Global Positioning Systems Market Summary

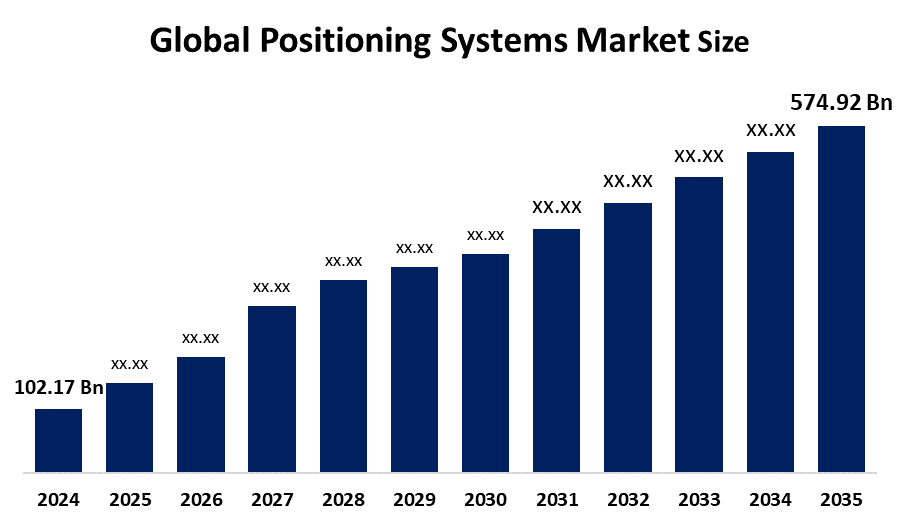

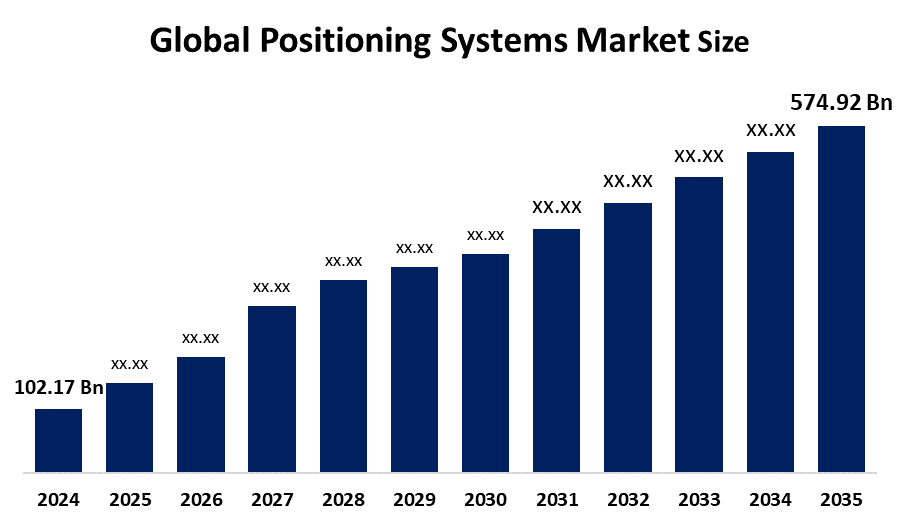

The Global Positioning Systems Market Size Was Estimated at USD 102.17 Billion in 2024 and is Projected to Reach USD 574.92 Billion by 2035, Growing at a CAGR of 17.01% from 2025 to 2035. The market for positioning systems is expanding due to the growing need for precise location services across many industries, the extensive use of smartphones and Internet of Things devices, and the incorporation of cutting-edge technologies like artificial intelligence, big data, and 5G.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 36.6% and dominated the market globally.

- In 2024, the consumer devices segment had the highest market share by deployment, accounting for 44.3%.

- In 2024, the location-based services segment had the biggest market share by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 102.17 Billion

- 2035 Projected Market Size: USD 574.92 Billion

- CAGR (2025-2035): 17.01%

- Asia Pacific: Largest market in 2024

The Positioning Systems Market Size comprises products and services that depend on satellite-based systems such as GPS and GNSS, and indoor positioning technologies to precisely determine the exact location of objects, vehicles, and people. These systems play a vital role in delivering location-based services and tracking and navigation solutions to multiple sectors, including logistics, healthcare, automotive, aerospace, and defense. Autonomous vehicle adoption, together with smart city development, fleet management optimization, and mobile applications based on location services, represent significant market growth drivers. The growing number of Internet of Things (IoT) devices, together with improved mobile connectivity, drives the worldwide expansion of markets that require precise real-time positioning data.

The development of positioning systems undergoes substantial progress through technological advancements, which enhance both system accuracy and reliability. Performance levels reach higher thresholds through the combined effects of 5G networks and multi-constellation GNSS with AI-powered location analytics, even in complex operational scenarios. The healthcare sector, along with retail establishments increasingly adopting Bluetooth, Wi-Fi, and ultra-wideband technology for their indoor positioning needs. Multiple nations worldwide allocate funding toward space-based systems and smart transport development and create regulatory structures to protect navigation security. These programs promote the development of innovative positioning technology solutions and lead to market growth.

Deployment Insights

The consumer devices segment led the positioning systems market with 44.3% revenue share in 2024. Consumer devices dominate the market because wearable technology, along with smartphones, tablets, and other personal electronics, primarily depend on positioning technologies for location-based service, fitness monitoring, and navigation. Position awareness became standard in consumer gadgets because GPS and satellite navigation systems integrated more deeply, which led to increased demand. The market continues to grow because customers show increasing interest in social networking applications as well as augmented reality and mobile gaming applications. The expanding market share of positioning system installations in consumer products receives continuous support from ongoing device miniaturization, battery performance improvements, and enhanced connectivity, which maintains their market leadership.

The automotive telematics systems segment is expected to grow at the fastest CAGR during the projection period. The explosive growth of ADAS and autonomous driving systems, along with connected car demand, depends on precise positioning data, which drives this market expansion. The modern automotive industry depends on telematics systems for real-time vehicle tracking and navigation as well as fleet management and enhanced safety features. The installation of telematics systems receives support from rising government regulations, which target both pollution reduction and road protection. The deployment of automotive telematics becomes more powerful through 5G connectivity combined with AI analytics, which drives segment innovation and accelerates market development.

Application Insights

The location-based services (LBS) segment held the largest revenue share in the positioning systems market during 2024. The widespread use of smartphones, tablets, and wearable devices, which need positioning systems for navigation, local search, social networking, ride-hailing, and targeted advertising, drives this market dominance. The segment grows because organizations need instant location information for their urban mobility, retail, and tourism operations. The rising demand for accurate geolocation services emerged from the expanding mobile commerce sector and customized marketing approaches. LBS dominates the global market because data analytics improvements, together with 5G connectivity and location precision developments, enhance its effectiveness.

During the forecast period, the road segment in the positioning systems market will experience a substantial CAGR. The expanding use of connected car technologies, along with ADAS and autonomous driving solutions, drives the market since these technologies need precise positioning data to operate safely and effectively. Positioning technology requirements increase because smart transportation infrastructure, including intelligent traffic management and tolling systems, is expanding. The market growth receives additional momentum from the rising importance of real-time navigation systems, fuel efficiency, and vehicle safety for commercial and passenger vehicles. Governments' investment in smart transportation initiatives, together with automakers' development of advanced positioning technology, will drive substantial growth in the road market.

Regional Insights

The North American global positioning systems (GPS) market maintained stable growth during 2024 because consumer electronics, automotive, defense, and aviation sectors showed strong market demand. The industry maintains its expansion potential through the widespread adoption of GPS-enabled devices that include wearables, smartphones, and vehicle navigation systems. The automotive sector needs better precision from GPS systems because of the rising number of connected and autonomous vehicles. The US government maintains ongoing funding for satellite infrastructure development and GPS modernization, which enhances signal availability, together with accuracy and reliability. The market expands through advancements in location-based services, together with fleet management solutions and real-time tracking systems. GPS technology development and deployment remain essential for North America because of its advanced technological framework and comprehensive regulatory system.

Europe Global Positioning Systems Industry Trends

The European market for global positioning systems (GPS) is growing significantly because industries such as consumer electronics, logistics, transportation, agriculture, and defense need increasing amounts of GPS technology. The adoption of high-precision GPS technologies expands throughout Europe because the continent focuses on advanced navigation systems combined with autonomous driving and smart mobility solutions. The European Union benefits from the Galileo satellite navigation system, which provides precise positioning capabilities for multiple commercial and government applications. The market growth stems from increasing investments in cross-border logistics, together with intelligent transportation systems and smart city initiatives. The strong regulatory environment, together with technological advancement and major industry partnership development, makes Europe a key center for GPS-enabled system development.

Asia Pacific Global Positioning Systems Industry Trends

The Asia Pacific region led the global positioning systems (GPS) market with 36.6% revenue share in 2024. The leading position of this region stems from fast urban development, together with growing industrial activity and increasing requirements for GPS-enabled devices used in consumer electronics, automotive, transportation, and agricultural sectors. Multiple nations, including China, India, Japan, and South Korea, allocate substantial funding toward smart city initiatives, intelligent transportation systems, and defense modernization because these projects rely on advanced positioning technologies. The rising usage of smartphones and IoT devices has substantially boosted the demand for GPS services. The worldwide GPS market finds its strongest position in the Asia Pacific due to regional satellite systems, BeiDou from China and NavIC from India, which enhance positioning capabilities.

Key Global Positioning Systems Companies:

The following are the leading companies in the global positioning systems market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- TomTom International BV

- Topcon Positioning Systems, Inc.

- Collins Aerospace

- Hexagon AB

- MiTAC Holdings Corporation

- Garmin Ltd.

- Qualcomm Technologies, Inc.

- Trimble Inc.

- Septentrio N.V.

- Swift Navigation

- Others

Recent Developments

- In June 2025, Garmin Ltd. unveiled the GPSMAP 15x3 chartplotter, which was created to improve sailing, boating, and cruise navigation. Its ultrawide 15-inch high-resolution touchscreen offers exceptional clarity and a sleek, contemporary appearance. Its glass edge-to-edge display blends in perfectly with a variety of dash configurations, giving users the advantage of two screens without having to install additional devices. This simplified approach facilitates the viewing and access of critical applications and data when traveling by sea.

- In June 2025, TomTom International BV and NextBillion.ai, a Singapore-based AI mapping company, announced an expanded collaboration to provide extremely precise route computations and travel time estimates for the worldwide logistics, fleet, and mobility industries. By integrating TomTom's Orbis Maps into its API-first platform, NextBillion.ai facilitates better route optimization, more efficient scheduling, and smooth integration for enterprise apps throughout the globe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the positioning systems market based on the below-mentioned segments:

Global Positioning Systems Market, By Deployment

- Standalone tracker

- Portable Navigation Devices

- Automotive Telematics Systems

- Consumer Devices

- Others

Global Positioning Systems Market, By Application

- Road

- Aviation

- Marine

- Location-Based Services

- Surveying & Mapping

- Others

Global Positioning Systems Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa