Packaged Wastewater Treatment Market Summary

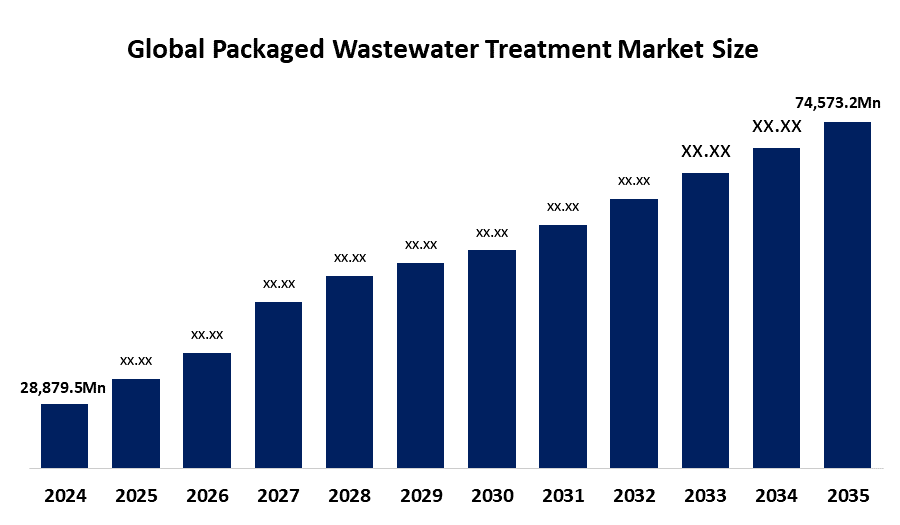

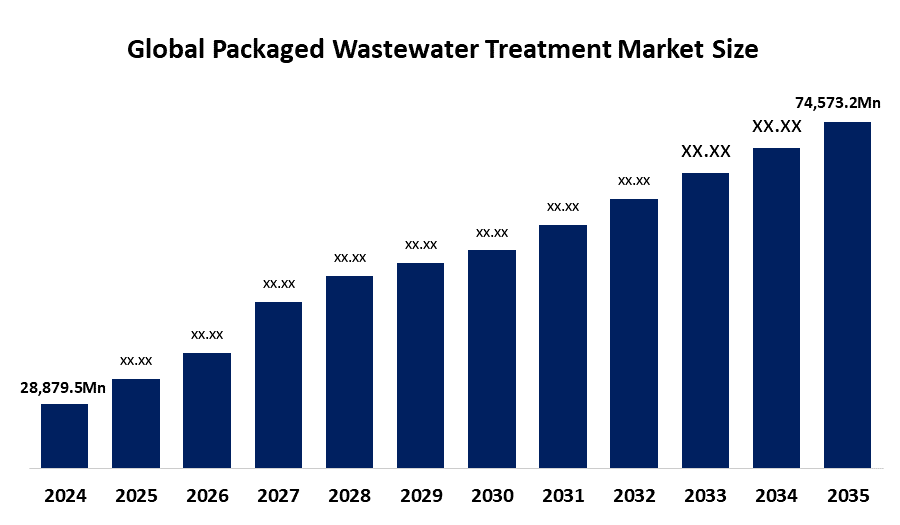

The Global Packaged Wastewater Treatment Market Size was valued at USD 28,879.5 Million in 2024 and is Projected To Reach USD 74,573.2 Million by 2035, Growing at a CAGR of 9.01% from 2025 To 2035. The packaged wastewater treatment market is primarily driven by factors such as rising urbanization and industrialization, more stringent environmental regulations, and the demand for affordable and space-efficient solutions.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the greatest revenue share of 32.8%, dominating the packaged wastewater treatment market.

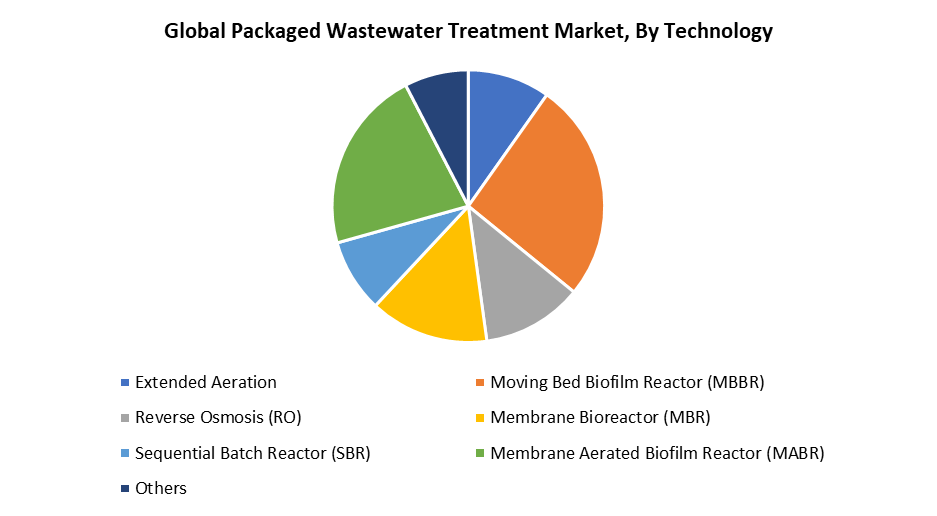

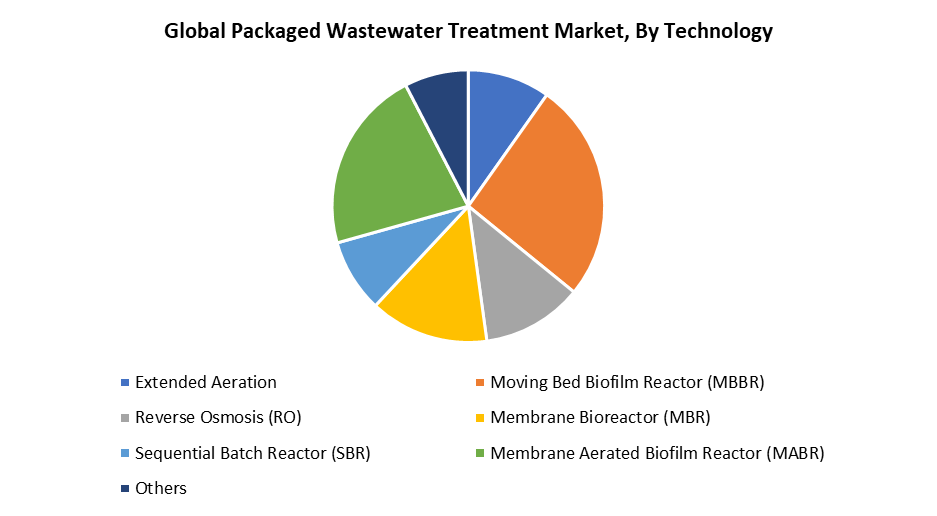

- In 2024, the moving bed biofilm reactor (MBBR) segment held the largest revenue share of 26.5% and led the market based on technology.

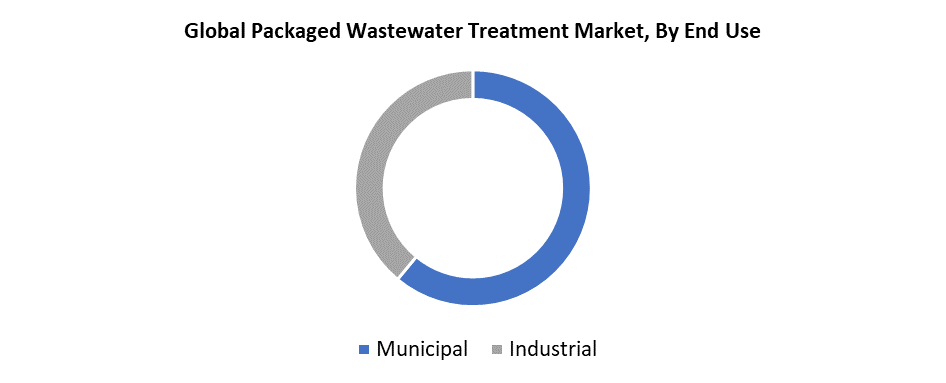

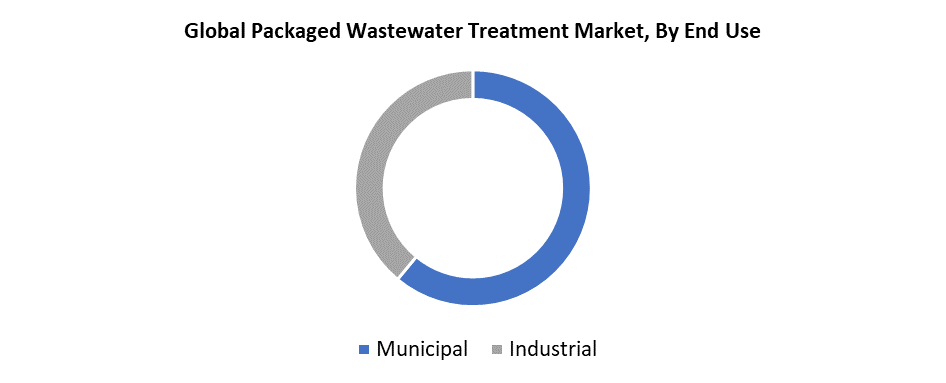

- Municipal dominated the market and generated the highest revenue share of 61.7% in 2024 based on end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 28,879.5 Million

- 2035 Projected Market Size: USD 74,573.2 Million

- CAGR (2025-2035): 9.01%

- Asia Pacific: Largest market in 2024

The packaged wastewater treatment market refers to the sector focused on pre-engineered, modular systems that treat sewage/wastewater as stand-alone treatment plants. Because they are typically pre-manufactured, installation is simpler and faster than conventional large treatment plants. The market for packaged wastewater treatment continues to grow, largely due to increasing population, urbanization, and tightening environmental regulations. The rising requirements of industrial situations, combined with a need for decentralized solutions, also contribute to the demand in the market, primarily in municipalities without central sewage systems. As freshwater resources are becoming increasingly scarce, the transition towards water recycling and reuse is expedited, with packaged systems offering what appears as both scalable and cost-effective solutions. Furthermore, as corporations and consumers prioritize sustainable practices as part of a corporate social responsibility (CSR) strategy, investments in sustainable treatment solutions are also growing.

Also, national government rules about discharge standards force both industry and municipalities to find an effective, yet economically sufficient treatment system to comply with regulations. Technical advancements in modular design, automation, IoT, and digital monitoring systems enhance operational efficiencies and facilitate real-time management of the systems. The market is trending toward decentralized wastewater treatment systems, especially in remote and fast-growing markets where traditional full-scale infrastructure may not otherwise be developed. The development of government programs and funding to improve water infrastructure across the World also supports market development worldwide. These facilitators and trends are creating a favourable environment for packaged wastewater treatment systems in the industrial, commercial, and municipal sectors.

Technology Insights

In 2024, the moving bed biofilm reactor (MBBR) segment accounted for 26.5% of the market, due to its ease of operation and high efficacy. This technology consists of an efficient and compact system for the treatment of waste with a small operational footprint, which makes it suitable for decentralized installations and areas with design limitations. Its minimal maintenance requirements will also be attractive to industrial and municipal users and have a direct impact on operating costs and complexity. Additionally, its modular systems are designed for scalability and can be expanded based on demand with ease. Its predictable performance under variable load conditions and differences in climate demonstrates its dependence. For these reasons, it has experienced increasing uptake worldwide and across numerous applications.

MABR continues to grow the fastest due to its energy efficiency and improved nitrogen removal capabilities. With the growing demand for low-energy and sustainable wastewater solutions, there is an acceleration in the implementation of MABR technology. The quality of effluent produced by MABR is ideal for water reuse initiatives, improving desirability. MABR systems consume considerably less energy than conventional aeration systems, meaning they are not only cheaper to operate, but are better for the environment. Additionally, MABR provides greater efficiency in nutrient removal and is appropriate for wastewater with higher nitrogen and carbon concentrations. These unique attributes are driving the adoption of MABR technology in municipal and industrial applications. MABR systems are scalable and adaptable for several uses and capacities, contributing to their rapid growth.

End Use Insights

In 2024, the municipal sector accounted for 61.7% due to growth in urban populations and the expansion of sanitation infrastructure. In the context of municipal wastewater treatment, wastewater flows which are municipal and non-potable sources. Municipal packaged systems are designed to effectively manage the high volumes associated with sewage and domestic wastewater. Decentralized systems are being implemented by governments, particularly in rural and peri-urban applications. Public sector investments and regulations are driving large-scale municipal installations. The outcomes provide reasonable assurances that returned treated water is safely returned to the environment or reused for non-potable purposes, including for agriculture, industrial uses, or landscape irrigation. Having these systems in place can also play an important role in public health, environmental stewardship, and water conservation through effective wastewater management.

The fastest-growing industrial segment is due to the increasing regulations on effluent discharge and water reuse requirements. As industries face stricter oversight on water usage and pollution management, the need for advanced and reliable wastewater treatment technologies is increasing. Industries like pharmaceuticals, food & beverage, and chemicals are in increasing need of compact high-efficiency systems to control increasingly complicated waste streams. These industries benefit from on-site treatment systems, which can reduce environmental impacts and enhance resource recovery. Furthermore, the increasing awareness of sustainability and conserving water usage is expanding the acceptance of industrial on-site systems. There are considerable monetary savings available from reduced use of centralized facilities, avoiding penalties for regulatory infractions, and more efficient completed treatment.

Regional Insights

The ongoing replacement of older infrastructure and stringent environmental regulations are propelling North America's impressive growth at a CAGR of 7.7%. Identification of water reuse and decentralized systems in rural settings will be a central focus in the U.S. and Canada. North America's stringent environmental regulations promote the adoption of innovative technologies in wastewater treatment. Growth in the industry has accelerated due to ongoing industrialization and urbanization alongside an increased focus on environmental sustainability. The existing growth trends around the municipal sector, industrial sector, and infrastructure renovation projects are driving demand for packaged systems. The region benefits from well-established companies in the industry, along with ongoing technology developments, which contribute to its continued growth. Technological developments and smart monitoring systems enhance the market attractiveness. The need for on-site treatment in industry is another important contributor to growth.

U.S. Packaged Wastewater Treatment Market Trends

The U.S. packaged wastewater treatment market is estimated to grow at a CAGR of 7.4% from 2025 to 2035. The United States has the most advanced infrastructure and environmental regulations, which have made it a leader in the North American packaged wastewater treatment market. There are now small, decentralized systems replacing aging municipal systems. Market growth will be driven by ongoing investments in water reuse systems and high industrial demand. The U.S. federal government’s water reuse initiatives, coupled with state-sponsored water reuse initiatives, also further support efforts to promote sustainable wastewater management. The rising emphasis on resource recovery and water reuse practices, mainly in metropolitan and industrial areas, is accelerating market growth as well. In addition, the growing demand for wastewater treatment systems in remote and rural settings, where traditional infrastructure is often not economically feasible, is also boosting the market.

Europe Packaged Wastewater Treatment Market Trends

A combination of stringent environmental regulations, sustainability initiatives, and technology is driving packaged wastewater treatment systems in Europe. Modern, energy-efficient systems are displacing obsolete treatment plants in developed countries like France and Germany. There is a rapid pace of adoption driven by funding for environmental projects and favourable government policy. With businesses and municipalities dealing with challenges in achieving wastewater treatment compliance, European Union directives like the Urban Waste Water Treatment Directive are pushing the industry forward even more. In addition, the demand for portable treatment systems that enable resource recovery and water reuse is rising due to concerns about water quality and scarcity in many regions. Packaging solutions are evolving to become more effective and versatile as a result of technological advances in membrane filtration, biofiltration, and ultraviolet disinfection.

Asia Pacific Packaged Wastewater Treatment Market Trends

Asia Pacific holds a leading region with 32.8% market share due to increased industrialization, urbanization, and water stress. Improving water quality is a high priority for governments that are encouraging innovative, scalable packaged solutions to reduce pollution and improve water availability. Technological advances in energy-efficient, compact systems have been addressing the need for affordable and green solutions. Furthermore, the areas' increased reliance on water reuse in industry and agriculture has created new potential for packaged wastewater treatment. Demand for these systems is expected to grow as the need for effective water management increases in the area. Countries like China and India are investing heavily in decentralized sanitation infrastructure. There is also the benefit of foreign investment and government-sponsored technology adoption. There is a high population density that creates a need for compact and efficient treatment options.

Key Packaged Wastewater Treatment Companies:

The following are the leading companies in the packaged wastewater treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Microbics, Inc.

- Veolia Environment SA

- Global Treat, Inc.

- Clearford Water Systems Inc.

- Hitachi Zosen Corporation

- CST Wastewater Solution

- Organica Water, Inc.

- Pollution Control Systems, Inc.

- Smith & Loveless, Inc.

- Corix Group of Companies

- Westech Engineering, Inc.

- Xylem Inc.

- Evoqua Water Technologies LLC

- Fluence Corporation Limited

- Aquatech International LLC

- Others

Recent Developments

- In October 2024, Corix DE Systems has inaugurated the district energy system, which currently provides low-carbon heating and cooling to over 200,000 square feet of buildings in the downtown waterfront district in Bellingham, Washington.

- In March 2024, Fluence Corporation installed its first MABR systems in Indiana and Colorado, respectively, after winning new wastewater treatment contracts in both states. The systems will serve a school in Indiana and a residential community in Colorado. These projects increase Fluence's presence in the municipal sector in the United States. The Company also won biogas and industrial contracts in Italy, which reflects its international expansion.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the packaged wastewater treatment market based on the below-mentioned segments:

Global Packaged Wastewater Treatment Market, By Technology

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Reverse Osmosis (RO)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Membrane Aerated Biofilm Reactor (MABR)

- Others

Global Packaged Wastewater Treatment Market, By End Use

Global Packaged Wastewater Treatment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa