Thermal Insulation Coating Market Summary

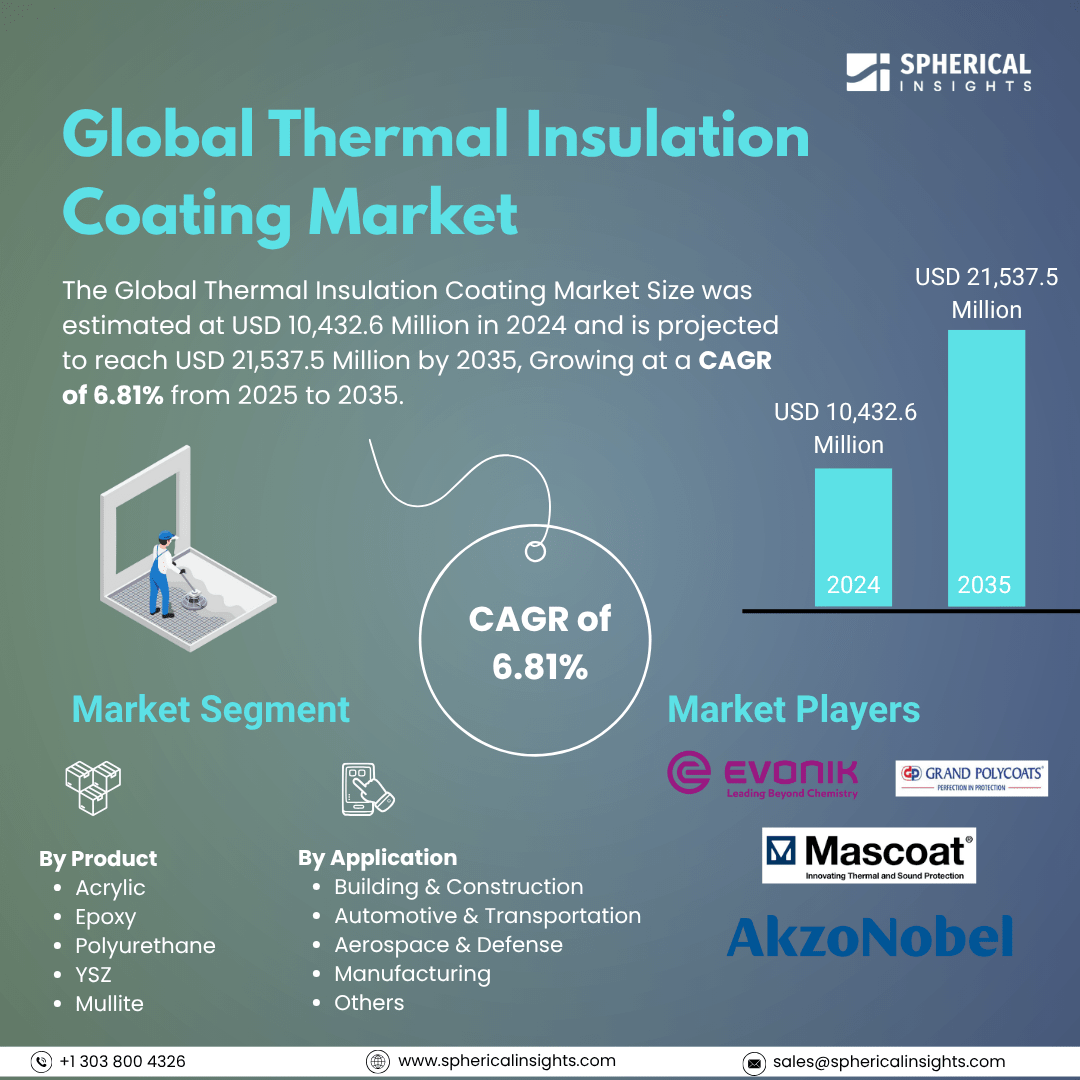

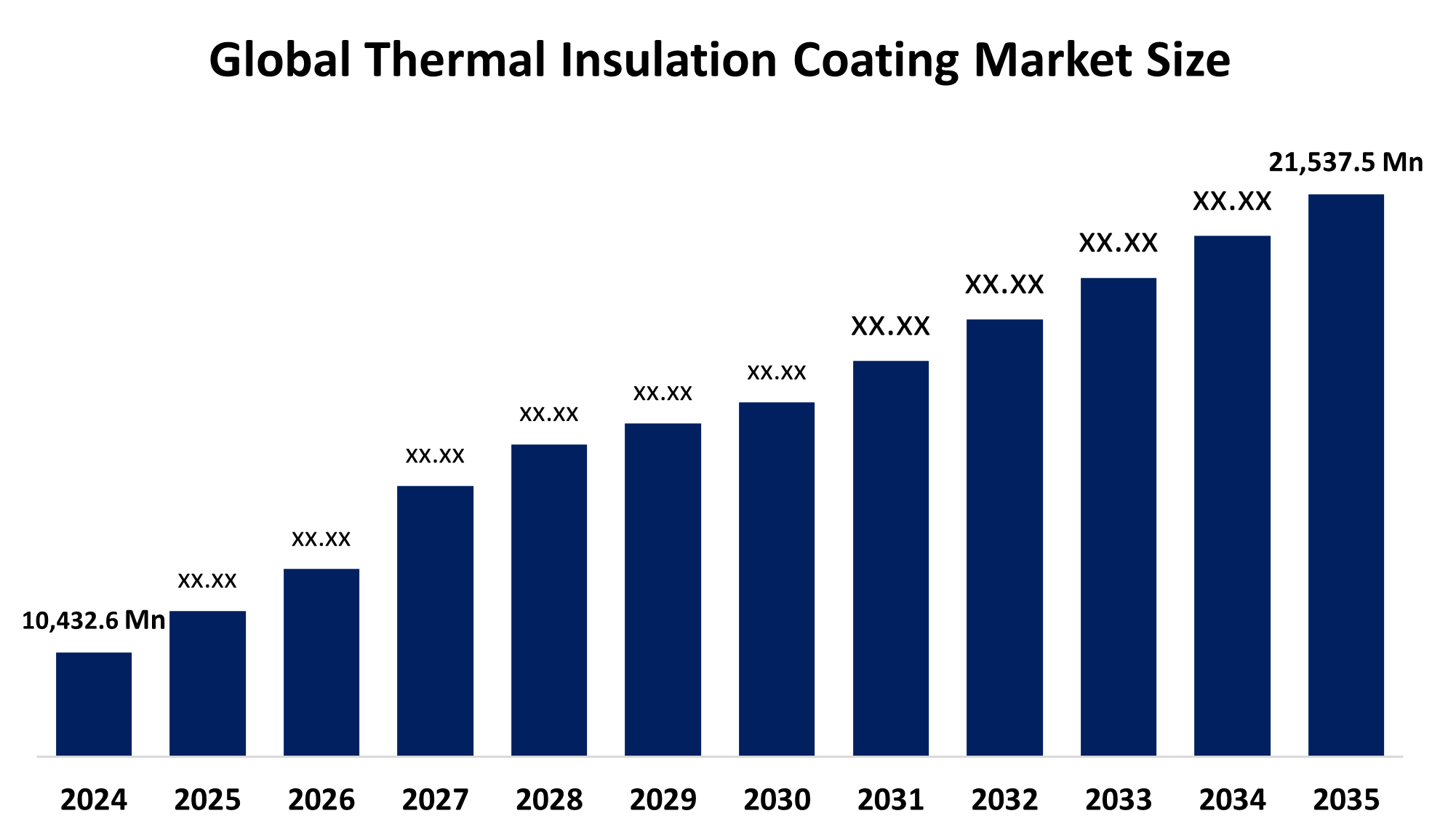

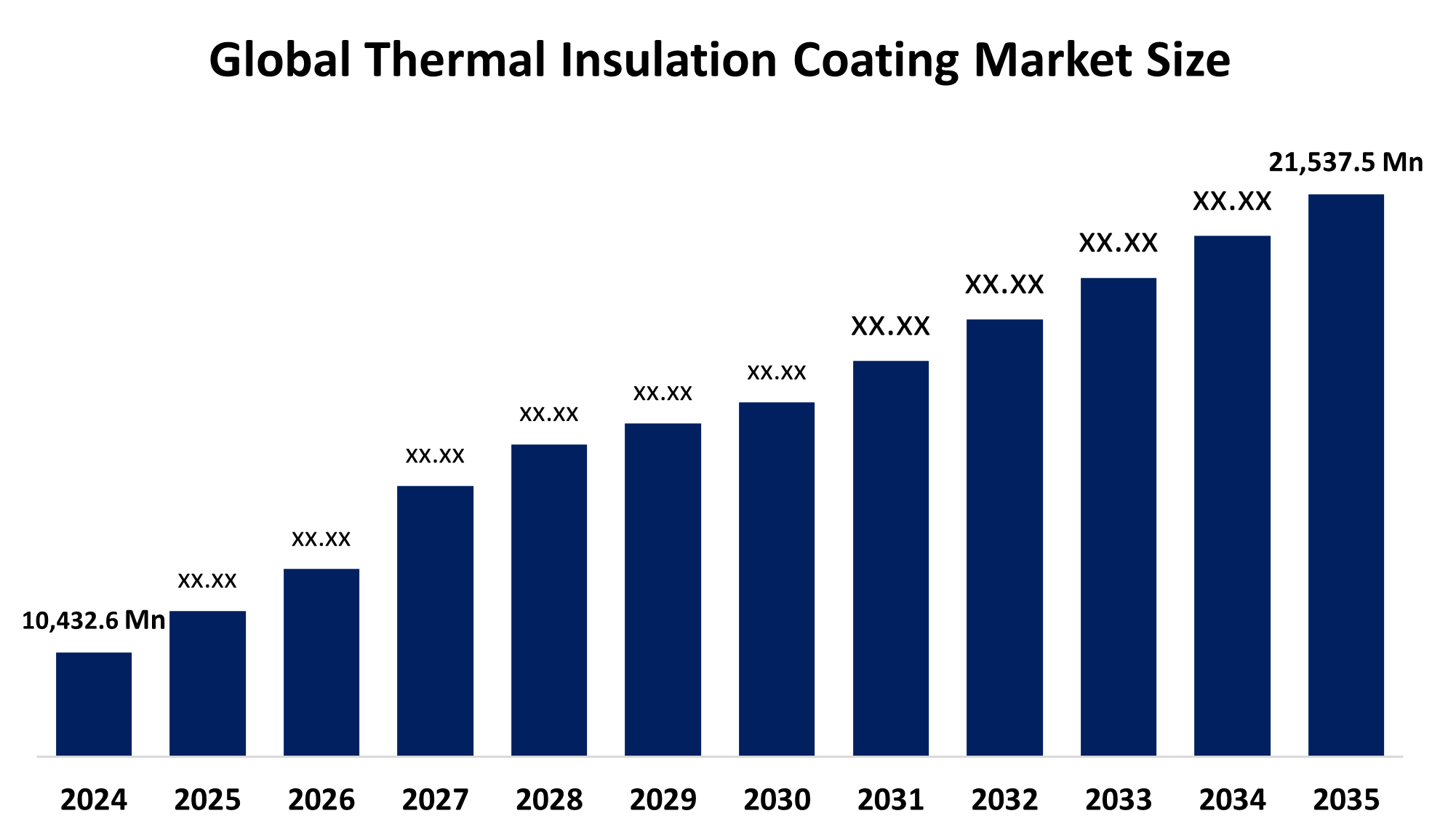

The Global Thermal Insulation Coating Market Size was Estimated at USD 10,432.6 Million in 2024 and is projected to reach USD 21,537.5 Million by 2035, Growing at a CAGR of 6.81% from 2025 to 2035. The market for thermal insulation coatings is expanding globally as a result of stricter environmental regulations, growing building and infrastructure development, and growing energy efficiency requirements.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific thermal insulation coating market held the largest revenue share of 33.7% and led the global market.

- In 2024, Yttria-Stabilized Zirconia (YSZ) held the largest revenue share of 32.6% and led the market based on product.

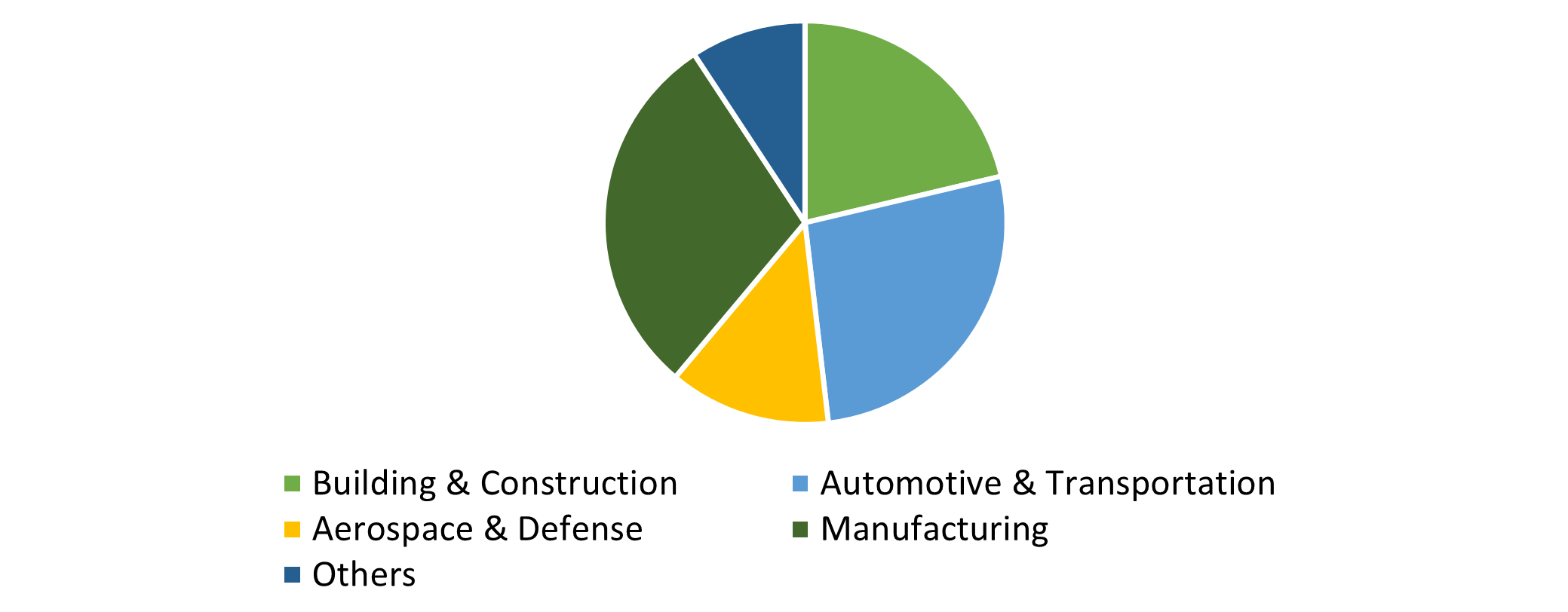

- Manufacturing dominated the market and generated the highest revenue share of 30.8% in 2024 based on application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 10,432.6 Million

- 2035 Projected Market Size: USD 21,537.5 Million

- CAGR (2025-2035): 6.81%

- Asia Pacific: Largest market in 2024

The Global thermal insulation coatings market consists of products for the production and distribution of the liquid or semi-liquid coatings that are intended to impede heat transfer from surface temperature to surroundings. The global thermal insulation coatings market has a rapid growth trajectory due to its key role in energy savings and operational efficiencies across various markets. The foundation for growth in the market is the ability to deliver cost-value, energy-efficient solutions for a breadth of commercial, residential, and industrial applications. Presently, with an unprecedented rise in demand in this market due to a broader global focus on sustainability and energy efficiency. The demand for high-tech thermal insulation coatings will increase with the surge in urbanization, requiring more commercial and residential building development. The market for thermal insulation coatings is predicted to grow even larger with technological advancements, like as the emergence of high-tech, environmentally conscious formulations becoming increasingly desirable. Even coatings that leverage smart technologies will become more desirable due to their ability to react to and address real-time behaviour or change in the environment. The trade will also benefit from improvements in application techniques to facilitate uniform and less wasteful coatings.

Additionally, in response to tighter environmental and fuel efficiency standards, the automotive sector is increasingly employing thermal insulating coatings. As noted in the market, manufacturers and technology providers are also working together with greater frequency to enhance product offerings. There is also the consideration of geographic expansion strategies that are creating new areas with a higher potential for growth and are shaping the competitive landscape. Furthermore, there are also many opportunities for specialized product development, given the range of application requirements across different industries. Finally, there is tremendous opportunity for expanding the market, given the heightened awareness of sustainability and energy conservation globally.

Product Insights

In 2024, Yttria-Stabilized Zirconia (YSZ) accounted for 32.6% of revenue and remained the leading product in the market. The product's remarkable durability and potential to withstand harsh temperatures were its primary features. YSZ is a popular thermal barrier coating made from a material with outstanding thermal insulation properties and temperature tolerance. YSZ coatings continue to exceed performance standards when it comes to thermal barriers due to ongoing R&D and their overall versatility for use in power generation, automotive, and aerospace applications.

During the forecasted period, epoxy coatings are expected to grow at the fastest CAGR of 4.6%. The major reason for this growth in epoxy is the variety of construction applications. Given their strength, adhesion, and chemical resistance, epoxy resins play a key role as structural adhesives and in concrete restoration, as well as in flooring. Epoxy coatings provide better dimensional stability and durability for manufacturing and construction applications requiring very high wear resistance. These characteristics also align with the demand for sustainable products, since they have no VOC formulations. Thermal insulation coatings, the combination of durability, energy efficiency, and green construction guidelines, have greatly improved demand.

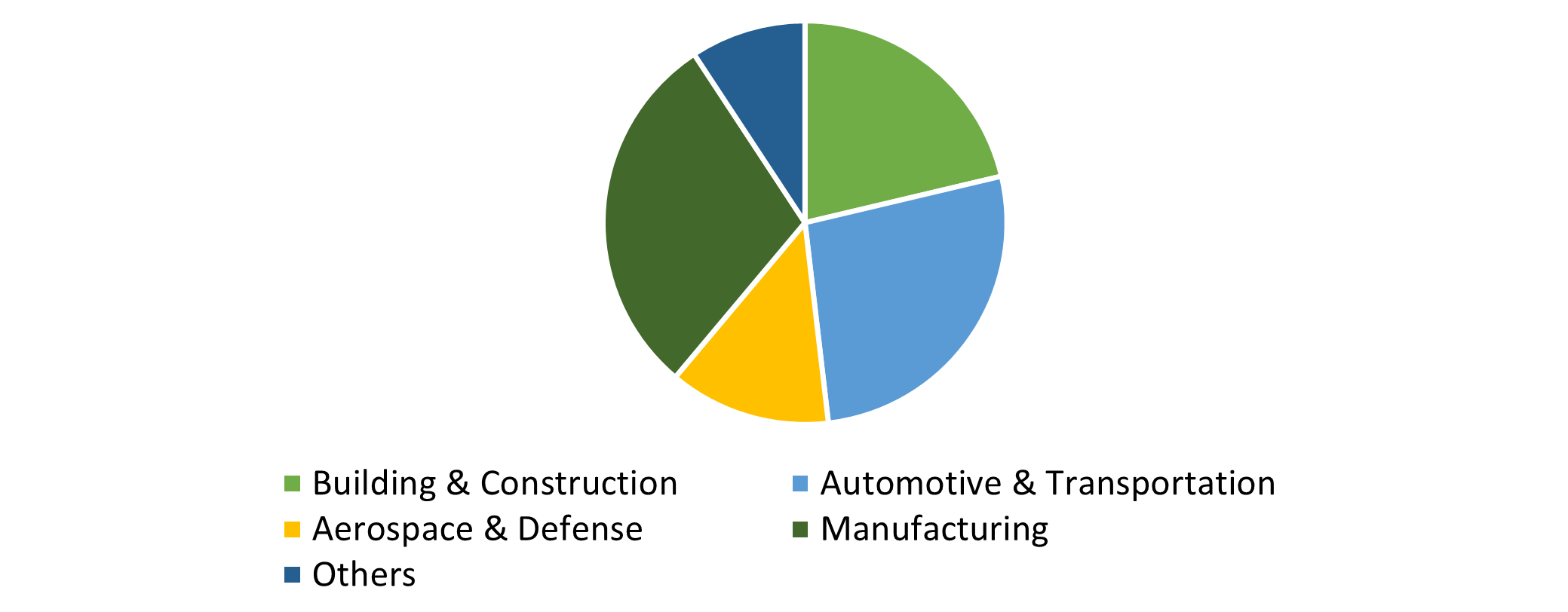

Application Insights

In 2024, the manufacturing segment had a 30.8% revenue share in the expansion. Demand for energy efficiency and temperature control across several operations in industry is driving the segment's growth. Strict energy efficiency regulations direct industries to use thermal insulation solutions to decrease heat loss and improve operational efficiency. In addition, these coatings are key in reducing operating costs, optimizing overall efficiency, and cutting heat loss during industrial processes. In addition, the uptake of these coatings in industrial contexts is informed by a heightened focus on worker safety and regulatory compliance.

During the forecast period, the automotive and transportation segment will grow at the highest CAGR of 4.7%. The increase is because the demand for heat control in automobiles continues to grow. The move towards electric vehicles (EVs) requires efficient heat management systems to optimize battery performance and ensure comfort for passengers. As manufacturers are prioritizing their emissions, thermal insulation coatings are paramount in reducing heat to the engines and exhaust systems while increasing fuel economy. The coatings will help improve comfort and performance, as they reduce the amount of heat being transferred into the vehicle's cabin. Similarly, in EVs, thermal insulation coatings become vital to battery temperature because a regulated battery will provide optimum efficiency and maximize battery lifespan.

Regional Insights

In 2024, the Asia Pacific thermal insulation coating market accounted for a 33.7% revenue share, leading the global market. The sector is growing due to the industrialization and urbanization of countries like China and India. With the need for energy-efficient solutions in the automotive, construction, and manufacturing sectors, as well as extensive investments in infrastructure and construction, the demand for thermal insulation coatings is increasing. Industries are also utilizing advanced thermal insulation coatings due to heightened awareness of sustainability and energy conservation. The economic growth in these countries, along with their desire to reduce energy use and environmental impact, is driving the adoption of thermal insulation coatings. The presence of major manufacturers and the availability of accessible raw materials add to the likelihood of further sector growth.

China Thermal Insulation Coating Market Trends

In 2024, China's thermal insulation coating market accounted for a large revenue share in the Asia Pacific region. There is currently a strong demand for thermal insulation coatings and other energy-efficient alternatives due to investments in infrastructure and building. Additionally, MEPS (Minimum Energy Performance Standards), which require high-efficiency insulation and heating solutions, are required in China for buildings, improving energy efficiency and lowering carbon emissions in those industries.

North America Thermal Insulation Coating Market Trends

The thermal insulation coating industry in North America is expected to grow at a CAGR of 4.9% during the forecast period. This growth is due to their energy efficiency legislation and commitment to reducing carbon emissions. The thermal insulation coating market has largely been underpinned by environmental regulations and energy conservation targets set by the Federal and State Governments of the United States and Canada. The robust infrastructure and continued investments in industrial applications, particularly in the oil and gas industry, also substantiate its market share.

- In 2024, the U.S. thermal insulation coating market was the largest in terms of revenue share in North America. The U.S. Federal Government has provided incentives to improve energy-efficient technologies via the Inflation Reduction Act (IRA), worth considerable funding to promote programs like the High Efficiency Electric Home Rebate program, which offers as much as USD 14,000 to help households upgrade insulation. Furthermore, the U.S. has a large established industrial base that increases demand for these coatings in an industrial context, and the need for them in this context is driven by improving greenhouse gas emissions and energy consumption.

Europe Thermal Insulation Coating Market Trends

The European market for thermal insulation coatings held a significant market share in 2024, which is due to increasing consumer purchasing power and a preference for environmentally friendly construction methods. Increasing regulation has increased demand for efficiency and innovation, and countries in the region invest heavily in energy-efficient technologies, including thermal insulation coatings. In addition to improving building energy efficiency, thermal insulation coatings help projects meet European energy performance standards, which is advantageous for the entire construction supply chain. Moreover, Europe is a considerable player in the market, due to the sustainability push and demands for green building, which are drivers of thermal insulation coatings.

- The anticipated growth of Germany's thermal insulation coating market will be substantial during the forecasted timeframe. The German government has directed substantial funds toward energy-efficient technologies, including thermal insulation coatings, because of its environmental targets for reducing greenhouse gas emissions. The construction sector continues to increase its use of these solutions to meet the Energy Saving Ordinance (EnEV) standards.

Key Thermal Insulation Coating Companies:

The following are the leading companies in the Thermal insulation coating market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Mascoat

- Grand Polycoats Company Pvt. Ltd.

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd.

- The Sherwin-Williams Company

- Carboline

- PPG Industries, Inc.

- Kansai Paint Co., Ltd.

- Sika AG

- Others

Recent Developments

- In August 2024, PPG announced the launch of spray-on insulation (SOI) coating named PPG PITT-THERM 909. This silicone-based coating delivers improved safety measures and better asset protection and operating efficiency when compared to traditional thermal insulating materials used in high-temperature environments across the petrochemical, chemical, oil & gas sectors and other vital infrastructure facilities.

- In October 2023, the new Heat-Flex 7000 thermal insulating coating solution by Sherwin-Williams Protective & Marine provides solar heat reflectivity and insulating properties together with personnel safety features across numerous industrial applications. The single-component spray-applied coating system meets OSHA requirements to protect personnel from skin-contact burns when applied to assets operating at temperatures up to 350°F (177°C).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the thermal insulation coating market based on the below-mentioned segments:

Global Thermal Insulation Coating Market, By Product

- Acrylic

- Epoxy

- Polyurethane

- YSZ

- Mullite

Global Thermal Insulation Coating Market, By Application

- Building & Construction

- Automotive & Transportation

- Aerospace & Defense

- Manufacturing

- Others

Global Thermal Insulation Coating Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa