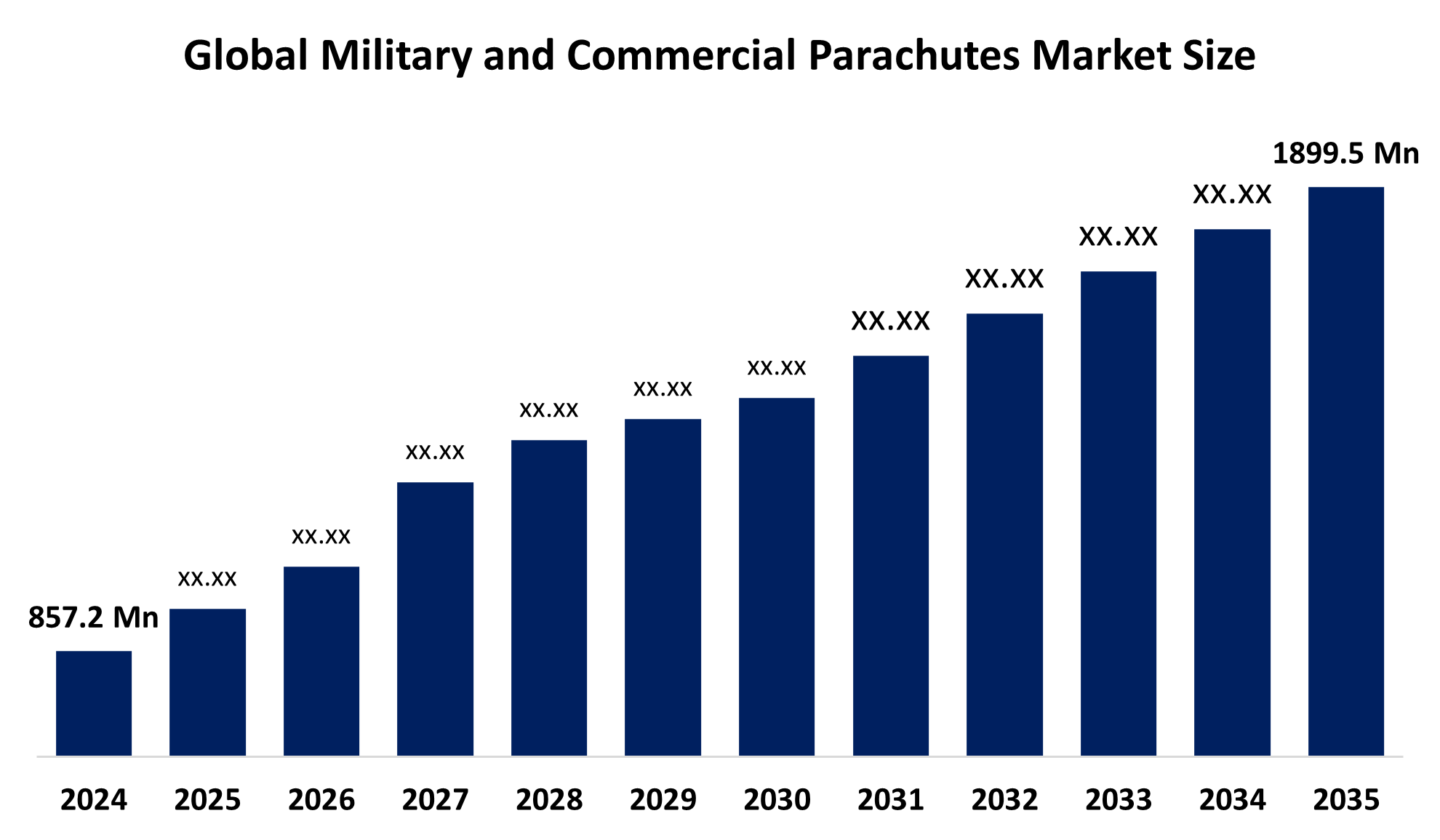

Global Military and Commercial Parachutes Market Insights Forecasts To 2035

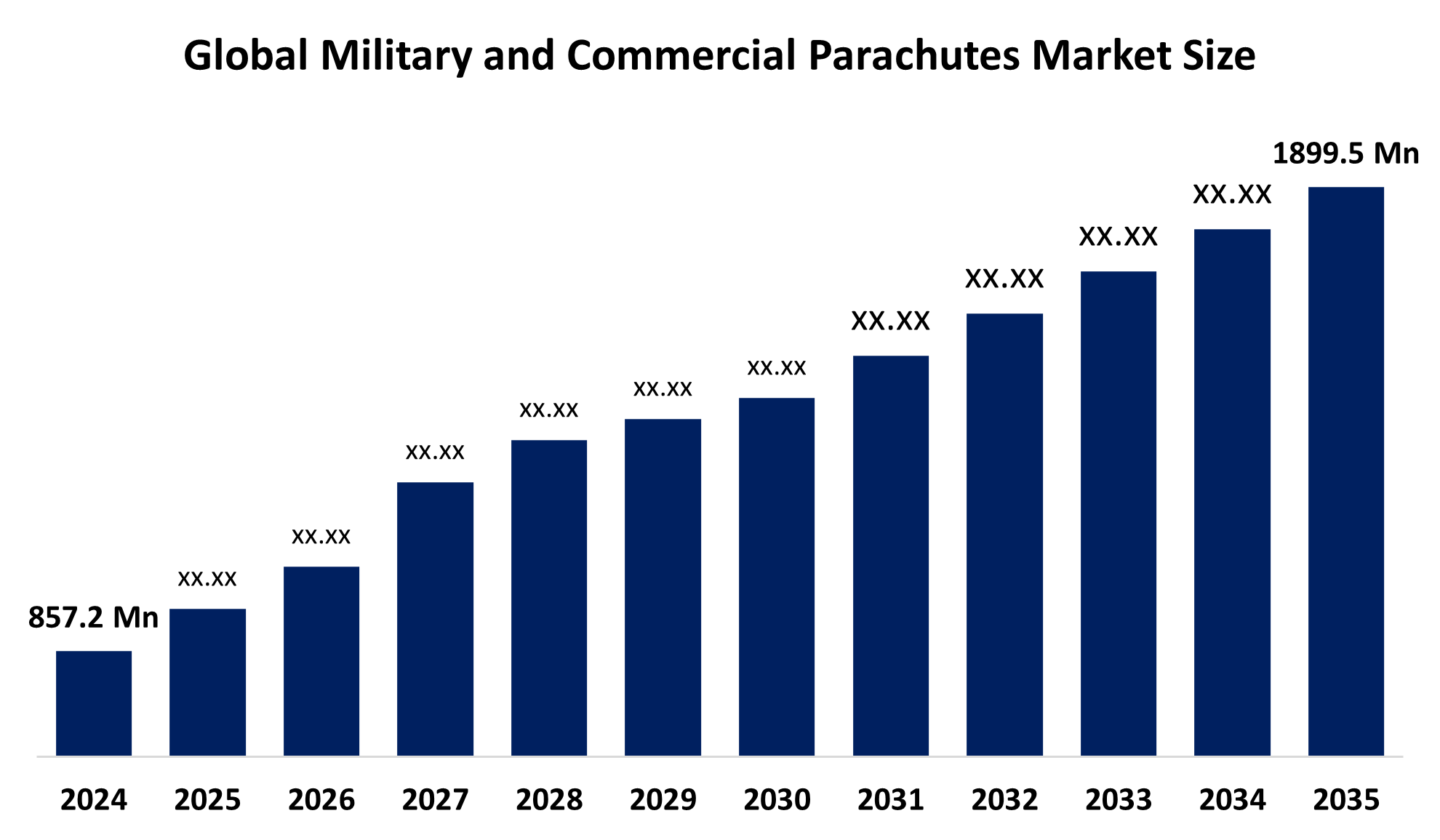

- The Global Military and Commercial Parachutes Market Size Was Estimated at USD 857.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.50% from 2025 to 2035

- The Worldwide Military and Commercial Parachutes Market Size is Expected to Reach USD 1899.5 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Military and Commercial Parachutes Market

The military and commercial parachutes market involves the design, manufacturing, and distribution of parachute systems used across defense and civilian sectors. Military parachutes are engineered for tactical use, including personnel drops, cargo delivery, and emergency evacuations, focusing on durability and reliability in diverse operational environments. Commercial parachutes are primarily used in recreational activities such as skydiving, as well as in aviation and space applications for emergency descent. These parachutes are crafted from advanced materials to ensure strength, flexibility, and safety. The market includes various types of parachutes, such as round, ram-air, and ribbon parachutes, tailored to specific functions. Regulatory standards play a critical role in ensuring performance and safety compliance. Technological advancements have improved deployment mechanisms and control systems, enhancing user experience and operational precision. Overall, the market reflects a blend of traditional manufacturing with modern innovation to meet the diverse needs of military and commercial users globally.

Attractive Opportunities in the Military and Commercial Parachutes Market

- Growing use of unmanned aerial vehicles (UAVs) and drones creates demand for parachute systems to safely recover payloads, offering cost-effective and reliable solutions.

- Incorporation of sensors, IoT-enabled monitoring, and real-time tracking enhances parachute safety, performance, and ease of use.

- Parachute delivery of supplies to remote or disaster-affected areas supports efficient and timely humanitarian operations.

- Advanced parachutes are increasingly needed for safe capsule re-entry and landings, driving innovation in materials and deployment systems.

Global Military and Commercial Parachutes Market Dynamics

DRIVER: Rising military operations and airborne missions require reliable

Rising military operations and airborne missions require reliable, high-performance parachutes that ensure safety and operational efficiency. In the commercial sector, growing interest in adventure sports such as skydiving and paragliding fuels demand for recreational parachutes. Additionally, advancements in materials science have led to the development of lightweight, durable fabrics that enhance parachute performance and user safety. Technological innovations like automated deployment systems, GPS integration, and improved control mechanisms also contribute to market growth by increasing reliability and ease of use. Furthermore, the expansion of the aerospace industry and space exploration missions calls for specialized parachutes for emergency escape and safe landings. Strict regulatory standards for safety and quality further encourage manufacturers to innovate, supporting overall market expansion.

RESTRAINT: High manufacturing and development costs

High manufacturing and development costs, particularly for advanced and specialized parachute systems, limit widespread adoption, especially in budget-constrained defense programs or smaller commercial operators. The stringent regulatory and certification processes required to ensure safety and performance can lead to lengthy approval times, delaying product launches and increasing compliance costs. Additionally, the niche nature of parachute usage restricts market size, as demand is limited to specific military operations or recreational activities rather than mass-market applications. Technical challenges such as ensuring consistent deployment reliability under varying environmental conditions can also pose obstacles. Moreover, competition from alternative technologies, like powered descent systems and drones for cargo delivery, may reduce the reliance on traditional parachute systems. Finally, economic uncertainties and fluctuating defense budgets can further constrain investment and procurement in parachute technologies, impacting overall market growth.

OPPORTUNITY: Increasing adoption of unmanned aerial vehicles (UAVs) and drones

Increasing adoption of unmanned aerial vehicles (UAVs) and drones creates new applications for parachute recovery systems, offering safer and cost-effective solutions for payload retrieval. The integration of smart technologies, such as sensors and IoT-enabled monitoring, opens avenues for real-time performance tracking and enhanced safety features. Growth in humanitarian aid and disaster relief operations provides opportunities for parachute-delivered supplies in remote or inaccessible areas. Additionally, expanding space exploration initiatives and commercial space tourism require advanced parachutes for safe re-entry and landing of capsules, boosting innovation. Collaboration between manufacturers and research institutions can accelerate development of eco-friendly, biodegradable parachute materials, aligning with global sustainability goals. Lastly, rising interest in training programs and simulation technologies creates a market for parachute-related educational tools and equipment, further diversifying revenue streams. These emerging trends present significant growth potential for the industry beyond conventional applications.

CHALLENGES: The complexity of designing parachutes

One major challenge is the complexity of designing parachutes that perform reliably across diverse and extreme environmental conditions, including high altitudes, strong winds, and varying temperatures. Ensuring consistent deployment and maneuverability under these conditions requires extensive testing and innovation. Another challenge lies in balancing weight and durability; parachutes must be lightweight for ease of use but strong enough to withstand high stresses, which demands advanced material engineering. Additionally, the integration of new technologies, such as automated systems and sensors, introduces cybersecurity risks that must be addressed to prevent system failures or hacking. Supply chain disruptions, especially for specialized materials, can delay production and increase costs. Furthermore, maintaining skilled personnel for parachute packing, maintenance, and operation is critical but often challenging, particularly in remote military or commercial settings.

Global Military and Commercial Parachutes Market Ecosystem Analysis

The global military and commercial parachutes market ecosystem includes manufacturers specializing in advanced materials and deployment systems, supported by R&D institutions driving innovation. Key end-users are military forces requiring tactical parachutes for personnel and cargo, and commercial sectors like recreational skydiving, aviation, and space agencies. Regulatory bodies enforce safety and quality standards, shaping design and certification. Distributors and aftermarket service providers handle supply, maintenance, and training. This interconnected network ensures continuous development, compliance, and efficient delivery of parachute systems, supporting diverse applications in defense, recreation, and aerospace industries worldwide.

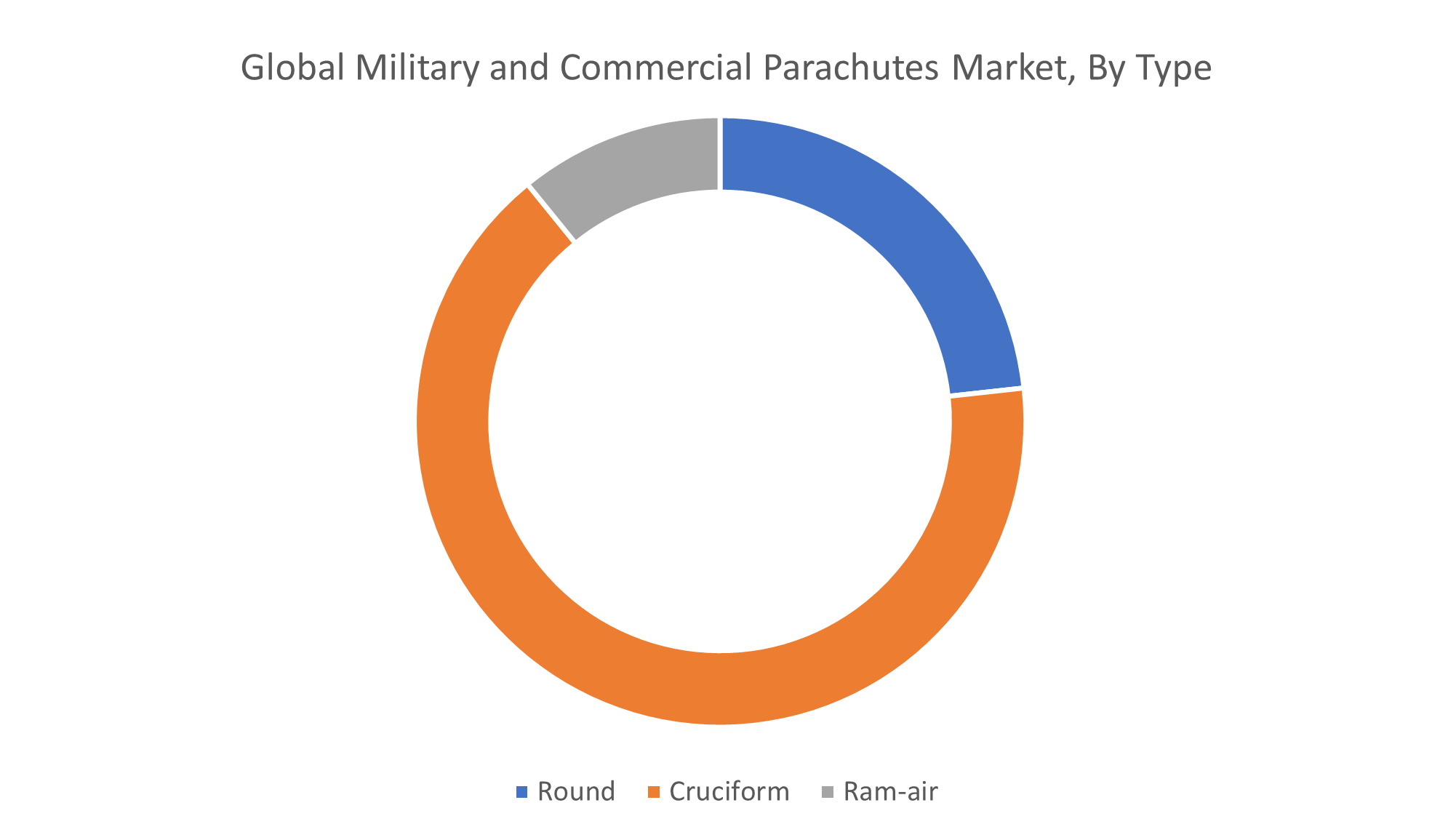

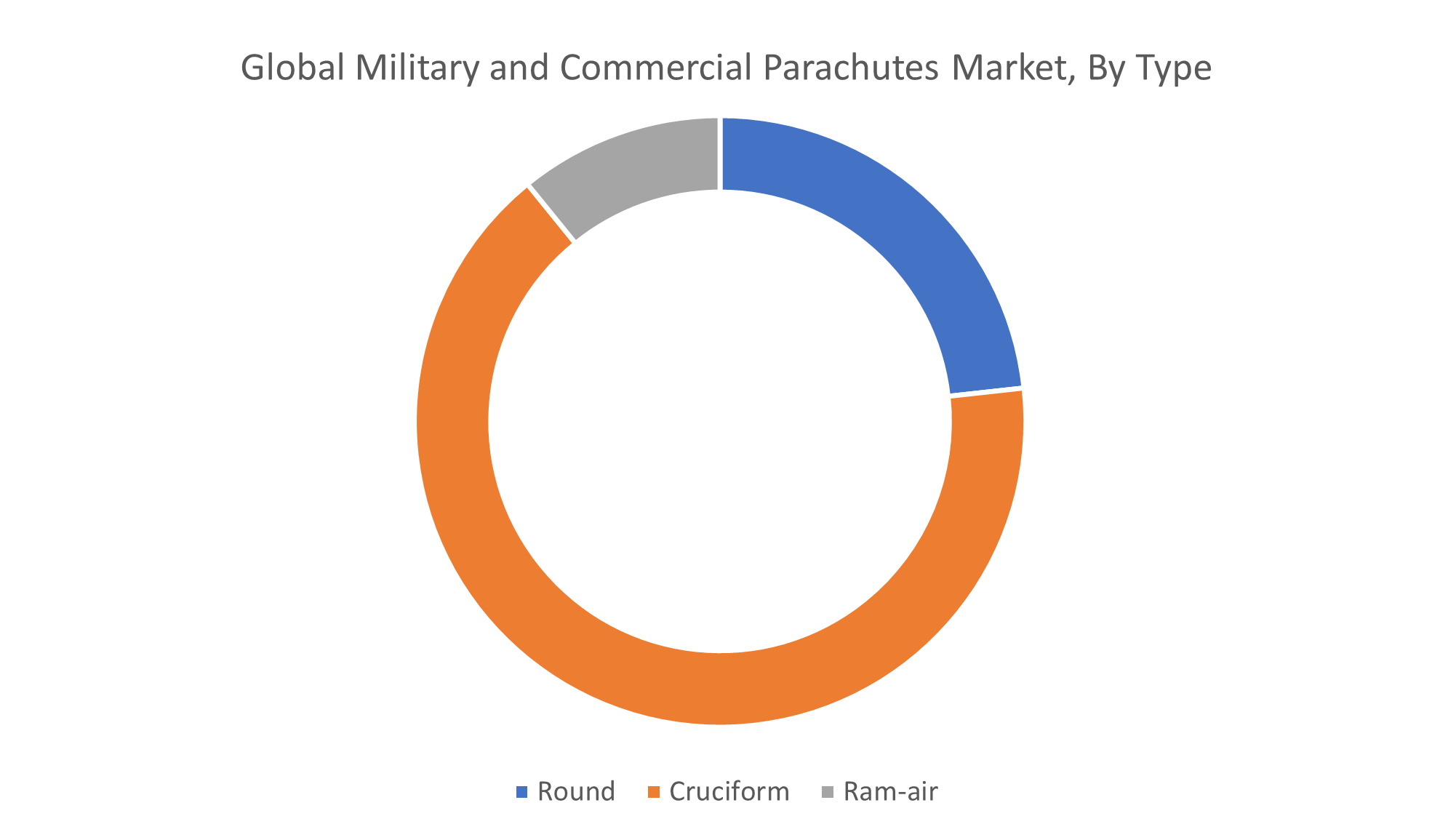

Based on the type, the cruciform segment held the largest revenue share and is expected to grow at a substantial CAGR over the forecast period

The cruciform parachute segment holds the largest revenue share in the global military and commercial parachutes market due to its distinct design and operational advantages. Featuring a cross-shaped canopy, cruciform parachutes provide enhanced stability during descent, reducing oscillations and swaying compared to traditional round parachutes. This improved stability ensures greater landing accuracy, which is vital for military personnel drops and cargo deliveries, directly impacting mission success and safety. Additionally, the cruciform design offers better control and a slower, more controlled descent rate, minimizing impact forces and lowering the risk of injuries.

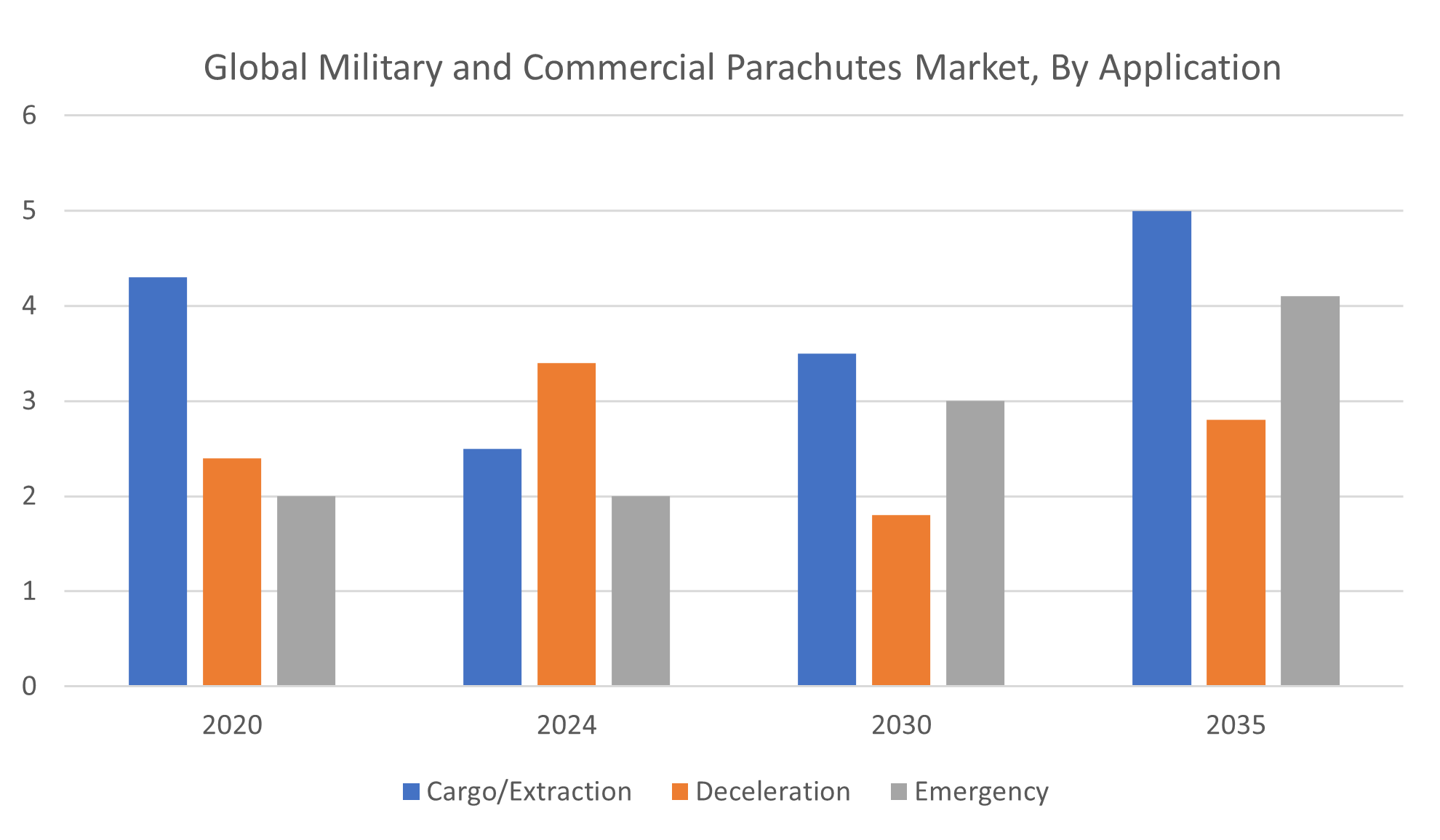

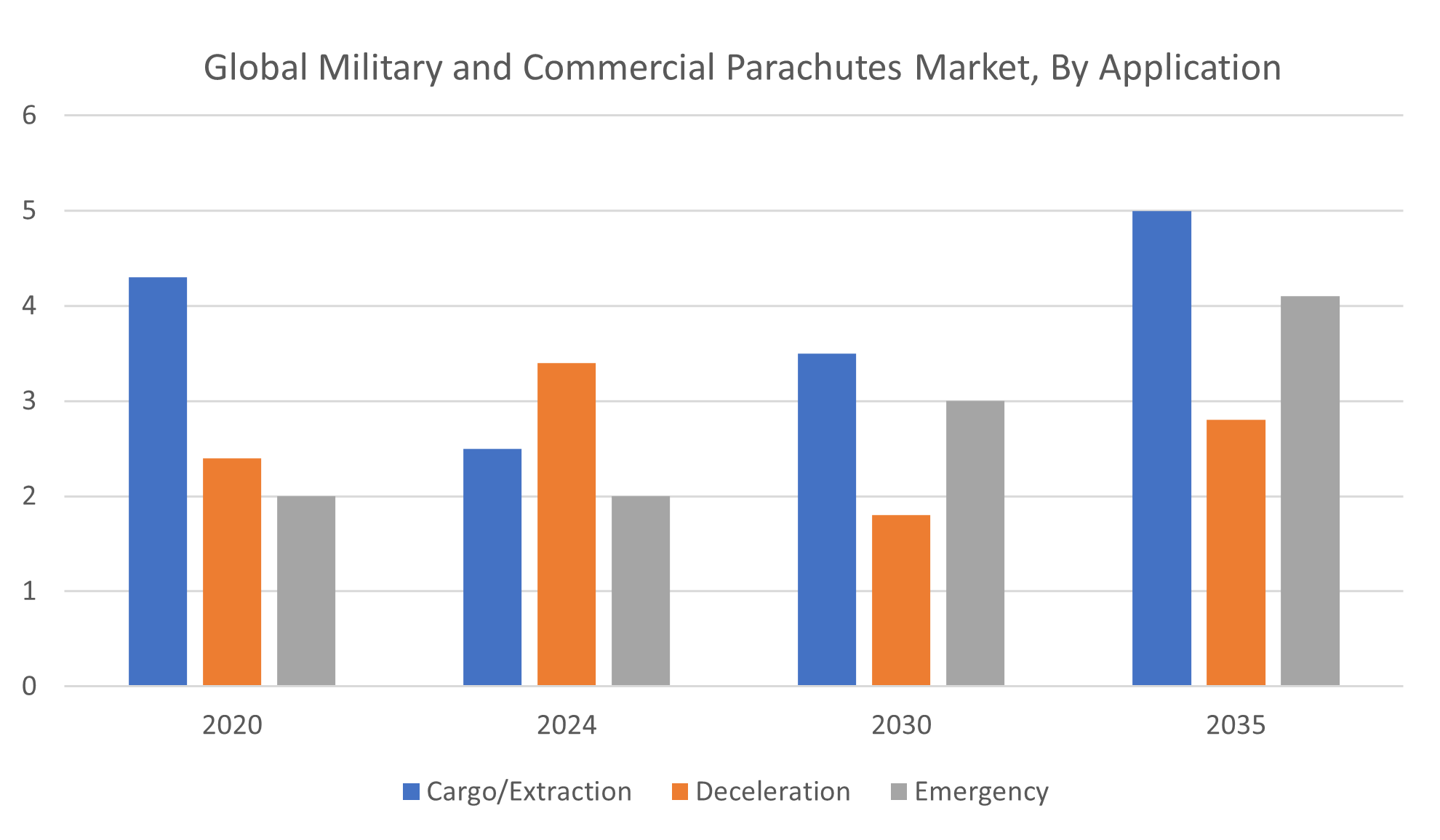

Based on the application, the cargo/extraction segment held the largest revenue share and is expected to grow at a remarkable CAGR over the forecast period

The segment’s dominance is driven by the critical need for safe and efficient delivery of supplies, equipment, and personnel in both military operations and commercial activities. Cargo parachutes are essential for airdropping heavy loads in remote or difficult-to-access areas, supporting logistics and mission success. Their ability to handle large weights with controlled descent makes them indispensable in defense and humanitarian aid missions. As military operations and disaster relief efforts increase worldwide, the demand for advanced cargo and extraction parachutes is expected to rise, leading to a remarkable CAGR over the forecast period.

North America is anticipated to hold the largest market share of the military and commercial parachutes market during the forecast period

North America is anticipated to hold the largest market share in the military and commercial parachutes market during the forecast period. This leadership is driven by the region’s well-established defense infrastructure, substantial military spending, and advanced aerospace industry. The presence of major parachute manufacturers and continuous investments in research and development further strengthen North America’s market position. Additionally, the growing popularity of recreational skydiving and commercial aviation activities in the region contributes to steady demand. Strong regulatory frameworks ensuring safety and quality also support market growth.

Asia Pacific is expected to grow at the fastest CAGR in the military and commercial parachutes market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the military and commercial parachutes market during the forecast period. This rapid growth is driven by increasing defense budgets and modernization efforts among emerging economies in the region. Expanding military capabilities and the rising need for advanced parachute systems for personnel and cargo deployment are key factors fueling demand. Additionally, the growing popularity of recreational skydiving and adventure sports, along with expanding commercial aviation sectors, contribute to market expansion. Investments in local manufacturing and technology development further support this growth.

Key Market Players

KEY PLAYERS IN THE MILITARY AND COMMERCIAL PARACHUTES MARKET INCLUDE

- Airborne Systems

- Strong Enterprises

- Zodiac Aerospace

- Paratech Inc.

- IrvinGQ

- BRS Aerospace

- Performance Designs

- Nexus Parachutes

- Aerodyne Industries

- Cypres

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the military and commercial parachutes market based on the below-mentioned segments:

Global Military and Commercial Parachutes Market, By Type

Global Military and Commercial Parachutes Market, By Application

- Cargo/Extraction

- Deceleration

- Emergency

Global Military and Commercial Parachutes Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa