Ammonia Market Summary

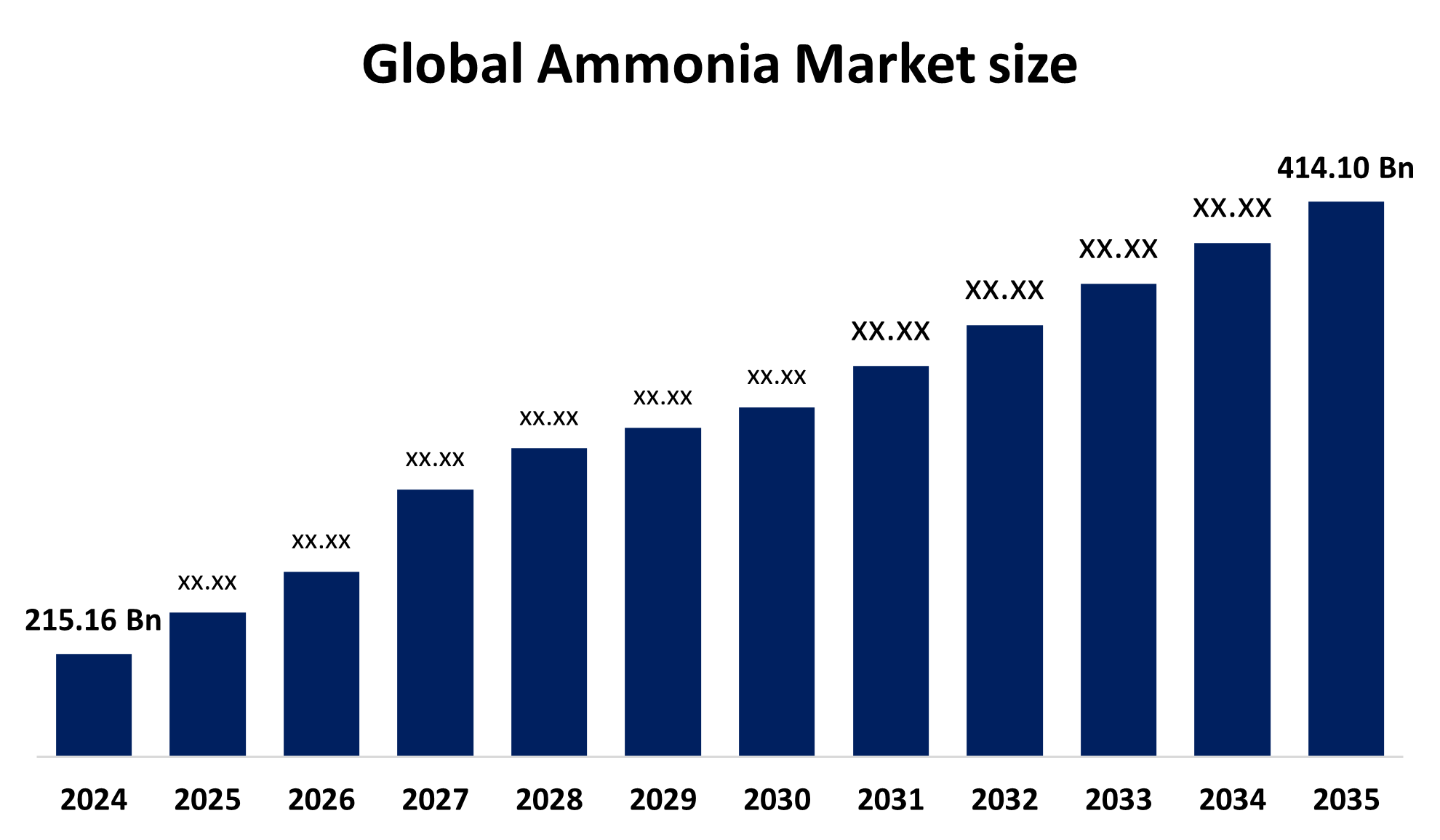

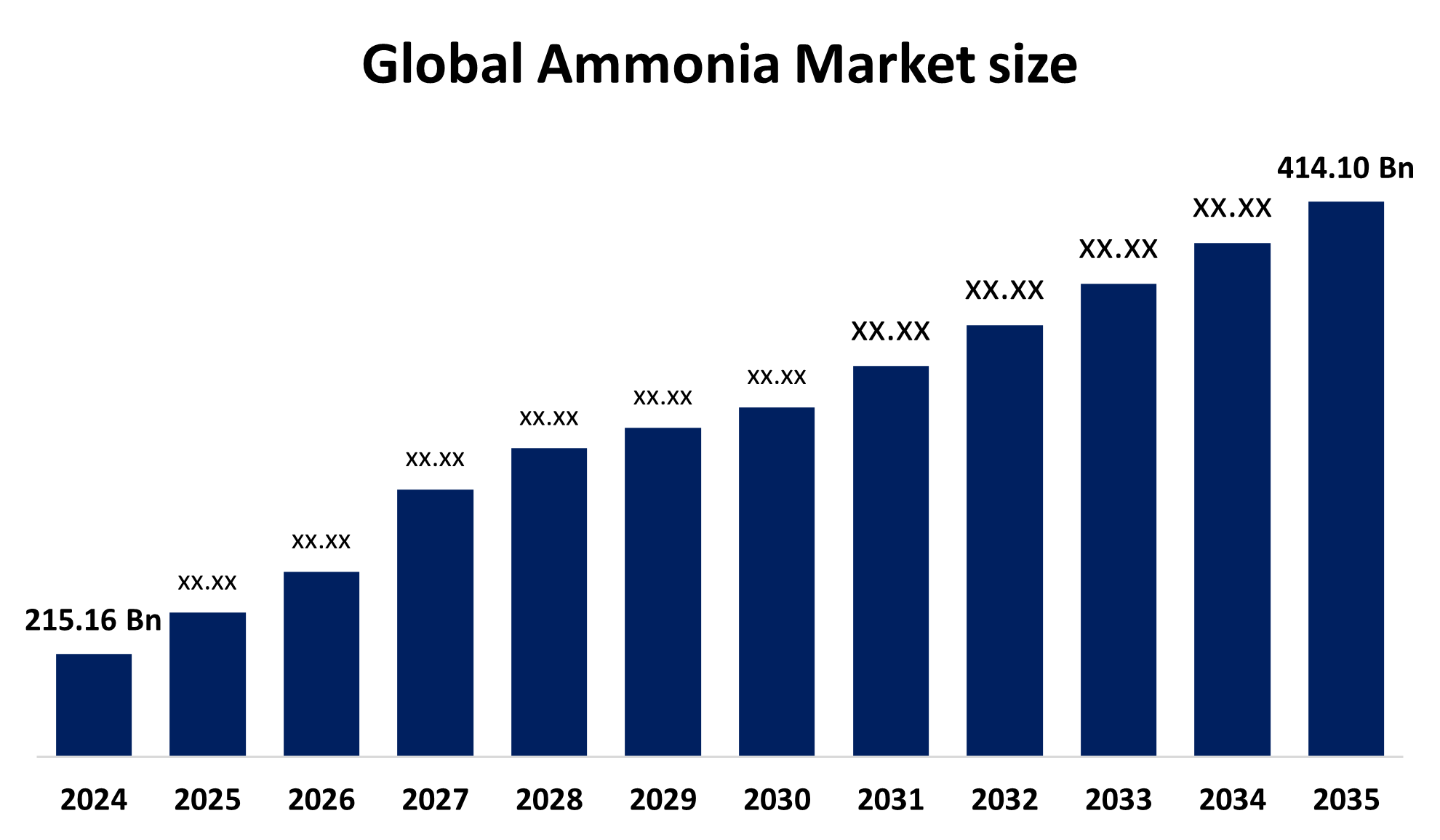

The Global Ammonia Market size was valued at USD 215.16 Billion in 2024 and is projected to reach USD 414.10 Billion by 2035, Growing at a CAGR of 6.13% from 2025 to 2035. The Growing need for fertilizers, industrial uses, and the use of green ammonia for sustainable energy solutions are the main factors propelling the ammonia market's expansion. The market is growing as a result of the growing agriculture sector as well as increased industrial uses in refrigeration and chemicals.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific ammonia market held the largest revenue share of 54.3% and led the global market.

- Approximately 92% of ammonia production in the U.S. is based on natural gas, with about 60% of the production capacity in Louisiana, Oklahoma, and Texas due to their large natural gas reserves.

- In 2024, the anhydrous sector had the highest revenue market share of 58.3% based on product.

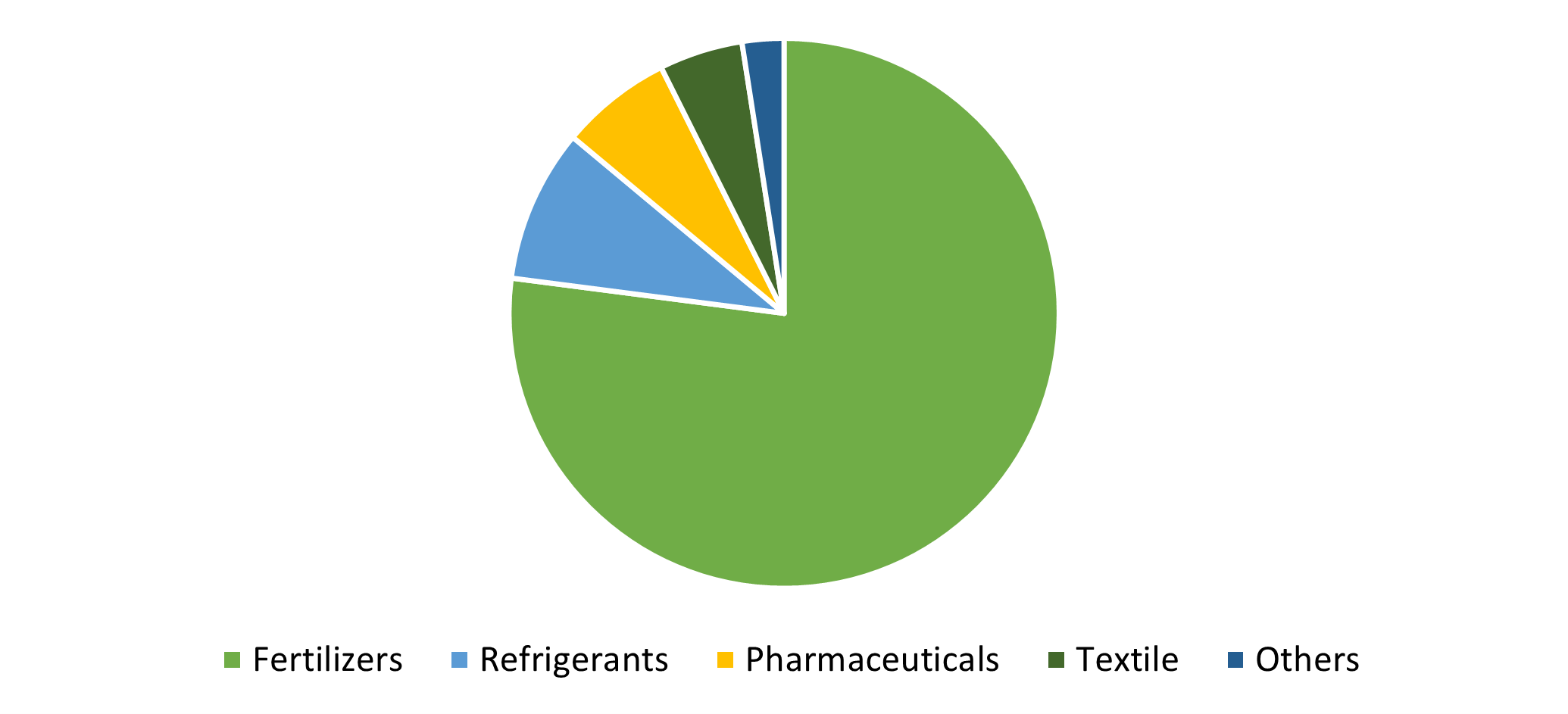

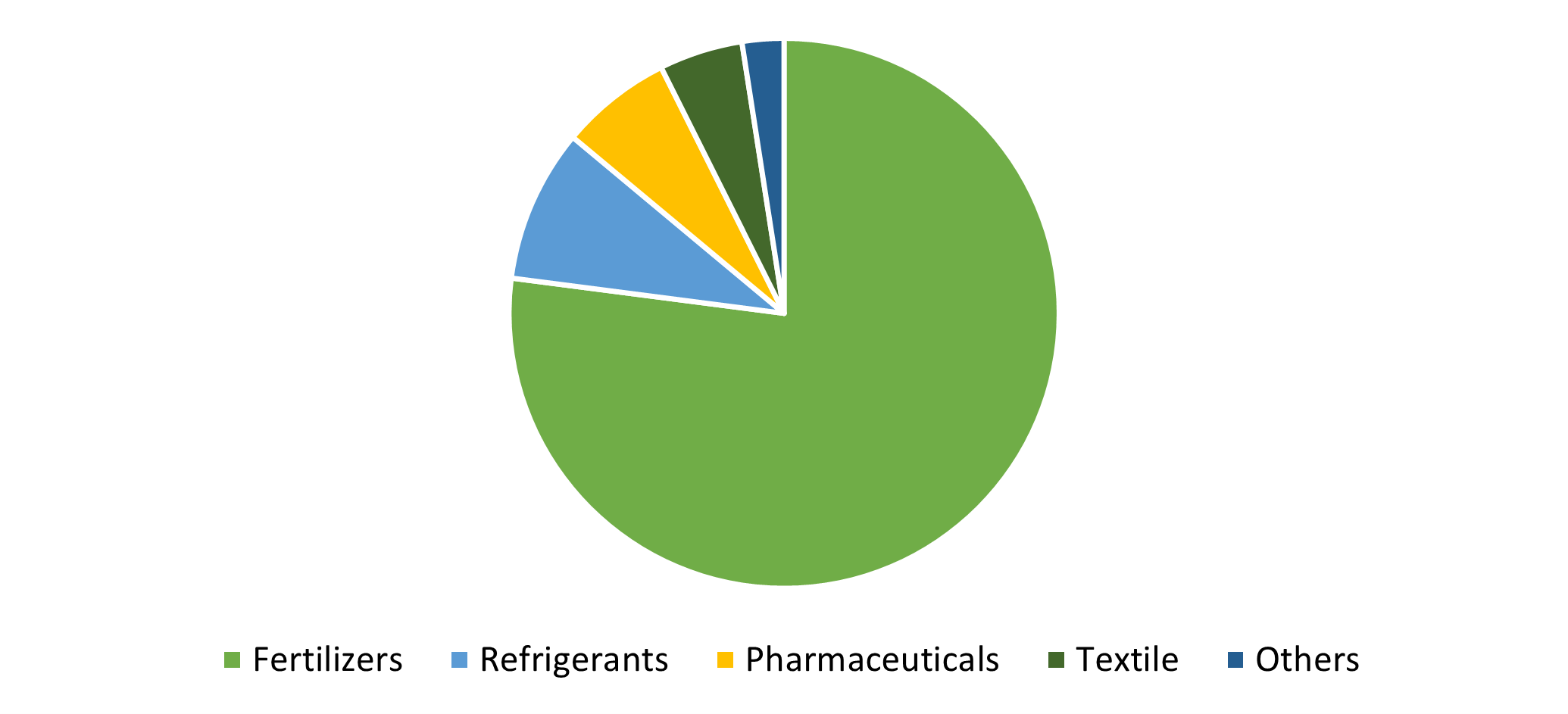

- With a 77.6% market share in 2024, the fertilizers sector led the market in terms of application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 215.16 Billion

- 2035 Projected Market Size: USD 414.10 Billion

- CAGR (2025-2035): 6.13%

- Asia Pacific: Largest market in 2024

- North America: Fastest Market

The ammonia market encompasses the complete process of creating, distributing, and using ammonia (NH3), which is a colorless gas with a strong smell that serves multiple industrial purposes. The manufacturing of industrial chemicals, together with fertilizer production and refrigeration systems, heavily depends on ammonia, while renewable energy applications continue to explore its possibilities. The ammonia industry transforms because industrial operations, together with clean energy projects and agricultural activities, require increasing amounts of this substance. The fertilizer production sector remains the primary market driver since ammonia-based compounds such as urea and ammonium nitrate serve essential functions to boost agricultural output. The rising population and limited farmland availability force governments and agricultural businesses to enhance their operational efficiency, which propels market expansion. The industrial applications of ammonia span multiple sectors, including plastics manufacturing and pharmaceutical production, as well as textiles and explosives, which maintains consistent demand throughout various markets. The development of green ammonia will propel market expansion because this process uses renewable energy-powered electrolysis to generate carbon-free emissions.

The chemical substances, including ammonia, serve a double purpose because they function as essential elements for plant development while also functioning as soil fertilizer components. The market will grow at an accelerated pace throughout the upcoming forecast period because the fertilizers industry maintains its growth trajectory. Ammonia operates as a natural refrigerant because it produces no ozone depletion effects and generates no direct greenhouse impact. The thermodynamic properties of ammonia enable it to produce refrigeration output through minimal power consumption. The sustainable economic nature of ammonia stems from its status as an inexpensive feedstock when compared to manufactured refrigerants, while it also delivers environmental advantages. Market growth will be driven by these trends throughout the forecast period.

Product Insights

Anhydrous ammonia held the top position in the market with a revenue share of 58.3% in 2024 and is expected to keep this position over the next several years. The use of this segment in agricultural operations, particularly for fertilizer production, remains the leading factor that drives its market growth. The high nitrogen concentration within anhydrous ammonia makes it the preferred choice for fertilizer applications because it functions effectively. The application of nitrogenous fertilizers that use NH3 results in enhanced production periods and adequate crop defense as well as increased harvest volumes. Anhydrous ammonia functions effectively as both a solvent and a refrigerant because of its strong odor and its energy requirements for vaporization. The industrial applications of liquefied NH3 extend from textile manufacturing and pharmaceutical production to ore metal extraction.

The solution known as aqueous ammonia results from dissolving ammonia gas in water. The solution remains clear and colorless, yet impurities might cause a faint yellow coloration. The industrial sector used aqueous ammonia extensively in refrigeration systems as well as in water treatment applications and particular chemical processing operations. Aqueous ammonia functions effectively as a cleaning solution because it dissolves and eliminates oils and grease, and grime from various surfaces and materials. The growing environmental regulations, together with business sustainability requirements across multiple industries, have driven an ongoing rise in its industrial use.

Application Insights

The fertilizer category secured the leading position in the industry through its 77.6% market share during 2024. The production of food across the world relies heavily on nitrogen-based fertilizers, which need ammonia as a fundamental component. The main driver behind ammonia's market leadership in fertilizer production remains the increasing requirement for food due to expanding populations, together with rising agricultural productivity requirements. Ammonia serves as a key agricultural input because it quickly combines with organic matter, alongside silty clay and free hydrogen ions and soil moisture. The speed at which they provide nitrogen for plant growth exceeds organic fertilizers because these substances need more time to undergo decomposition before releasing nutrients. The utilization of ammonium in agriculture improves through Method, land quality & architecture, and infiltration rate attributes.

Ammonia functions as a thermodynamically superior refrigerant due to its outstanding properties. The refrigerant does not harm the atmosphere since it produces no global warming potential or ozone depletion effect and it does not ignite unlike CFCs and HFCs. The market shows increasing interest in natural refrigerants because these substances produce less environmental damage compared to synthetic alternatives. The substance exists in abundance throughout the market and costs reasonable amounts. Ammonia functions as the primary cooling agent for smaller refrigeration facilities including ice rinks together with cold storage areas and food processing plants. Large-scale industrial refrigeration operations in chemical processing and petroleum processing facilities rely on ammonia for their cooling requirements.

Regional Insights

In 2024, Asia-Pacific accounted for the largest market share of over 54.3%. The ammonia industry leads Asia Pacific because of its fast urban growth combined with expanding industrial operations and growing agricultural requirements. The agricultural sector's development receives support through the widespread use of ammonia fertilizers, which drives substantial growth in major markets including China, South Korea, Japan, and India. Around 60% of all nitrogenous fertilizers consumed worldwide come from this region. The International Energy Agency identifies China as the leading ammonia manufacturer since it produces more than 30% of all worldwide output. The region continues to lead the market through its strategic partnerships and technological improvements of ammonia synthesis production capacity that boost its competitive environment.

North America Ammonia Market Trends

During the forecasted period, the North American ammonia market will experience the fastest growth among all regions. Specialty crops, vegetables, fruits, oilseeds, and grains are among the many crops produced in North America. The North American ammonia market faces significant industrial growth because of fertilizer requirements in agriculture, together with expanding industrial uses. The market dynamics face influences from raw material cost fluctuations, together with regulatory needs and ecological technological advancements related to green ammonia production. The focus of producers remains on enhancing operational efficiency and emission reductions because they must meet sustainability requirements. The broader North American supply and demand equilibrium for ammonia experiences major influences from regional trade rules, together with infrastructure progress and evolving environmental regulations.

U.S. Ammonia Market Trends

The rising importance of ammonia-based fertilizers stems from the United States being a top producer of agricultural commodities such as corn, wheat, and soybeans. The petrochemical sector has a strong influence on ammonia demand because it produces chemicals, together with polymers and explosives. The rising demand for ammonia emerges from the implementation of advanced fertilizers that include controlled-release types and the shift toward environmentally friendly agricultural approaches. The United States holds the third position as an ammonia producer worldwide and maintains significant import activities with Canada and Trinidad and Tobago serving as its primary trading partners. The production of ammonia in the United States relies on natural gas as its primary input, which forms 92% of the total production, while Louisiana, Oklahoma, and Texas together host 60% of the production capacity because they have the largest natural gas reserves. Through its financial assistance and programs for sustainable agriculture, the US government creates a stronger demand for ammonia. The United States maintains a strong ammonia production system, which delivers a dependable supply for meeting home market requirements and international export operations.

Europe Ammonia Market Trends

The primary force driving the ammonia industry in Europe remains agricultural activities, although other significant forces contribute to its growth. The area's agriculture sector relies heavily on ammonia, which functions as an essential nitrogen fertilizer component to maintain competitiveness and food security. The market experiences growth because population numbers rise while farmland areas decline, thus creating increased demand for higher agricultural product yields and better production efficiency. The region's product marketplaces are now in more demand as a result of this. The main factors driving the European ammonia market include the expanding agricultural sector, alongside farming technique improvements and rising consumer awareness about healthy diet requirements. The manufacturing industry for chemicals and polymers, as well as explosives, depends on ammonia, which drives market growth.

Key Ammonia Companies:

The following are the leading companies in the ammonia market. These companies collectively hold the largest market share and dictate industry trends.

- Acron

- Togliattiazot

- Sumitomo Chemical Co., Ltd.

- Koch Fertilizers, LLC

- Nutrien Ltd.

- BASF SE

- Yara International

- Qatar Fertiliser Company

- SABIC

- CF Industries Holdings, Inc.

- Mitsui Chemicals, Inc.

- Asahi Kasei Corp

- Others

Recent Developments

- In April 2024, JERA Co., Inc. and CF Industries Holdings, Inc. joined forces through a Joint Development Agreement to develop a low-carbon ammonia manufacturing project across the United States. The project will operate at CF Industries' Blue Point Complex in Louisiana, USA, and produce an estimated 1.4 million tonnes of low-carbon ammonia annually. JERA plans to purchase a 48% stake in the project while committing to take more than 500,000 tonnes of ammonia annually to serve Japan's low-carbon fuel needs. JERA, together with CF Industries, aims to decide on the project's final investment within the next year to begin production by 2028.

- In March 2024, A solid and legally binding agreement was signed by GHC SAOC, a wholly owned subsidiary of Acme Cleantech, a prominent renewable energy company in India, and Yara, a leading crop nutrition company in Norway and a global leader in ammonia trade and shipping, for the long-term supply of ammonia with lower CO2 emissions from Acme to Yara.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ammonia market based on the below-mentioned segments:

Global Ammonia Market, By Product

Global Ammonia Market, By Application

- Fertilizers

- Refrigerants

- Pharmaceuticals

- Textile

- Others

Global Ammonia Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa