Protein Ingredients Market Summary

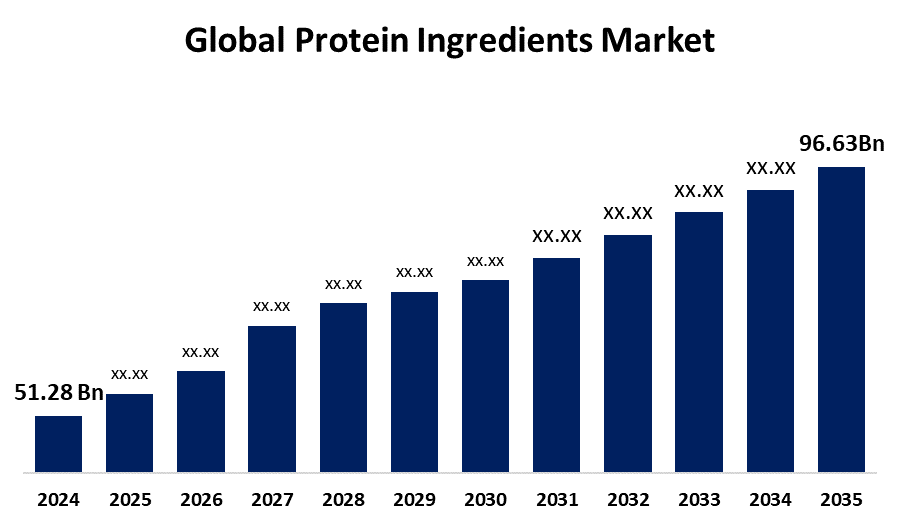

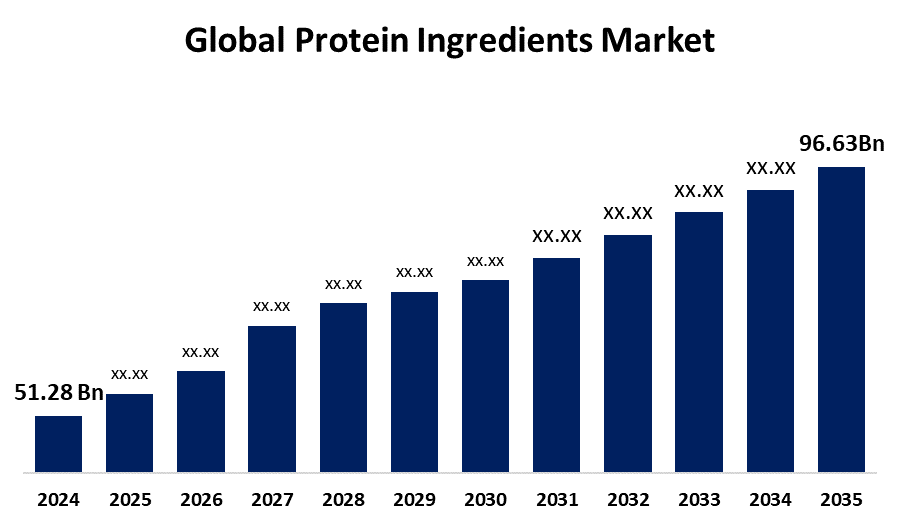

The Global Protein Ingredients Market Size was Estimated at USD 51.28 Billion in 2024 and is projected to reach USD 96.63 Billion by 2035, Growing at a CAGR of 5.93% from 2025 to 2035. The market for protein ingredients is expanding significantly due to growing demand for plant-based protein options, the growth of the health and fitness sector, and increased awareness of the health benefits of protein.

Key Regional and Segment-Wise Insights

- North America held a 36.7% market share in 2024, dominating the global market.

- From 2025 to 2035, the U.S. market for protein ingredients is anticipated to expand at a CAGR of 4.6%.

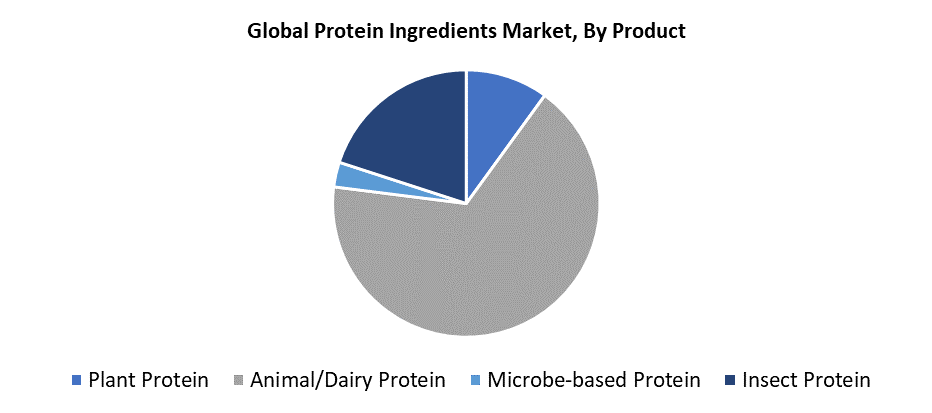

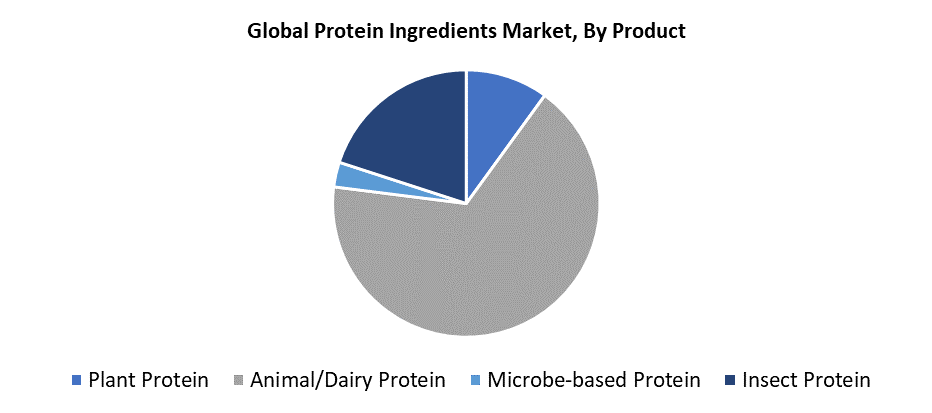

- In 2024, the animal/dairy protein market held the largest revenue share, accounting for 67.3% based on product.

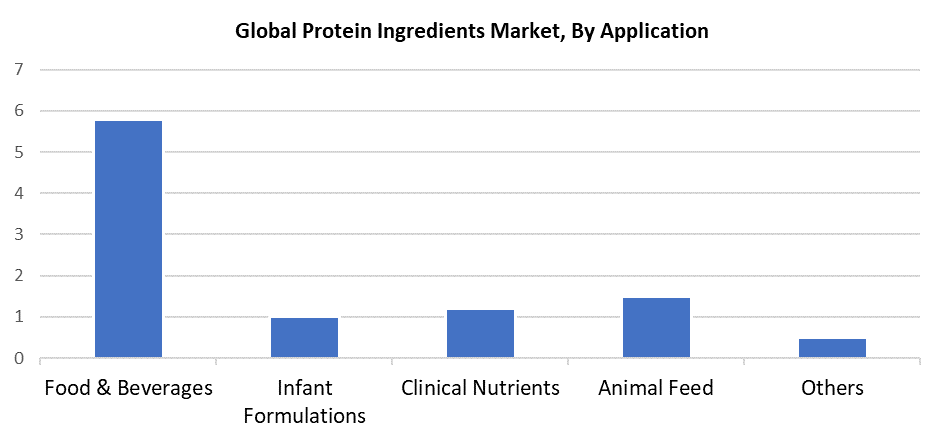

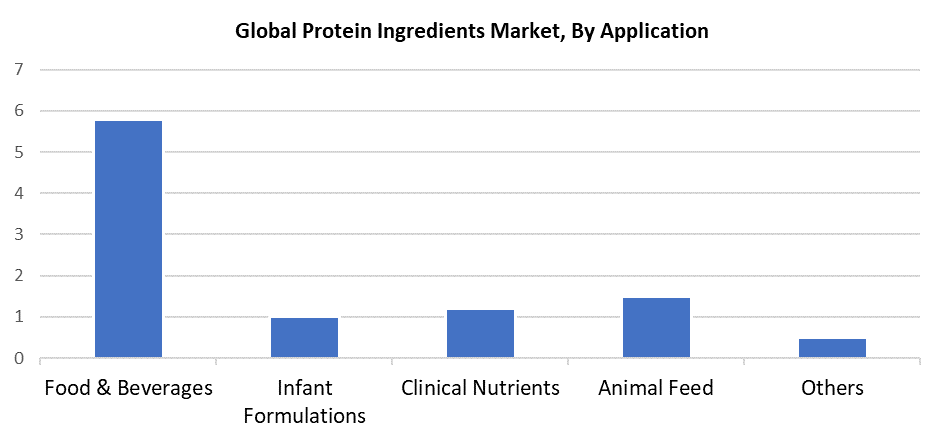

- In 2024, the food and beverage sector held the largest revenue share, accounting for 58.6% based on application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 51.28 Billion

- 2035 Projected Market Size: USD 96.63 Billion

- CAGR (2025-2035): 5.93%

- North America: Largest market in 2024

The protein ingredients market represents the worldwide industry that generates and distributes protein components from plant, animal, and microbial sources to various applications, including food products and beverages, dietary supplements, animal feed, pharmaceutical products, and cosmetics. The protein ingredients market experiences substantial growth because consumers transition toward sustainable lifestyles while focusing on fitness and health. The rising consumer understanding of high-protein diets creates increased demand among food and beverage companies and supplement manufacturers. The food industry experiences innovation through clean-label and plant-based trends because customers seek products that provide weight management benefits, energy boosts, along with muscle recovery support and immune system protection. Plant-based protein products experience market growth because vegetarian and flexitarian dietary patterns become more popular. The development of alternative protein sources receives support from sustainability concerns and dietary requirements, such as lactose intolerance. Urbanization and busy lifestyles also contribute to the rising demand for convenient, nutrient-rich products.

The plant-based protein market experiences rapid growth because companies dedicate substantial funds to research projects that develop superior ingredients. Organizations employ advanced fermentation methods together with research on algae, fungal, and insect protein sources to expand their protein portfolio. Established manufacturers partner with food IT companies to speed up their product development process. The food industry expands because governments provide financial backing and establish supportive legal frameworks for sustainable food production. Consumer awareness about environmental and health benefits drives dietary preferences toward plant-based foods. The market receives momentum from venture capital funding and educational programs, which focus on nutrition and sustainability in particular regions.

Product Insights

In 2024, ingredients containing animal or dairy proteins held the largest revenue share, accounting for 67.3%. The proteins gained popularity because they have complete amino acid compositions along with excellent nutritional qualities and superior absorption characteristics. Energy support, along with muscle development and overall health benefits, make these proteins essential for functional food products, sports nutrition, and therapeutic meal preparations. The traditional protein sources maintain their position because consumers trust these options, particularly in emerging markets. Processing methods have enhanced animal-based proteins so they taste better and last longer, which boosts their usage throughout food production, pharmaceutical, and cosmetic industries. The widespread availability, along with affordable prices of fish, chicken, and milk, helps sustain market demand. The continuous research and development activities improve the sensory properties and functional qualities of these products, which enables further market growth.

Throughout the forecasted period, the insect protein segment will expand at a significant CAGR. This market is growing because it serves as an economically sustainable replacement for traditional animal-derived proteins. The environmental advantages of insects, together with their minimal requirements for land, water, and feed resources, make them an increasingly attractive option as sustainability matters grow. The nutritional and health-focused market finds insect proteins appealing because they contain essential amino acids, together with vitamins and minerals, and they are easily digestible. Strategic alliances between multinational companies and insect protein startups help drive the expansion of insect-based products, particularly in markets that focus on innovative solutions and environmentally conscious consumers. The rising demand for environmentally sustainable nutrient-dense solutions is driving insect protein to become a versatile food, feed, and supplement ingredient for commercial development.

Application Insights

Food and beverage applications held the largest market share, accounting for 58.6% of total revenue in 2024. The rising demand from consumers for fast, nutritious products with high protein content drives growth across the food and beverage industry. To promote active living and wellness objectives, protein is incorporated into a wide range of products, including dairy and fortified beverages, snacks, and meal replacements. The rising trend of plant-based diets accelerates the adoption of plant-derived proteins because clean-label movements and functional benefits, including satiety and muscle support, enhance overall consumer appeal. The development of new product formats through plant-based dairy products and meat substitutes supports market growth. The combination of government regulations focusing on protein consumption, together with consumer attention to health and fitness, drives ongoing expansion in this market segment.

Throughout the forecasted period, animal feed protein applications are expected to grow at a significant CAGR. The rising need to boost cattle health along with their development and performance drives the market expansion. Protein-rich components, including fishmeal together with soybean meal and processed animal proteins, serve as fundamental ingredients to develop nutritionally balanced diets for pigs, poultry, cattle, and aquaculture. The worldwide increase in meat, together with dairy and poultry product consumption, leads to rising demand for premium feed solutions. The rising use of insect meal and other alternative proteins drives feed technology innovations, which boost both feed sustainability and operational efficiency. The feed business shift toward sustainability encourages new brands to introduce environmentally friendly pet and animal nutrition solutions that enable continuous market growth.

Regional Insights

In 2024, North America led the protein ingredients market with 36.7% revenue share globally. The market growth stems from the rising consumer awareness about nutrition, together with the increasing popularity of functional and fortified food products. The sports nutrition tradition in the region, together with the rising demand for plant-based and clean-label products enables ongoing innovation and product diversity. The current state of food processing technology enables manufacturers to produce high-end protein components, which will drive market growth. The combination of changing eating patterns along with rising vegan popularity and scientific validation of soy protein health benefits through USDA research drives North American consumers to choose both animal and plant-based protein sources.

U.S. Protein Ingredients Market Trends

The protein ingredients sector in the United States is expected to hold a CAGR of 4.6% during the forecasted period. The increasing number of health-conscious consumers, along with the rising appeal of ketogenic and paleo diets, drives the market expansion. Consumers who pursue wellness and fitness goals now seek various protein sources, which drives demand for these products. The plant-based protein market expands because more people choose vegan and flexitarian lifestyles. The market expands because new ready-to-drink beverages and protein-enriched snack offerings target customers with hectic schedules. Food technology investments and legislative support have made the United States a primary growth center for global protein ingredients because these factors enable new product launches and production efficiency improvements.

Europe Protein Ingredients Market Trends

The protein ingredients market in Europe will experience a 4.5% CAGR between 2025 and 2035, because consumers choose clean-label products and sustainable, vegan, and vegetarian options. The market for plant-based and animal protein replacements, including functional meals and plant-based dairy alternatives, shows increasing consumer interest because of ethical and environmental concerns. The strict food regulations ensure both quality standards and safety measures, which build trust among consumers and businesses. The substantial R&D funding, together with technological advancement in Europe, drives product innovation, which results in multiple protein-based product lines. The protein industry experiences growth because consumers, together with animal feed companies, select sustainable protein sources from plants and aquaculture. The combination of regulatory support, consumer trends, and technological advancement establishes Europe as a major player in the global protein ingredients market.

Asia Pacific Protein Ingredients Market Trends

Throughout the forecasted period, the Asia Pacific protein ingredients market is expected to experience a CAGR of 5.7% because of shifting consumer preferences, alongside rising disposable income and rapid urban growth. The rising middle class, along with increased health knowledge about proteins, creates substantial demand growth in the market. The growing fitness culture, along with the expanding functional food industry, has led to increased protein component consumption throughout the region. Technical developments and innovative food product creation receive support from government programs, which drive market development. The market advances because of strong economic development and increased food industry presence, as well as healthcare industry expansion. Additionally, the Asia Pacific region is experiencing market expansion because of increasing demand for plant and animal protein components.

Key Protein Ingredients Companies:

The following are the leading companies in the protein ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Kewpie Corporation

- Rousselot

- Mead Johnson & Company, LLC

- ADM

- Tessenderlo Group

- Roquette Freres

- Bunge Limited

- The Scoular Company

- Burco

- CHS, Inc.

- CropEnergies AG

- Cargill, Incorporated

- Fonterra Co-Operative Group

- MG

- Ingredion

- Others

Recent Developments

- In July 2024, Ingredion extended its range of protein fortification products and introduced a new pea protein under the VITESSENCE Pea 100 HD brand that is ideal for cold-pressed bars. The recently introduced pea protein works similarly to whey or soy protein and has a high protein level of 84% on a dry basis.

- In October 2023, Tyson Foods, Inc. formed a partnership with Protix, which produces insect-based ingredients to boost sustainable protein production. Tyson Foods acquired a minority stake in Protix to help expand its worldwide operations while working together on U.S. insect ingredient production facilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the protein ingredients market based on the below-mentioned segments:

Global Protein Ingredients Market, By Product

- Plant Protein

- Animal/Dairy Protein

- Microbe-based Protein

- Insect Protein

Global Protein Ingredients Market, By Application

- Food & Beverages

- Infant Formulations

- Clinical Nutrients

- Animal Feed

- Others

Global Protein Ingredients Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa