LCD Glass Market Summary

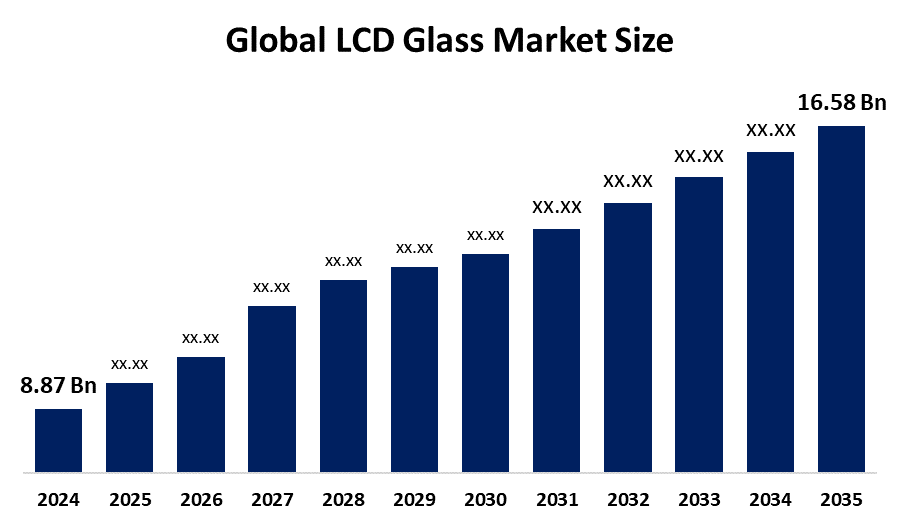

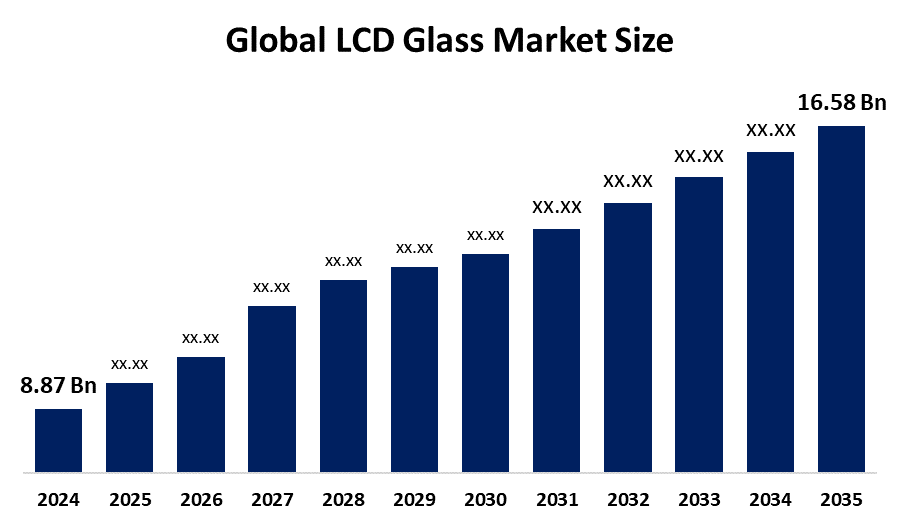

The Global LCD Glass Market Size Was Estimated at USD 8.87 Billion in 2024 and is Projected to Reach USD 16.58 Billion by 2035, Growing at a CAGR of 5.85% from 2025 to 2035. The market for LCD glass is growing mostly due to the rising demand for consumer electronics like laptops, TVs, and smartphones, as well as the growing use of high-resolution displays and LCD integration in automotive applications like infotainment systems and digital dashboards.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of 47.5% and dominated the market globally.

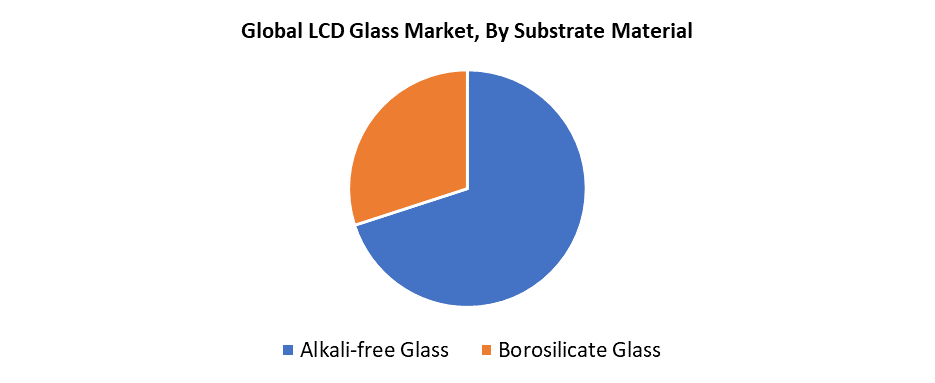

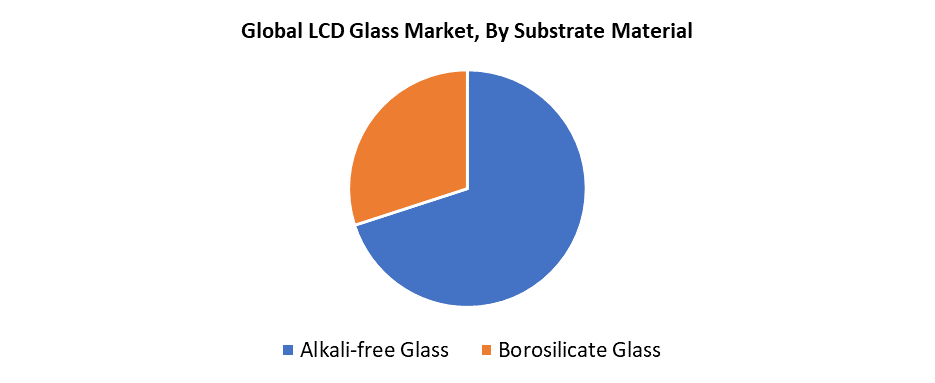

- In 2024, the alkali-free glass segment had the highest market share by substrate material, accounting for 37.4%.

- In 2024, the LCD TVs segment had the biggest market share by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.87 Billion

- 2035 Projected Market Size: USD 16.58 Billion

- CAGR (2025-2035): 5.85%

- Asia Pacific: Largest market in 2024

The LCD Glass Market Size consists of a dedicated industry that manufactures high-quality glass substrates for LCDs that function in televisions, smartphones, monitors, tablets, and automobile displays. The glass component of LCD screens determines both their longevity and their image clarity and resolution. Market growth primarily results from increasing worldwide consumer electronics requirements and display panel technology enhancements, and larger screen demand. Market expansion receives additional support through the rising adoption of 4K and 8K resolution displays alongside expanding LCD applications in both medical and automotive fields. The consumption of LCD glass increases because urbanization trends and rising disposable incomes generate more demand for smart devices and flat-panel TVs.

The advancements in LCD glass technology produce thinner and stronger materials, which make electronic devices lighter while enhancing durability. The industry meets evolving customer needs by implementing cutting-edge technology such as ultra-thin glass, along with improved optical clarity and enhanced scratch and impact resistance. Governments assist the electronics and display manufacturing industries through financial support and infrastructure development, and favorable trade regulations. The market growth stems from domestic display manufacturing support programs that primarily benefit China, South Korea, and India.

Substrate Material Insights

The alkali-free glass segment held the largest revenue share in the LCD glass market during 2024. This segment gained market dominance because its outstanding characteristics suit high-resolution and precision display needs. The material contains outstanding thermal stability, together with chemical resistance and outstanding electrical insulation properties. The performance of thin-film transistors in LCD panels requires absolutely low contamination levels, which alkali-free glass provides during production. The extensive application of alkali-free glass in televisions, smartphones, tablets, and advanced electronic displays has driven its demand to increase substantially. The strong market position of alkali-free glass substrates remains strong because of ongoing display technology enhancements and growing production of high-definition panels.

The borosilicate glass segment within the LCD glass market will experience the fastest CAGR during the forecast period. The material proves perfect for complex LCD applications, which need high-temperature production capabilities because it offers outstanding heat resistance and minimal thermal expansion alongside strong durability. The chemical stability of borosilicate glass results in longer lifespan and enhanced dependability for display panels. The market growth stems from increasing adoption of this technology in industrial monitors and automobile displays, as well as specialized medical equipment. The rising requirement for sturdy and high-performance displays, mainly in tough operating conditions, is driving increased market demand. Manufacturers dedicate resources toward borosilicate-based innovations because they want to develop next-generation, durable, and energy-efficient LCD panels.

Application Insights

The LCD TVs segment held the largest revenue share in the LCD glass market in 2024. The broad use of LCD technology in televisions emerged as the primary factor behind this market dominance because consumers wanted large-screen displays with high resolution at affordable prices. The worldwide demand for LCD TVs remains strong because they offer affordable pricing along with superior visual quality, which makes them popular in developing countries. The need for high-quality LCD glass has surged because of display technology advancements such as panel thinning and enhanced color precision, and 4K and 8K resolution standards. The sustained market leadership of this segment stems mainly from increased urbanization, higher disposable incomes, and expanding smart TV adoption in households.

During the forecast period, the desktop monitors segment is expected to grow at the fastest CAGR. The expanding requirement for advanced monitors used in professional business and gaming settings propels this growth. Users now seek bigger displays that deliver precise color performance alongside faster refresh rates and enhanced resolution because remote work, digital content creation, and e-sports popularity continue to rise. These qualities call for sophisticated LCD glass substrates. Ultra-wide screens and multi-monitor setups also propel demand growth. Technological advancements in display panels, including curved and frameless designs, help improve user experience and accelerate market adoption. The segment achieves rapid international growth because of increased digital workspace investments and expanding IT infrastructure worldwide.

Regional Insights

The Asia Pacific region led the LCD glass market with the largest revenue share of 47.5% during 2024 because it has strong manufacturing facilities and growing consumer electronics needs. The production of LCD glass receives strong support from the established supply chain because key display panel and electronics manufacturing facilities exist across China, South Korea, Japan, and Taiwan. LCD-based devices, including TVs, smartphones, tablets, and monitors, have increased demand in the region through fast urbanization and higher consumer income, and widespread appliance adoption. Government programs supporting domestic manufacturing, together with rising display technology investments and infrastructure spending, have strengthened the market position of this region. The Asia Pacific region emerges as a worldwide hub for LCD glass development because it hosts leading companies alongside continuous innovation in the field.

North America LCD Glass Market Trends

During the forecast period, North America is expected to experience continuous growth in the LCD glass market because consumers demand better display panels in consumer electronics and automotive and healthcare, and industrial sectors. Modern display technologies, including 4K and 8K, along with rising smart TV and gaming monitor, and touchscreen device usage, are driving up market demand. The region's innovative approach and presence of major electronics and technology companies enable advanced LCD glass applications across multiple sectors. The increasing use of LCDs for medical imaging, along with automotive infotainment systems and rising domestic manufacturing and R&D investments, helps drive North America's market growth.

Europe LCD Glass Market Trends

The European LCD glass market will experience steady growth throughout the forecasted period due to increasing demand for high-resolution display technologies across consumer electronics, automotive, and healthcare sectors. The automotive sector in Germany and France demonstrates strong growth through its increasing adoption of LCD screens in vehicle instrument clusters, infotainment systems, and dashboards. Smart home devices and connected gadgets are creating a rising demand for advanced display panels. Europe promotes sustainable energy-efficient technology through its use of durable and efficient LCD glass products. The LCD glass market across the region expands due to rising digital infrastructure investments, together with medical imaging improvements and professional-grade monitor technological advancements.

Key LCD Glass Companies:

The following are the leading companies in the LCD glass market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Glass Co., Ltd. (AGC)

- Sharp Corporation

- BOE Technology Group Co., Ltd.

- Nippon Electric Glass Co., Ltd. (NEG)

- China National Building Material Group Corporation (CNBM)

- Samsung Display Co., Ltd.

- Corning Incorporated

- Schott AG

- LG Display Co., Ltd.

- TCL Technology Group Corporation

- Others

Recent Development

- In May 2024, Vedanta Limited declared that it would buy a further 46.57% of the Japanese display glass maker AvanStrate Inc. from HOYA Corporation, bringing its ownership interest to 98.2%. The purchase is a major step in Vedanta's plan to expand into high-tech manufacturing, particularly in electronics, in addition to natural resources. AvanStrate's competence in LCD glass substrates, along with its more than 700 patents and state-of-the-art production facilities in Asia, will help Vedanta realize its goal of creating India's first integrated fabrication plant for display glass and panels.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the LCD glass market based on the below-mentioned segments:

Global LCD Glass Market, By Substrate Material

- Alkali-free Glass

- Borosilicate Glass

Global LCD Glass Market, By Application

- LCD TVs

- Desktop Monitors

- Notebook PCs

- Smartphones & Tablets

- Others

Global LCD Glass Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa