Tactical Footwear Market Summary

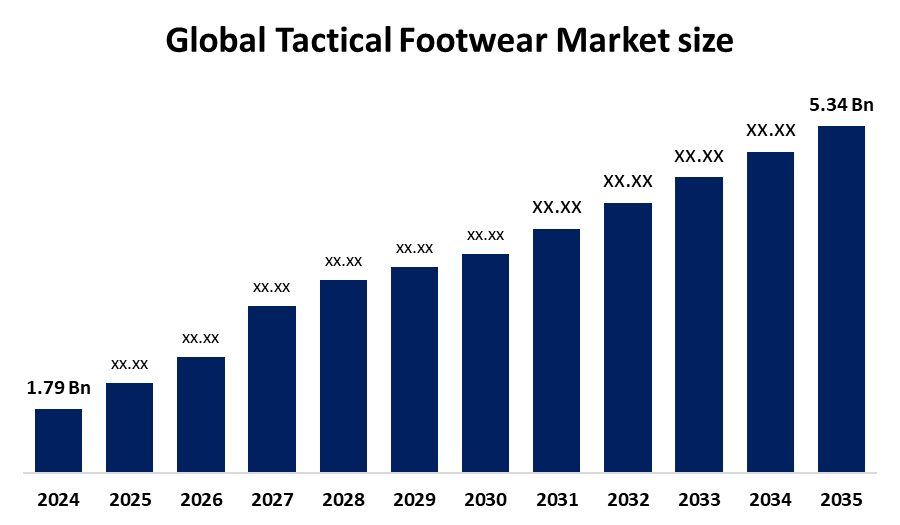

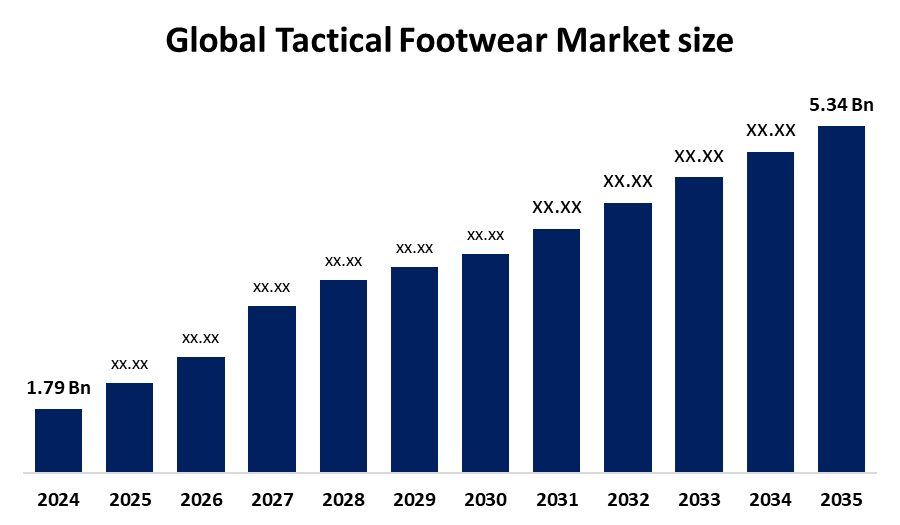

The Global Tactical Footwear Market size was valued at USD 1.79 Billion in 2024 and is Projected to Reach USD 5.34 Billion by 2035, Growing at a CAGR of 10.45% from 2025 to 2035. The market for tactical footwear is expanding as a result of several factors, including the convenience of e-commerce platforms, the development of adventure sports and outdoor activities, and rising demand from the military and law enforcement. In particular, this market is being driven by the growth of the military and defense industries, the escalation of security concerns, and the increasing appeal of outdoor pursuits like hiking and climbing.

Key Market Trends & Insights

- The North America Tactical Footwear Market Size held the largest revenue share of 37.2% in 2024

- In 2024, the US Tactical footwear Market Size achieved the largest revenue, solidifying its position as the region's leading market.

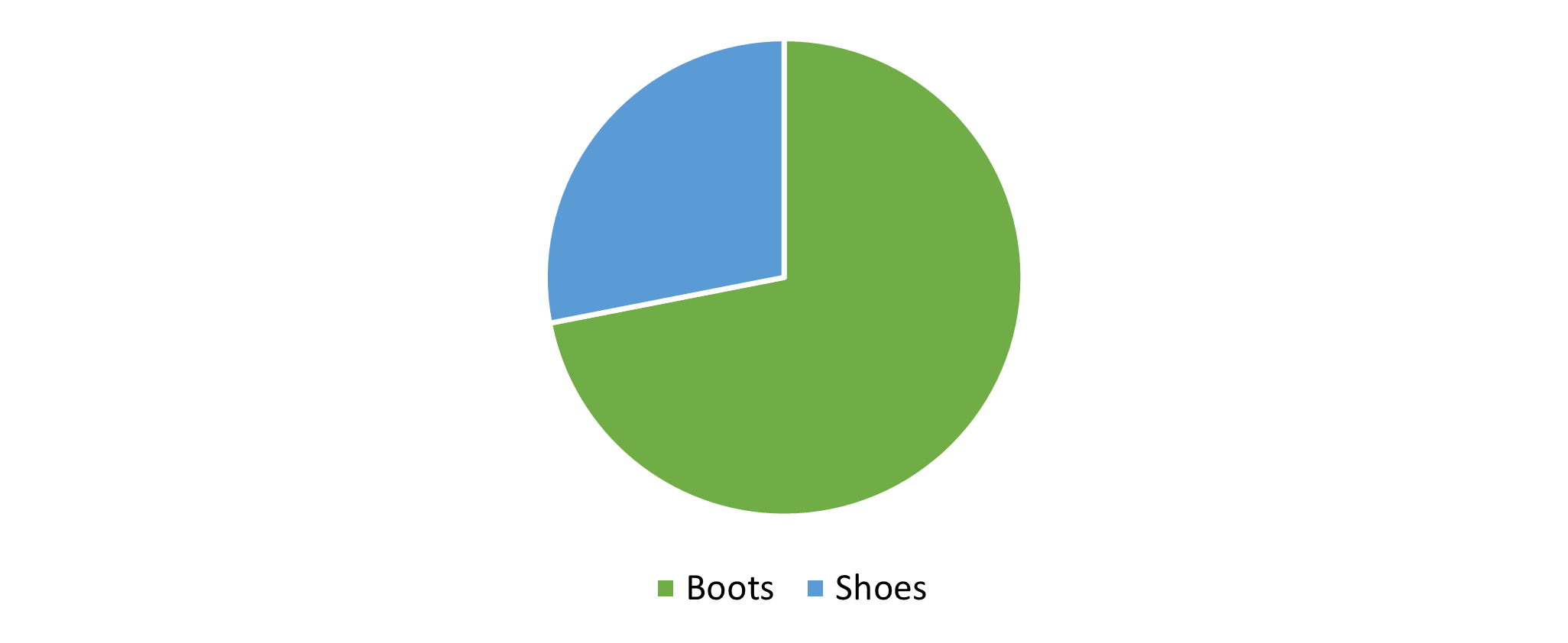

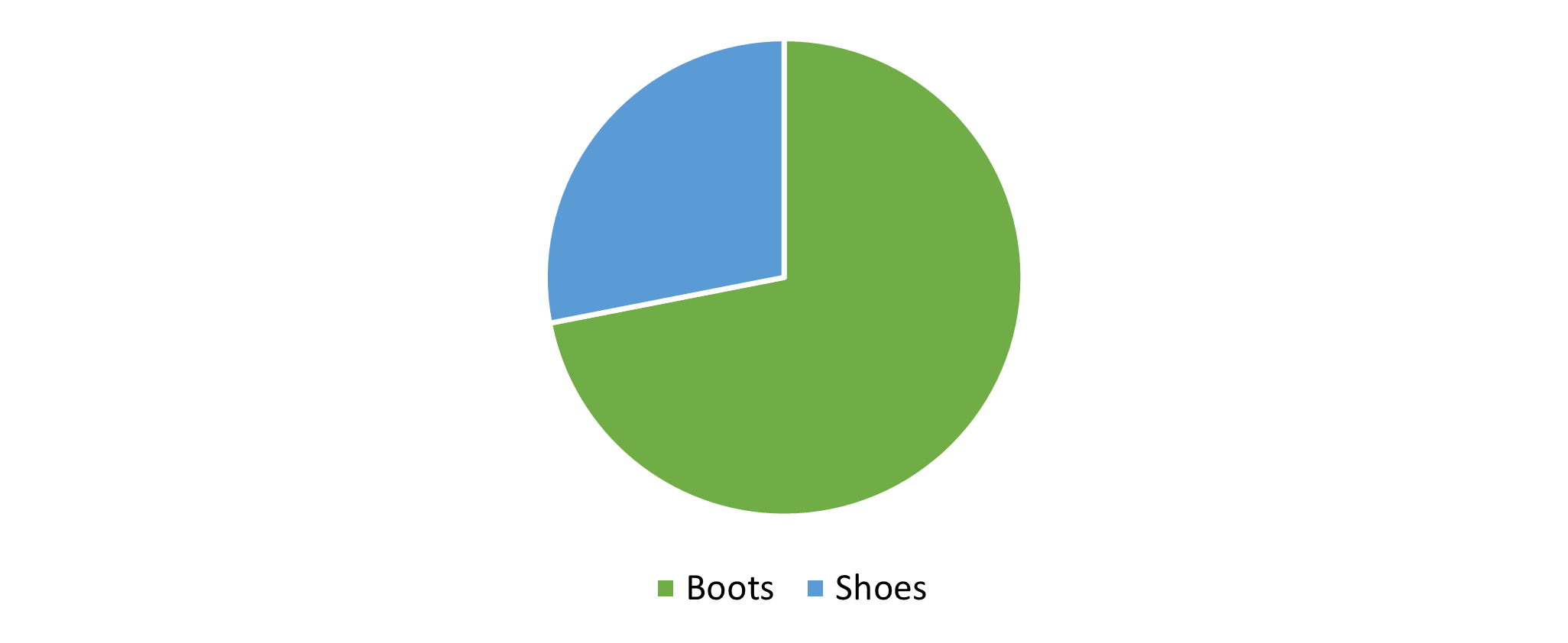

- The boots segment dominated the worldwide Tactical Footwear Market Size by product because it held the largest share of 66.79% in 2024

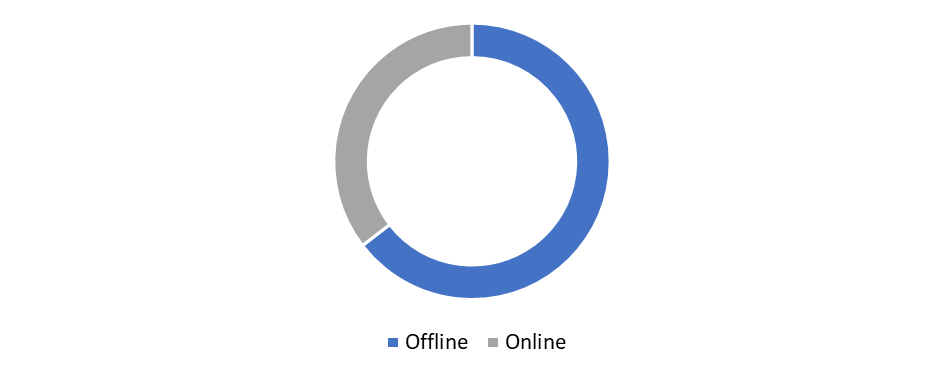

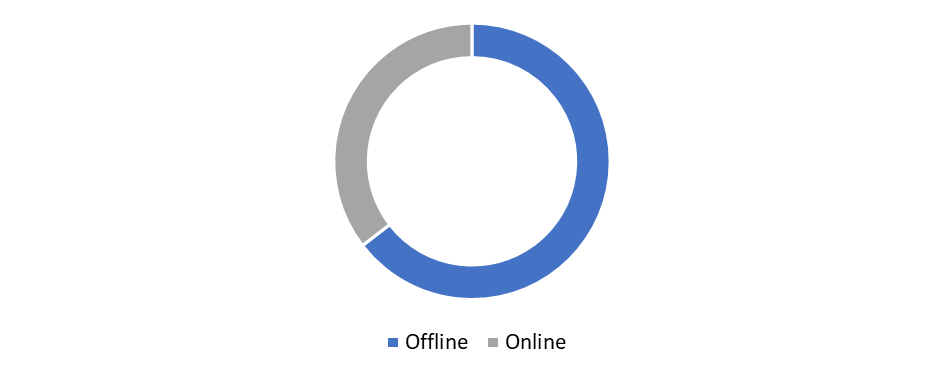

- The offline distribution segment held the highest revenue share for the worldwide Tactical Footwear market during 2024, according to distribution channel analysis.

Market Size & Forecast

- 2024 Market Size: USD 1.79 Billion

- 2035 Projected Market Size: USD 5.34 Billion

- CAGR (2025-2035): 10.45%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in the forecasted period.

Tactical footwear represents a specific market segment that serves military personnel, along with law enforcement officers and outdoor enthusiasts who require specialized footwear for demanding conditions. The market consists of performance footwear, which includes boots, together with shoes and other protective footwear designed to endure demanding environments. The production of tactical footwear now requires manufacturers to implement environmentally friendly materials together with sustainable manufacturing methods because environmental awareness continues to rise. Tactical footwear businesses that proactively tackle environmental challenges will experience lower chances of regulatory modifications and compliance violations. The future sustainability of tactical footwear will drive progress in creating environmentally friendly materials. The market expects manufacturers to explore advanced materials that deliver both high-performance durability and environmental sustainability for tactical footwear production.

Tactical footwear serves multiple purposes because it supports military operations and functions effectively in challenging outdoor environments and extreme sports activities and hunting, and mountaineering. Tactical footwear offers improved insole and outsole cushioning features, which help minimize foot impact and strain during sprinting or jumping and extended walking distances. The worldwide market for tactical footwear continues to grow because military forces around the world are modernizing their equipment. The United States, along with China and India, is driving faster acquisition of modern equipment through its government defense infrastructure investments. The enforcement of stricter military safety standards is pushing manufacturers to obtain compliance certifications. Modern tactical boots with energy return technology and ergonomic improvements have gained popularity because they are certified and laboratory-tested. These limitations influence the competitive environment that exists within the industry.

Commercial demand, particularly amongst hikers, survivalists, and law enforcement trainees, is creating more choice. Because of their strength and style, tactical boots are gaining traction as lifestyle pieces. Market participants are now utilizing e-commerce to access the newly growing user base. Latin American and Southeast Asian nations are entering growing markets while increasing defense spending. Local manufacturing incentives for regional players have encouraged them to enter the market. As a result, more diverse pricing and distribution networks an anticipated upward trend for the tactical footwear market.

Product Insights

In 2024, the tactical footwear industry experienced its highest revenue share through the boots segment at 66.79%. The worldwide focus on security measures, together with the expanding outdoor leisure activities, has driven up consumer demand. Law enforcement personnel along with military members, and outdoor enthusiasts choose these boots for their robust build quality and excellent ankle protection, and enduring performance. The tactical boot market provides multiple design options that align with specific product purposes. The increasing utilization of boots in challenging terrain operations, together with tactical training activities, drives the growth of this market segment. Consumers in this market select protection and durability instead of trends, thus boosting the popularity of tactical boots for work-related and recreational activities. Manufacturers who direct their efforts toward material innovation and functional design enhancements lead the entire tactical boot market to new industry standards.

The shoes segment is expected to grow at the fastest CAGR over the forecast period. Shoes in the tactical footwear category serve a specific market that prioritizes minimal weight and flexibility. Even though tactical shoes are comfortable and agile, their use is frequently restricted to settings where protection is not as important as mobility. Hunting, hiking, and extreme sports enthusiasts who want protection against sand, dirt, water, and challenging terrain are the main users of these shoes. The segment's growth has been fueled by ongoing product introductions. The product's XS trek Vibram outsole offers the best possible balance, comfort, and durability. Police personnel frequently wear tactical shoes, which are probably a necessary component of their Class B patrol uniform or Class C tactical training and deployment kit.

Distribution Channel Insights

In 2024, the tactical footwear market was dominated by the offline sector, which held the largest revenue share. The distribution outlets inside this channel include sporting goods chains and independent retailers, together with department store chains and institutional athletic departments. Customers especially prefer the offline sales channel because it gives them a chance to test shoes in stores before buying. The market segment experienced growth because potential buyers have numerous choices when selecting shoe cushioning and material options. The expansion elements, together with offline store advantages, make consumers choose this channel for obtaining detailed product information from store personnel. Through this distribution channel, customers can find an extensive selection of tactical shoes that match their work requirements and specific uses. Customers can choose from three ankle height options, including mid-ankle, high-ankle, and low-ankle models.

The online distribution channel is expected to demonstrate the fastest growth rate throughout the forecast period. The distribution channel's expansion is primarily driven by growing internet usage and doorstep delivery services as well as simple exchange policies and hassle-free payment methods offered by e-commerce businesses. Consumers now favor purchasing items through home delivery services because this distribution method allows them to shop from their homes. The distribution channel provides customers with various purchase choices that enable them to combine multiple discounts for cost reduction. Before buying high-end footwear, buyers seek complete information about the product's uses and advantages. Online platforms provide potential buyers with detailed product descriptions along with high-quality reviews, which help them make informed decisions and drive fast market growth.

Regional Insights

In 2024, the North American tactical footwear sector held the biggest revenue share of 37.2%, dominating the global market. People who serve in the military, together with law enforcement officers and outdoor activity participants, represent a significant part of North America's population, which drives this industry growth. The region features famous brands and experiences a rising popularity of outdoor adventures, which drives market growth. Because e-commerce platforms are so widely used, customers in North America have access to a large variety of tactical footwear options. The market experiences consistent growth because customers recognize the importance of foot protection, together with product durability. The demand for tactical footwear in this region has grown because of Adidas AG and Under Armour, Inc., and other popular manufacturers, alongside increasing public interest in outdoor activities, including hiking, trekking, mountain climbing, and wildlife camping.

U.S. Tactical Footwear Market Trends

The tactical footwear market in the United States secured the highest revenue in 2024 to establish its dominant position throughout North America. Law enforcement and military personnel need footwear that is both long-lasting and performance-oriented for their daily tasks. Likewise, emergency services and construction sectors need particular footwear that protects workers from dangers involving falls and impact injuries, and slips. The Central Intelligence Agency (CIA) reported that the U.S. military maintained 2.86 million service members globally during 2023, which positioned it as the third-largest active military force worldwide.

Europe Tactical Footwear Market Trends

Europe held a substantial market share in 2024. The tactical footwear market in Europe operates through a mix of business and recreational purposes. The UK, Germany, and France lead the market because they maintain substantial military forces while serving as preferred spots for hiking and outdoor activities. The market receives support from consumers who recognize tactical-grade products along with the expanding recreational outdoor culture in Germany and the UK. Regulatory support for safety and quality requirements continues to shape the regional market environment. Several parts of Europe need tactical footwear built for harsh conditions because of their unpredictable or inconsistent weather patterns.

Asia Pacific Tactical Footwear Market Trends

Throughout the forecast period, the Asia Pacific tactical footwear market is anticipated to expand at the fastest CAGR of 9.25%. The Asia-Pacific area experiences rising demand for tactical footwear because China, together with India and Japan, leads the way. Tactical footwear demand increases because industrial activity grows, while military spending rises and law enforcement needs expand, and safety and protection in hazardous environments receive greater attention. The armed services' need for tactical boots has increased as a result of China's and India's expanding military spending. The fitness culture boom and growing popularity of adventure sports and outdoor activities serve as major growth factors for the global tactical footwear market. China led the Asia Pacific tactical footwear market in 2024 by obtaining the highest revenue share. China Xinxing, along with other Chinese companies, drives market demand because they create custom tactical footwear at budget-friendly costs.

Key Tactical Footwear Companies:

The following are the leading companies in the Tactical footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Under Armour, Inc.

- LaCrosse Footwear

- Magnum Boots International

- adidas AG

- Belleville Boot Co.

- Wolverine World Wide, Inc.

- VF Corporation

- Maelstrom Footwear

- Others

Recent Developments

- In March 2025, the GeoPilot Collection marks a revolutionary addition to NORTIV 8's product line because it delivers men's tactical boots that combine exceptional comfort with durability and versatility. The GeoPilot Collection represents a breakthrough in tactical footwear design because it unites advanced technology with masterful craftsmanship to deliver unmatched performance across any terrain. The GeoPilot Collection consists of nine distinct models, which include Terrascope, Metrostrike, Peakforce, VaporGuard, DriftShield, HydroTrek, HydroArmor, Desertstorm, and Paladin-Steel to serve specific operational needs.

- In November 2024, OTB Boots, a well-regarded tactical boots company, has bring a performance range of boots to market. OTB Boots are made by a team of experienced shoemakers and are tested by "elite tip-of-the-spear operators around the world, as well as U.S. Navy Seals. They are made to "survive the most punishing operational environments." On the heels of a request by the U.S. Navy Seals for OTB to develop tactical boots for amphibious missions, the company was founded. OTB boots came together through a series of focus groups of SEAL operators that used these boots in some of the harshest environments and, for the first time, created a tactical boot designed for air, sea, and land operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the tactical footwear market based on the below-mentioned segments:

Global Tactical Footwear Market, By Product

Global Tactical Footwear Market, By Distribution Channel

Global Tactical Footwear Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa