Phase-Transfer Catalyst Market Summary

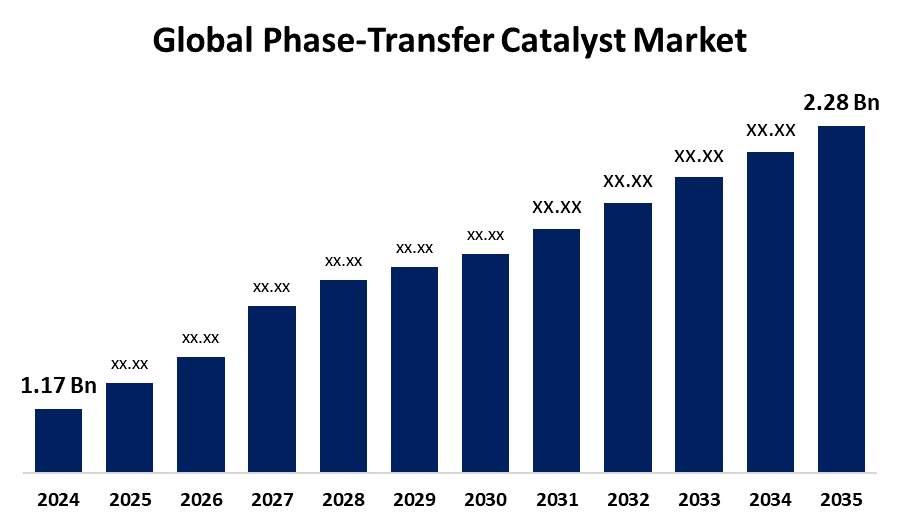

The Global Phase-Transfer Catalyst Market Size was valued at USD 1.17 Billion in 2024 and is projected to reach USD 2.28 Billion by 2035, Growing at a CAGR of 6.25% from 2025 to 2035. Due to a number of factors, such as use in green chemistry, growing applications across a range of industries, and the growing demand from emerging economies, the phase-transfer catalyst (PTC) market is expanding.

Key Regional and Segment-Wise Insights

- In 2024, the North American phase-transfer catalysts market held a 26.8% market share, dominating the global market.

- The market for phase-transfer catalysts in the United States occupied a prominent place in North America.

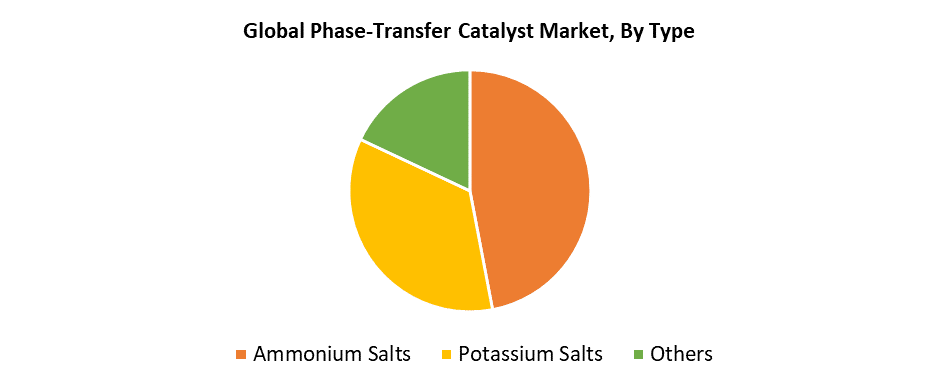

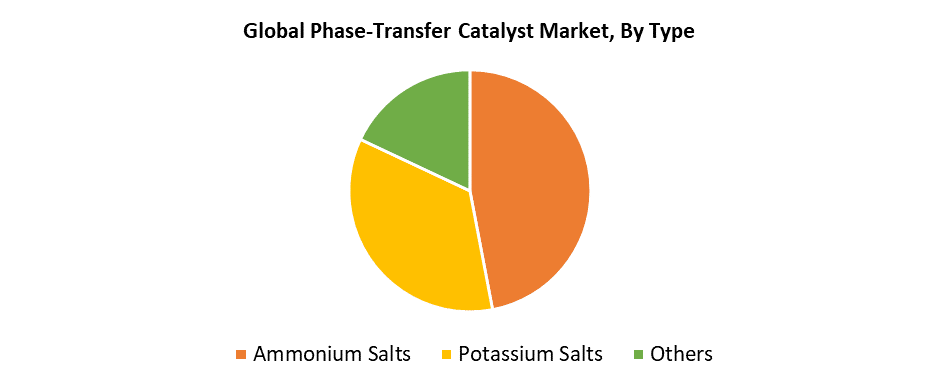

- With a 47.4% market share in 2024, the ammonium salts category had the biggest revenue share by type.

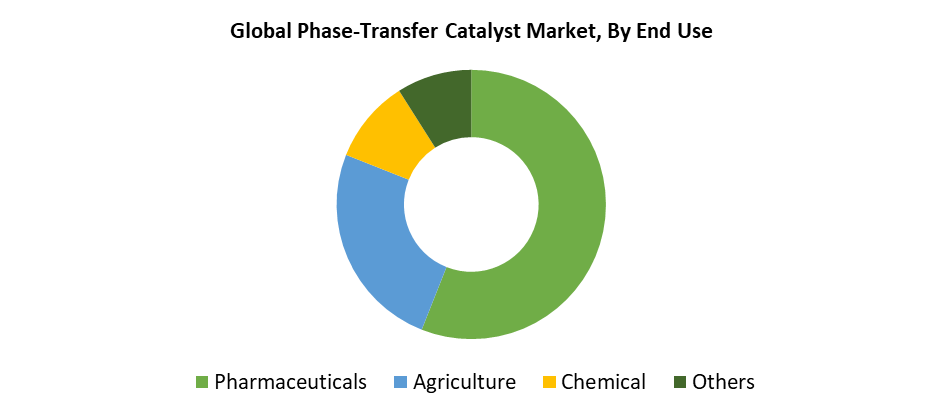

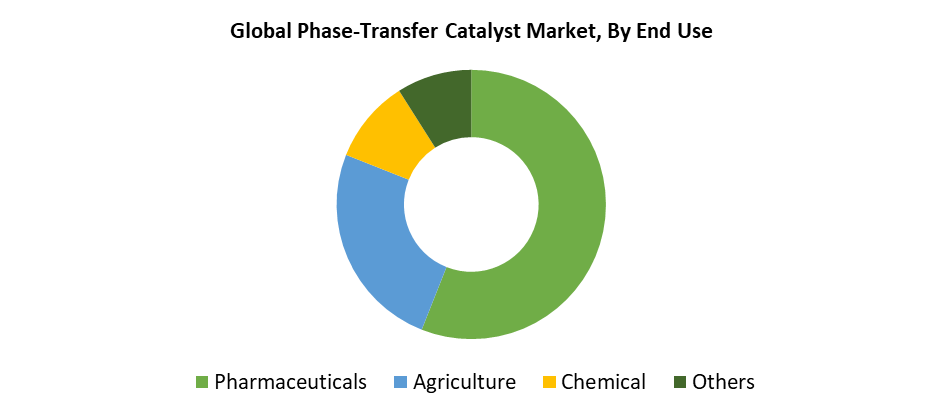

- In 2024, the pharmaceuticals category led the market by end use.

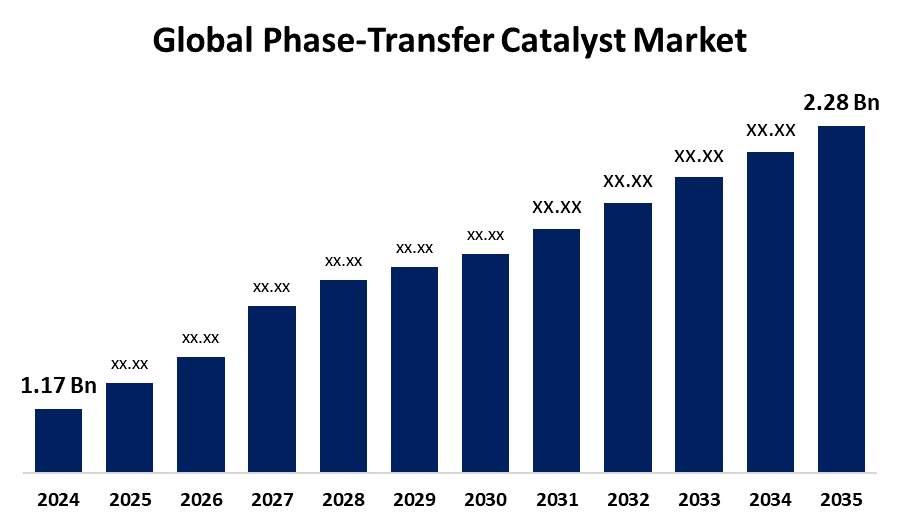

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.17 Billion

- 2035 Projected Market Size: USD 2.28 Billion

- CAGR (2025-2035): 6.25%

- North America: Largest market in 2024

The phase-transfer catalyst (PTC) market represents the worldwide business of chemical compounds that facilitate interactions across different phases of substances. The global phase-transfer catalyst (PTC) market experiences strong growth because of synthetic chemistry advancements and rising needs for selective, effective chemical processes. PTCs function to connect reactions that occur in immiscible phases to produce complex compounds through safer and more gentle methods. Scientists require reliable and versatile catalysts such as PTCs to develop more complex chemical processes while chemical demand increases. These catalysts find widespread application in fields that require high yield, purity, and selectivity, such as medicines, agrochemicals, and fine chemicals. Process efficiency improves through PTCs because they shorten reaction times and allow the use of cheap sodium hydroxide bases, thus providing both productivity gains and cost savings.

The PTC market experiences growth because environmental responsibility, together with sustainability, serves as a key market driver. Industries are adopting cleaner synthesis methods because both consumers and regulators demand environmentally friendly chemical production methods. The use of PTCs enables chemical reactions to take place in water environments, which significantly cuts down the need for dangerous organic solvents and chemical waste production. The pharmaceutical industry, which serves as a major consumer of PTCs, obtains enhanced reaction control, which leads to higher product yield and selectivity. The industrial application of PTCs expands because of new catalyst design approaches that stem from academic and industrial partnerships to address various reaction types, such as esterification, asymmetric synthesis, and alkylation. The global market growth accelerates through these developments because they enhance catalyst performance while broadening industrial applicability.

Type Insights

The ammonium salts segment held the largest revenue share, accounting for 47.4% in 2024. The ammonium salts segment experiences major growth because it plays a fundamental role in essential chemical processes, including alkylation and nucleophilic substitution, which find extensive use in both chemical and polymer industries. The quaternary ammonium compound tetra-n-butylammonium bromide (TBAB) serves as a phase-transfer catalyst for Williamson ether synthesis, which produces ethers along with medicinal intermediates and surfactants. The agrochemical and pharmaceutical sectors drive TBAB demand since they require efficient, scalable synthesis methods. The domestic pharmaceutical manufacturing sector receives backing from government entities, which strengthens this trend in the market. The business employs ammonium salts for their ability to transfer anion and monomer components that result in safer, cleaner, and more effective chemical production processes.

Potassium salts serve essential functions during halogenation and esterification processes through the formation of stable water-soluble complexes, which enhance reaction performance, thus enabling the expansion of the potassium salts segment throughout the forecasted period. The agrochemical industry utilizes potassium salt-based phase-transfer catalysts to produce herbicides, along with insecticides and pest control agents. Their ability to enable precise and secure reactions supports the industry's shift toward greener manufacturing methods. The use of phosphonium salts continues to increase because these compounds deliver outstanding catalytic effectiveness when working with sensitive or complicated chemical reactions. Their distinctive characteristics enable better reaction management and product selectivity, which makes them ideal for specialized applications such as advanced material production and sensitive compound synthesis. These market segments play a major role in keeping the phase-transfer catalysts market diverse and innovative.

End Use Insights

The pharmaceutical sector dominated the phase-transfer catalyst market in 2024 because of rising demand for cleaner and more efficient synthesis methods. PTCs serve as vital components for medication formulation and development since they enable phase interactions and decrease reliance on dangerous organic solvents and toxic reagents. Environmental and safety regulations, primarily in North America and Europe, drive the adoption of more sustainable manufacturing practices. The production of complex pharmacological compounds and intermediates for high-purity active pharmaceutical ingredients (APIs) requires PTCs as essential components. The demand for chiral compounds in drug research has driven increased use of PTCs for asymmetric synthesis because they enhance selectivity to produce therapeutic agents with optical activity.

The agriculture segment will experience significant growth throughout the forecast period because of increasing phase-transfer catalyst (PTC) applications in agrochemical manufacturing. PTCs improve reaction selectivity and efficiency, allowing important chemical reactions to occur in softer environments with lower energy requirements and streamlined purification procedures. They are therefore perfect for the industrial manufacturing of fungicides, insecticides, and herbicides on a large scale. The production of modern pest control and crop defense products demands the synthesis of specialty agrochemicals together with crown ether extraction from water-based environments. The agricultural sector's requirement for cheaper ecological solutions drives the adoption of PTCs because they enable faster chemical synthesis with lower environmental impact.

Regional Insights

North America maintained the leading market position in the global phase-transfer catalysts (PTCs) market, accounting for 26.8% in 2024, because of its strong industrial foundation and favorable regulatory framework. The area contains top-level agrochemical and pharmaceutical companies that deploy PTCs for improved safety and environmental protection during high-value compound production. The US and Canada have strict environmental and safety laws that drive the adoption of cleaner chemical processes through the use of PTCs as essential instruments. The market expands at a faster rate because government support provides research and development funding to pharmaceutical companies. North America maintains its leading position in the global PTC market because it possesses state-of-the-art research facilities and focuses on sustainable chemistry, which drives continuous development of catalyst technologies.

U.S. Phase-Transfer Catalyst Market Trends

The North American market for phase-transfer catalysts is dominated by the United States because the chemical and pharmaceutical sectors, along with agrochemical industries, drive a strong market need. The market adoption of PTCs grows because these catalysts deliver enhanced processing results while reducing expenses and enabling sustainable manufacturing. The accelerated adoption of PTCs in complex synthesis processes stems from increasing research and development spending, particularly for specialized and green chemicals in this region. Through its ability to simplify manufacturing processes and decrease solvent usage, these catalysts advance national sustainability targets. The EPA's Green Chemistry Challenge Awards, together with other regulatory bodies, support the use of emission-reducing technologies, including PTCs. The U.S. market continues to advance because of new catalyst development and increased focus on sustainable production methods.

Europe Phase-Transfer Catalyst Market Trends

Europe maintained a significant share of the global phase-transfer catalyst (PTC) market in 2024 due to its strong industrial foundation and commitment to environmentally friendly chemical manufacturing. The specialized chemicals market in Europe uses PTCs extensively for the production of resins, plastics, coatings, adhesives, and cosmetics because these products represent major sectors in the region. The catalysts help manufacturers obtain better product yields and produce less dangerous waste while improving the efficiency of chemical reactions, thus meeting the region's strict environmental standards. Europe's leadership in green chemistry, together with its commitment to environmentally friendly technologies, drives the adoption of phase-transfer catalysts as safer and cleaner chemical processing solutions. The use of PTCs in Europe helps achieve sustainable industrial growth, environmental compliance, and innovation because they reduce hazardous reagent requirements and boost process performance.

Asia Pacific Phase-Transfer Catalyst Market Trends

The Asia Pacific region is expected to grow at the fastest CAGR during the forecasted period because of its expanding chemical production facilities and fast industrial development. High market demand stems from the pharmaceutical, agrochemical, and specialty chemical sectors because PTC adoption enhances manufacturing efficiency and cuts costs while enabling sustainable production. The PLI Program by the Indian government supports local pharmaceutical manufacturing operations while helping market players improve their competitiveness. The adoption of PTC increases because companies invest in research and development, together with innovative manufacturing approaches. The adoption of PTC becomes faster because environmental regulations become more demanding, while the industry turns toward sustainable technology solutions. Asia Pacific holds a key position to drive the global phase-transfer catalyst market growth because of these factors.

Key Phase-Transfer Catalyst Companies:

The following are the leading companies in the phase-transfer catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- SACHEM, INC.

- Tatva Chintan Pharma Chem Limited

- Pacific Organics Pvt Ltd

- Central Drug House

- Tokyo Chemical Industry Co., Ltd.

- Pat Impex

- Volant-Chem Corp.

- Nippon Chemical Industrial Co., Ltd.

- Otto Chemie Pvt. Ltd.

- Others

Recent Developments

- In March 2025, the board of NAGASE & CO., LTD. passed a resolution to buy the Asian operations of SACHEM Inc., which produces high-purity chemicals for semiconductor applications. The strategic plan consisted of acquiring five SACHEM subsidiaries, including SACHEM Wuxi Co., Ltd.. Through this acquisition, NAGASE gained better standing within the chemicals industry while boosting its ability to develop high-purity chemical solutions together with partners.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the phase-transfer catalyst market based on the below-mentioned segments:

Global Phase-transfer Catalyst Market, By Type

- Ammonium Salts

- Potassium Salts

- Others

Global Phase-transfer Catalyst Market, By End Use

- Pharmaceuticals

- Agriculture

- Chemical

- Others

Global Phase-transfer Catalyst Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa