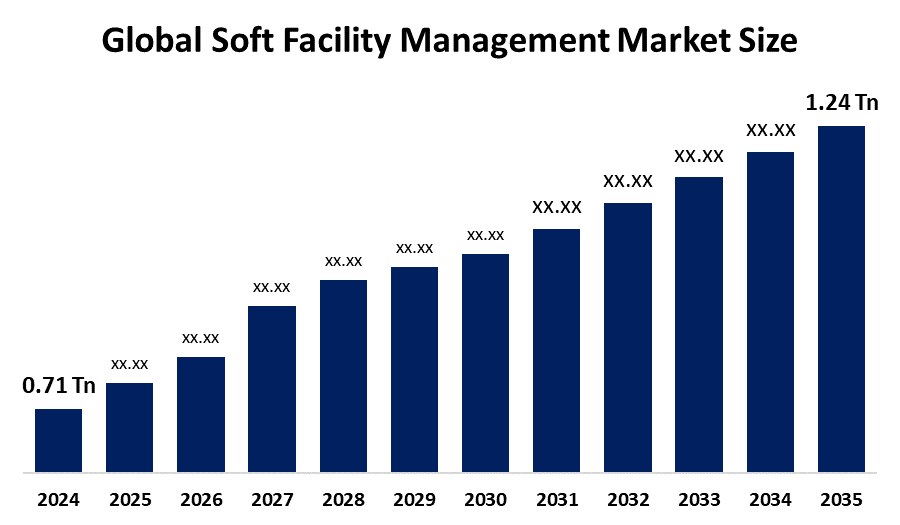

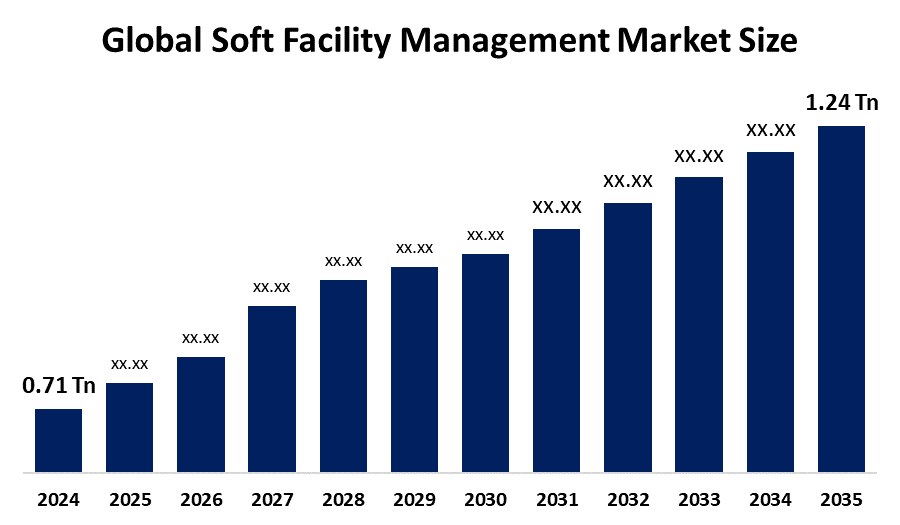

Global Soft Facility Management Market Insights Forecasts to 2035

- The Global Soft Facility Management Market Size Was Estimated at USD 0.71 Trillion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035

- The Worldwide Soft Facility Management Market Size is Expected to Reach USD 1.24 Trillion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Soft Facility Management Market

The global soft facility management market refers to the outsourced services that support the smooth operation and maintenance of buildings and workplaces, focusing primarily on non-technical activities. These services typically include cleaning, security, landscaping, waste management, and front-desk operations. Soft facility management plays a crucial role in enhancing the overall environment of commercial, residential, and institutional spaces, ensuring comfort, safety, and efficiency for occupants. As organizations increasingly prioritize creating better workplace experiences, the demand for soft FM services has grown significantly. The market is characterized by a variety of service providers ranging from specialized companies to large integrated facility management firms offering bundled solutions. With technological advancements, such as digital platforms for service management and workforce scheduling, the soft facility management sector is evolving to provide more efficient, responsive, and customized solutions. Overall, the global soft facility management market continues to expand, reflecting the rising importance of professional facility services in maintaining operational excellence and occupant satisfaction across diverse sectors.

Attractive Opportunities in the Soft Facility Management Market

- The rise of smart building technologies offers significant potential for Soft FM providers. Integration of automation, data analytics, and IoT-based solutions can transform the delivery of soft services, enhancing real-time monitoring and enabling predictive maintenance.

- There is a growing trend toward green and eco-friendly facility management practices. As businesses face increasing pressure to meet environmental standards and sustainability goals, there’s a rising demand for energy-efficient and eco-conscious cleaning, waste

- management, and landscaping services.

Global Soft Facility Management Market Dynamics

DRIVER: Increasing awareness among organizations about the importance of maintaining clean

Increasing awareness among organizations about the importance of maintaining clean, safe, and well-managed environments is boosting demand for outsourced soft FM services like cleaning, security, and landscaping. Companies are focusing on enhancing employee productivity and customer experience, which requires efficient facility support. Additionally, cost optimization is a significant driver, as outsourcing soft FM services allows businesses to reduce operational expenses and focus on core activities. The rise of large commercial real estate developments and expanding infrastructure in emerging economies is creating new opportunities for service providers. Furthermore, advancements in technology, including mobile apps and IoT-based solutions, are streamlining service delivery and improving responsiveness, making soft facility management more attractive. Growing emphasis on sustainability and hygiene standards, especially post-pandemic, has also accelerated the adoption of professional cleaning and sanitation services, contributing to the market’s steady growth globally.

RESTRAINT: Reliance on labor-intensive tasks, which can escalate costs

A major issue is the reliance on labor-intensive tasks, which can escalate costs, particularly in areas facing rising wages and workforce shortages. Inconsistent service quality among providers also creates hesitation among businesses considering outsourcing, as unreliable performance can affect overall operations. Smaller companies often struggle with the expense of outsourcing these services and may prefer handling them internally. Concerns about data security and privacy linked to digital management tools further slow adoption, especially in industries with strict confidentiality requirements. Economic instability can lead organizations to reduce spending on outsourced soft FM services during tough financial periods. Additionally, navigating diverse regulatory frameworks across different countries complicates operations for global providers, limiting seamless service delivery. These factors collectively pose significant challenges to the widespread expansion of the soft facility management sector.

OPPORTUNITY: Expanding urbanization and infrastructure projects in developing countries

One key opportunity lies in the increasing demand for specialized services tailored to niche industries such as healthcare, education, and hospitality, where customized solutions can improve safety and operational efficiency. The rise of smart building technologies offers facility managers the chance to integrate automation and data analytics into soft services, enhancing real-time monitoring and predictive maintenance. Expanding urbanization and infrastructure projects in developing countries open new markets for soft FM providers to establish a foothold early. Additionally, partnerships and collaborations between facility management companies and technology firms can foster innovation and create value-added services. The growing trend of green and eco-friendly facility management practices also presents an opportunity for providers to differentiate themselves by offering sustainable and environmentally responsible solutions. Lastly, increasing focus on employee well-being and experience in workplaces encourages organizations to invest in premium soft facility services, fueling market expansion.

CHALLENGES: Ensuring rigorous hygiene and safety standards

A significant hurdle is the effective adoption of new technologies, as many providers face difficulties integrating digital solutions due to a lack of technical skills or resistance among employees accustomed to traditional methods. Coordinating a geographically dispersed workforce also creates communication gaps and inconsistencies in service quality. Ensuring rigorous hygiene and safety standards, particularly in sensitive sectors like healthcare or food services, demands constant vigilance and specialized training. Evolving client demands require ongoing upskilling of staff to meet higher expectations. Managing multiple subcontractors and vendors simultaneously adds complexity to service delivery and quality assurance. Moreover, navigating an ever-changing landscape of regulations related to labor, health, and environmental compliance puts additional strain on facility management teams. Overcoming these challenges calls for innovative approaches, strong leadership, and continuous investment in workforce development and technology.

Global Soft Facility Management Market Ecosystem Analysis

The global soft facility management ecosystem includes service providers specializing in cleaning, security, and landscaping, along with integrated FM firms offering bundled solutions. Clients range from commercial, healthcare, education, hospitality, to government sectors outsourcing non-technical services. Technology vendors supply digital tools and IoT devices to improve efficiency and monitoring. Workforce agencies and subcontractors provide essential labor. Regulatory bodies set compliance standards, while consultants and industry associations promote best practices. Together, these stakeholders drive innovation, quality, and efficiency in the market.

Based on the offering type, the outsourced segment held the dominant position in the market and accounted for the leading revenue share over the forecast period

The outsourced segment dominated the market, capturing the largest revenue share throughout the forecast period. This trend highlights the growing preference among organizations to delegate soft facility management services to specialized external providers. Outsourcing allows businesses to focus on their core operations while benefiting from expert service delivery, cost efficiency, and improved quality. As a result, the outsourced segment continues to lead, driven by increasing demand for professional, scalable, and flexible facility management solutions across various industries.

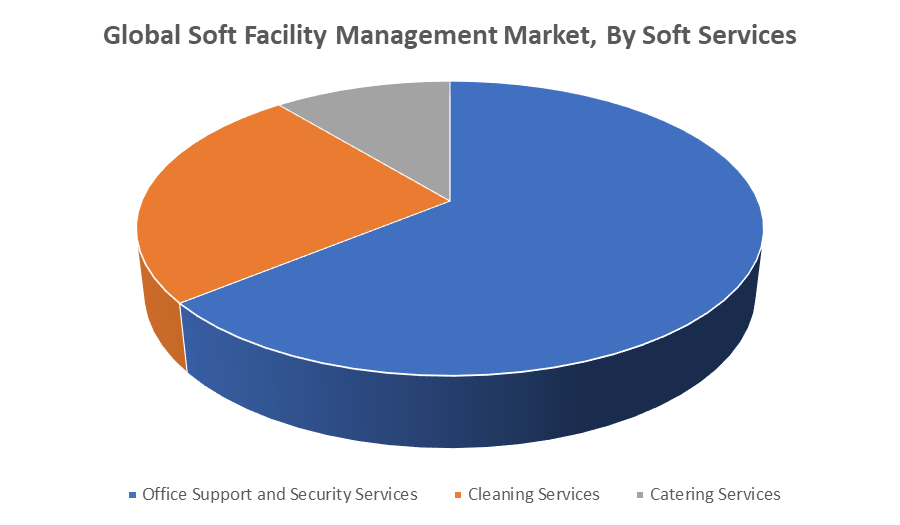

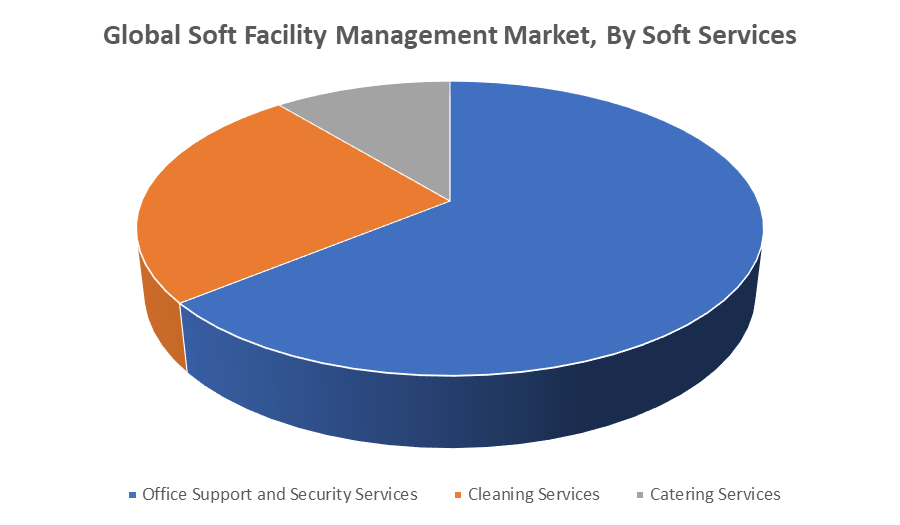

Based on the soft services, the office support and security services segment led the market, holding the largest revenue share during the forecast period

The office support and security services segment led the market, holding the largest revenue share throughout the forecast period. This dominance reflects the critical role these services play in ensuring safe, efficient, and well-managed workplace environments. Organizations increasingly prioritize security and administrative support to enhance employee productivity and safeguard assets. The growing demand for professional security personnel and comprehensive office management solutions has propelled this segment to maintain its leading position in the soft facility management market.

North America is anticipated to hold the largest market share of the soft facility management market during the forecast period

North America is anticipated to hold the largest market share in the soft facility management market during the forecast period. This is driven by the region’s advanced infrastructure, high adoption of integrated facility management solutions, and a strong focus on workplace safety and employee well-being. Additionally, the presence of numerous large corporations and growing demand for outsourcing non-technical services contribute to market growth. North America’s regulatory environment and emphasis on sustainability further support the expansion of soft facility management services across various industries.

Asia Pacific is expected to grow at the fastest CAGR in the soft facility management market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the soft facility management market during the forecast period. Rapid urbanization, increasing commercial infrastructure development, and rising adoption of outsourced facility services are key factors driving this growth. Additionally, expanding industrial and service sectors, along with growing awareness of workplace safety and hygiene, are fueling demand. Emerging economies in the region are investing heavily in smart building technologies and sustainable facility management practices, further accelerating market expansion.

Recent Development

- In March 2023, ISS launched a new mobile platform to streamline their facility management services. This app offers features like real-time tracking of tasks, communication between clients and service teams, and seamless integration of various services.

Key Market Players

KEY PLAYERS IN THE SOFT FACILITY MANAGEMENT MARKET INCLUDE

- ISS Facility Services

- Sodexo

- CBRE Group

- JLL (Jones Lang Lasalle)

- G4S

- Cushman & Wakefield

- Aramark

- Mitie Group

- Blue Diamond Facilities Management

- Avendra

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the soft facility management market based on the below-mentioned segments:

Global Soft Facility Management Market, By Offering Type

Global Soft Facility Management Market, By Soft Services

- Office Support and Security Services

- Cleaning Services

- Catering Services

Global Soft Facility Management Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa