Automotive Powertrain Sensors Market Summary

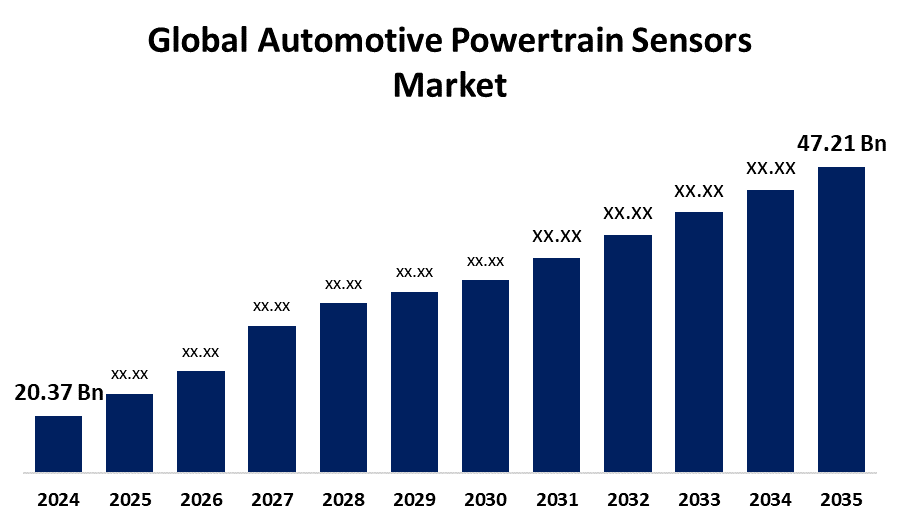

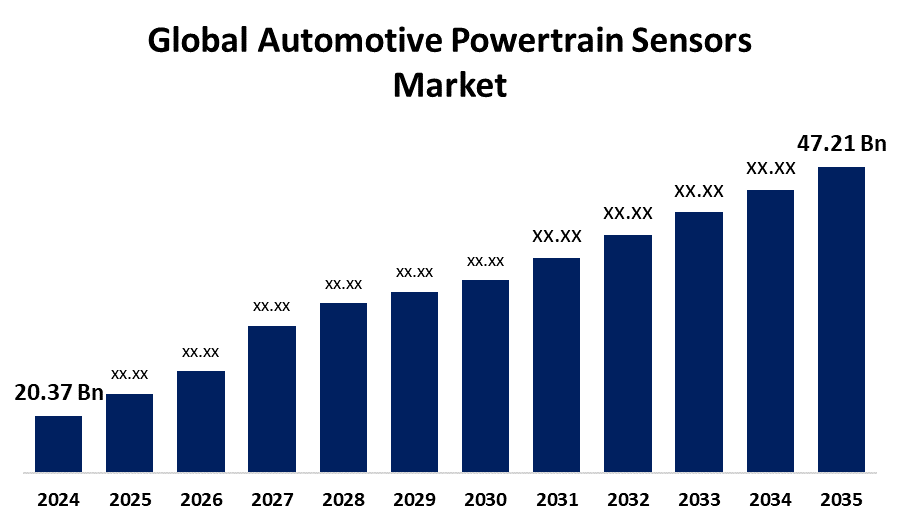

The Global Automotive Powertrain Sensors Market Size Was Estimated at USD 20.37 Billion in 2024 and is Projected to Reach USD 47.21 Billion by 2035, growing at a CAGR of 7.94% from 2025 to 2035. Increased vehicle production, growing demand for electric and hybrid vehicles, and tighter emissions rules are the main factors propelling the automotive powertrain sensors market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, the market for automobile powertrain sensors in North America held a 21.7% market share and dominated the market.

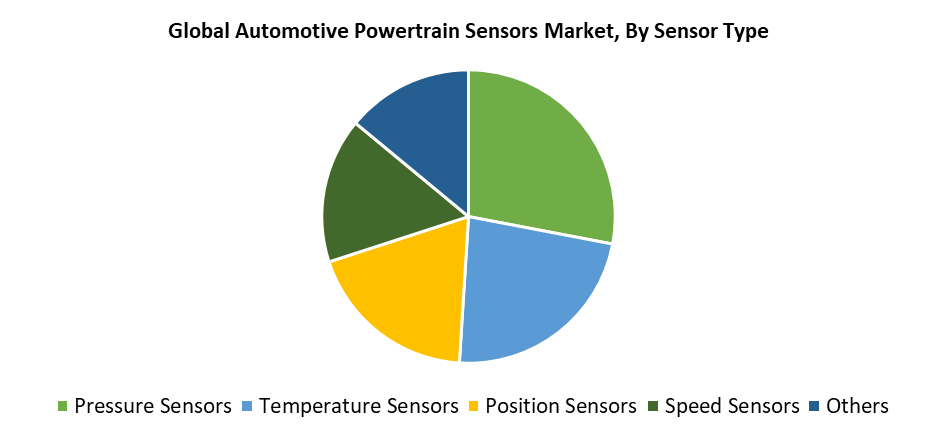

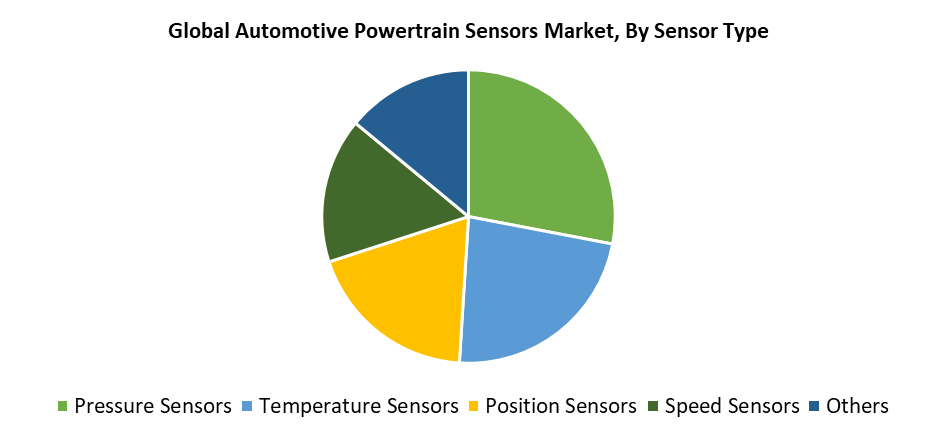

- In terms of sensor type, the Pressure Sensors category held the biggest share in 2024, accounting for 28.3%.

- In 2024, the Internal Combustion Engine (ICE) Vehicles segment led the market by Propulsion Type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 20.37 Billion

- 2035 Projected Market Size: USD 47.21 Billion

- CAGR (2025-2035): 7.94%

- North America: Largest market in 2024

The automotive powertrain sensors market includes the industry that develops and manufactures sensors for automobile powertrain systems. The automotive powertrain sensors market experiences rapid growth because consumers want vehicles with high performance, low emissions, and fuel efficiency characteristics. Automakers are implementing advanced sensors at rising rates to enhance engine efficiency while maintaining emission standards and improving vehicle performance. The rising popularity of electric and hybrid propulsion systems drives market expansion because these systems depend primarily on sensors for monitoring and control functions. Modern cars adopt advanced sensing technologies because real-time data collection, together with intelligent engine control and energy optimization has become essential. The combination of improved MEMS technology with AI-based diagnostics and sensor shrinking enables automotive systems to seamlessly integrate sensors while achieving higher accuracy and faster reaction times.

Machine learning (ML), together with artificial intelligence (AI), continues to transform powertrain sensor applications through their ability to make intelligent decisions and adaptive powertrain control while enabling predictive maintenance. These technologies use real-time sensor data, which helps improve operational efficiency and vehicle reliability. The market for electric vehicles is expected to grow substantially because sensors play a vital role in enabling torque control, temperature management, and battery monitoring functions for EVs. The increasing investments in smart grids and environmentally friendly transportation systems, and EV infrastructure have intensified the requirement for advanced powertrain sensors. The future remains positive because governments worldwide are implementing cleaner vehicle technology programs and tighter emissions standards despite present development cost challenges, complex integration requirements, and supply chain issues.

Sensor Type Insights

The pressure sensors segment dominated the market with a 28.3% share in 2024 because these sensors perform essential functions in modern automotive powertrain systems. These sensors play an essential role in tracking engine parameters such as exhaust back pressure, fuel rail pressure and turbocharger boost, and engine oil pressure, so engines achieve maximum performance while meeting environmental regulations. The rising number of turbocharged engines in passenger and commercial vehicles has driven up market demand. The application of pressure sensors continues to grow in electric powertrains through their use in thermal circuit monitoring and battery cooling operations. Their superiority is cemented by their adaptability to both internal combustion and electric cars, which improves their dependability and compatibility. Automakers select pressure sensors because they enhance vehicle safety while enabling better emissions control and improved fuel efficiency.

The temperature sensor segment within the automotive powertrain sensor market demonstrates the fastest growth throughout the forecasted period, because modern vehicles, including internal combustion engines and electric vehicles, require precise thermal management systems. Electric vehicles and hybrids utilize temperature sensors to monitor their electric motors, inverters, and battery systems because these sensors help prevent overheating and maximize safety and system performance. The sensors maintain optimal engine temperature control, which improves combustion efficiency while simultaneously reducing emissions and increasing fuel economy in ICE-powered vehicles. Modern manufacturers drive the rapid expansion of advanced temperature sensors for all vehicle types because they focus on improving system reliability alongside emission standards and operational efficiency.

Propulsion Type Insights

The Internal Combustion Engine (ICE) Vehicles segment maintained its lead in the automotive powertrain sensors market throughout 2024 because of the continuous requirement for precise engine monitoring and control, and it continues to grow at a consistent rate. The automotive industry increasingly uses advanced sensors for improving combustion processes while reducing toxic emissions to meet Euro 7 and U.S. Tier 4 emission requirements. The powertrain sensors of ICE vehicles utilize various types of sensors to detect temperature, pressure, airflow, and knock, which enable optimal engine performance, fuel efficiency, and engine durability. The need for improved sensors grows because ICE technology remains mature and widely used across trucks, passenger cars, as well as construction and agricultural vehicles. The ongoing development of hybrid and turbocharging systems enables the sustained use of ICE sensors, which drives the market forward.

The electric vehicles (EVs) sector is expected to experience the fastest growth during the forecasted period. This growth stems primarily from global environmental initiatives and the expanding use of electric vehicles (EVs). Modern sensors play a key role in monitoring essential components such as battery status, together with inverter heat levels and electric motor output capabilities within EV powertrains. The rising demand for integrated temperature sensors, along with battery pressure sensors and high-voltage current sensors, demonstrates this trend. OEMs increasing their EV production while launching advanced electric platforms drive the rising need for lighter and smarter sensors with higher energy efficiency. The sensors play a fundamental role in regenerative braking and motor control as well as battery management, which boosts powertrain performance and extends vehicle range while reducing energy consumption.

Regional Insights

The automotive powertrain sensors market in North America maintained its leading position by holding 21.7% of the worldwide market share in 2024. The leadership of this region is driven by robust automobile production coupled with initial electric vehicle adoption, together with strict fuel efficiency and emission regulations, including EPA and CAFE standards. Advanced powertrain sensors, which enhance performance efficiency together with emission tracking abilities and electric powertrain functionality, are growing more popular because of these requirements. The region benefits from substantial R&D investments that focus on electrification and smart mobility technologies. Market development receives additional support through government funding programs that support infrastructure construction and electric vehicle adoption. Powertrain sensors maintain their global leadership position in North America because of the widespread adoption of ADAS and autonomous technologies which drive sensor development.

Europe Automotive Powertrain Sensors Market Trends

The European Union's strict emission standards and powertrain electrification initiatives drive Europe to control a major part of the worldwide automobile powertrain sensor market. Modern sensor technology implementation by Germany, France, and the UK advances powertrain efficiency and diminishes emissions while supporting hybrid and electric vehicle market expansion. Strong R&D activities combined with government incentives and electric vehicle subsidies actively support industry expansion. The region's automotive legacy, coupled with advancing vehicle connectivity and autonomy systems, creates increased demand for sensors that are precise and robust yet compact. The combination of sensor integration enhancements with real-time diagnostic capabilities and performance optimization continues to expand because powertrain systems require low emissions and electric power steering solutions.

Asia Pacific Automotive Powertrain Sensors Market Trends

The Asia Pacific region represents a significant expansion in the automotive powertrain sensors market because it has numerous automotive manufacturing facilities and quick technology adoption. The automotive powertrain sensors market gains momentum from expanding fuel-efficient vehicle demand and government electric mobility incentives, and increased vehicle production across major economies, including China, Japan, India, and South Korea. The region has adopted modern powertrain sensors to perform real-time monitoring and control as part of its emissions reduction and vehicle efficiency improvement initiatives. The market environment benefits from strong supply chain networks and low production costs, together with increasing investments in connected and smart vehicles. Asia Pacific has established itself as a premier innovation hub for market expansion because of its robust research and development activities and purposeful partnerships between domestic and international organizations.

Key Automotive Powertrain Sensors Companies:

The following are the leading companies in the automotive powertrain sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- TE Connectivity

- NXP Semiconductors

- DENSO CORPORATION

- Renesas Electronics Corporation

- Infineon Technologies AG

- Texas Instruments Incorporated

- Continental AG

- Valeo SA

- Mitsubishi Electric Mobility Corporation

- Others

Recent Developments

- In January 2025, at CES, Texas Instruments unveiled the AWRL6844 60GHz mmWave radar sensor, which is intended for in-cabin safety with edge AI. By using sensor fusion, this sensor indirectly supports powertrain systems while achieving 98% occupant identification accuracy and saving $20 per vehicle.

- In November 2024, NOVOSENSE Microelectronics and Continental announced a collaboration to create automotive-grade sensor integrated circuits for safety systems, including powertrain applications. By increasing sensor accuracy for airbag triggers and battery pack monitoring, our partnership raises vehicle efficiency and safety.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive powertrain sensors market based on the below-mentioned segments:

Global Automotive Powertrain Sensors Market, By Sensor Type

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Speed Sensors

- Others

Global Automotive Powertrain Sensors Market, By Propulsion Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Fuel Cell Vehicles (FCVs)

Global Automotive Powertrain Sensors Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa