Global Operating Tables Market Insights Forecasts to 2035

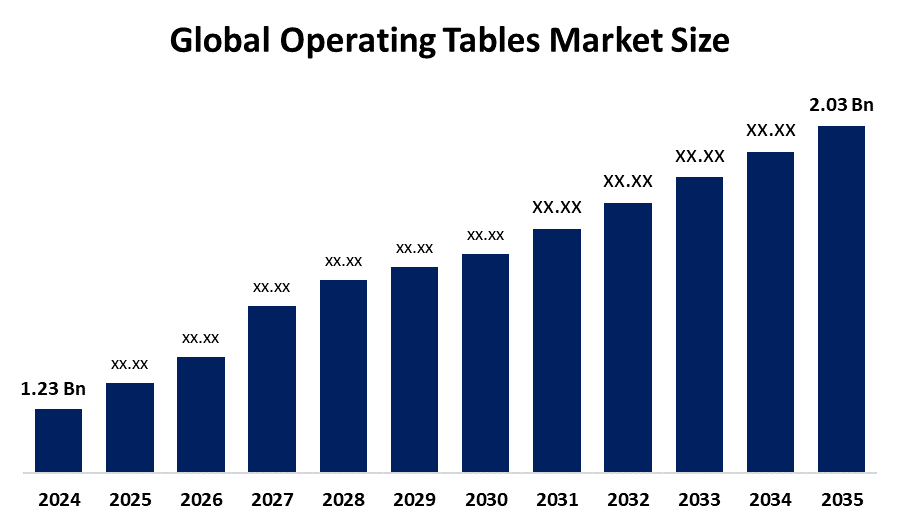

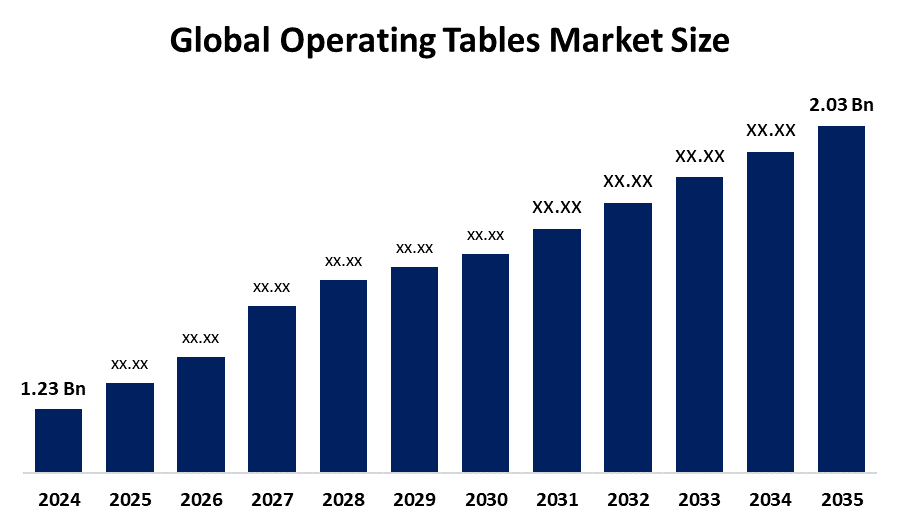

- The Global Operating Tables Market Size Was Estimated at USD 1.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.66% from 2025 to 2035

- The Worldwide Operating Tables Market Size is Expected to Reach USD 2.03 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Operating Tables Market

Operating tables are essential surgical platforms designed to support patients during a wide range of medical procedures. They are equipped with facilities such as adjustable height, tilt, lateral movements, and Trendelenburg positioning to optimize access and visualization for surgeons. Modern tables now integrate the robotic interface for imaging compatibility, motorized control, ergonomic design, and even advanced surgical workflows. The increase in minimally invasive, orthopaedic, cardiovascular, and neurosurgical processes is increasing the demand for these special tables. Development is further supported by expanding healthcare infrastructure in emerging markets, enhancing surgical volumes, and investing in hybrid operating rooms.

Attractive Opportunities in the Operating Tables Market

- Ambulatory surgical centres (ASCs) are expanding in both developed and developing nations, necessitating flexible yet affordable surgical platforms for a range of operations.

- Demand for sophisticated, high-end versions is being driven by the growing integration of operating tables with robotically assisted surgical systems and intraoperative imaging technology.

- As governments and private investors continue to spend on modernising healthcare infrastructure, improving surgical departments, and introducing high-quality medical equipment to improve patient care standards, emerging countries offer enormous possibilities.

Global Operating Tables Market Dynamics

DRIVER: Rising Surgical Procedure Volumes and Hospital Modernization

The increasing number of surgical processes worldwide is one of the primary drivers of the operating table market. Factors such as a rising elderly population, high prevalence of chronic diseases, and an increase in cases of accident and accidents lead to greater demand for surgical intervention. Hospitals and surgical centers are investing in modern operating tables that offer flexibility, durability, and integration with advanced imaging systems to improve surgical results. Both developed and emerging economies are pushing for the modernization of hospitals and accelerating technically advanced operating tables, especially in the hybrid operating room.

RESTRAINT: High Capital and Maintenance Costs

A significant restraint for the operating table market is the high cost associated with achieving and maintaining advanced surgical tables. Models equipped with motorised adjustment, robot compatibility, and integrated imaging support command premium prices, which can be challenging for small healthcare facilities with limited budgets. In addition to early procurement costs, these systems often require special maintenance, spare parts, and technician training, adding to overall operating expenses. This cost can delay obstruction replacement cycles and can limit adoption in rural hospitals and reduce health care systems, especially in developing areas.

OPPORTUNITY: Growth of Ambulatory Surgical Centers and Specialty Surgeries

The rapid development of ambulance surgical centers represents a major opportunity for the operating table market. ASCS demands tools that are compact, versatile, and easily adjustable to adjust a variety of outpatient processes while maintaining cost efficiency. Additionally, the increasing number of special surgeries like orthopaedic, neurosurgical, and cardiac procedures is demanding tables offering accurate positions.

CHALLENGES: Infrastructure and Regulatory Limitations in Emerging Markets

While emerging markets provide high growth potential, they face challenges due to underdeveloped healthcare infrastructure, inconsistent regulatory structures, and technical service networks. In many developing countries, hospitals may be required to operate advanced surgical tables, have a power supply, or lack skilled personnel. Regulatory approval in meeting international compliance standards and delays in difficulties can also slow down the market. To address these challenges, manufacturers need to work closely with local authorities to design sustainable, easy-to-interesting tables and to streamline approval procedures and improve the availability of service.

Global Operating Tables Market Ecosystem Analysis

A multi-tiered ecosystem comprising upstream suppliers of components and materials, original equipment manufacturers (OEMs), distribution and service networks, clinical end users, and regulatory and reimbursement players powers the operating tables industry. OEMs like Getinge/MAQUET, STERIS, Stryker, Hill-Rom/Trumpf Medical, and regional companies that design and assemble entire table systems and make significant investments in R&D for imaging compatibility, robotic integration, and modularity serve as a guide for market growth and investment decisions.

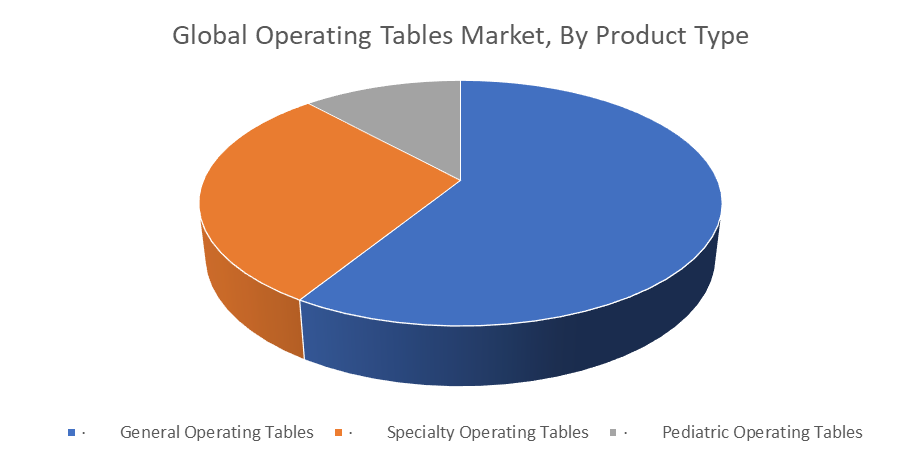

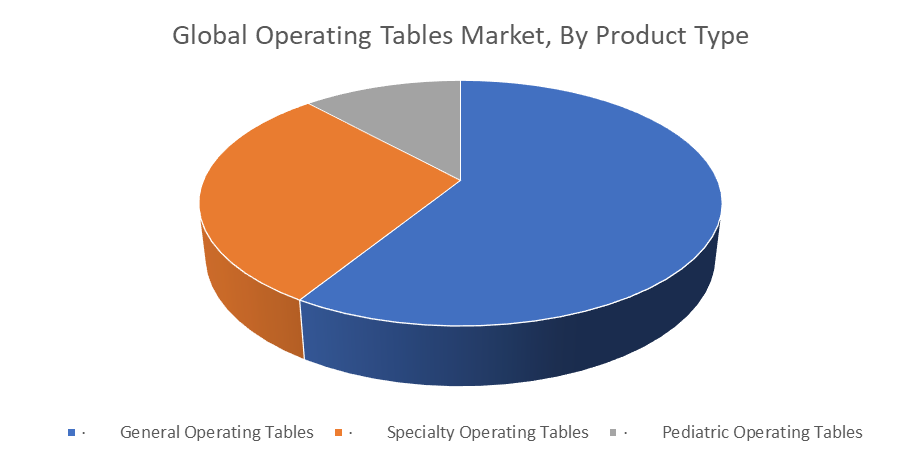

Based on the product type, the general operating tables segment led the market with the leading revenue share over the forecast period

The segment dominance is driven by their adaptability and capacity to perform a variety of surgical procedures in a number of different medical specialties. General operating tables are preferred by hospitals and surgical centres due to their cost-effectiveness for high-volume surgical settings, adjustable placement, sturdy design, and compatibility with a variety of surgical tools. Their versatility in gynaecological, orthopaedic, and general surgery treatments guarantees consistent demand across the globe.

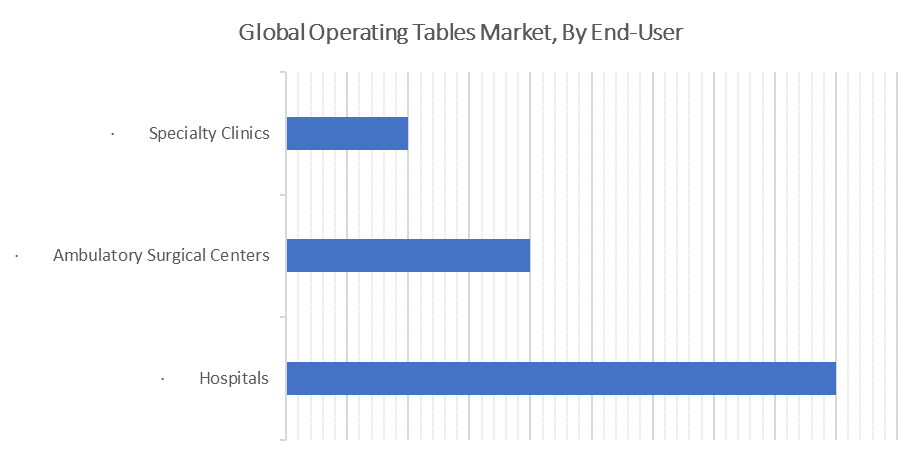

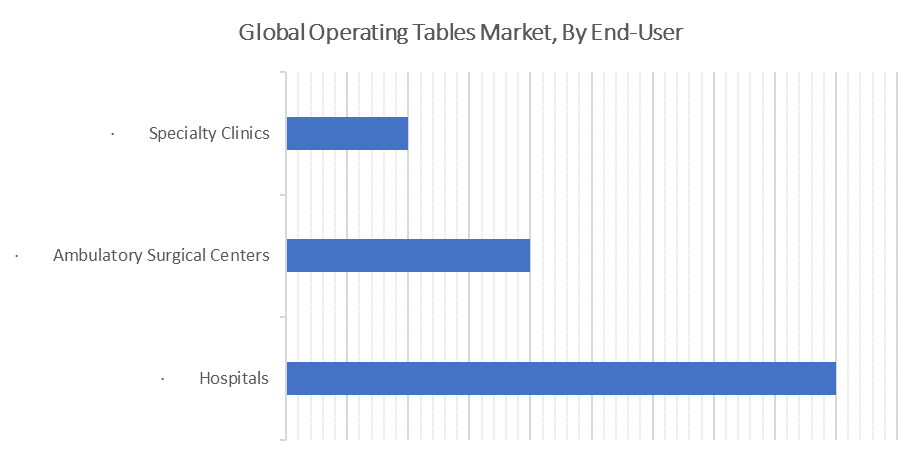

Based on the end-user, the hospitals segment led the market with the major revenue share during the forecast period

The hospitals segment led the market, holding the largest revenue share during the forecast period. Strong, multipurpose operating tables that can tolerate heavy use and provide accurate positioning and imaging capabilities are essential for hospitals. The need for technologically sophisticated tables is also rising as a result of the hybrid operating rooms that are found in many healthcare settings.

North America is anticipated to hold the largest market share of the operating tables market during the forecast period

North America is anticipated to hold the largest market share in the operating tables market during the forecast period. Supported by a widely adopted strong healthcare infrastructure, high per capita healthcare expenses, and advanced surgical technologies. Hospitals and surgical centers of the region are early adopters of integrated surgical systems, including robots and surgical tables with imaging equipment. Along with favourable reimbursement policies, a high rate of alternative, trauma, and complex surgery continuously leads to demand. The presence of major global manufacturers and constant investment in hospital modernization further strengthens the position of North America as a market leader.

Asia Pacific is expected to grow at the fastest CAGR in the operating tables market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the operating tables market during the forecast period. Rapid economic development, enhancing health care investment, and increasing surgical volumes. Countries like China, India, and Indonesia are expanding the capacity of hospitals and upgrading surgical departments to meet the needs of the growing patients. The government-led -led healthcare is accelerating the demand for modern, cost-effective operating tables in countries such as Thailand and Malaysia. Increasing minimally invasive surgical techniques in the region are also promoting the need for technically advanced, versatile operating platforms.

Recent Development

- In January 2025, Mindray North America launched its first surgical table, the HyBase V6. This versatile, precise table caters to a wide patient population, enhancing surgical innovation and improving clinical and operational workflows for healthcare facilities.

- In July 2023, Getinge AB completed the acquisition of Maquet, significantly strengthening its product offering in powered and imaging-compatible operating tables across modern surgical environments.

- In March 2023, Getinge AB introduced a modular hybrid operating table platform designed for seamless integration with robotic surgical systems, enhancing precision and flexibility in high-tech operating rooms.

Key Market Players

KEY PLAYERS IN THE OPERATING TABLES MARKET INCLUDE

- Getinge AB

- Stryker Corporation

- Hill-Rom Holdings, Inc.

- Steris plc

- Mizuho OSI

- Skytron, LLC

- Alvo Medical

- Merivaara Corp.

- Eschmann Equipment

- Famed Zywiec Sp. z o.o.

- Stille AB

- UFSK-International OSYS GmbH

- Schaerer Medical USA, Inc.

- AGA Sanitaotsartikel GmbH

- Mindray Medical India Pvt. Ltd.

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the operating tables market based on the below-mentioned segments:

Global Operating Tables Market, By Product Type

- General Operating Tables

- Specialty Operating Tables

- Pediatric Operating Tables

Global Operating Tables Market, By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Global Operating Tables Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa