge interior lighting solutions, including energy-efficient LEDs, RGBW systems, and smart adaptive lighting, is facilitated by the presence of top aircraft manufacturers, airlines, and technology providers. The U.S. Federal Aviation Administration (FAA) shortened certification times to six to twelve months by streamlining permits under 14 CFR 25.812 for emergency lights. In order to improve retrofit accessibility, PWI, Inc. released many Parts Manufacturer Approvals (PMAs) in 2025, such as those for the Beechjet/Hawker 400A/XP in September and the Cessna Citation 650 series in June.

Asia Pacific is expected to grow at a rapid CAGR in the aircraft interior lighting market during the forecast period. Growing demand for air travel, an increase in aircraft deliveries, and the growth of commercial and low-cost carriers in nations like China, India, and Southeast Asia are the main causes of the swift expansion. The expanding business aviation sector and government programs to improve airport infrastructure are also driving industry expansion. Important advancements include the introduction of recyclable "eco everything" solutions for low-carbon cabins by STG Aerospace in April 2025 at the Aircraft Interiors Expo (AIX) Hamburg with the E1 sustainable emergency floor path marking. Circadian-aligned accent lighting, which improves long-haul wellbeing, was included in Diehl Aviation's March 2025 AIX showcase.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aircraft interior lighting market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AES

- Astronics Corporation

- Beadlight

- Bruce Industries

- Cobham Aerospace Communications

- Collins Aerospace (Raytheon Technologies)

- Diehl Stiftung

- Heads Up

- Luminator Technology Group

- Madelec Aero

- Pilotlights

- PWI Inc.

- SCHOTT

- Safran

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Satair and Collins Aerospace launched a four-year extension of their distribution agreement, covering cabin interior components and lighting solutions, strengthening long-term collaboration in aviation interior supply.

- In March 2025, Diehl Aviation launched its advanced cabin illumination technologies at AIX Hamburg, featuring accent lighting and premium materials designed to enhance passenger comfort and overall in-flight experience.

- In June 2023, STG Aerospace launched the Curve, a new flexible cabin lighting product within its universal lighting family, specifically developed to elevate the business jet cabin environment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aircraft interior lighting market based on the below-mentioned segments:

Global Aircraft Interior Lighting Market, By Product Type

- Emergency And Signage Lights

- Floor Strips Lights

- Reading Lights

- General Illumination Lights

- Low Profile Ambient Lights

Global Aircraft Interior Lighting Market, By Application

- Passenger Seating Area

- Cockpit

- Lavatory

- Cabin Crew Area

Global Aircraft Interior Lighting Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aircraft interior lighting market over the forecast period?The global aircraft interior lighting market is projected to expand at a CAGR of 7.24% during the forecast period.

-

2. What is the market size of the aircraft interior lighting market?The global aircraft interior lighting market size is expected to grow from USD 1.59 billion in 2024 to USD 3.43 billion by 2035, at a CAGR of 7.24 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the aircraft interior lighting market?North America is anticipated to hold the largest share of the aircraft interior lighting market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global aircraft interior lighting market?AES, Astronics Corporation, Beadlight, Bruce Industries, Cobham Aerospace Communications, Collins Aerospace (Raytheon Technologies), Diehl Stiftung, Heads Up, Luminator Technology Group, Madelec Aero, Pilotlights, PWI Inc., SCHOTT, Safran, and Others.

-

5. What factors are driving the growth of the aircraft interior lighting market?The aircraft interior lighting market growth is driven by increasing demand for energy-efficient LED systems, enhanced passenger experience, cabin modernization, regulatory compliance, technological advancements, and rising commercial and business aviation investments.

-

6. What are the market trends in the aircraft interior lighting market?Key trends include the adoption of smart and customizable lighting systems, RGBW LEDs, mood-enhancing cabin illumination, retrofitting older aircraft, IoT integration, sustainability-focused solutions, and emphasis on passenger comfort and operational efficiency.

-

7. What are the main challenges restricting the wider adoption of the aircraft interior lighting market?Market adoption is restricted by high installation costs, technical complexities in retrofitting older aircraft, stringent regulatory standards, limited airline budgets, and slow awareness of long-term benefits of advanced lighting solutions.

Need help to buy this report?