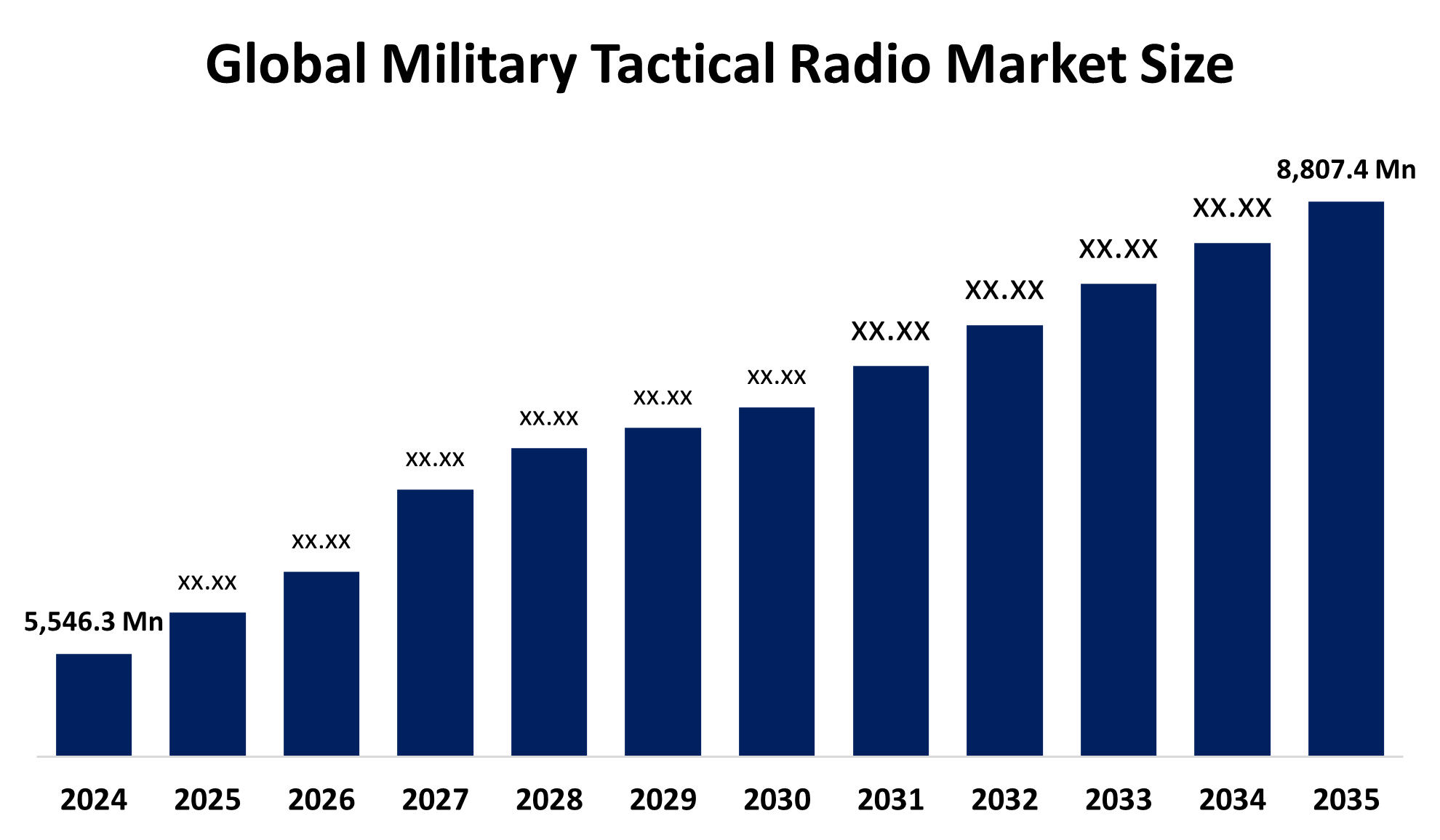

Global Military Tactical Radio Market Insights Forecasts to 2035

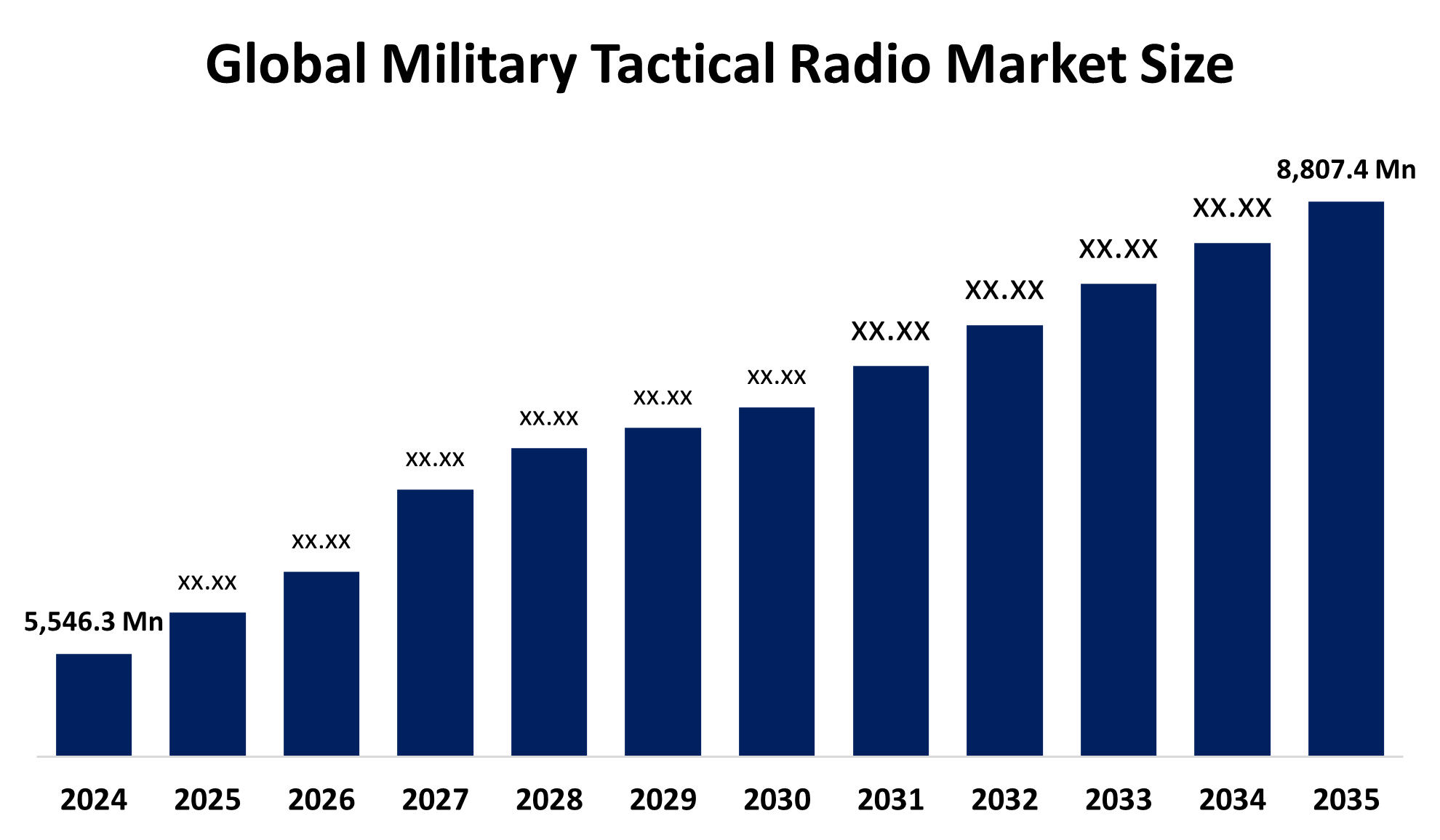

- The Global Military Tactical Radio Market Size Was Estimated at USD 5,546.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.29% from 2025 to 2035

- The Worldwide Military Tactical Radio Market Size is Expected to Reach USD 8,807.4 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Military Tactical Radio Market

The military tactical radio market comprises advanced communication systems specifically designed for use in military operations to ensure secure, real-time transmission of voice, data, and video among armed forces. These radios are a critical component of modern battlefield communication, supporting effective coordination, command, and control in both strategic and tactical scenarios. Built to withstand harsh environmental conditions, military tactical radios are rugged, portable, and adaptable to a variety of mission needs. They include handheld, manpack, and vehicle-mounted units that offer features such as multi-band frequency support, encryption, and interoperability across various military platforms. These systems are capable of operating independently or as part of larger communication networks, enhancing situational awareness and mission effectiveness. The market serves all branches of the military and plays a key role in modernizing defense communication infrastructure. As military operations increasingly rely on network-centric capabilities, tactical radios remain essential for maintaining operational readiness and secure communication in the field.

Attractive Opportunities in the Military Tactical Radio Market

- The rising use of drones, robotic ground units, and other autonomous military platforms creates strong demand for tactical radios that provide robust, reliable communication links essential for mission success.

- Growing emphasis on coalition and joint military operations worldwide drives the need for radios that enable seamless interoperability across diverse military forces, fostering coordinated responses and collaboration.

- Partnerships that integrate AI-driven threat detection and adaptive communication into radios provide opportunities to enhance system resilience and operational effectiveness.

Global Military Tactical Radio Market Dynamics

DRIVER: Increasing demand for secure, real-time communication across diverse

One of the primary drivers is the increasing demand for secure, real-time communication across diverse and dynamic battlefield environments. As military operations become more network-centric, there is a growing need for radios that support voice, data, and video transmission with high reliability and encryption. The advancement of technologies such as Software-Defined Radios (SDRs), which offer flexibility and interoperability, is also fueling market growth. Additionally, the rising focus on soldier modernization programs and the integration of tactical radios into broader command and control systems are enhancing their adoption. The proliferation of asymmetric warfare and the need for efficient communication in remote or hostile areas further emphasize the importance of mobile, rugged communication solutions. Investments in defense modernization and upgrades of legacy systems continue to support the expansion of this market globally.

RESTRAINT: Substantial cost of acquiring and maintaining advanced tactical communication systems

A significant barrier is the substantial cost of acquiring and maintaining advanced tactical communication systems, which includes expenses related to infrastructure upgrades, integration with existing systems, and ongoing personnel training. These financial demands can be particularly challenging for nations with limited defense budgets. Another constraint lies in the technical complexity and compatibility issues between next-generation radios and older communication platforms, which can lead to delays and inefficiencies in deployment. Additionally, stringent regulatory frameworks, including spectrum management and cybersecurity protocols, often create obstacles in the swift adoption of new systems. Environmental and operational limitations, such as susceptibility to signal interference, limited range in rugged terrain, and weather sensitivity, can affect reliability in critical missions. Moreover, the constant need for innovation to counter evolving threats places pressure on manufacturers and defense agencies to invest in rapid technological advancements, adding to operational strain.

OPPORTUNITY: Rising integration of tactical radios with autonomous and remotely operated military systems

A key prospect is the rising integration of tactical radios with autonomous and remotely operated military systems, such as drones and robotic ground units, which rely on robust communication links for mission success. Additionally, the growing emphasis on multinational joint operations highlights the need for radios that offer seamless interoperability across diverse military forces, fostering collaboration and coordinated responses. There is also increasing demand for enhanced cybersecurity features, as militaries prioritize protecting communication channels against sophisticated cyber threats and electronic warfare tactics. The shift towards compact, lightweight, and energy-efficient radio devices creates room for innovation tailored to special operations and rapid deployment units. Furthermore, as combat scenarios evolve to include dense urban and electronic warfare environments, developing radios capable of maintaining reliable connections amid signal congestion and interference presents a valuable opportunity for manufacturers and defense agencies alike.

CHALLENGES: Technology is advancing so fast that radios can quickly become outdated

Technology is advancing so fast that radios can quickly become outdated, forcing military forces to constantly upgrade their equipment, which can be expensive. It is also difficult to make these radios work smoothly with new battlefield technologies like AI systems and advanced sensors. Protecting communications from electronic attacks and jamming by enemies is another big challenge. There is also a shortage of trained personnel who know how to operate and maintain these complex radios effectively. Lastly, designing radios that are both lightweight and durable enough to work well in tough environments like extreme weather and rough terrain is a constant struggle. These challenges make it harder for the market to grow and for manufacturers to develop the right solutions.

Global Military Tactical Radio Market Ecosystem Analysis

The global military tactical radio market ecosystem includes radio manufacturers, technology providers, and system integrators who develop and deliver secure, rugged communication solutions for defense forces. Military end-users set requirements and provide feedback, while regulatory bodies manage spectrum and security standards. Service providers support training, maintenance, and operations. Emerging collaborations with cybersecurity experts and AI developers enhance radio capabilities with advanced threat detection and adaptive communication. Together, these stakeholders create a collaborative network that drives innovation and ensures reliable battlefield communications worldwide.

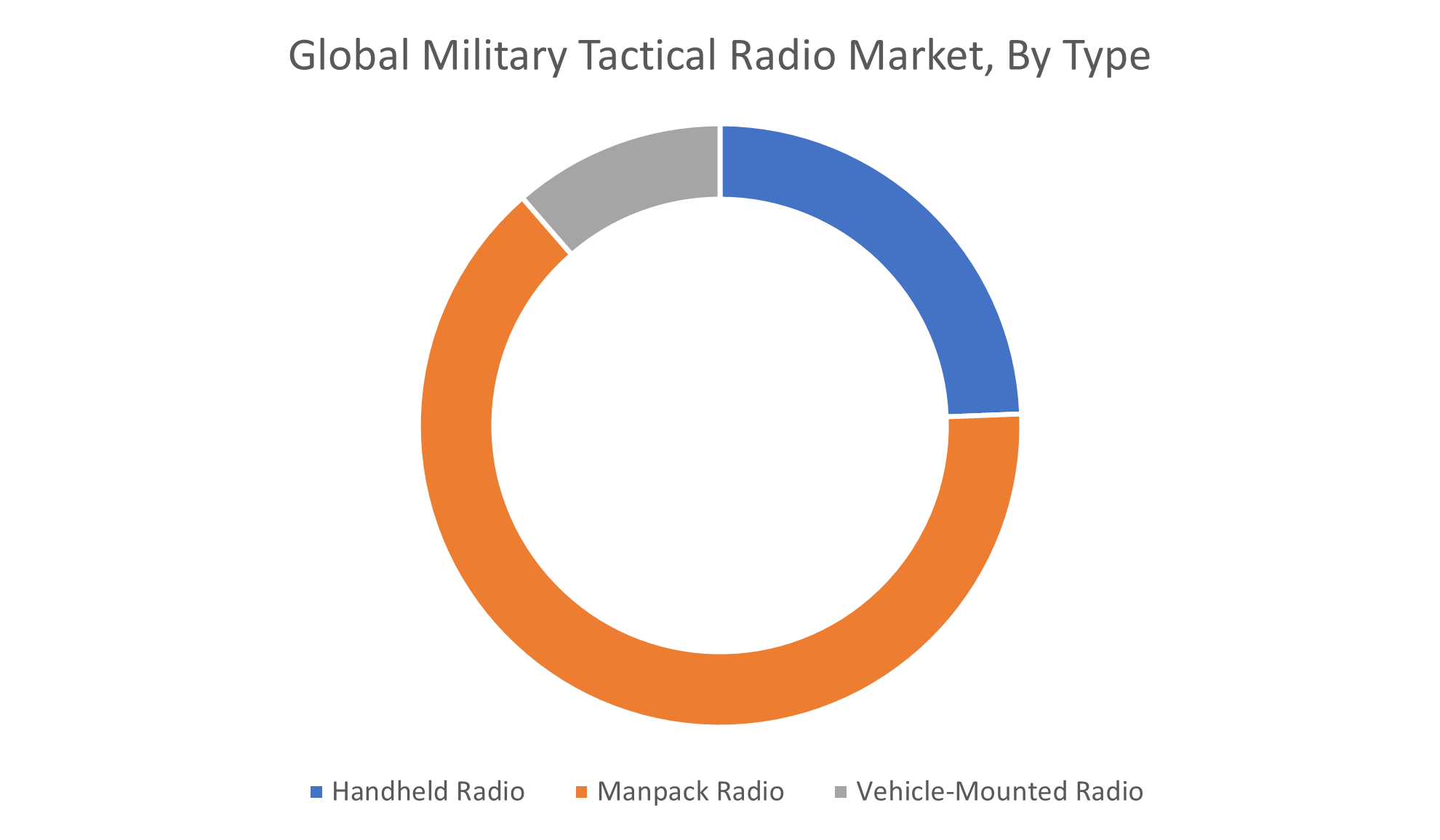

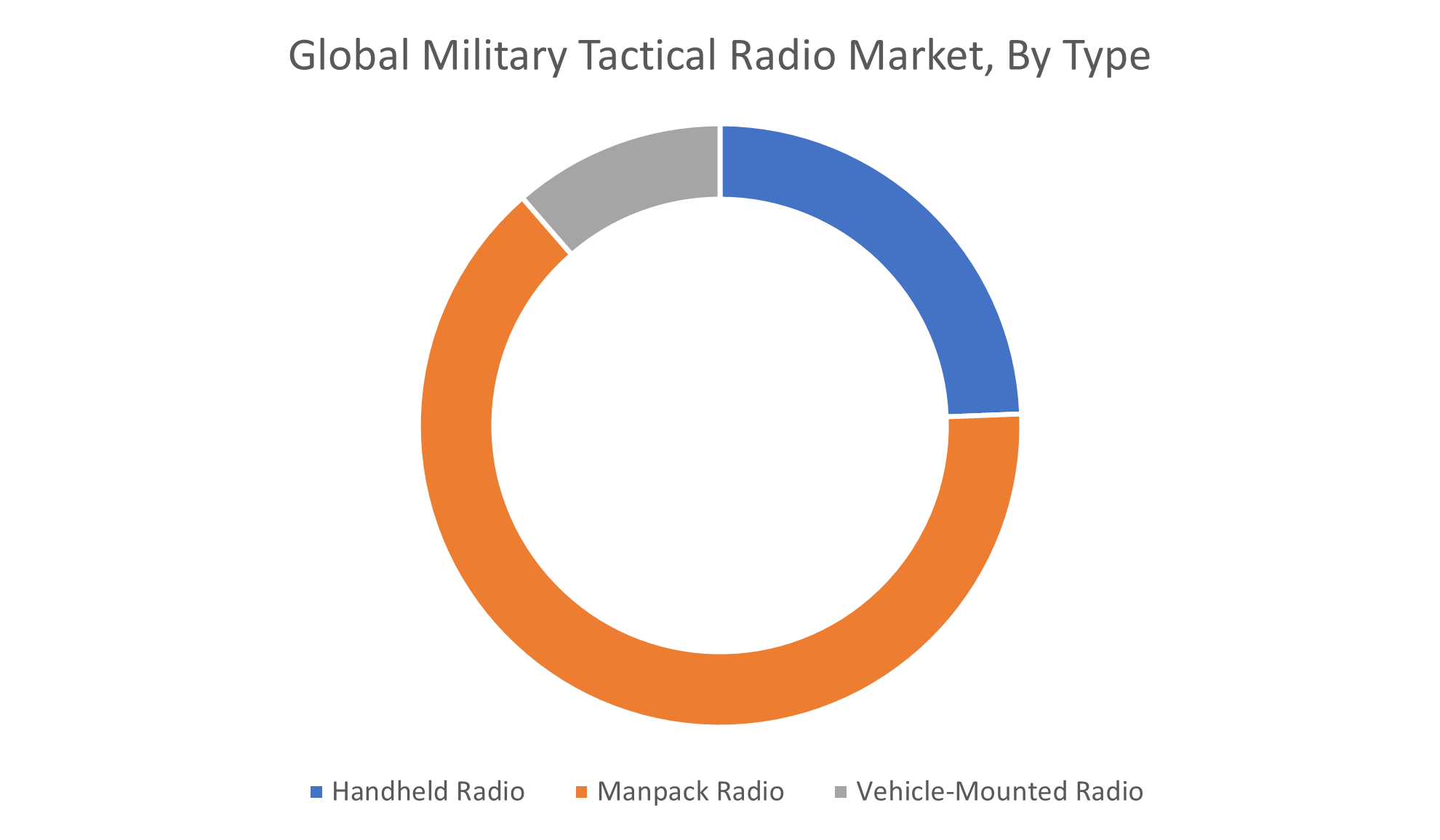

Based on the type, the manpack radio segment accounted for the largest market share and is expected to grow at a significant CAGR over the forecast period

Manpack radios are favored for their portability, durability, and ability to provide reliable communication in diverse and challenging battlefield environments. Their flexibility allows soldiers to carry them easily while maintaining robust connectivity over long distances. These radios support multiple frequencies and encryption standards, making them essential for secure and effective tactical communication across various military operations. Their growing adoption is driven by increasing demand for mobile, secure communication solutions among armed forces worldwide.

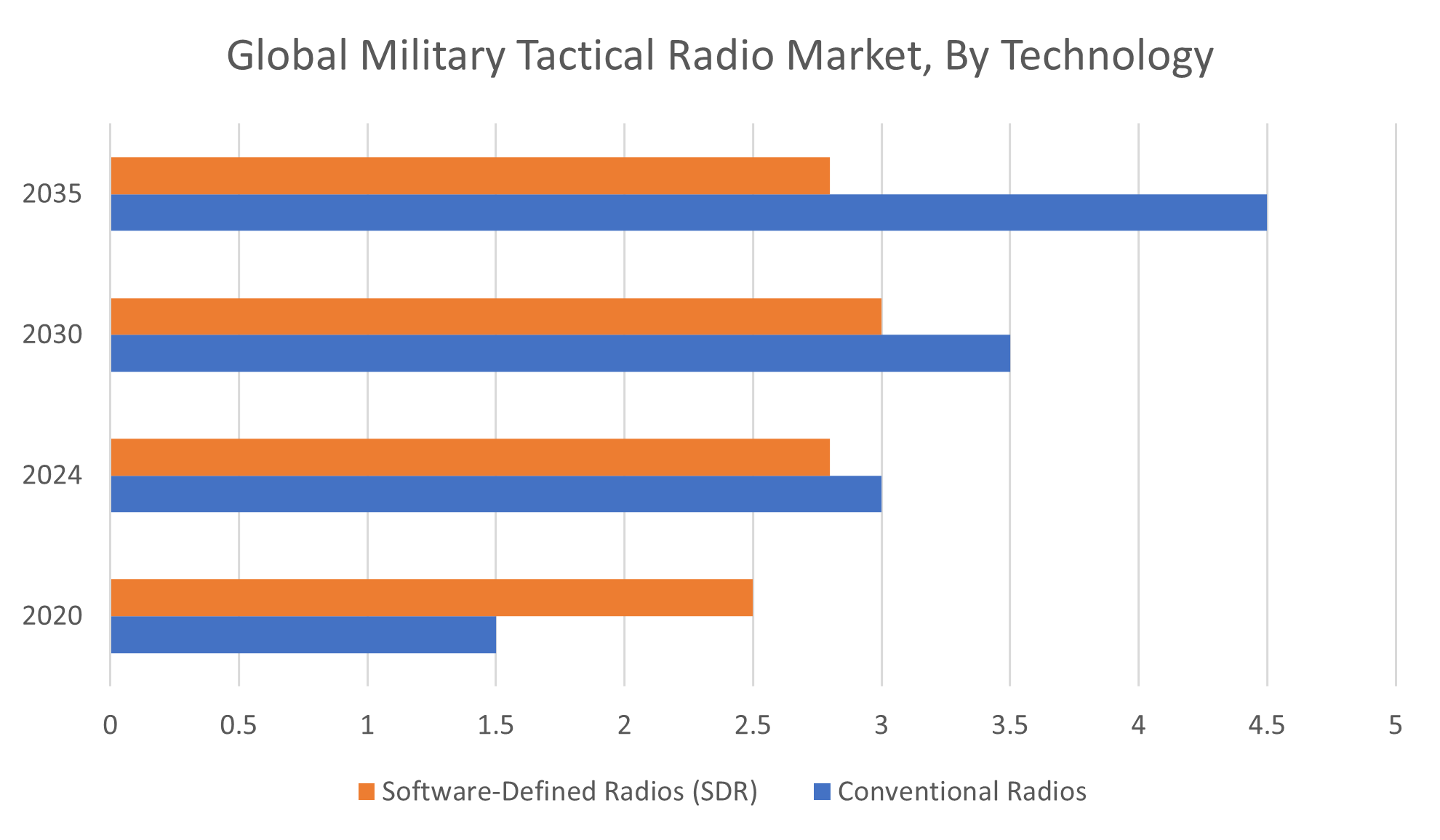

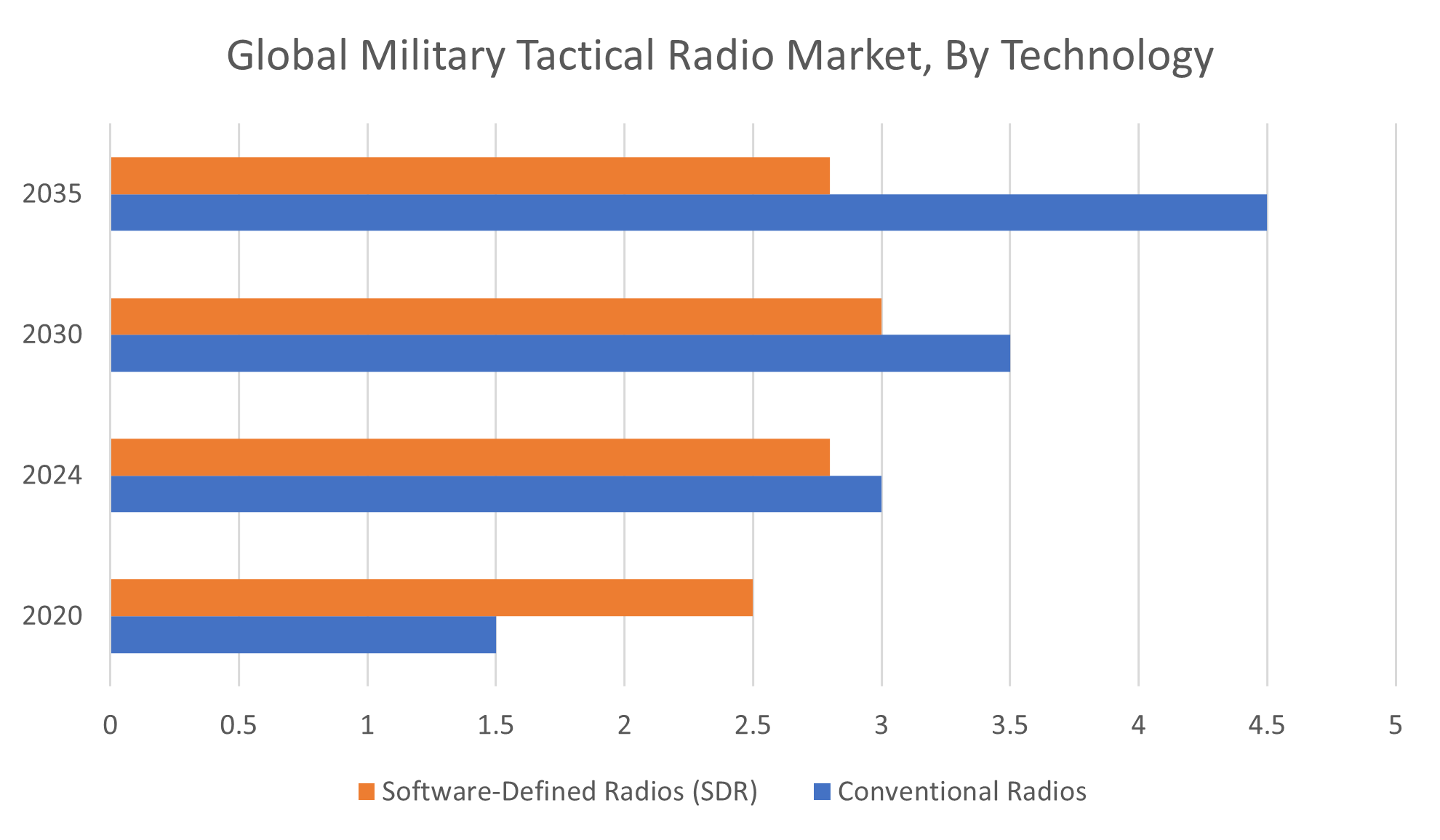

Based on the technology, the conventional radios segment held a significant revenue share and is expected to grow at a substantial CAGR over the forecast period

Conventional radios remain widely used due to their proven reliability, simplicity, and cost-effectiveness in various military applications. They provide stable communication over dedicated frequency bands and are easier to operate and maintain compared to more complex systems. Despite advancements in newer technologies, conventional radios continue to play a crucial role in tactical operations, especially in regions where infrastructure and technological adoption may be limited. Their steady demand is supported by ongoing modernization efforts and the need for dependable communication solutions in diverse operational scenarios.

North America is anticipated to hold the largest market share of the military tactical radio market during the forecast period

North America is anticipated to hold the largest market share in the military tactical radio market during the forecast period. This dominance is driven by the region's substantial defense budgets, advanced technological infrastructure, and the presence of key market players and defense contractors. Additionally, North American military forces continually invest in modernizing their communication systems to enhance operational efficiency and secure battlefield connectivity. Supportive government policies and ongoing research and development activities further strengthen the region’s leadership in adopting cutting-edge tactical radio technologies. The high frequency of military exercises, deployments, and defense collaborations also contributes to the sustained demand for tactical radios in North America.

Asia Pacific is expected to grow at the fastest CAGR in the military tactical radio market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the military tactical radio market during the forecast period. This rapid growth is driven by increasing defense modernization programs, rising military expenditures, and expanding geopolitical tensions in the region. Countries like China, India, Japan, and South Korea are investing heavily in upgrading their communication infrastructure to enhance battlefield connectivity and operational capabilities. Additionally, the growing adoption of advanced technologies and the need for secure, reliable communication systems in diverse and challenging terrains further fuel market expansion. Supportive government initiatives and partnerships with global defense manufacturers also contribute to the region’s accelerated growth in the military tactical radio sector.

Recent Development

- In October 2024, Himera, a Ukrainian company, launched the G1 Pro tactical radio, designed to resist electronic warfare. The first batch was delivered to the U.S. Air Force for testing alongside secure video streaming technology.

- In March 2024, L3Harris Technologies launched an upgraded tactical radio platform, featuring AI-enhanced signal processing to improve voice clarity and data transmission in contested environments.

Key Market Players

KEY PLAYERS IN THE MILITARY TACTICAL RADIO MARKET INCLUDE

- L3Harris Technologies

- Thales Group

- Harris Corporation

- Northrop Grumman Corporation

- Rohde & Schwarz GmbH & Co. KG

- General Dynamics Corporation

- Rockwell Collins (Collins Aerospace)

- Elbit Systems Ltd.

- Cobham plc

- Leonardo S.p.A.

- Others

Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the military tactical radio market based on the below-mentioned segments:

Global Military Tactical Radio Market, By Type

- Handheld Radio

- Manpack Radio

- Vehicle-Mounted Radio

Global Military Tactical Radio Market, By Technology

- Conventional Radios

- Software-Defined Radios (SDR)

Global Military Tactical Radio Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa