Global Financial Wellness Software Market Size To Exceed USD 7.23 Billion by 2033

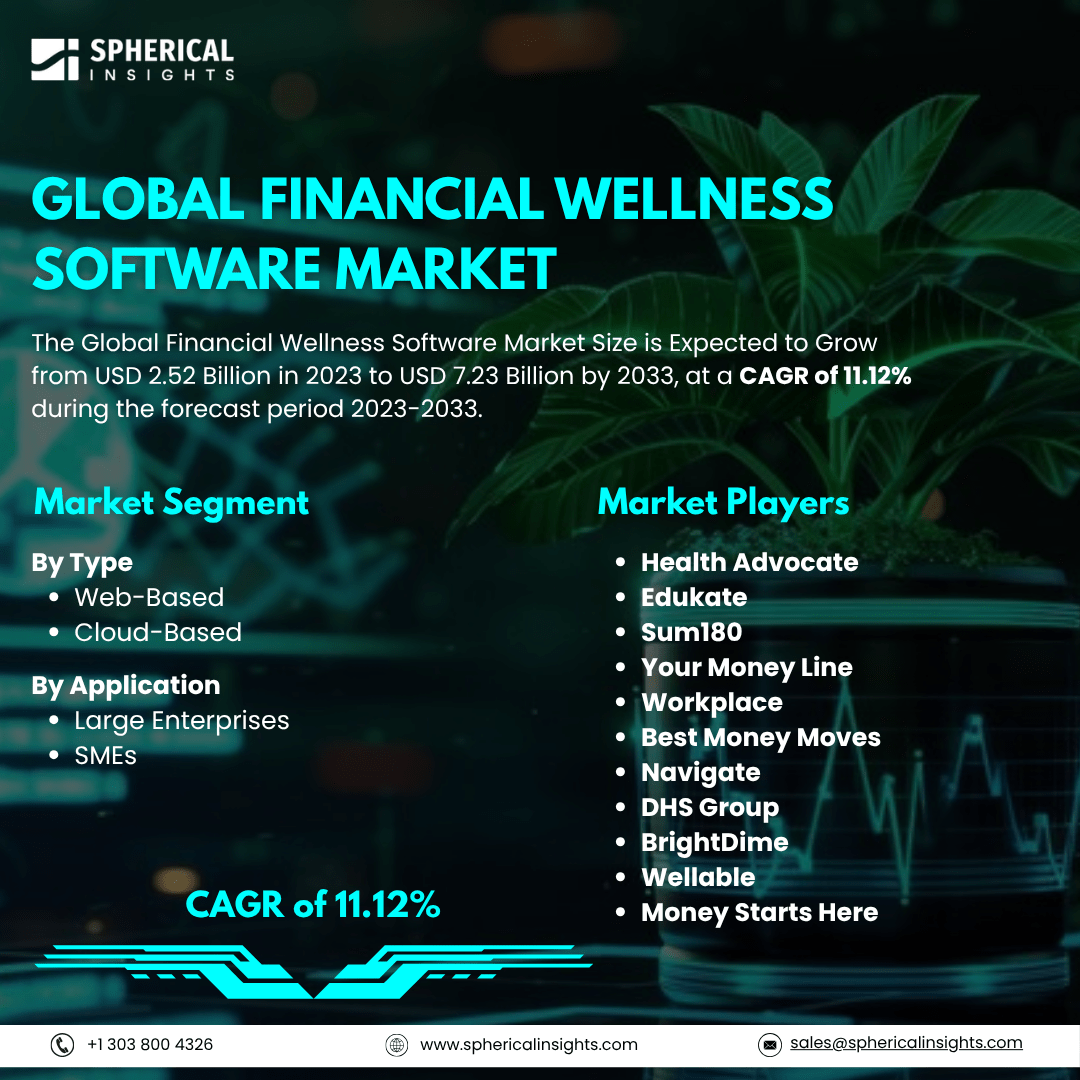

According to a research report published by Spherical Insights & Consulting, The Global Financial Wellness Software Market Size is Expected to Grow from USD 2.52 Billion in 2023 to USD 7.23 Billion by 2033, at a CAGR of 11.12% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Financial Wellness Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Web-Based and Cloud-Based), By Application (Large Enterprises and SMEs), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The global financial wellness software market refers to the industry comprising digital platforms and tools designed to help individuals and employees manage their finances, reduce financial stress, and improve overall financial well-being. These software solutions typically offer features such as budgeting assistance, debt management, savings plans, financial education, and real-time financial tracking. The market is driven by increasing employer focus on employee wellness, rising financial stress levels, and the growing demand for digital financial literacy tools. Furthermore, the global financial wellness software market is experiencing robust growth driven by several key factors. Employers increasingly recognize the importance of supporting employee financial well-being, leading to a surge in demand for comprehensive financial wellness programs. The rising levels of personal debt and financial stress among individuals have further emphasized the need for effective financial management tools. Advancements in technology, particularly the proliferation of mobile-friendly applications, have made financial wellness solutions more accessible and user-friendly. Additionally, regulatory support and incentives have encouraged organizations to adopt such programs. The shift towards digital transformation across industries has also played a significant role in propelling the market forward. However, the global financial wellness software market faces restraining factors such as limited organizational budgets, low employee participation rates, data privacy concerns, fragmented financial literacy levels, and difficulty in quantifying return on investment.

The web-based segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the type, the global financial wellness software market is divided into web-based and cloud-based. Among these, the web-based segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its easy accessibility, lower deployment costs, and compatibility across devices. Employers favored web platforms for their scalability and user-friendly interfaces. As organizations increasingly adopt digital tools to support employee financial wellness, demand for flexible, cloud-accessible web-based solutions is expected to drive continued strong growth.

The SMEs segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the application, the global financial wellness software market is divided into large enterprises and SMEs. Among these, the SMEs segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The SMEs segment led in 2023 as small and medium-sized enterprises increasingly adopted financial wellness software to attract and retain talent, boost employee productivity, and address financial stress. Cost-effective, scalable solutions tailored for smaller workforces fueled adoption, and growing awareness of employee well-being is expected to drive remarkable growth during the forecast period.

North America is projected to hold the largest share of the global financial wellness software market over the forecast period.

North America is projected to hold the largest share of the global financial wellness software market over the forecast period. The regional growth is attributed to its early adoption of digital workplace solutions, high financial literacy awareness, and strong employer focus on holistic wellness programs. The presence of leading software providers, advanced IT infrastructure, and rising concerns over employee financial stress further contribute to the region’s dominance in the financial wellness software market.

Asia Pacific is expected to grow at the fastest CAGR in the global financial wellness software market during the forecast period. The regional growth is attributed to rapid digitalization, increasing adoption of employee wellness programs, and growing financial stress in emerging economies. Rising middle-class populations, tech-savvy workforces, and government initiatives promoting financial literacy are encouraging employers to invest in financial wellness software, driving robust market expansion across countries like India, China, and Southeast Asia.

Company Profiling

Major vendors in the global financial wellness software market are Health Advocate, Edukate, Sum180, Your Money Line, Workplace, Best Money Moves, Navigate, DHS Group, BrightDime, Wellable, Money Starts Here, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global financial wellness software market based on the below-mentioned segments:

Global Financial Wellness Software Market, By Type

Global Financial Wellness Software Market, By Application

Global Financial Wellness Software Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa