Back to School Market Summary

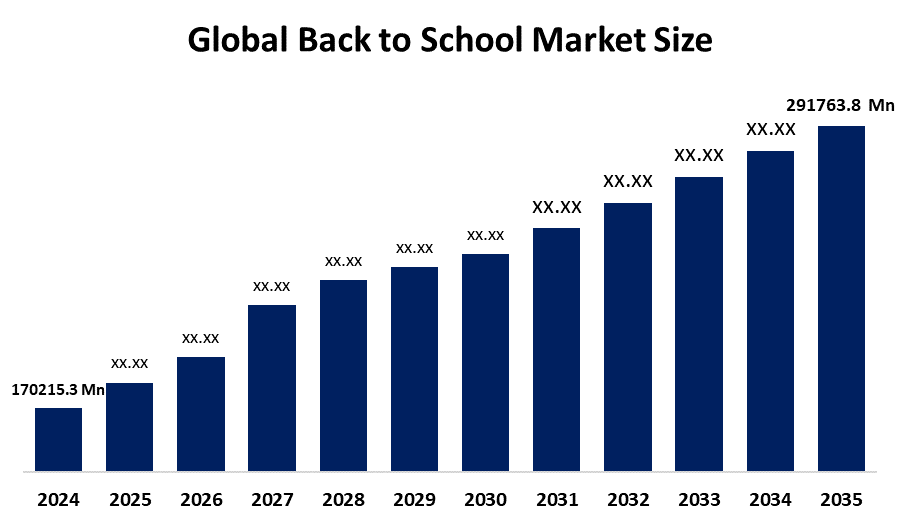

The Global Back to School Market Size Was Estimated at USD 170215.3 Million in 2024 and is Projected to Reach USD 291763.8 Million by 2035, Growing at a CAGR of 5.02% from 2025 to 2035. The back-to-school market is boosted by growing e-commerce, seasonal promotions, tech-driven education, and rising student enrollment.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share and dominated the market globally.

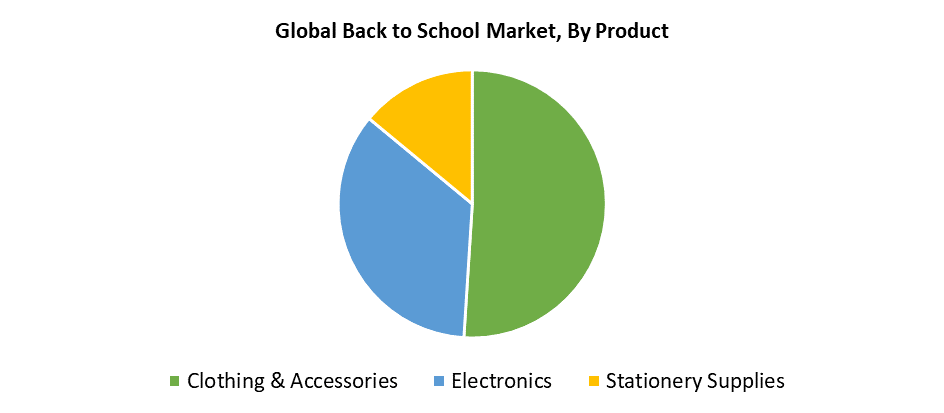

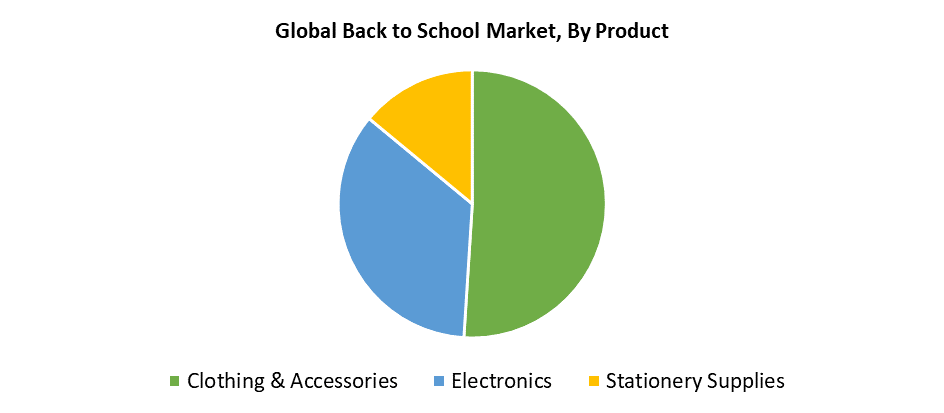

- In 2024, the clothing and accessories segment had the highest market share by product, accounting for 51.75%.

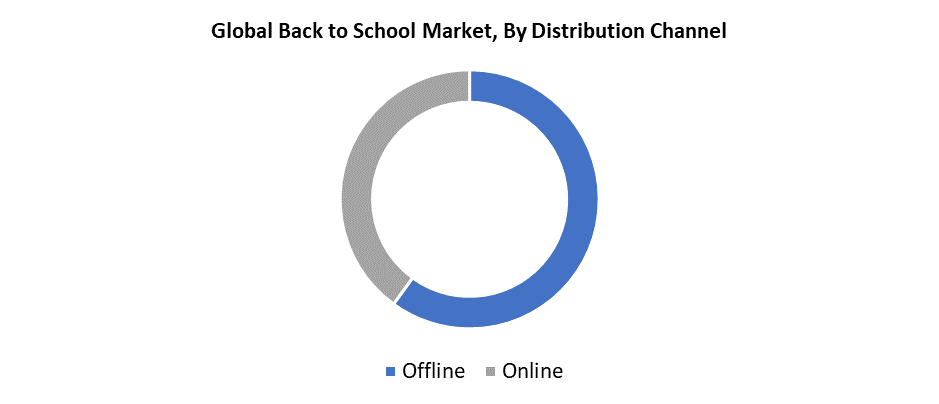

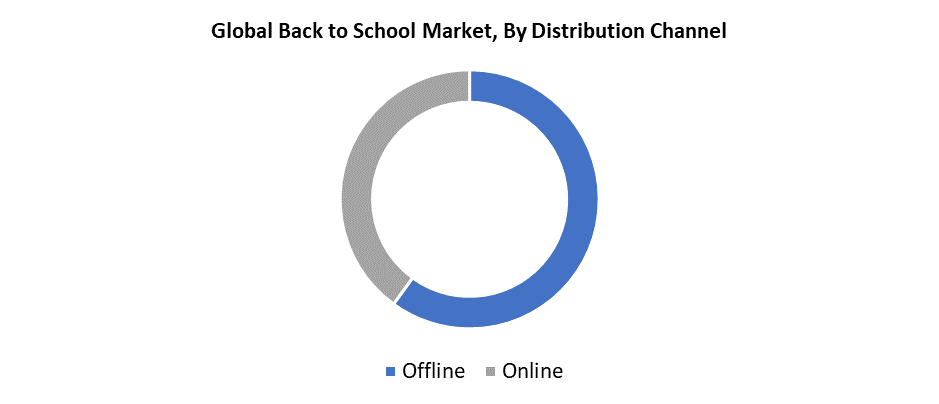

- In 2024, the offline segment had the biggest market share by distribution channel, accounting for 60.72%.

Global Market Forecast and Revenue Outlook

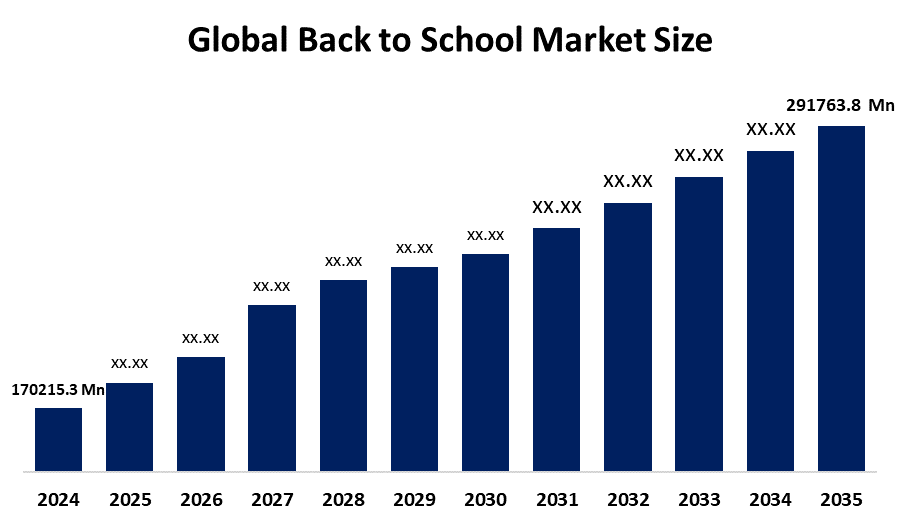

- 2024 Market Size: USD 170215.3 Million

- 2035 Projected Market Size: USD 291763.8 Million

- CAGR (2025-2035): 5.02%

- Asia Pacific: Largest market in 2024

The Back to School Market encompasses the retail season and product sales that target students who need supplies for their upcoming academic year. A rising count of students, along with increasing educational quality standards, serve as primary drivers for the expanding Back to School market. Educational institution growth directly correlates with rising demand for school supplies, along with uniforms, stationery items, and learning materials. Customer demand for personalized high-quality learning resources drives the market growth. Parents now spend more money on environmentally friendly products such as recycled notebooks and biodegradable lunch boxes because of their growing environmental awareness. Technology advancements in digital learning tools, together with tablets and educational software, are crucial for the market growth because families select resources that support hybrid and distant learning models following COVID.

Additionally, the Back to School market experiences growth due to the increasing implementation of e-commerce and omnichannel retail strategies. Customers benefit from online shopping through easy navigation combined with extensive product selection and straightforward price comparisons, which allows budget-conscious parents to select the best items. Retailers leverage digital technology to fulfill student demand for unique items by offering custom-made school supplies such as personalized backpacks and monogrammed stationery. During back-to-school sales events, customers can find discounted products alongside special pricing deals that minimize inflationary effects and increase consumer purchases. The demand for portable high-performance tech products such as laptops with extended battery life and lightweight construction persists because students need adaptable equipment to learn both in classrooms and online.

Product Insights

The clothing and accessories sector accounted for 51.75% of worldwide sales in 2024 because of the necessity of school-appropriate apparel for all age groups. At the start of the academic year, families prefer versatile clothing which meets school dress codes and environmental needs, thus leading to the purchase of layered garments, including jackets, long-sleeved shirts, and durable footwear. The mandatory uniform guidelines create additional purchase requirements which drive customers to spend their money on suitable attire. The fashion-oriented students drive segment growth by purchasing clothing with character-themed accessories and branded items along with trend-conscious apparel. The market receives substantial contributions from sports equipment alongside headgear and backpacks. This essential market experiences consistent growth because back-to-school shopping season and parental preference for quality and comfortable products create continuous demand.

The electronics sector will experience a steady growth rate of 5.9% throughout the forecasted period because of technology advancement in educational institutions. Modern students require reliable electronic equipment such as laptops, tablets, and smartphones for their academic activities and digital platform access, which has become standard in higher education and hybrid learning settings. The demand for high-performance educational gadgets increases because parents want to invest in devices that enhance their children's academic success. Students prefer electronic devices that combine advanced educational features with extended battery life, cloud integration, and superior performance capabilities. Back-to-school electronics will remain an essential market sector that will experience growth because educational technology development continues to accelerate.

Distribution Channel Insights

The offline distribution channel generated 60.72% of back-to-school product sales in 2024 since consumers prefer to shop in person. Physical stores allow customers to examine back-to-school products such as stationery, backpacks, and clothes before making their purchases. The offline shopping experience becomes even more appealing because stores offer seasonal specials, package deals, and in-store discounts, which motivate customers to buy early. Families can count on knowledgeable staff to help them handle specific school-related needs. Families enjoy shopping at physical stores because the experience helps them connect, thus building anticipation for the next school year. Physical channels continue to lead the market because they offer customers tangible products combined with emotional connections and marketing promotions.

The online distribution channel for back-to-school goods will experience a 5.7% CAGR throughout the forecasted period because it provides simplicity together with effectiveness to children and working parents. Online shopping platforms allow customers to browse through extensive product selections that include gadgets, stationery, and uniforms. Consumers obtain well-informed purchase decisions through pricing comparisons, customer reviews, and product recommendation features. Online companies boost their appeal through targeted back-to-school promotions, which include discounts and package deals as well as time-limited offers. The shopping process becomes more efficient through mobile applications and fast delivery choices. The market expansion will rely increasingly on online channels because digital adoption rises and consumers shift their preferences toward convenience.

Regional Insights

The North American back-to-school market accounted for 20.75% of worldwide revenue because customers now prefer sustainable products and environmentally friendly shopping options. School supply shoppers in the United States and Canada choose environmentally friendly products, which include ethically produced apparel together with biodegradable stationery and recycled paper goods. The sustainability focus in consumer decision-making reaches its peak in California and New York as these regions lead this trend. Retailers now supply environmentally friendly alternatives, which they promote through Facebook and Instagram social media platforms. The combination of convenience and sustainability through e-commerce platforms has resulted in increased customer loyalty. North America serves as an emerging socially responsible back-to-school shopping market because customers now favor ethical products.

Europe Back to School Market Trends

The European back-to-school market is expected to expand at a CAGR of 3.3% between 2025 and 2035 because of Europe's varied social and economic characteristics. Western European markets, including Germany and France, experience rising customer interest in high-end educational products along with digital learning tools and environmentally friendly items that improve educational experiences. Customers from these markets choose products based on quality standards together with innovation and sustainability. Eastern European families tend to focus on purchasing affordable school essentials at value-based prices. The retailer's approach depends on this duality because it needs to maintain both budget-friendly and premium product lines. The market growth finds its basis in rising e-commerce platforms and educational system reforms, along with growing consumer interest in integrating conventional learning tools with digital educational resources throughout the continent.

Asia Pacific Back to School Market

The Asia Pacific region dominated the back-to-school market globally in 2024 because of its large number of students and the return to physical classroom attendance. The back-to-school market in China, India, and Japan shows strong demand for traditional supplies, including stationery, backpacks, and uniforms. Additionally, educational technology products are also experiencing increasing sales. The combination of fast urban expansion and rising disposable income levels drives consumers to spend more on top-quality advanced school supplies. Premium educational resources have become essential for markets including Singapore and South Korea to preserve academic competitiveness. Government policies that enhance educational accessibility create rising demand for school supplies. These combined characteristics lead to Asia Pacific becoming a leading and rapidly growing market segment.

Key Back to School Companies:

The following are the leading companies in the back-to-school market. These companies collectively hold the largest market share and dictate industry trends.

- The ODP Corporation

- HP Inc.

- Newell Brands Inc.

- Staples Inc.

- ITC Ltd

- Acco Brands Corporation

- Faber Castell AG

- Apple Inc.

- Pelikan

- Mitsubishi Pencil Co. Ltd.

- Others

Recent Developments

- In August 2024, Apparel Group's R&B brand launched its Back-to-School Collection in the United Arab Emirates to deliver stylish schoolwear at budget-friendly prices that attract parents and students alike. The company pursued brand exposure growth through influencer partnerships while also implementing social media marketing to connect with younger customers.

- In February 2024, the merger of Mitsubishi Pencil with LAMY allows the company to grow its product offerings while building its premium stationery market presence for students during the start of each school year. Through this acquisition, Mitsubishi Pencil will gain better market position while developing brand partnerships, which will unlock new business potential for conventional and digital stationery markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the back to school market based on the below-mentioned segments:

Global Back to School Market, By Product

- Clothing & Accessories

- Electronics

- Stationery Supplies

Global Back to School Market, By Distribution Channel

Global Back to School Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa